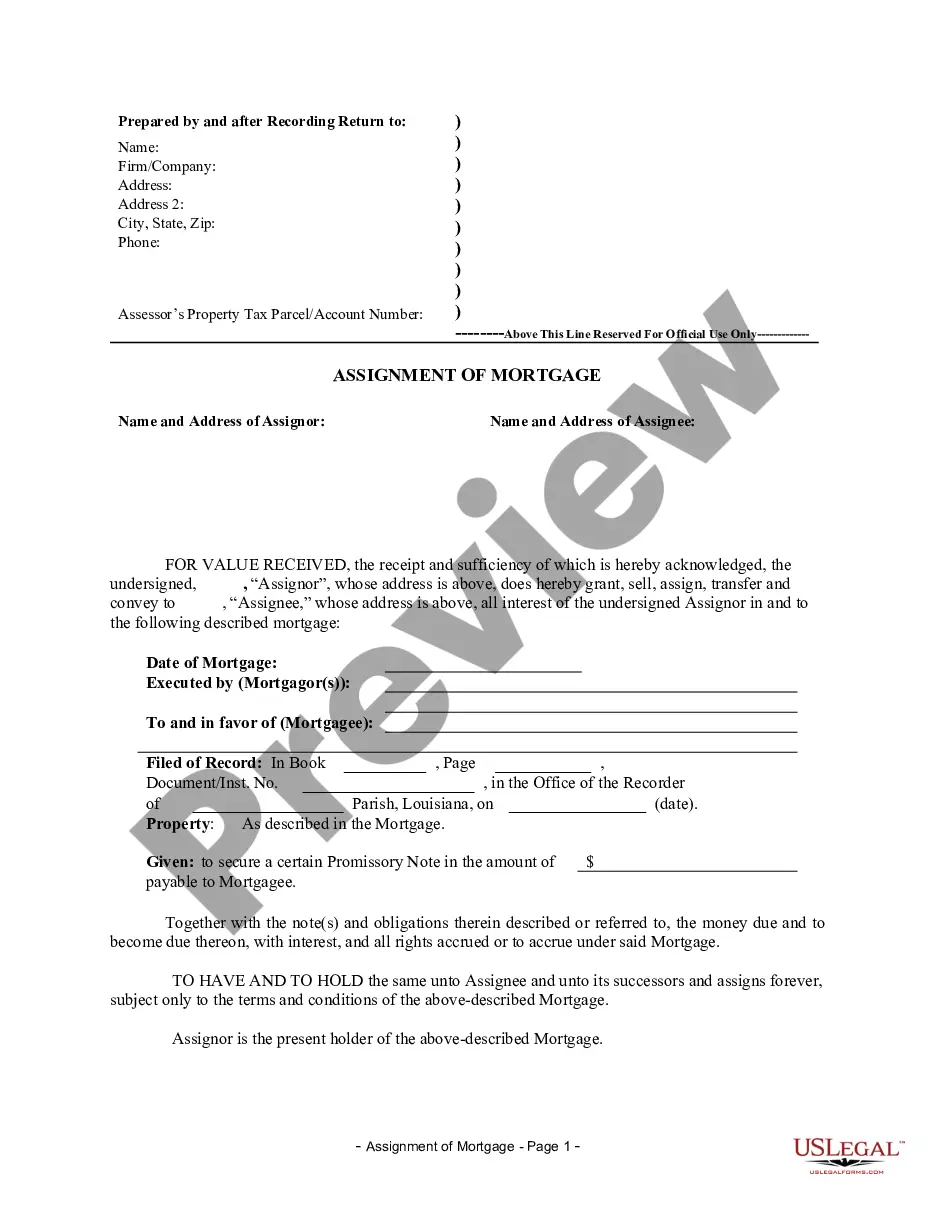

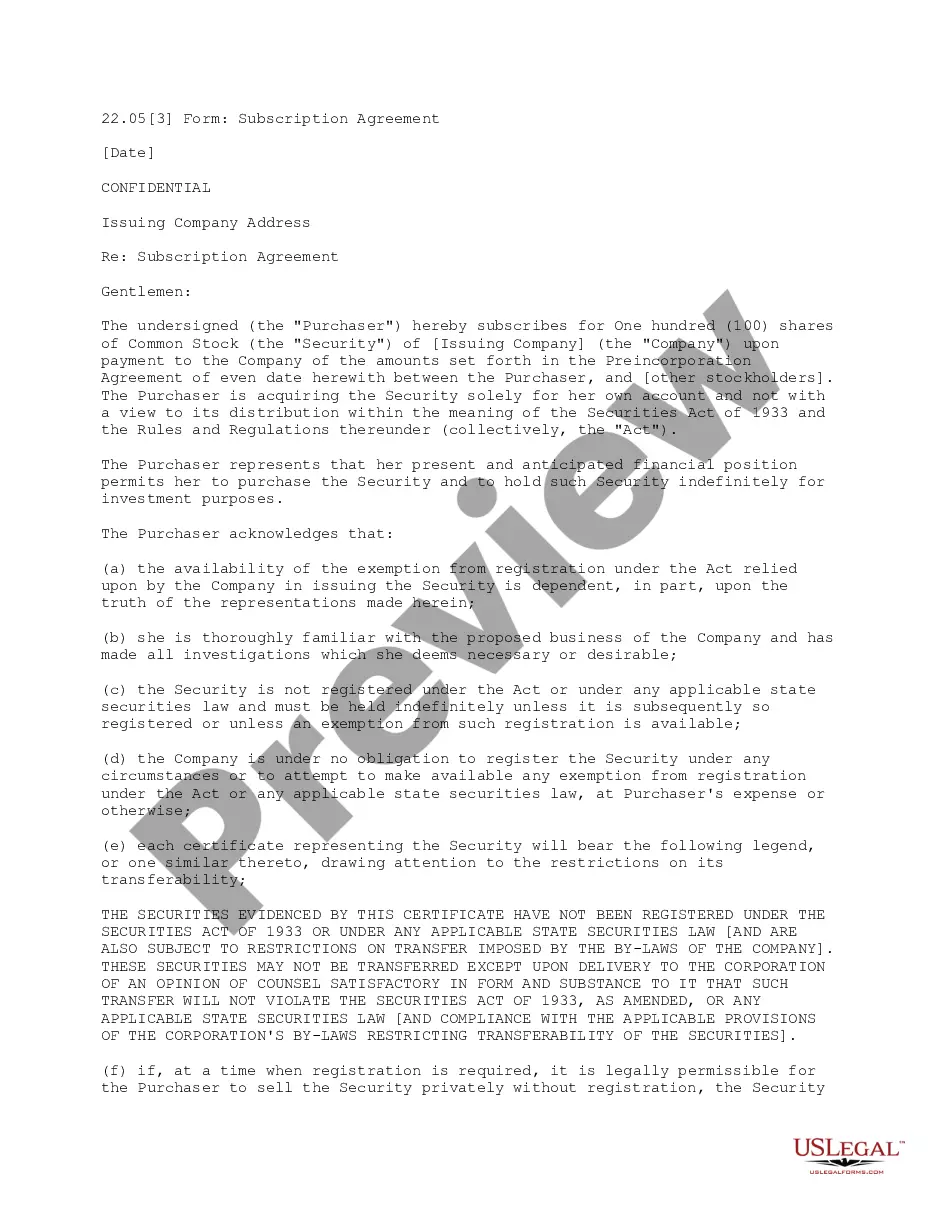

Assignment of Mortgage by Individual Mortgage Holder

Assignments Generally: Lenders, or holders

of mortgages or deeds of trust, often assign mortgages or deeds of trust

to other lenders, or third parties. When this is done the assignee

(person who received the assignment) steps into the place of the original

lender or assignor. To effectuate an assignment, the general rules

is that the assignment must be in proper written format and recorded to

provide notice of the assignment.

Satisfactions Generally: Once a mortgage

or deed of trust is paid, the holder of the mortgage is required to satisfy

the mortgage or deed of trust of record to show that the mortgage or deed

of trust is no longer a lien on the property. The general rule is that

the satisfaction must be in proper written format and recorded to provide

notice of the satisfaction. If the lender fails to record a satisfaction

within set time limits, the lender may be responsible for damages set by

statute for failure to timely cancel the lien. Depending on your state,

a satisfaction may be called a Satisfaction, Cancellation, or Reconveyance.

Some states still recognize marginal satisfaction but this is slowly being

phased out. A marginal satisfaction is where the holder of the mortgage

physically goes to the recording office and enters a satisfaction on the

face of the the recorded mortgage, which is attested by the clerk.

Louisiana Law

Assignment: It is recommended that an assignment

be in writing and recorded immediately.

Demand to Satisfy: Upon full payoff, mortgagor

may make written request to mortgagee to produce the satisfied promissory

note or an instrument of release in a form sufficient to bring about the

cancellation of the inscription of the recorded mortgage to the mortgagor,

whereupon mortgagee must do so within 30 days (60 days if domiciled outside

of Louisiana) or suffer liability.

Recording Satisfaction: The recorder of

mortgages for the parish of Orleans, and the clerk of court and ex-officio

recorder of mortgages of any other parish of the state, shall cancel from

the records of his office the inscription of a mortgage upon presentation

to him by the debtor thereunder of the original note or sufficient reproduction

thereof. (See below, sec. 9:5167)

Marginal Satisfaction: The recorder cancells

the mortgage by certification written upon the note.

Penalty: If mortgagee fails to timely comply

with written demand for satisfaction as described above (see, Demand

to Satisfy), mortgagee is liable for all damages and costs resulting

from said failure, including reasonable attorney fees.

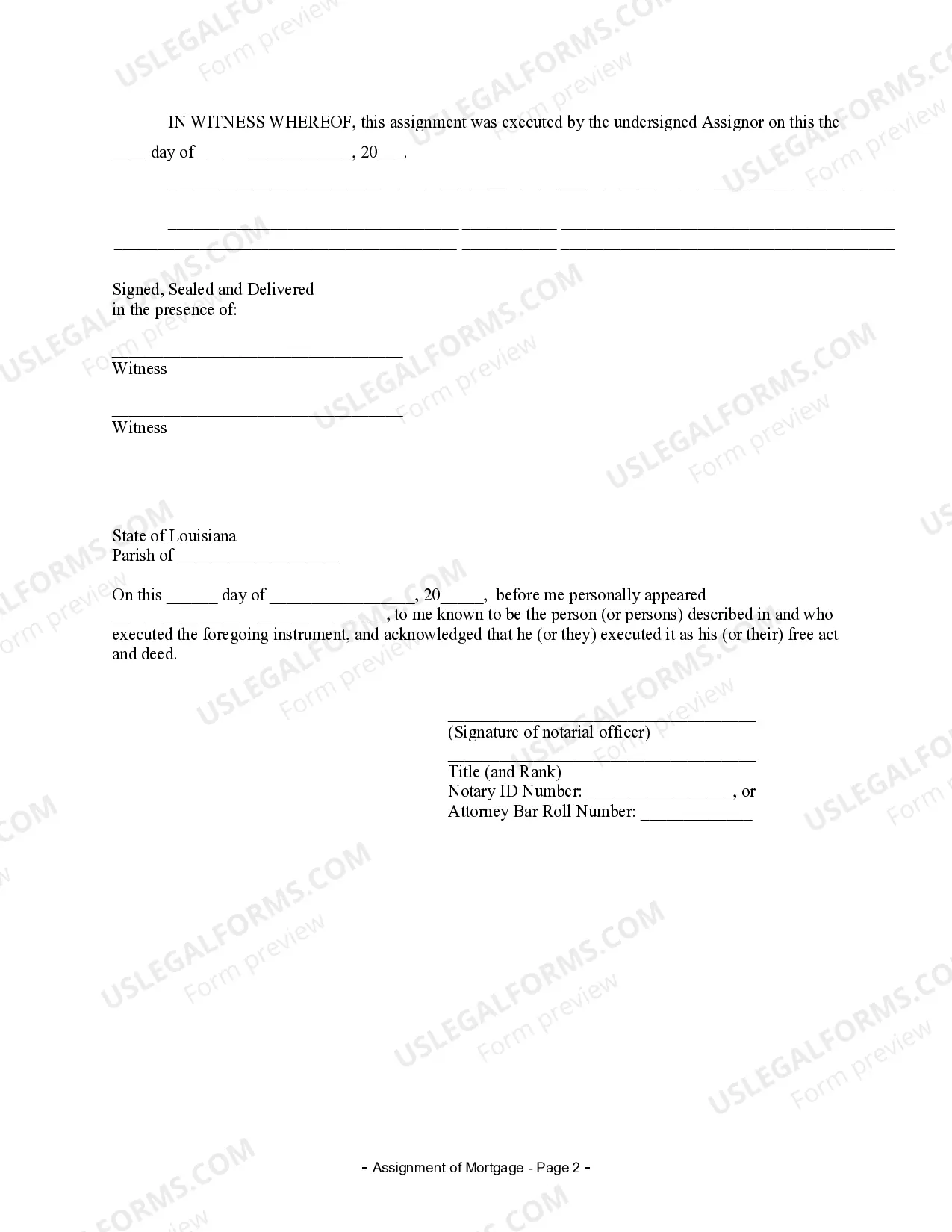

Acknowledgment: An assignment or satisfaction

must contain a proper Louisiana acknowledgment, or other acknowledgment

approved by Statute.

Louisiana Statutes

9:5167. Cancellation of mortgage inscription upon presentation

of note or affidavit; lost or destroyed note

A. The recorder of mortgages for the parish of Orleans, and the

clerk of court and ex-officio recorder of mortgages of any other parish

of the state, shall cancel from the records of his office the inscription

of a mortgage upon presentation to him by the debtor thereunder of either:

(1) The original note or notes; or

(2) Any reproduction of the original note or notes reproduces and

certified true in accordance with Subsection B of this Section as security

for which the mortgage noted in the inscription was given, if such original

note or notes are marked paid and if such original note or notes have been

duly paraphed for identification with the mortgage as required by Civil

Code Article 3384.

B. Immediately upon presentation of an original note pursuant to

Subsection A of this Section the recorder of mortgages for the parish or

Orleans, and the clerk of court and ex officio recorder of mortgages of

any other parish of the state shall certify on the original note

that the original note was presented on such date in accordance with this

statute and shall immediately photocopy, or otherwise facsimile reproduce,

one or more times as requested by the presenter, the original note so certified,

returning the original note to the presenter. Each such reproduction shall

be certified true by the recorder of mortgages for the parish of Orleans,

or the clerk of court and ex officio recorder of mortgages of any other

parish of the state, and may charge no more than ten dollars for each photocopy

or facsimile. One of the certified true reproductions shall be recorded.

C. Upon presentation of such a certified true reproduction, the recorder

of mortgages for the parish of Orleans, and the clerk of court and ex officio

recorder of mortgages of any other parish of the state, in addition to

cancelling the inscription as directed in Subsection A, shall record the

same.

D. The manner of cancellation of mortgage inscriptions provided for

by this Section shall be alternative and in addition to any other manner

of cancellation authorized by other laws.

E. (1) When a promissory note secured by a mortgage on immovable

property has been lost or destroyed after receipt by the notary public

who satisfied the promissory note out of the proceeds of an act of sale

or mortgage executed before him, the clerk of court or recorder of mortgages

may cancel the mortgage upon receipt of an affidavit from the notary public.

The affidavit shall set forth:

(a) A description of the promissory note and the property,

(b) That the affiant did satisfy the promissory note,

(c) That the affiant did receive the note marked "Paid in Full" from

the last holder of the note,

(d) That the note was lost or destroyed while in the affiant's custody,

and

(e) That the affiant agrees to hold harmless the clerk of court or

recorder of mortgages for any loss or damage occasioned by his failure

to produce the note.

(2) In addition, the affidavit shall include a statement that the

affiant has made a due and diligent search for the last holder, the last

holder cannot be located, and one year has elapsed since recordation of

the act of sale or mortgage giving rise to the affidavit of cancellation;

or, shall be accompanied by an affidavit from the last holder stating that

the promissory note marked "Paid in Full" was delivered to the notary public.

(3) No mandamus proceeding is required to use the provisions of this

Subsection.

(4) The clerk of court or recorder of mortgages shall not be liable

for any damages resulting to any person or entity as a consequence of cancelling

a mortgage pursuant to an affidavit which complies with this Subsection.

9:5167.1. Cancellation of mortgage inscription by affidavit;

penalties

A. A mortgagee shall execute and

deliver sufficient acceptable documentation, as required by the clerk of

court and ex officio recorder of mortgages for the cancellation of a mortgage,

to the mortgagor or the mortgagor's designated agent within sixty days

after the date of receipt of full payment of the balance owed on

the debt secured by the mortgage in accordance with a payoff statement.

The payoff statement shall be furnished by the mortgagee or its mortgage

servicer. If the mortgagee fails to execute and deliver acceptable documentation,

an authorized officer of a title insurance business,

the closing notary public, or the notary public for the person or entity

which made the payment may, on behalf of the mortgagor or an owner of the

property encumbered by the mortgage, execute an affidavit that complies

with the requirements of this Section and record the

affidavit in the mortgage records of each parish in which the mortgage

was recorded.

B. An affidavit executed under this

Section shall state that:

(1) The affiant is an authorized

officer of a title insurance business, the closing notary public, or the

attorney for the person or entity which made the payment.

(2) The affidavit is made on behalf

of the mortgagor or an owner of the property encumbered by the mortgage.

(3) The mortgagee provided a payoff

statement with respect to the loan secured by the mortgage.

(4) The affiant has ascertained that

the mortgagee has received payment of the loan secured by the mortgage

in accordance with the payoff statement, as evidenced by:

(a) A bank check, certified check,

or escrow account check which has been negotiated by or on behalf of the

mortgagee; or

(b) Other documentary evidence of

the receipt of payment by the mortgagee including but not limited to verification

that the funds were wired to the mortgagee.

(5) More than sixty days have elapsed

since the date payment was received by the mortgagee and the mortgagee

has not returned documentary authorization for cancellation of the mortgage.

(6) The mortgagee has been given

at least fifteen days notice in writing of the intention to execute and

record an affidavit in accordance with this Section, with a copy of the

proposed affidavit attached to the written notice.

C. The affidavit shall include the

names of the mortgagor and the mortgagee, the date of the mortgage, and

the book and page, or folio, or clerk's file number of the immovable property

records where the mortgage is recorded, together with similar information

for a recorded assignment of the mortgage.

D. The affiant shall attach to the

affidavit the documentary evidence that payment has been received by the

mortgagee including a copy of the payoff statement. Evidence of payment

may include a copy of the canceled check indicating endorsement by the

mortgagee or other documentary evidence described in Subsection B.

E. An affidavit executed and recorded

as provided by this Section shall constitute a release of and an authority

to cancel the mortgage described in the affidavit. The clerk of court and

ex officio recorder of mortgages may rely on the sworn statements contained

within the affidavit and has no duty to traverse the

contents thereof.

F. The clerk of court and ex officio

recorder of mortgages shall index the affidavit in the names of the original

mortgagee and the last assignee of the mortgage appearing of record as

the grantors and in the name of the mortgagor as grantee, and shall cancel

the inscription of the mortgage and assignments from the mortgage records.

G. The intentional falsification

of information by the affiant in an affidavit filed in the office of the

recorder of mortgages is subject to the provisions of R.S. 14:132, governing

the crime of injuring public records. The affiant shall also be liable

for any damages, attorney fees, and expenses occasioned by a fraudulently

executed affidavit.

H. As used in this Section:

(1) "Attorney for the person or entity

making payment" is an attorney licensed to practice law in this state who

certifies in the affidavit that he is authorized to make the affidavit

on behalf of the person or entity making payment.

(2) "Closing" shall have the same

meaning as provided in R.S. 22:2092.2(2) and (15).

(3) "Closing notary public" is the

duly commissioned notary public who executes the required documents or

performs notarial functions at the closing.

(4) "Payoff statement" is the statement

of the following:

(a) The unpaid balance of a loan

secured by a mortgage, including principal, interest, and other charges

properly assessed under the loan documentation of the mortgage.

(b) The interest on a per diem basis

for the unpaid balance.

(5) "Title insurance business" shall

have the same meaning as provided in R.S. 22:2092.2(17).

9:5174. Debtor's right to obtain release upon payment of obligation

He who shall have subscribed

in favor of another, an act bearing a mortgage or privilege, to secure

the payment of a debt or the execution of an obligation, may, on the payment

of the debt or performance of the obligation, require of the creditor a

release of the mortgage or privilege, provided he will defray the expense

of the act which it may be necessary to prepare for this purpose; and if

the creditor refuses to grant this release, the other party shall have

an action to compel him to grant it, and he shall be condemned to pay the

costs.

9:5385. Satisfaction of mortgage; production of promissory note

or release for cancellation; liability

A. When the obligation

secured by a mortgage has been fully satisfied, the mortgagee, the servicing

agent, or any holder of the note shall, within thirty days of receipt

of written demand by the person providing full satisfaction, produce

the satisfied promissory note or an instrument of release in a form sufficient

to bring about the cancellation of the inscription of the recorded mortgage

to the person providing full satisfaction. However, if the note is held

by a federal agency or instrumentality, or a federally sponsored or supported

lender, or any nonoriginating secondary mortgage market lender domiciled

outside the state of Louisiana, the holder of the note shall, within sixty

days after receipt of notice of the satisfaction from the servicing

agent, produce the satisfied promissory note or an instrument of release

to the servicing agent.

B. If the mortgagee,

the servicing agent, or any holder of the note fails to produce

the satisfied promissory note or an instrument of release in a form sufficient

to bring about cancellation of the mortgage within thirty days after

receipt of written demand by the person providing full payment

of the balance of the note, the mortgage and the servicing agent or the

mortgagee and any holder of the note shall be liable in solido to the person

providing full satisfaction for all damages and costs resulting therefrom,

including reasonable attorney fees. However, if the note is held by

a federal agency or instrumentality, or a federally sponsored or supported

lender, or an instrument of release from the holder of the note, produce

the note or instrument to the person providing full satisfaction.

C. For purposes of this

Section, "person" shall include the mortgagor acting in his own behalf,

or a notary public or any person, firm, or corporation acting in place

of or on behalf of the mortgagor.