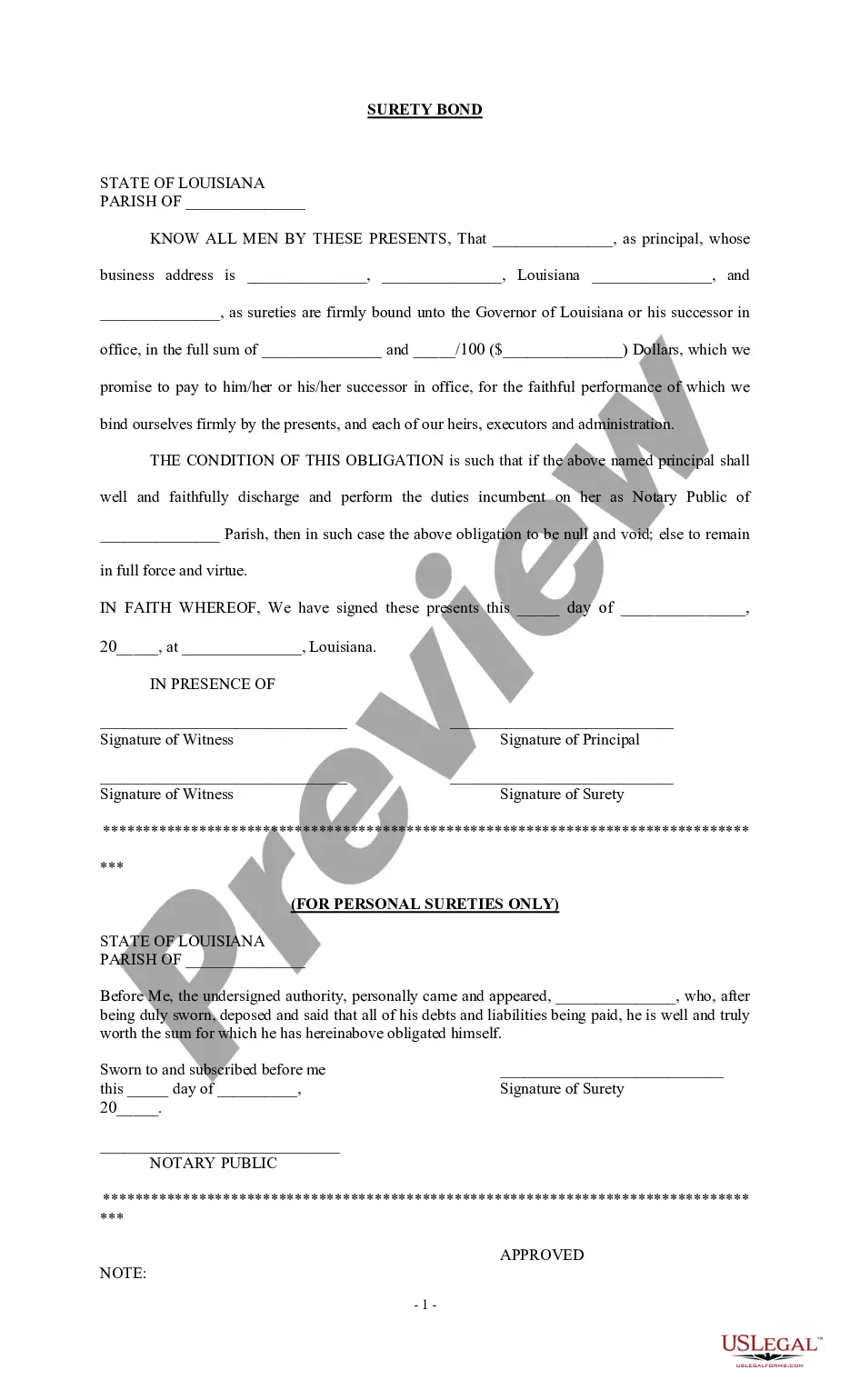

Shreveport Louisiana Surety Bond

Description

How to fill out Louisiana Surety Bond?

Finding validated templates tailored to your regional guidelines can be difficult unless you utilize the US Legal Forms library.

It’s a virtual compilation of over 85,000 legal documents for both personal and professional purposes and various real-life situations.

All the files are accurately categorized by area of application and jurisdictional areas, making the search for the Shreveport Louisiana Surety Bond as straightforward and simple as ABC.

Maintaining documentation orderly and in accordance with legal standards is essential. Take advantage of the US Legal Forms library to have crucial document templates for any requirements readily available at your fingertips!

- Review the Preview mode and document description.

- Confirm you've chosen the appropriate one that satisfies your requirements and fully aligns with your local jurisdiction mandates.

- Search for another template, if necessary.

- If you discover any discrepancies, utilize the Search tab above to locate the correct one. If it meets your needs, proceed to the next step.

- Complete the purchase.

- Click on the Buy Now button and select the subscription plan you prefer. You will need to create an account to gain access to the library’s materials.

Form popularity

FAQ

In Louisiana, notaries must secure a bond that typically includes specific requirements such as a minimum coverage amount and proof of liability insurance. The bond protects the public against potential misconduct by the notary. If you need assistance meeting these requirements, US Legal Forms can provide the necessary forms and guidelines to help you navigate the application for your Shreveport Louisiana Surety Bond effectively.

The timeframe for securing a bond in Louisiana can vary, but it generally takes a few days to a couple of weeks. This duration depends on factors like the type of bond and the applicant's financial background. For a quicker process, consider preparing your documentation ahead of time and checking resources on the US Legal Forms website to streamline your application for a Shreveport Louisiana Surety Bond.

To obtain a property bond in Louisiana, you typically need to apply through a bonding company or an insurance provider. They will evaluate your creditworthiness and other factors before issuing a Shreveport Louisiana Surety Bond. Consider using the US Legal Forms platform, which offers guided resources and forms to simplify the process and ensure you meet all necessary requirements.

In Louisiana, a notary bond typically costs between $10 and $100, depending on the amount of coverage required. For those seeking a Shreveport Louisiana Surety Bond, it is essential to choose an amount that adequately protects clients and complies with state law. You can easily obtain a notary bond through various insurance providers or brokers, ensuring it meets the specific needs of your notary services.

A surety bond in Louisiana’s jail context is a financial agreement that allows an individual to be released from custody while awaiting trial. This bond assures the court that the individual will appear for their scheduled court dates. Obtaining a Shreveport Louisiana Surety Bond can significantly improve an individual’s chances of securing temporary freedom.

A surety bond serves as a guarantee that one party will fulfill their obligations to another. It offers financial protection to the obligee in case the principal fails to meet those obligations. Acquiring a Shreveport Louisiana Surety Bond ensures compliance with local laws and provides peace of mind for all parties involved.

To obtain surety, you first need to decide the type of surety bond required for your situation. You can then consult with a surety bond provider, who will evaluate your financial standing and business practices. This step is crucial for acquiring your Shreveport Louisiana Surety Bond without complications.

A bond is a general financial agreement between parties, while a surety bond is specifically a three-party agreement involving the principal, the obligee, and the surety. The surety guarantees that the principal will fulfill its obligations to the obligee. Understanding this distinction is essential when pursuing a Shreveport Louisiana Surety Bond.

Getting a surety bond in Louisiana involves identifying the type of bond you need, followed by gathering the necessary documentation. You can work with a licensed surety bond agent who can guide you through the application process. They will help you assess your situation and secure the best Shreveport Louisiana Surety Bond for your needs.

To apply for a bonded title in Louisiana online, visit platforms like Uslegalforms. You will need to complete the necessary application forms and provide any required documentation. This process simplifies obtaining a bonded title and aligns with the state’s regulations. Always ensure you fully understand the requirements to secure your Shreveport Louisiana Surety Bond.