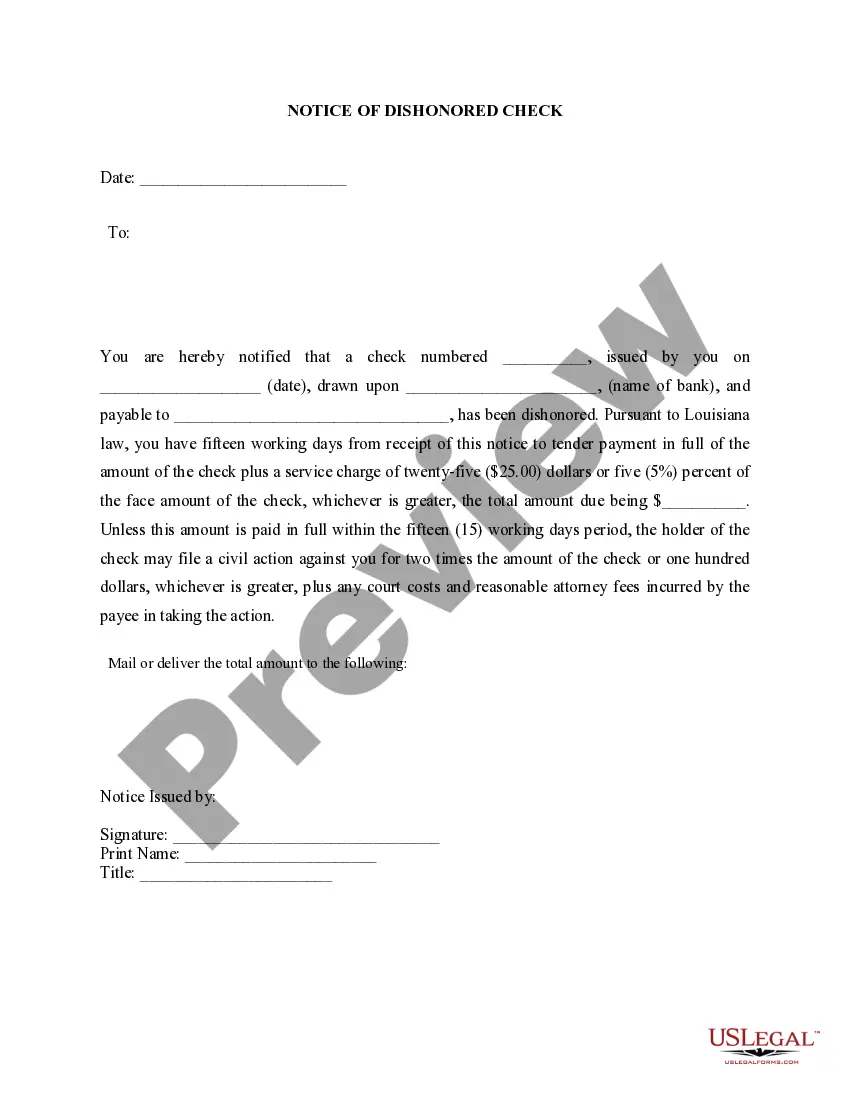

New Orleans Louisiana Notice of Dishonored Check Civilvi— - Keywords: bad check, bounced check Introduction: A Notice of Dishonored Check is a legal document issued in New Orleans, Louisiana, when a check has been returned unpaid by the bank. This notice serves as a formal notification to the check issuer informing them about the dishonored or bounced check. Violating check-writing guidelines can lead to serious consequences, including legal action. This detailed description will outline the types, implications, and procedures related to New Orleans Louisiana Notice of Dishonored Check — Civil. 1. Types of Bad Checks: In New Orleans Louisiana, several types of bad checks can lead to a Notice of Dishonored Check — Civil. These may include: a) Insufficient Funds: When the account balance is lower than the check amount, the check will bounce due to insufficient funds. b) Closed Account: If the check issuer has closed their bank account before the check is processed, it will be deemed as a bad check. c) Forged Signature: Checks with forged or unauthorized signatures are considered bad checks and can result in the same consequences. d) Post-Dated Checks: If a post-dated check is presented before the specified date, it will be marked as a bad check. 2. Implications of a Bad Check: When a check is dishonored, legal implications can arise, and it is crucial to understand the consequences. These may include: a) Criminal Charges: In New Orleans, knowingly issuing a bad check can be considered a crime, resulting in misdemeanor charges, fines, and even imprisonment. b) Civil Action: A Notice of Dishonored Check — Civil allows the recipient to file a lawsuit against the check issuer to recover the owed amount, plus any associated fees. c) Damaged Credit: Consistently writing bad checks can lead to a negative impact on the check issuer's credit score, making it difficult to access financial services in the future. 3. New Orleans Louisiana Notice of Dishonored Check — Civil Procedure: When a check bounces, certain procedures must be followed to initiate a civil action against the check issuer: a) Notice: The recipient should send a Notice of Dishonored Check by certified mail to the check issuer, informing them about the dishonored check and the amount owed. b) Redemption Period: The check issuer has ten days from receiving the notice to redeem the check by paying the owed amount, including any additional fees or penalties. c) Non-Redemption/Non-Payment: If the check issuer fails to pay within the redemption period, the recipient can proceed with legal action. d) Lawsuit: The recipient can file a civil lawsuit against the check issuer to recover the amount owed, including attorney fees and court costs. e) Settlement or Trial: The case may be settled outside of court, or it may proceed to trial where the judge will make a final decision based on the presented evidence. Conclusion: Understanding the implications and procedure of a New Orleans Louisiana Notice of Dishonored Check — Civil is essential to navigate the legal consequences of writing bad checks. It is crucial to ensure that sufficient funds are available in the account before writing a check and to promptly address any issues that may arise to avoid potential legal actions.

New Orleans Louisiana Notice of Dishonored Check - Civil - Keywords: bad check, bounced check

State:

Louisiana

City:

New Orleans

Control #:

LA-401N

Format:

Word;

Rich Text

Instant download

Description

This is a Notice of Dishonored Check - Civil. A "dishonored check" (also known as a "bounced check" or "bad check") is a check which the bank will not pay because there is no such checking account, or there are insufficient funds in the account to pay the check. In order to attempt the greatest possible recovery on a dishonored check, the business owner, or any other person given a dishonored check, may be required by state law to notify the debtor that the check was dishonored.

New Orleans Louisiana Notice of Dishonored Check Civilvi— - Keywords: bad check, bounced check Introduction: A Notice of Dishonored Check is a legal document issued in New Orleans, Louisiana, when a check has been returned unpaid by the bank. This notice serves as a formal notification to the check issuer informing them about the dishonored or bounced check. Violating check-writing guidelines can lead to serious consequences, including legal action. This detailed description will outline the types, implications, and procedures related to New Orleans Louisiana Notice of Dishonored Check — Civil. 1. Types of Bad Checks: In New Orleans Louisiana, several types of bad checks can lead to a Notice of Dishonored Check — Civil. These may include: a) Insufficient Funds: When the account balance is lower than the check amount, the check will bounce due to insufficient funds. b) Closed Account: If the check issuer has closed their bank account before the check is processed, it will be deemed as a bad check. c) Forged Signature: Checks with forged or unauthorized signatures are considered bad checks and can result in the same consequences. d) Post-Dated Checks: If a post-dated check is presented before the specified date, it will be marked as a bad check. 2. Implications of a Bad Check: When a check is dishonored, legal implications can arise, and it is crucial to understand the consequences. These may include: a) Criminal Charges: In New Orleans, knowingly issuing a bad check can be considered a crime, resulting in misdemeanor charges, fines, and even imprisonment. b) Civil Action: A Notice of Dishonored Check — Civil allows the recipient to file a lawsuit against the check issuer to recover the owed amount, plus any associated fees. c) Damaged Credit: Consistently writing bad checks can lead to a negative impact on the check issuer's credit score, making it difficult to access financial services in the future. 3. New Orleans Louisiana Notice of Dishonored Check — Civil Procedure: When a check bounces, certain procedures must be followed to initiate a civil action against the check issuer: a) Notice: The recipient should send a Notice of Dishonored Check by certified mail to the check issuer, informing them about the dishonored check and the amount owed. b) Redemption Period: The check issuer has ten days from receiving the notice to redeem the check by paying the owed amount, including any additional fees or penalties. c) Non-Redemption/Non-Payment: If the check issuer fails to pay within the redemption period, the recipient can proceed with legal action. d) Lawsuit: The recipient can file a civil lawsuit against the check issuer to recover the amount owed, including attorney fees and court costs. e) Settlement or Trial: The case may be settled outside of court, or it may proceed to trial where the judge will make a final decision based on the presented evidence. Conclusion: Understanding the implications and procedure of a New Orleans Louisiana Notice of Dishonored Check — Civil is essential to navigate the legal consequences of writing bad checks. It is crucial to ensure that sufficient funds are available in the account before writing a check and to promptly address any issues that may arise to avoid potential legal actions.

How to fill out New Orleans Louisiana Notice Of Dishonored Check - Civil - Keywords: Bad Check, Bounced Check?

If you’ve already utilized our service before, log in to your account and save the New Orleans Louisiana Notice of Dishonored Check - Civil - Keywords: bad check, bounced check on your device by clicking the Download button. Make certain your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple actions to get your document:

- Make sure you’ve found a suitable document. Read the description and use the Preview option, if any, to check if it meets your requirements. If it doesn’t fit you, utilize the Search tab above to get the appropriate one.

- Purchase the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Create an account and make a payment. Use your credit card details or the PayPal option to complete the transaction.

- Obtain your New Orleans Louisiana Notice of Dishonored Check - Civil - Keywords: bad check, bounced check. Choose the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to every piece of paperwork you have purchased: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to quickly locate and save any template for your personal or professional needs!