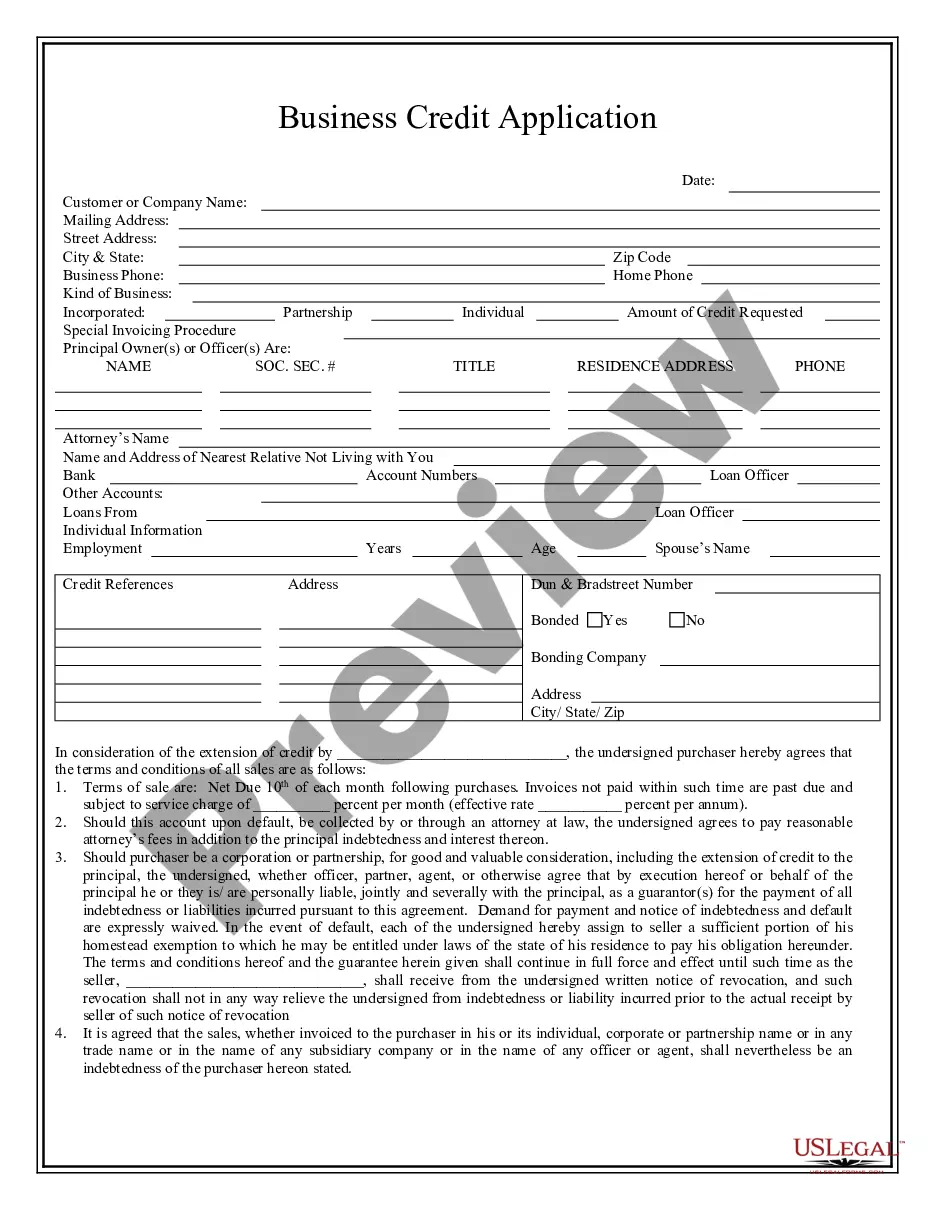

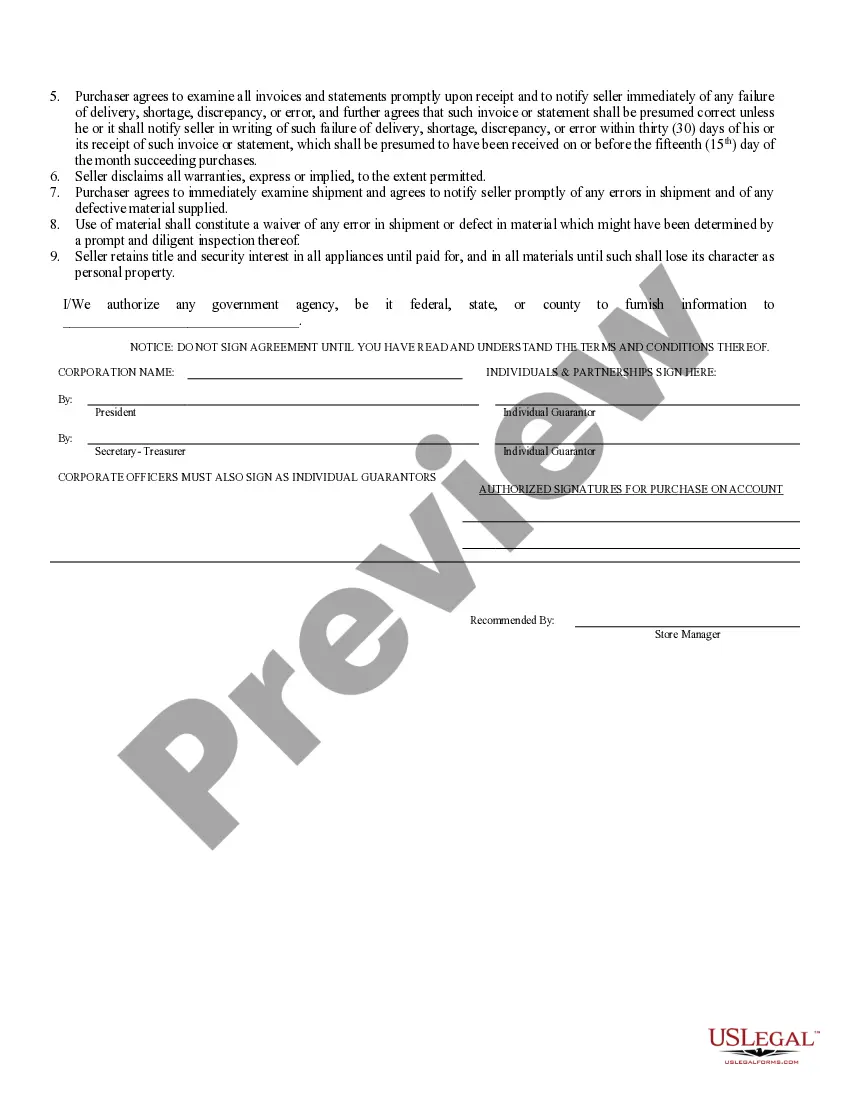

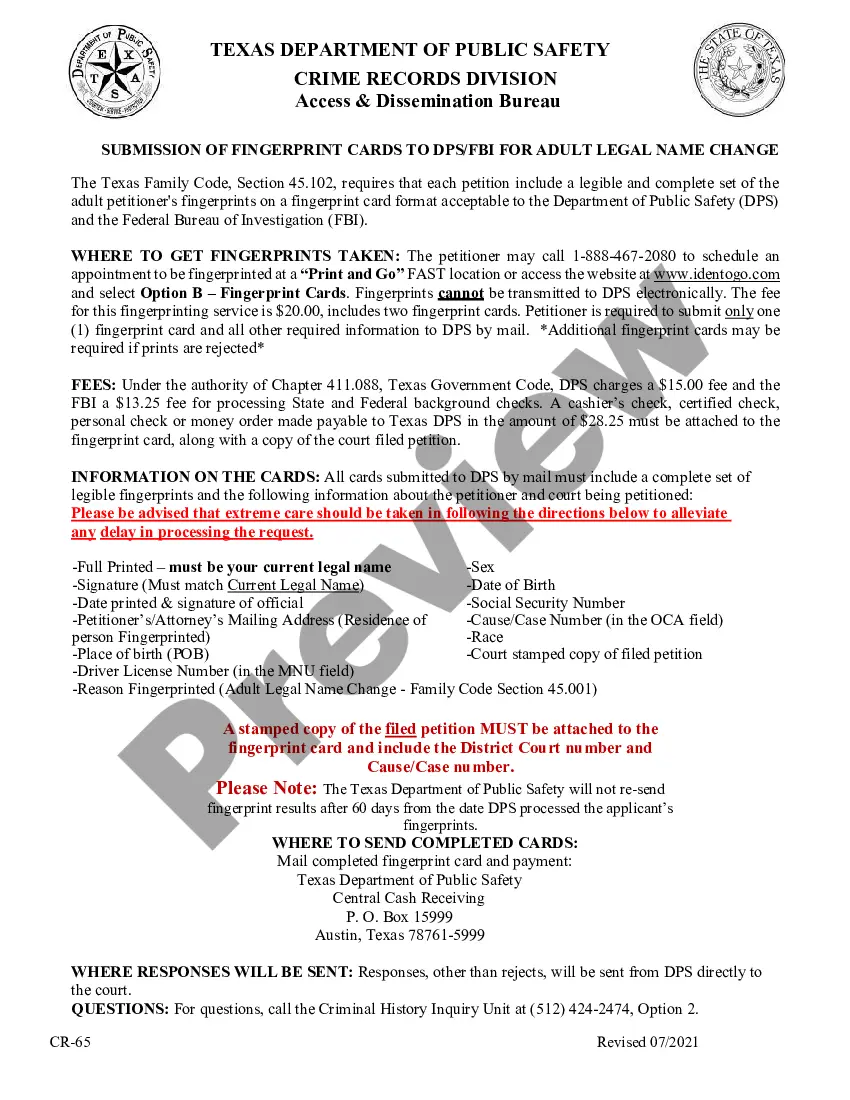

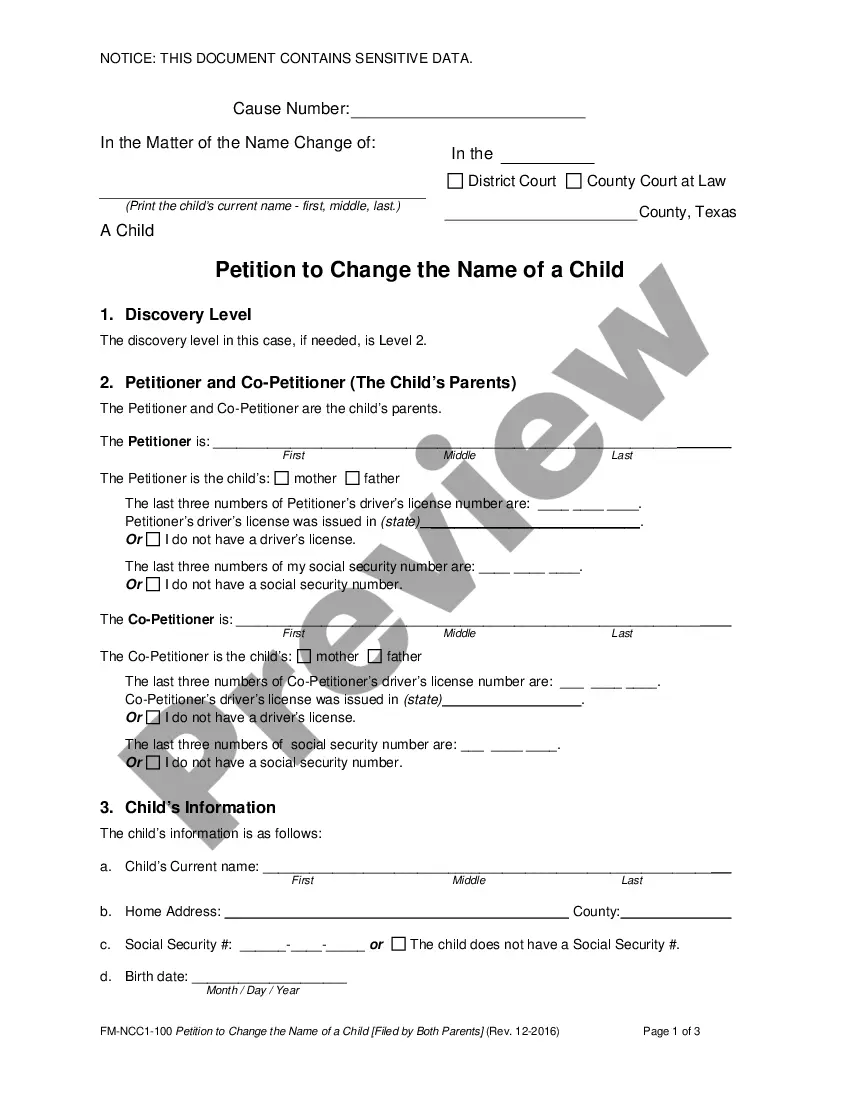

The New Orleans Louisiana Business Credit Application is a comprehensive document used by businesses in the New Orleans area to apply for credit from various financial institutions or lenders. This application is vital for organizations seeking financial assistance, as it helps lenders assess the creditworthiness and overall financial health of the applicant. Keywords: New Orleans, Louisiana, business, credit application There is a range of New Orleans Louisiana Business Credit Applications available, tailored to meet the diverse needs of businesses operating in the city. Some notable types of credit applications include: 1. Small Business Credit Application: This type of application is designed specifically for small businesses in New Orleans, providing them with the opportunity to secure credit for their day-to-day operations, equipment purchases, or expansion plans. 2. Start-up Business Credit Application: Entrepreneurs planning to establish a new business in New Orleans can utilize this credit application to apply for funding to support their initial setup costs, marketing initiatives, or hiring processes. 3. Commercial Real Estate Credit Application: Businesses seeking to invest in commercial real estate properties in New Orleans can utilize this application to apply for credit to finance their purchase, renovation, or development projects. 4. Working Capital Credit Application: This type of credit application is prevalent among businesses in New Orleans looking to improve their cash flow and meet their short-term financial obligations, such as paying suppliers or covering operational expenses. 5. Business Line of Credit Application: This application is valuable for businesses that require a revolving line of credit, enabling them to withdraw funds as needed to manage various expenses, handle fluctuations in cash flow, or seize investment opportunities. By utilizing the appropriate New Orleans Louisiana Business Credit Application, businesses can present their financial information, credit history, and growth plans in an organized and structured format to enhance their chances of securing the necessary credit for their endeavors. This process not only helps lenders evaluate the creditworthiness of the applicant but also ensures responsible financial management and sustainability within the New Orleans business community.

New Orleans Louisiana Business Credit Application

Description

How to fill out New Orleans Louisiana Business Credit Application?

We always strive to minimize or prevent legal damage when dealing with nuanced law-related or financial matters. To do so, we sign up for legal services that, usually, are very costly. Nevertheless, not all legal issues are equally complex. Most of them can be dealt with by ourselves.

US Legal Forms is a web-based library of up-to-date DIY legal forms addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your matters into your own hands without the need of using services of a lawyer. We provide access to legal form templates that aren’t always openly accessible. Our templates are state- and area-specific, which significantly facilitates the search process.

Take advantage of US Legal Forms whenever you need to find and download the New Orleans Louisiana Business Credit Application or any other form easily and safely. Simply log in to your account and click the Get button next to it. If you happened to lose the document, you can always download it again in the My Forms tab.

The process is just as straightforward if you’re new to the website! You can create your account within minutes.

- Make sure to check if the New Orleans Louisiana Business Credit Application adheres to the laws and regulations of your your state and area.

- Also, it’s crucial that you go through the form’s description (if provided), and if you spot any discrepancies with what you were looking for in the first place, search for a different template.

- Once you’ve made sure that the New Orleans Louisiana Business Credit Application would work for you, you can pick the subscription option and make a payment.

- Then you can download the document in any suitable file format.

For over 24 years of our presence on the market, we’ve helped millions of people by offering ready to customize and up-to-date legal forms. Make the most of US Legal Forms now to save efforts and resources!