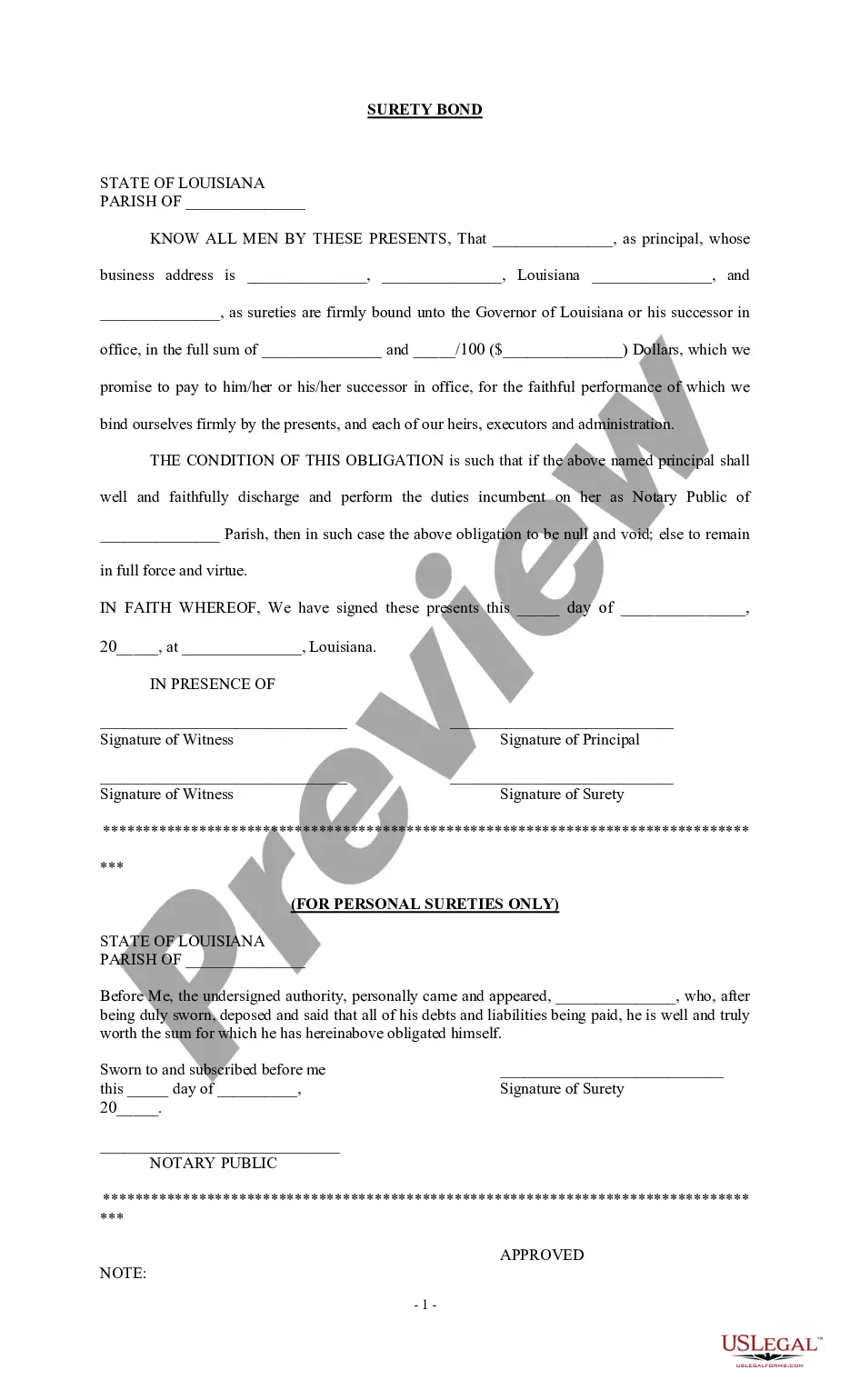

A Baton Rouge Louisiana Surety Bond is a legally binding contract that serves to protect parties involved in a business transaction or agreement. It is required by the state of Louisiana to ensure compliance with certain laws and regulations, providing financial security and peace of mind for all parties involved. The primary purpose of a surety bond is to provide a guarantee that the bonded party will fulfill their obligations or duties as outlined in the agreement. In the event of non-compliance, the bond acts as a form of compensation for any financial losses incurred by the affected party. There are various types of Baton Rouge Louisiana Surety Bonds, each designed to cater to specific industries and situations. Some commonly encountered types include: 1. Contractor License Bond: A bond that is required for contractors to obtain a license in Baton Rouge and ensures compliance with construction industry regulations. It protects project owners against incomplete work, property damage, and unpaid subcontractors. 2. Motor Vehicle Dealer Bond: This bond is mandatory for individuals or businesses engaged in selling motor vehicles. It safeguards customers against fraudulent activities, such as selling stolen vehicles or misrepresenting their condition. 3. Notary Bond: A bond required by notary public in Baton Rouge to guarantee their proper performance of notarial acts, ensuring adherence to state laws and protecting individuals against any negligence or wrongdoing. 4. Court Bond: These bonds are often required in legal proceedings to secure the interests of parties involved. They can include appeal bonds, performance bonds, probate bonds, or lost instrument bonds, among others. 5. Sales Tax Bond: Certain businesses in Baton Rouge may be required to provide a sales tax bond as a guarantee for their timely payment of sales taxes to the state. Obtaining a Baton Rouge Louisiana Surety Bond typically involves selecting a reputable surety bond provider, completing an application, and undergoing a thorough underwriting process. The cost of the bond is usually a percentage of the total bond amount, determined by factors such as the applicant's creditworthiness, bond type, and the bond's duration. In conclusion, a Baton Rouge Louisiana Surety Bond is a vital tool for promoting transparency, accountability, and protection in various industries and business transactions. By understanding the different types of bonds available, parties involved can ensure they select the appropriate bond that aligns with their specific requirements.

Baton Rouge Louisiana Surety Bond

Description

How to fill out Baton Rouge Louisiana Surety Bond?

Are you in search of a trustworthy and cost-effective legal forms provider to obtain the Baton Rouge Louisiana Surety Bond? US Legal Forms is your ideal selection.

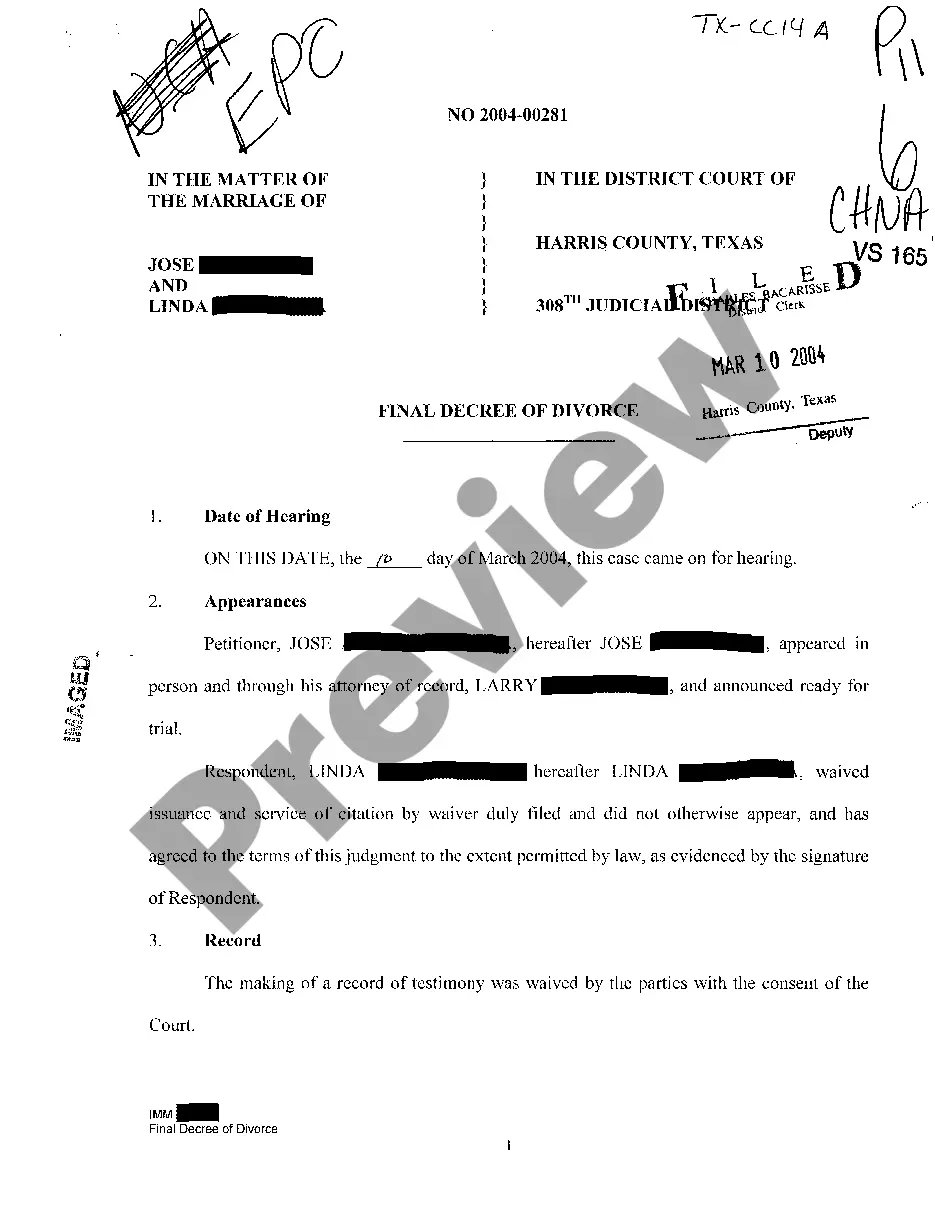

Whether you require a straightforward agreement to establish guidelines for living with your partner or a bundle of documentation to facilitate your separation or divorce through the judicial system, we have you covered. Our platform features over 85,000 current legal document templates for both personal and commercial use. All templates we offer access to are not generic and tailored to meet the standards of individual states and counties.

To acquire the document, you need to Log In to your account, find the required form, and hit the Download button adjacent to it. Please keep in mind that you can download your previously obtained document templates at any point in the My documents section.

Is this your first visit to our site? No problem. You can establish an account in just a few minutes, but before that, ensure to do the following: Check if the Baton Rouge Louisiana Surety Bond aligns with the regulations of your state and locality. Review the form’s specifics (if available) to identify who and what the document is designed for. Restart the search if the form does not suit your legal circumstances.

Acquiring current legal documents has never been more straightforward. Try US Legal Forms now, and eliminate the hassle of spending your precious time searching for legal papers online once and for all.

- Now you can set up your account.

- Then select the subscription option and proceed to payment.

- Once the payment is completed, download the Baton Rouge Louisiana Surety Bond in any provided format.

- You can revisit the website anytime and redownload the document without any cost.

Form popularity

FAQ

A surety bond provides financial assurance that a party will fulfill their legal obligations, offering peace of mind. It helps individuals secure release from jail, ensuring they can maintain their daily lives while awaiting trial. Moreover, having a Baton Rouge Louisiana Surety Bond can facilitate a smoother legal process, allowing individuals to focus on their case rather than worrying about extended incarceration.

A surety bond jail Louisiana refers to the use of a surety bond specifically for release from jail in Louisiana. It enables defendants to be released from custody while awaiting trial by paying a portion of the total bail amount to a bond agent. This option allows for greater freedom and the ability to prepare for your court case without being confined. Utilizing a Baton Rouge Louisiana Surety Bond can make navigating the legal process more manageable.

A surety bond works by involving three parties: the principal, the obligee, and the surety. The principal is the person who needs the bond, the obligee is the entity requiring the bond, and the surety is the bonding company that provides the financial backing. When you use a Baton Rouge Louisiana Surety Bond, the surety guarantees that you will meet your obligations, offering peace of mind in challenging times.

If you cannot make bail in Louisiana, you may remain in jail until your trial date. The duration can vary based on the court’s schedule and the nature of your case. In some instances, this can lead to months of incarceration, which significantly impacts your life. Exploring options like a Baton Rouge Louisiana Surety Bond can provide a way to secure your release while awaiting court proceedings.

Title jumping in Louisiana refers to the illegal practice of transferring ownership of a vehicle without updating the official title with the state. This can lead to significant legal issues, including penalties for those involved. To avoid complications, it's essential to follow the proper title transfer steps, including obtaining a Baton Rouge Louisiana Surety Bond if necessary. Staying informed through resources like US Legal Forms can help you navigate these situations effectively.

To secure a bonded title in Louisiana, start by collecting any documentation that proves your ownership of the vehicle. You'll then submit an application along with a Baton Rouge Louisiana Surety Bond, which acts as insurance against any ownership disputes. This bond reassures the state and any potential claimants. For a seamless experience, consider visiting US Legal Forms for guidance and necessary documents.

Yes, obtaining a title with just a bill of sale is possible, although it requires specific steps. You will need to apply for a bonded title and secure a Baton Rouge Louisiana Surety Bond to protect your ownership claims. This procedure verifies your ownership while safeguarding against disputes. Utilizing resources like US Legal Forms can make gathering necessary documentation more straightforward.

If you need to title a car that lacks one, begin by gathering all ownership documents you have, such as a bill of sale. You will likely need to apply for a bonded title, which includes acquiring a Baton Rouge Louisiana Surety Bond. This bond protects against future claims on the vehicle. US Legal Forms can provide helpful templates and guides to simplify this process for you.

To get a bonded title in Louisiana, you need to submit an application to the Office of Motor Vehicles. This process often involves providing proof of ownership, such as a bill of sale or prior registration documents. Obtaining a Baton Rouge Louisiana Surety Bond is a critical part of the process, which serves as a guarantee against any claims on the title. You may consider using platforms like US Legal Forms to streamline the paperwork and ensure compliance.

Securing a property bond in Louisiana involves gathering required documentation, such as proof of property ownership and financial history. Once you have your documents, contact a surety bond provider. They will assist you in obtaining a Baton Rouge Louisiana Surety Bond that fits your needs and projects.