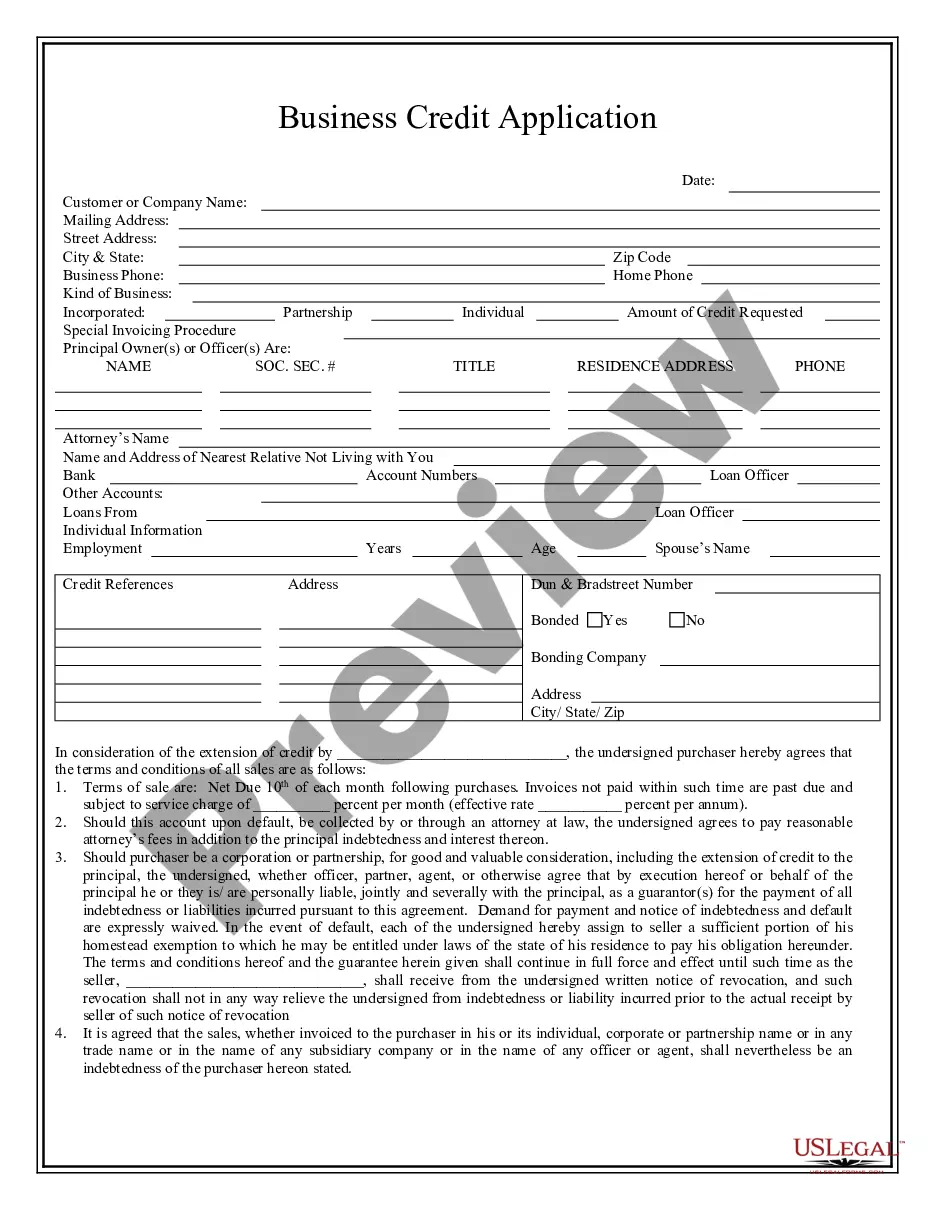

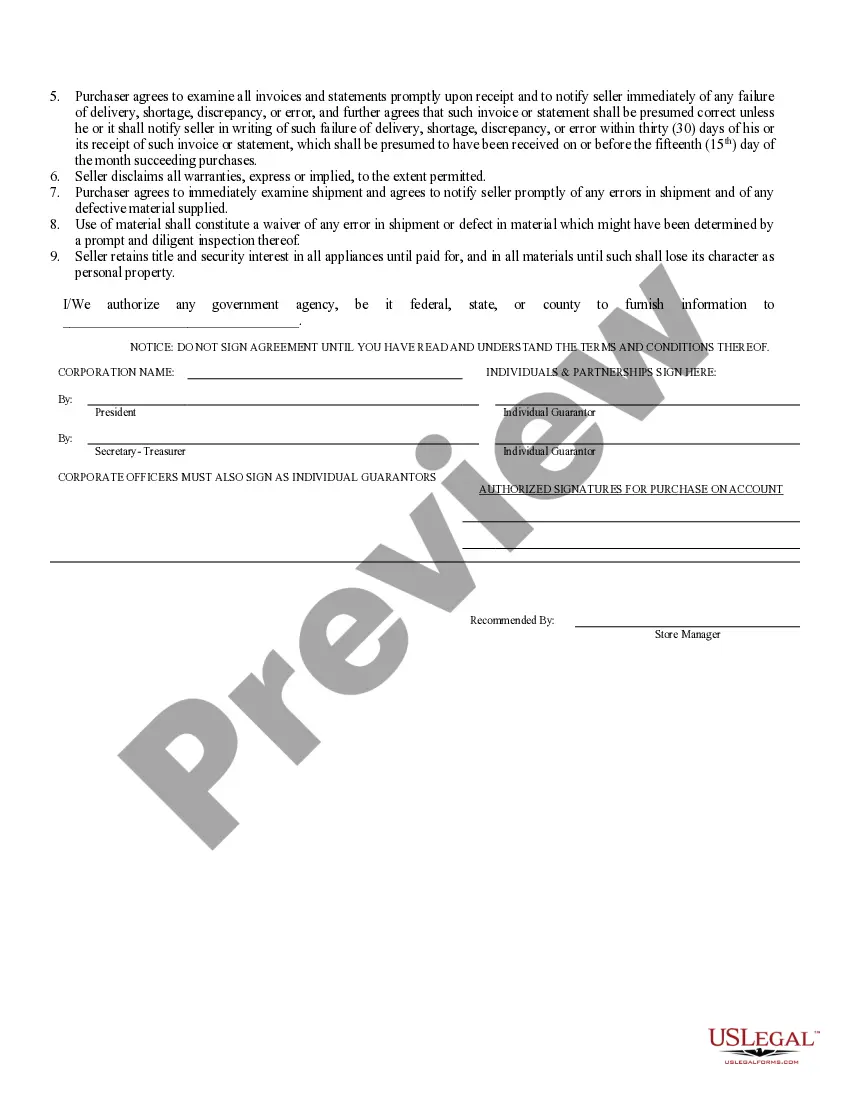

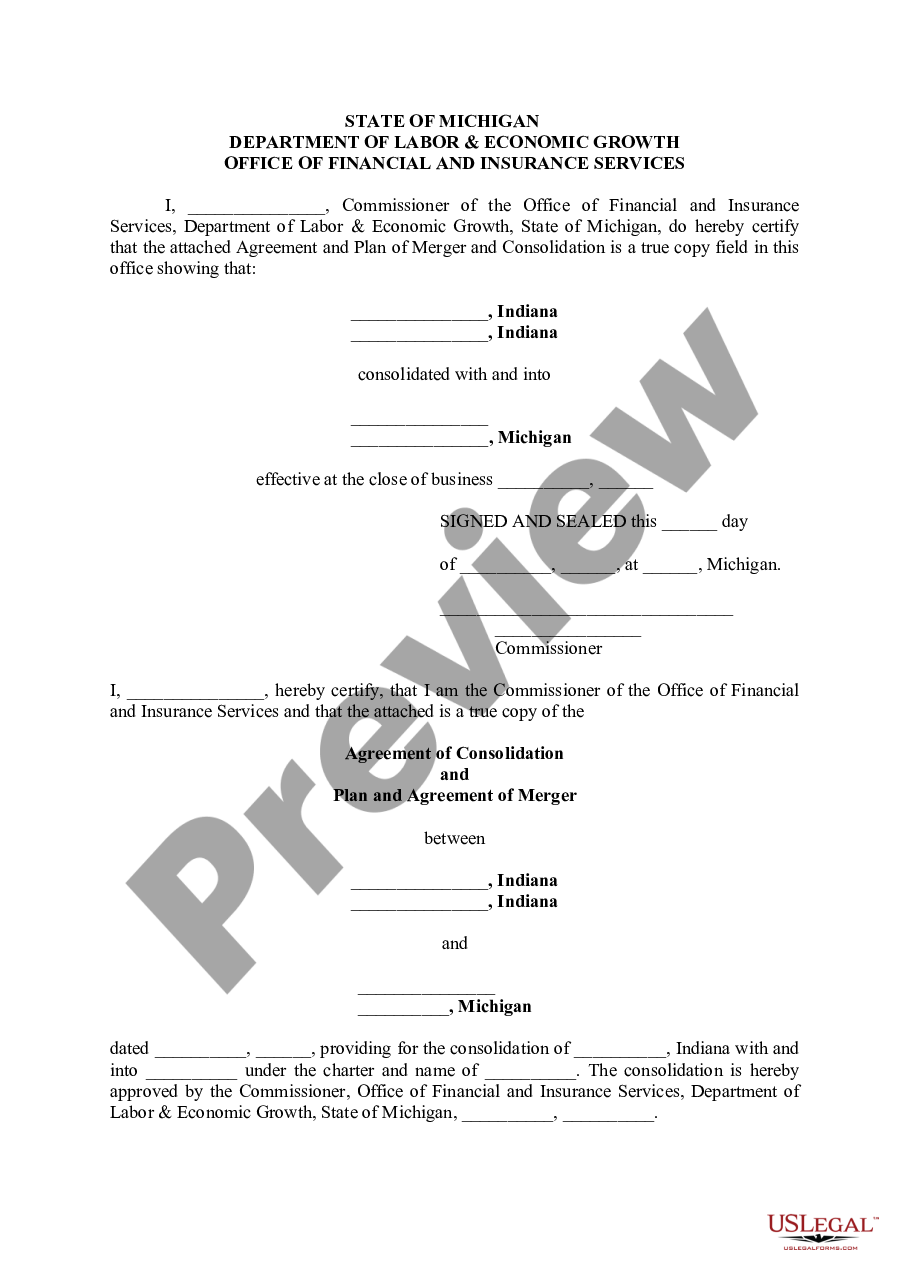

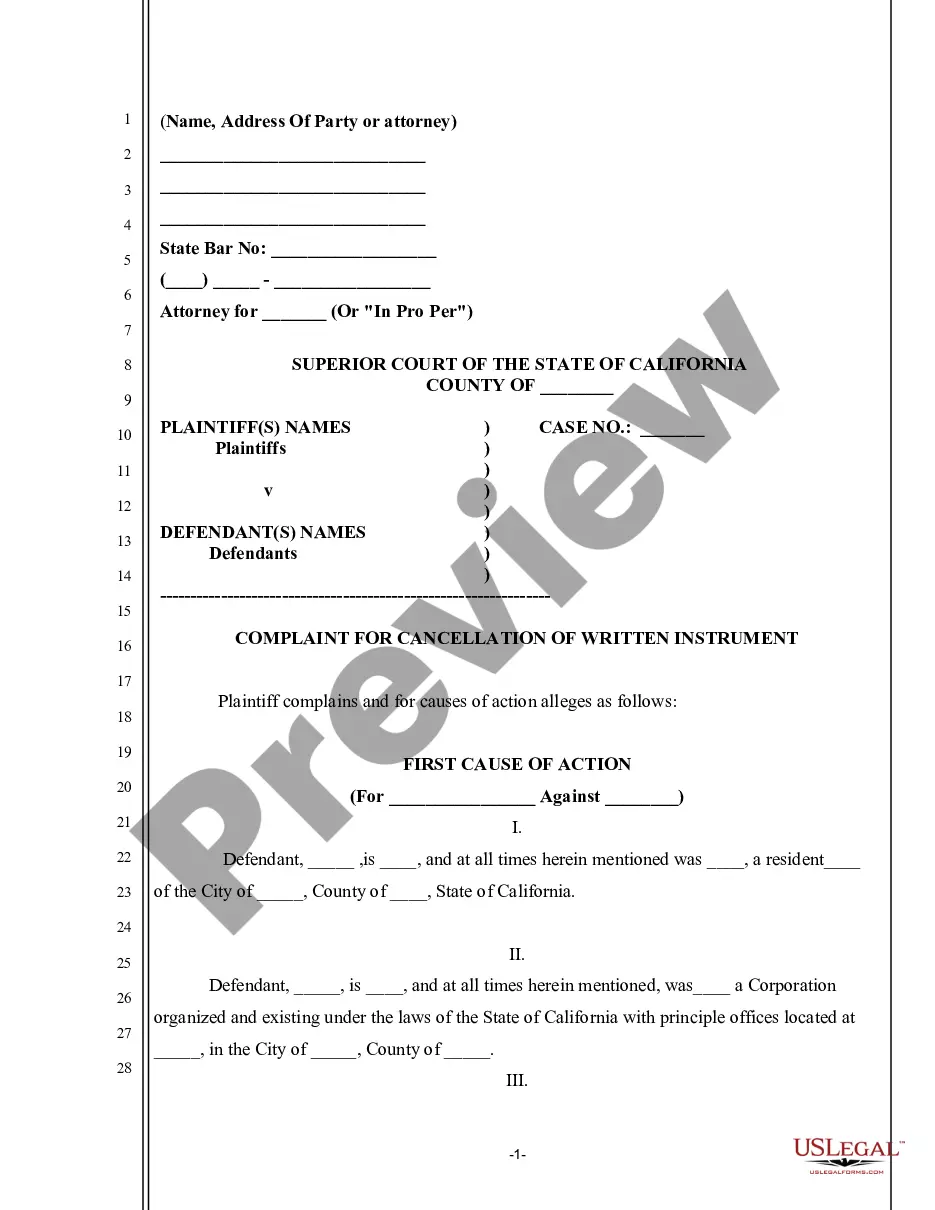

Baton Rouge Louisiana Business Credit Application is a comprehensive application form used by businesses in Baton Rouge, Louisiana, to apply for credit services and financing options. This detailed application plays a crucial role in assessing the creditworthiness of a business entity, thereby determining the eligibility for obtaining credit lines, loans, or other financial support. Keywords: Baton Rouge, Louisiana, business credit application, credit services, financing options, creditworthiness, eligibility, credit lines, loans, financial support. There are several types of Baton Rouge Louisiana Business Credit Application that cater to different industries and purposes: 1. Small Business Credit Application: Specifically tailored for small businesses operating in Baton Rouge, this type of credit application focuses on evaluating the financial stability, business plans, and potential growth of smaller enterprises. 2. Corporate Credit Application: Designed for larger corporations and organizations in Baton Rouge, this application type emphasizes the financial standing of a company, including revenue, assets, liabilities, and previous credit history. 3. Construction Business Credit Application: This specialized credit application targets businesses operating in the construction industry in Baton Rouge. It assesses the construction company's financial health, experience, ongoing projects, and potential profitability. 4. Start-up Business Credit Application: Specifically designed for newly established businesses in Baton Rouge, this application type addresses the unique challenges faced by startups. It examines the business model, market potential, projected cash flows, and viability of the venture. 5. Retail Business Credit Application: Tailored for retail businesses in Baton Rouge, this credit application focuses on factors such as inventory management, sales volume, customer base, and other retail-specific considerations. 6. Service-based Business Credit Application: Geared towards businesses providing services in Baton Rouge, this type of application evaluates the service provider's financial stability, customer satisfaction, contracts, and recurring revenue streams. It is important for businesses in Baton Rouge to choose the appropriate type of credit application that aligns with their specific needs and industry requirements. By accurately completing and submitting a Baton Rouge Louisiana Business Credit Application, businesses increase their chances of securing the necessary credit and financial assistance required for growth and expansion.

Baton Rouge Louisiana Business Credit Application

Description

How to fill out Baton Rouge Louisiana Business Credit Application?

If you are looking for a legitimate form template, it’s incredibly challenging to find a more suitable location than the US Legal Forms website – one of the most extensive libraries on the internet.

With this collection, you can obtain a vast array of form samples for business and personal uses organized by categories and regions or keywords.

With our enhanced search capability, locating the latest Baton Rouge Louisiana Business Credit Application is as simple as 1-2-3.

Complete the financial transaction. Use your credit card or PayPal account to finalize the registration process.

Obtain the form. Select the file format and save it on your device.

- Additionally, the relevance of each record is verified by a group of professional lawyers who routinely review the templates on our site and update them in line with the most current state and county regulations.

- If you are already familiar with our system and possess an account, all you need to obtain the Baton Rouge Louisiana Business Credit Application is to Log In to your profile and click the Download button.

- If you are using US Legal Forms for the first time, simply follow the guidelines below.

- Ensure you have located the form you require. Review its details and use the Preview option (if available) to examine its content. If it does not satisfy your needs, utilize the Search feature at the top of the screen to find the suitable document.

- Verify your choice. Click the Buy now button. Next, select the desired pricing plan and enter your details to register for an account.

Form popularity

FAQ

To close a business in Louisiana, you must file dissolution documents with the Secretary of State and settle outstanding debts. If you submitted a Baton Rouge Louisiana Business Credit Application, make sure all your financial obligations are cleared before proceeding. It’s wise to consult with an attorney or use a service like uslegalforms to assist with the legal aspects of dissolving your business.

Registering an LLC in Louisiana usually takes two to four weeks after you complete your Baton Rouge Louisiana Business Credit Application. The timeline depends on the submission method, as online registrations are typically processed quicker. To avoid delays, ensure you have all required documents ready before submission.

Generally, registering your business in Louisiana can take anywhere from one to four weeks, depending on the method of registration. Online submissions tend to be faster than paper applications. For a smoother process, consider using platforms like uslegalforms that guide you through the registration steps and help expedite your Baton Rouge Louisiana Business Credit Application.

Starting a business in Louisiana begins with filing the appropriate forms, including your Baton Rouge Louisiana Business Credit Application if you plan on obtaining credit. First, choose your business structure, such as an LLC or corporation. Then, secure necessary licenses and permits, and finally, make sure to comply with state tax registration requirements to ensure legal operation.

After you submit your Baton Rouge Louisiana Business Credit Application and file the necessary paperwork, it typically takes two to six weeks for your LLC to be officially recognized. Factors like processing speed at the Secretary of State’s office and any backlog can influence this timeline. Regularly checking your application status will help you stay informed about your LLC's progress.

The quickest way to get business credit is by registering your business and applying for a business credit card. Choose a lender that specializes in quick and easy approvals. Submitting an accurate Baton Rouge Louisiana business credit application will allow you to efficiently gather necessary funds to grow your business.

You can start building business credit within a few months. Establishing trade lines with suppliers and creditors, and consistently making on-time payments plays a significant role. By utilizing the Baton Rouge Louisiana business credit application effectively, you can set a solid foundation for a strong credit profile in record time.

It is possible to obtain a business credit card immediately if you meet the lender's requirements. Many financial institutions offer instant approval for applicants who have a solid credit history and a complete Baton Rouge Louisiana business credit application. Just ensure you have necessary documentation ready to expedite the process.

The fastest way to build business credit includes establishing a legal business entity, opening a business bank account, and obtaining a business credit card. Regularly paying your bills on time and maintaining low balances will further improve your credit. Consider using the Baton Rouge Louisiana business credit application process to align your credit-building efforts effectively.

To access your business credit, start by obtaining your business credit report from major credit bureaus. Next, review your credit history for inaccuracies or outdated information. Understanding your Baton Rouge Louisiana business credit application history allows you to improve your score and strategically manage your credit usage.