Title: Exploring Shreveport Louisiana Cash Sale Property of One Spouse: A Comprehensive Guide Introduction: In Shreveport, Louisiana, cash sale properties owned by one spouse carry significant legal and financial implications. This article aims to provide a detailed description of such properties, shedding light on their characteristics, types, and key considerations. Whether you're a potential buyer, seller, or simply curious about this niche, we will explore all aspects to broaden your understanding. Keywords: Shreveport Louisiana, cash sale property, one spouse, types, legal implications I. Understanding Shreveport Louisiana Cash Sale Property of One Spouse 1. Definition: Cash sale property refers to real estate that is purchased without any financing or mortgage, i.e., paid for entirely in cash. 2. Ownership: Cash sale property of one spouse means that the property is solely owned by one partner and is not subject to joint ownership with the other spouse. 3. Unique Legal Framework: Shreveport, Louisiana operates under the community property system, where both spouses generally have equal rights to marital property. Understanding the legal implications of a cash sale property owned solely by one spouse is vital. II. Types of Shreveport Louisiana Cash Sale Property of One Spouse 1. Primary Residence: A cash sale property that serves as the primary domicile of one spouse, establishing it as their main place of residence. 2. Secondary/Vacation Home: This type of cash sale property refers to real estate acquired for recreational or vacation purposes, providing a temporary change of scenery from the primary residence. 3. Rental Properties: Cash sale properties purchased solely by one spouse and dedicated to generating rental income can include single-family homes, apartments, or other types of investment properties. 4. Land and Acreage: This category encompasses undeveloped land or larger plots purchased solely by one spouse without any structural improvements. III. Key Considerations for Shreveport Louisiana Cash Sale Property of One Spouse 1. Ownership Documentation: Proper documentation of sole ownership is crucial, clearly identifying the property as owned solely by one spouse. 2. Marital Agreement: Having a prenuptial or postnuptial agreement in place which designates certain properties as cash sale properties of one spouse can help protect individual ownership rights. 3. Inheritance and Gifting: Understanding the implications of inherited or gifted cash sale properties and how they may impact marital property division in case of divorce. 4. Tax and Insurance Responsibilities: As the sole owner, understanding the tax implications and insurance coverage requirements for cash sale properties is essential. 5. Future Implications: Considering potential future scenarios, such as divorce or inheritance, enables spouses to plan and protect their interests regarding cash sale properties. Conclusion: Shreveport Louisiana cash sale property of one spouse holds distinct characteristics within the community property regime. By understanding the various types, legal implications, and key considerations, individuals can navigate this niche real estate market more confidently. Whether you are looking to invest in cash sale properties, contemplating divorce, or simply expanding your knowledge, this detailed guide offers valuable insight into this specialized segment of Shreveport's real estate landscape. Keywords: Shreveport Louisiana, cash sale property, one spouse, types, legal implications, ownership, primary residence, secondary home, vacation home, rental property, land, acreage, considerations, documentation, marital agreement, inheritance, gifting, tax responsibilities, insurance, future implications, community property regime.

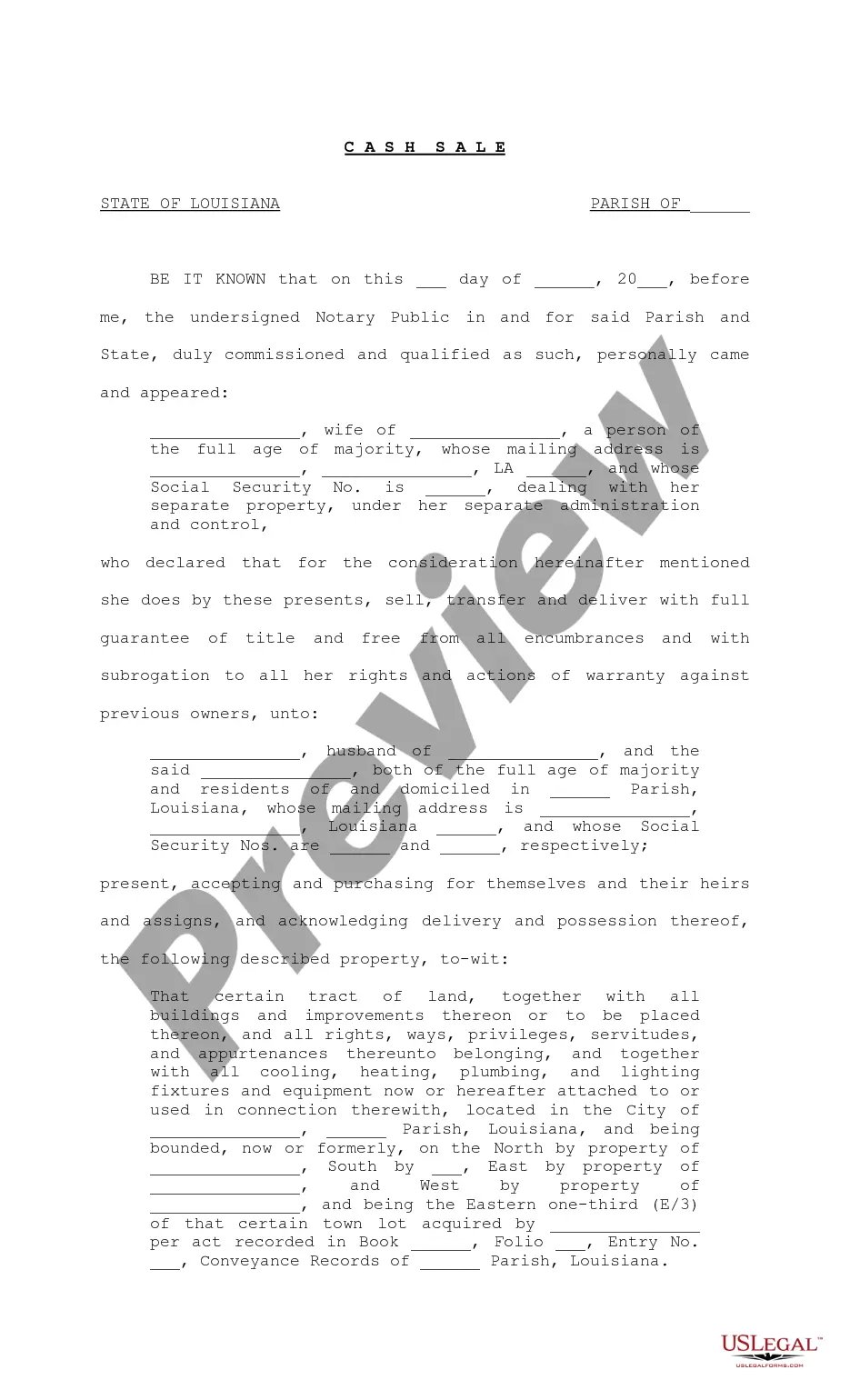

Shreveport Louisiana Cash Sale property of one spouse

Description

How to fill out Shreveport Louisiana Cash Sale Property Of One Spouse?

Take advantage of the US Legal Forms and have immediate access to any form sample you need. Our beneficial website with a large number of documents simplifies the way to find and get virtually any document sample you will need. You are able to export, complete, and certify the Shreveport Louisiana Cash Sale property of one spouse in a few minutes instead of surfing the Net for hours seeking the right template.

Using our library is a superb strategy to improve the safety of your form submissions. Our professional lawyers regularly review all the records to ensure that the forms are appropriate for a particular region and compliant with new acts and regulations.

How can you obtain the Shreveport Louisiana Cash Sale property of one spouse? If you have a subscription, just log in to the account. The Download button will appear on all the documents you look at. Additionally, you can find all the previously saved documents in the My Forms menu.

If you haven’t registered a profile yet, follow the instructions listed below:

- Find the template you require. Make certain that it is the form you were looking for: verify its name and description, and utilize the Preview function when it is available. Otherwise, use the Search field to find the appropriate one.

- Launch the saving procedure. Click Buy Now and choose the pricing plan you prefer. Then, create an account and pay for your order with a credit card or PayPal.

- Download the document. Select the format to obtain the Shreveport Louisiana Cash Sale property of one spouse and change and complete, or sign it according to your requirements.

US Legal Forms is one of the most extensive and trustworthy template libraries on the web. We are always ready to help you in any legal case, even if it is just downloading the Shreveport Louisiana Cash Sale property of one spouse.

Feel free to make the most of our form catalog and make your document experience as straightforward as possible!