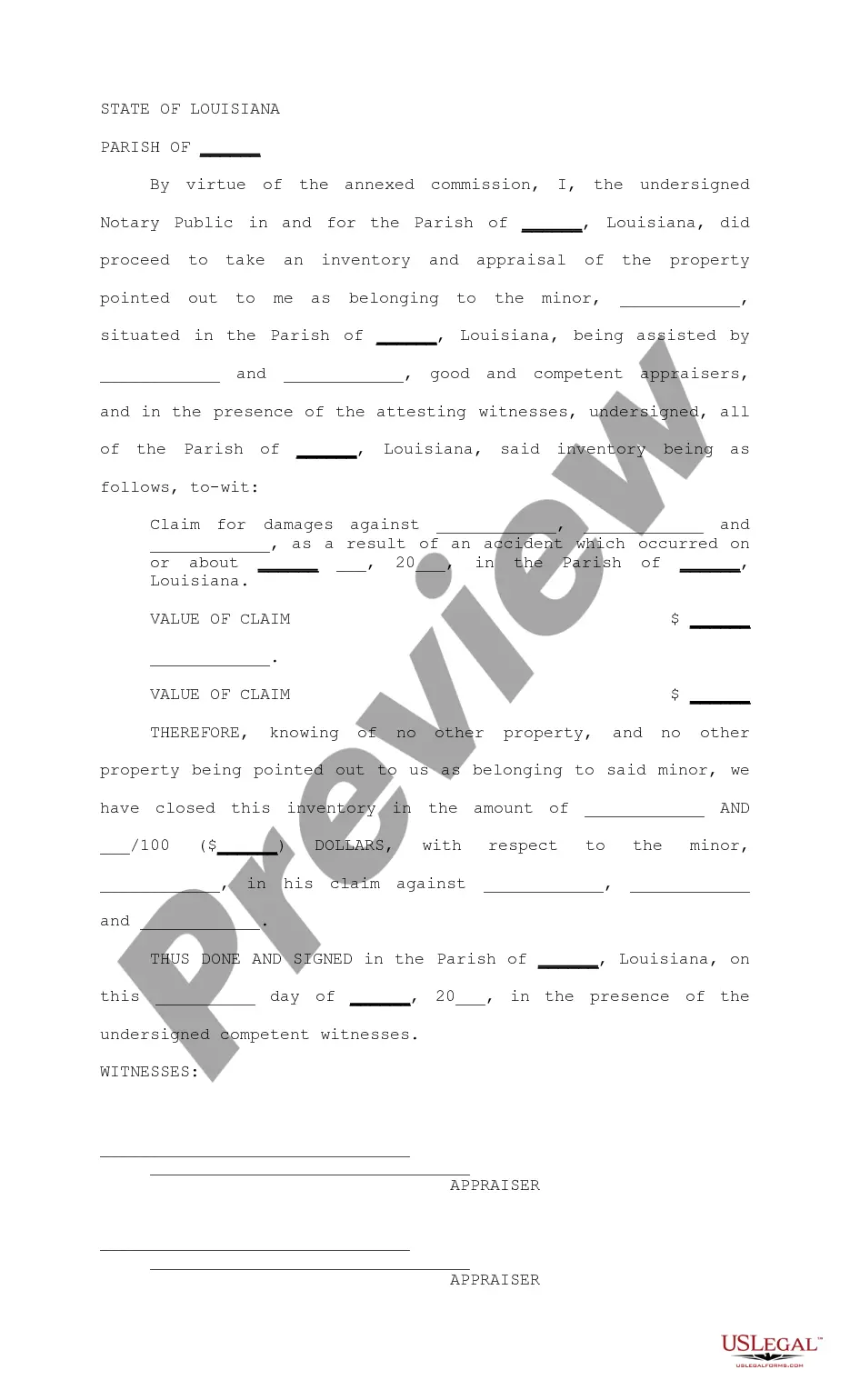

Baton Rouge Louisiana Inventory and Appraisal of Property is a comprehensive process that involves identifying, cataloging, and evaluating various assets within a specific location. This crucial task helps individuals, businesses, and government entities to have a clear understanding of their property's value, condition, and potential uses. It is particularly important during buying, selling, estate planning, insurance claims, legal disputes, and tax assessments. The types of Baton Rouge Louisiana Inventory and Appraisal of Property can vary based on the purpose and nature of the evaluation. Some common categories include: 1. Residential Property Appraisal: This focuses on assessing residential properties such as houses, apartments, townhouses, and condominiums in Baton Rouge. The evaluation considers factors like location, size, amenities, condition, and recent sales of comparable properties. 2. Commercial Property Appraisal: This entails appraising commercial real estate properties such as office buildings, retail spaces, warehouses, and industrial complexes in Baton Rouge. The assessment factors in rental income potential, location, market trends, utility, and physical condition. 3. Industrial Property Appraisal: This specialized appraisal type concentrates on evaluating large-scale industrial properties like manufacturing plants, factories, storage facilities, and distribution centers. Experts consider factors like land value, machinery and equipment valuation, specialized usage permits, and market demand. 4. Personal Property Inventory: This involves cataloging and valuing personal belongings within a property, including furniture, electronics, appliances, artwork, jewelry, and collectibles. It assists in insurance coverage, estate planning, and divorce settlements. 5. Estate Appraisal: Estate appraisals are conducted to determine the value of assets owned by an individual upon their passing, providing key information for probate and estate tax purposes. It includes all the property types mentioned above. 6. Machinery and Equipment Appraisal: This focuses exclusively on assessing the value of machinery, tools, and equipment used in various industries like agriculture, construction, manufacturing, or healthcare. It may involve experts with specialized knowledge in specific machinery types. 7. Special Purpose Property Appraisal: This covers unique properties that require specific expertise due to their uncommon nature. Examples include historic buildings, religious structures, government-owned properties, and special-use facilities like sports arenas or schools. Baton Rouge Louisiana Inventory and Appraisal of Property aims to provide accurate, unbiased, and legally defensible information regarding the value and condition of various assets. Accredited appraisers with in-depth knowledge of the local market and regulations conduct these evaluations, ensuring the credibility and reliability of the final appraisal reports. Whether for individual property owners, businesses, or government entities, this process helps in making informed decisions related to buying, selling, insuring, or utilizing the property.

Baton Rouge Louisiana Inventory and Appraisal of Property

Description

How to fill out Baton Rouge Louisiana Inventory And Appraisal Of Property?

Irrespective of societal or occupational rank, filling out legal documents is a regrettable requirement in the modern professional landscape.

Frequently, it is nearly unfeasible for an individual lacking any legal expertise to compose such documents from scratch, primarily owing to the complex language and legal nuances they entail.

This is where US Legal Forms can come to the rescue.

Ensure that the template you’ve selected is appropriate for your region, as the rules of one state or area do not apply to another.

Review the document and, if available, read a brief overview of the situations for which the form can be utilized.

- Our platform provides a vast collection of over 85,000 ready-to-use, state-specific forms suitable for almost any legal circumstance.

- US Legal Forms is also an excellent resource for associates or legal advisers who aim to enhance their time efficiency using our DIY forms.

- Whether you require the Baton Rouge Louisiana Inventory and Appraisal of Property or any other documentation that aligns with your state or locality, US Legal Forms makes everything easily accessible.

- Here’s how you can obtain the Baton Rouge Louisiana Inventory and Appraisal of Property in just minutes using our reliable platform.

- If you are already a subscriber, feel free to Log In to your account to access the desired form.

- However, if you are new to our platform, make sure to follow these instructions prior to downloading the Baton Rouge Louisiana Inventory and Appraisal of Property.

Form popularity

FAQ

Property tax in Baton Rouge is calculated based on the assessed value of the property and the cumulative local tax rates, which can vary. It’s beneficial for property owners to check with the East Baton Rouge Parish Tax Assessor for specific rates and assessments. Being informed about property tax can enhance your management of Baton Rouge Louisiana Inventory and Appraisal of Property.

In Louisiana, property is assessed based on its fair market value, which is determined by the local assessor's office. The assessment considers various factors, including property condition, location, and comparable sales. Understanding how property is assessed is essential for those navigating the Baton Rouge Louisiana Inventory and Appraisal of Property process.

In Louisiana, seniors aged 65 and older may qualify for exemptions that can reduce or eliminate property taxes. It is important for seniors to understand the criteria and apply for these exemptions to benefit from lower rates. This can be particularly useful for individuals managing Baton Rouge Louisiana Inventory and Appraisal of Property.

In Louisiana, the annual property tax can vary significantly depending on the property's assessment value and the local tax rate. It is generally computed as a percentage of the property's assessed value. Knowing the annual property tax is crucial for those dealing with Baton Rouge Louisiana Inventory and Appraisal of Property to budget appropriately.

The tax rate for Baton Rouge, Louisiana, varies based on property type and location, but it typically falls within a range set by local authorities. Understanding the tax rate is essential for assessing the Baton Rouge Louisiana Inventory and Appraisal of Property. To get the most accurate information, it’s wise to consult the East Baton Rouge Parish Tax Assessor's Office.

Looking up your record in Louisiana can be accomplished through the local clerk of court's office or official online databases. These resources allow you to view public documents relating to your property, including tax assessments and ownership history. It is essential for those interested in the Baton Rouge Louisiana Inventory and Appraisal of Property to maintain accurate records. If you need assistance in this process, uslegalforms offers tools to facilitate your search.

To see who owns a property in Louisiana, you can check the local parish assessor's website or use property records databases. These records typically include the owner's name, property description, and transfer history. For those interested in the Baton Rouge Louisiana Inventory and Appraisal of Property, accessing ownership information is crucial. Platforms like uslegalforms can help you navigate inquiries about property ownership efficiently.

Property taxes in Baton Rouge, Louisiana, depend on the assessed value of the property and the local tax rate. Generally, the average property tax rate in the area hovers around 5% of the assessed value. To fully understand your obligations, reviewing the Baton Rouge Louisiana Inventory and Appraisal of Property can be insightful. For personalized guidance, resources like uslegalforms may provide helpful information and documentation.

To find property records in Louisiana, you can start by visiting the local assessor's office website or using online databases. These resources often provide valuable information about property ownership, assessed values, and historical data. When exploring the Baton Rouge Louisiana Inventory and Appraisal of Property, accessing these records can be incredibly beneficial. For additional help, uslegalforms offers tools to streamline the retrieval of property documentation.

Yes, Louisiana is an open records state, meaning that most public records are accessible to citizens. This includes property records, court documents, and other governmental information. If you're interested in the Baton Rouge Louisiana Inventory and Appraisal of Property, utilizing this openness can aid in your research. Platforms like uslegalforms can assist you in acquiring and understanding these records.