A security deposit is a payment required by a landlord from a tenant to cover the expenses of any repairs of damages to the premises greater than normal "wear and tear." Everyday usage is normal wear and tear, but excess damage is a debated definition. A security deposit is not the same as rent. It is money that actually belongs to the tenant but is held by the landlord for tenant-caused damages and sometimes past-due rent. Without the agreement of the landlord, a security deposit may not legally be used as the last month's rent.

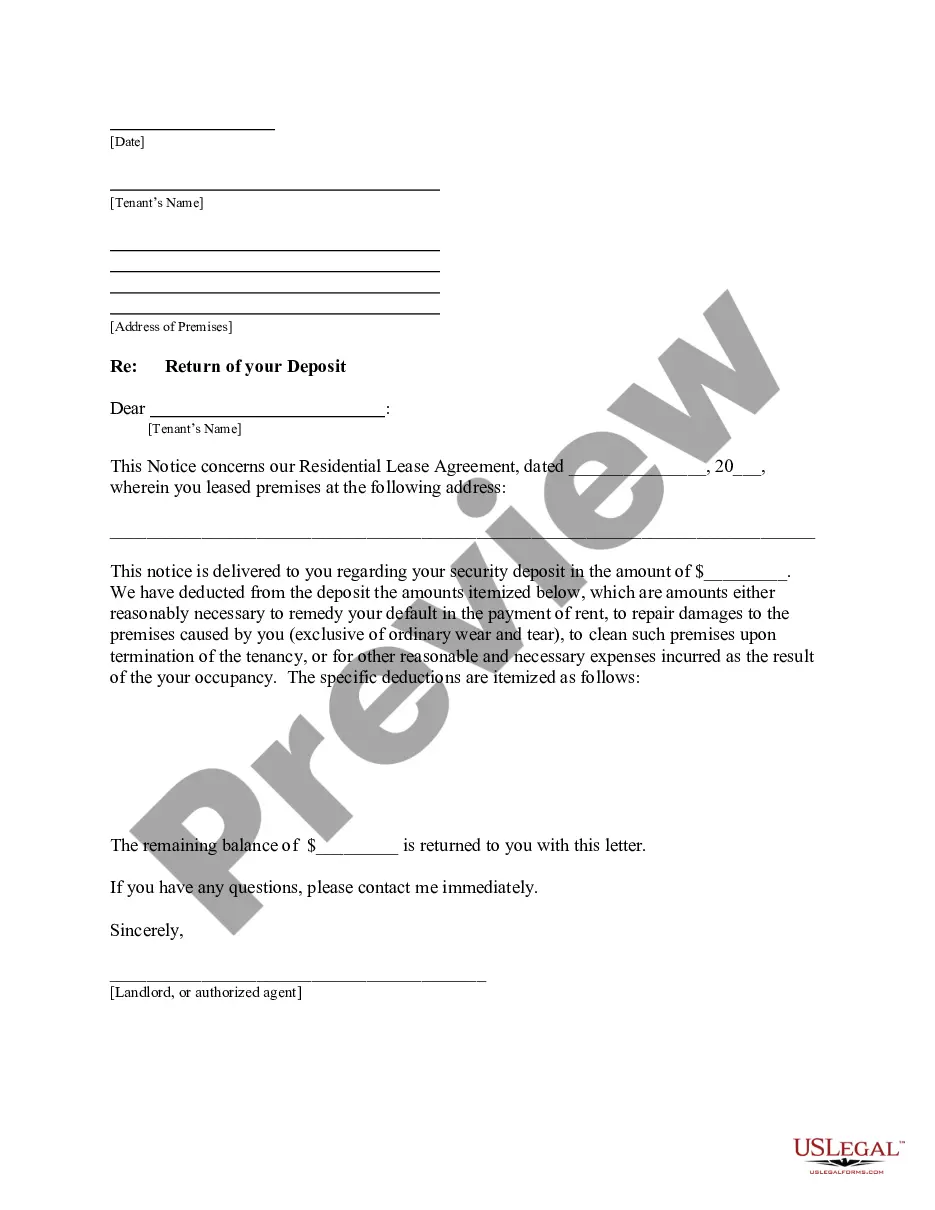

Laws vary by state, but some states place a limit on the amount of a security deposit that a landlord may charge. Some states also regulate where residential security deposits must be kept and when interest payments on the security deposits must be made to the tenant. State laws also define the time period after the tenant vacates within which the deposit must be returned to the tenant. Title: Shreveport, Louisiana Letter from Landlord to Tenant Returning Security Deposit Less Deductions — Detailed Description Introduction: In Shreveport, Louisiana, when a tenant vacates a rental property, the landlord is responsible for returning their security deposit. This letter serves as a formal notification from the landlord to the tenant, detailing the final disposition of the security deposit after accounting for any necessary deductions. Below, we will provide a comprehensive overview of what this letter typically includes and discuss different types of deductions that may be applicable in specific situations. Content: 1. Receiving Address: The letter should begin with the landlord's contact information, including name, address, phone number, and email address. The tenant's details, such as their name and forwarding address, should also be mentioned. 2. Statement of Security Deposit: This section outlines the initial security deposit amount paid by the tenant, the rental property's address, and the lease start and end dates. 3. Deductions and Explanation: The landlord must itemize and explain any deductions made from the security deposit. Different types of deductions that can be mentioned include: a) Outstanding Rent: If the tenant has any unpaid rent, this amount will be subtracted from the security deposit. b) Property Damage: Cost incurred for repairs or replacements due to damages that exceed normal wear and tear will be deducted. Examples include broken furniture, smashed windows, large holes in the walls, or damage caused by pets. c) Cleaning Costs: In case the property requires cleaning beyond the level of cleanliness mentioned in the lease agreement, cleaning expenses such as carpet cleaning, removing stains, or addressing excessive filth will be subtracted. d) Utility Charges: If the tenant is responsible for utility bills and any unpaid charges remain, those may be deducted from the security deposit. e) Unfulfilled Obligations: If the tenant failed to comply with specific lease obligations, such as maintenance or repairs agreed upon, deductions may be made. f) Other Deductions: Additional charges, such as unpaid fees (late rent fees, pet fees, etc.) or outstanding balances, may also be listed under this section with proper explanations. 4. Calculation Summary: Here, the itemized deduction amounts will be totaled, clearly indicating the final amount deducted from the security deposit. 5. Remaining Balance and Return Method: The letter should provide details on the remaining balance after deductions. Additionally, the landlord should specify the method through which the payment will be made (e.g., by mail, electronic transfer), the expected timeline for reimbursement, and any necessary instructions for the tenant. Conclusion: Shreveport, Louisiana Letter from Landlord to Tenant Returning Security Deposit Less Deductions is an essential communication document that ensures transparency and fairness during the entire security deposit return process. By carefully detailing the deductions while adhering to legal guidelines, landlords and tenants can maintain a harmonious relationship. Extra types of Shreveport, Louisiana Letters from Landlord to Tenant Returning Security Deposit Less Deductions: — Shreveport Louisiana Lease Termination Letter with Security Deposit Deductions — Shreveport Louisiana Letter from Landlord to Tenant Returning Security Deposit Deducted for Repairs — Shreveport Louisiana Letter from Landlord to Tenant Returning Security Deposit Deducted for Cleaning Expenses.

Title: Shreveport, Louisiana Letter from Landlord to Tenant Returning Security Deposit Less Deductions — Detailed Description Introduction: In Shreveport, Louisiana, when a tenant vacates a rental property, the landlord is responsible for returning their security deposit. This letter serves as a formal notification from the landlord to the tenant, detailing the final disposition of the security deposit after accounting for any necessary deductions. Below, we will provide a comprehensive overview of what this letter typically includes and discuss different types of deductions that may be applicable in specific situations. Content: 1. Receiving Address: The letter should begin with the landlord's contact information, including name, address, phone number, and email address. The tenant's details, such as their name and forwarding address, should also be mentioned. 2. Statement of Security Deposit: This section outlines the initial security deposit amount paid by the tenant, the rental property's address, and the lease start and end dates. 3. Deductions and Explanation: The landlord must itemize and explain any deductions made from the security deposit. Different types of deductions that can be mentioned include: a) Outstanding Rent: If the tenant has any unpaid rent, this amount will be subtracted from the security deposit. b) Property Damage: Cost incurred for repairs or replacements due to damages that exceed normal wear and tear will be deducted. Examples include broken furniture, smashed windows, large holes in the walls, or damage caused by pets. c) Cleaning Costs: In case the property requires cleaning beyond the level of cleanliness mentioned in the lease agreement, cleaning expenses such as carpet cleaning, removing stains, or addressing excessive filth will be subtracted. d) Utility Charges: If the tenant is responsible for utility bills and any unpaid charges remain, those may be deducted from the security deposit. e) Unfulfilled Obligations: If the tenant failed to comply with specific lease obligations, such as maintenance or repairs agreed upon, deductions may be made. f) Other Deductions: Additional charges, such as unpaid fees (late rent fees, pet fees, etc.) or outstanding balances, may also be listed under this section with proper explanations. 4. Calculation Summary: Here, the itemized deduction amounts will be totaled, clearly indicating the final amount deducted from the security deposit. 5. Remaining Balance and Return Method: The letter should provide details on the remaining balance after deductions. Additionally, the landlord should specify the method through which the payment will be made (e.g., by mail, electronic transfer), the expected timeline for reimbursement, and any necessary instructions for the tenant. Conclusion: Shreveport, Louisiana Letter from Landlord to Tenant Returning Security Deposit Less Deductions is an essential communication document that ensures transparency and fairness during the entire security deposit return process. By carefully detailing the deductions while adhering to legal guidelines, landlords and tenants can maintain a harmonious relationship. Extra types of Shreveport, Louisiana Letters from Landlord to Tenant Returning Security Deposit Less Deductions: — Shreveport Louisiana Lease Termination Letter with Security Deposit Deductions — Shreveport Louisiana Letter from Landlord to Tenant Returning Security Deposit Deducted for Repairs — Shreveport Louisiana Letter from Landlord to Tenant Returning Security Deposit Deducted for Cleaning Expenses.