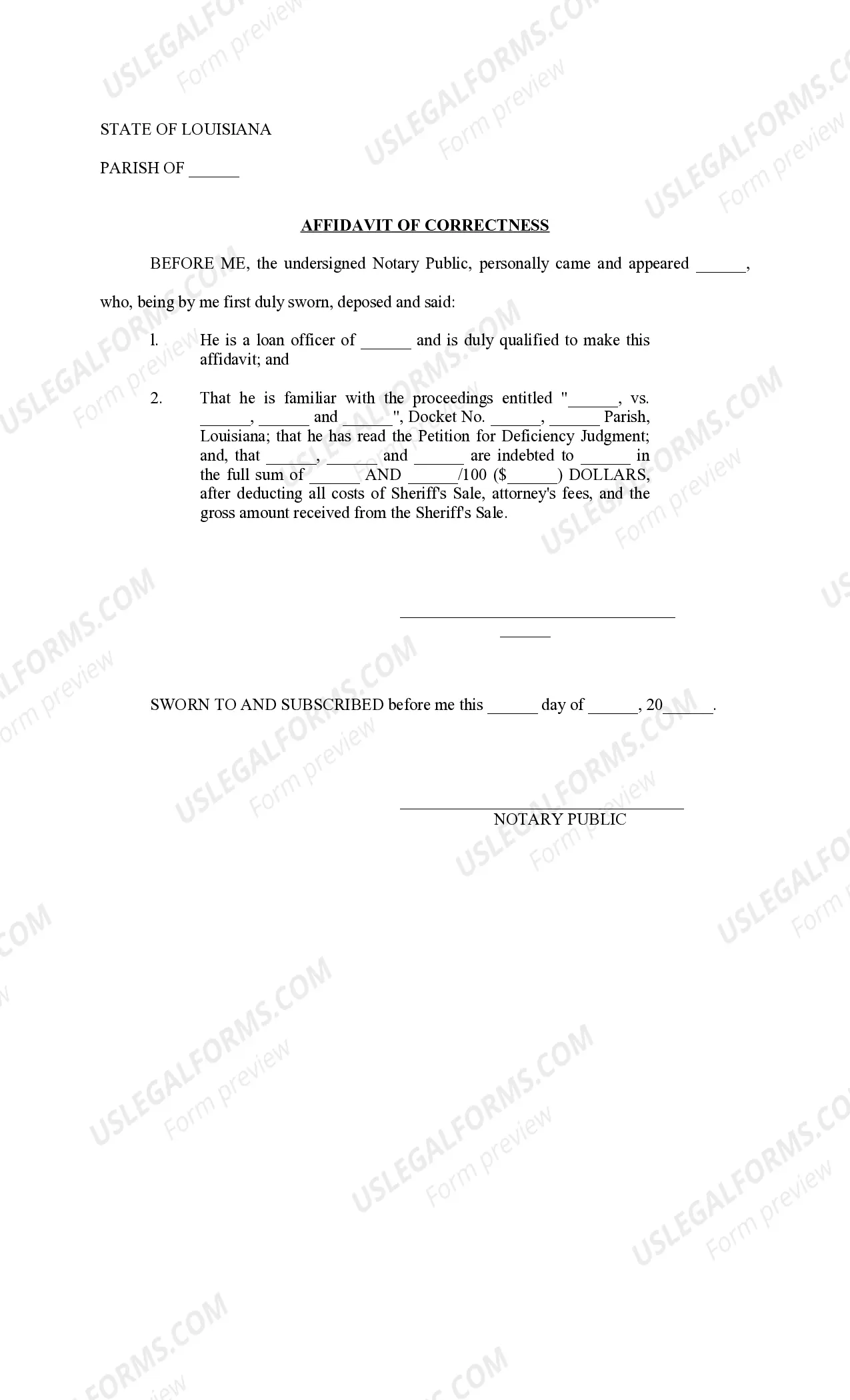

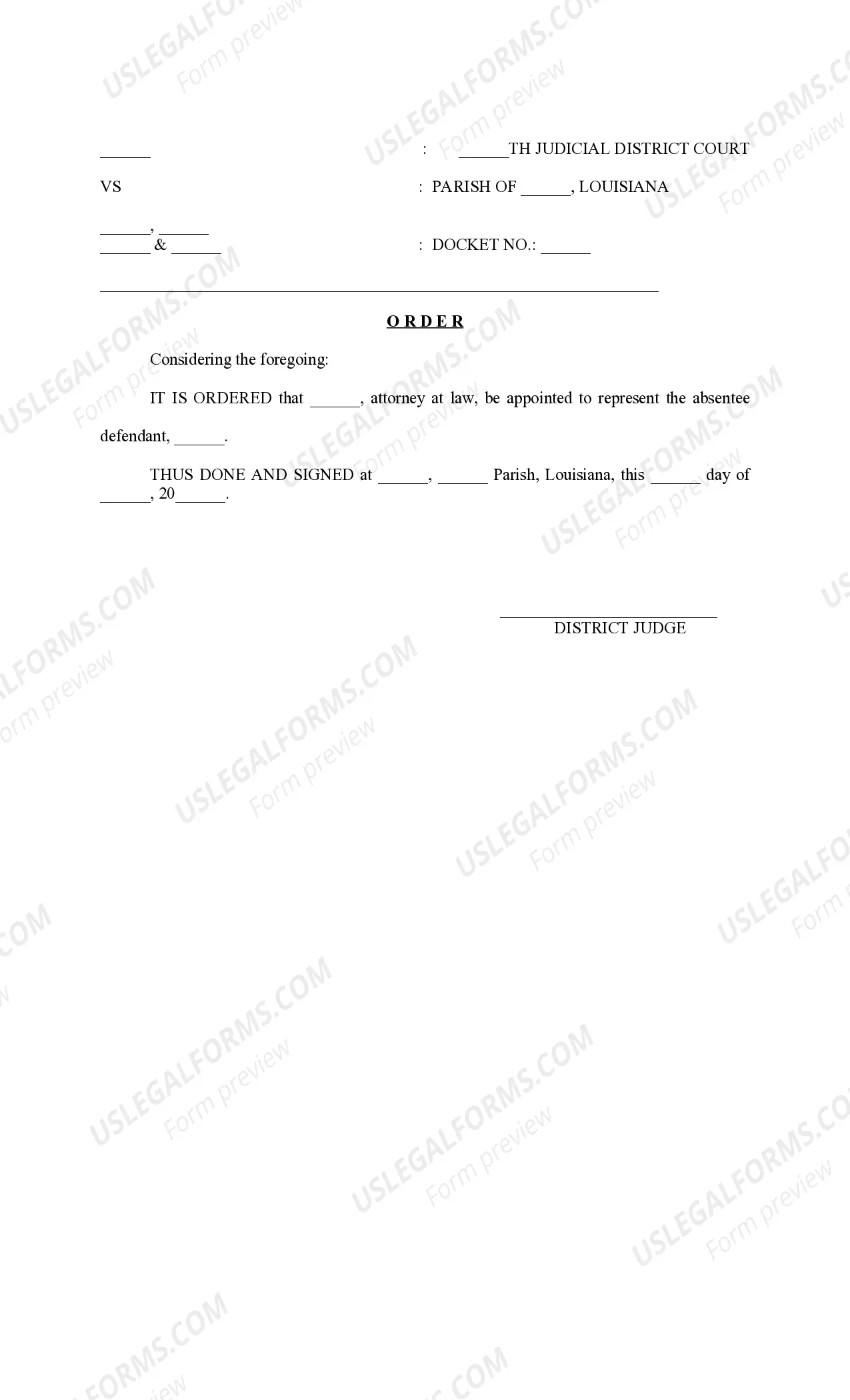

The New Orleans Louisiana Petition for Deficiency Judgment is a legal document used in cases where a borrower in the state of Louisiana fails to repay the full amount of a mortgage or loan, and the lender seeks to obtain a deficiency judgment against the borrower for the remaining balance. A deficiency judgment is a court order that allows the lender to collect the difference between the outstanding loan balance and the fair market value of the property through various means, such as wage garnishment or asset seizure. This petition is an important legal step for lenders aiming to recover their losses following a foreclosure or property repossession. In New Orleans, there are two main types of Petition for Deficiency Judgment: judicial and non-judicial foreclosure. In a judicial foreclosure, the lender files a lawsuit against the borrower seeking repayment of the remaining loan balance. The court oversees the foreclosure process, reviews the evidence presented by both parties, and decides whether to grant a deficiency judgment. On the other hand, non-judicial foreclosure occurs when the mortgage or loan agreement includes a power of sale clause, allowing the lender to foreclose and sell the property without court involvement. If the sales proceeds do not cover the outstanding loan balance, the lender can file a Petition for Deficiency Judgment to pursue collection of the remaining debt. Keywords: New Orleans, Louisiana, Petition for Deficiency Judgment, borrower, lender, mortgage, loan, deficiency judgment, foreclosure, property repossession, legal document, court order, fair market value, repayment, wage garnishment, asset seizure, judicial foreclosure, non-judicial foreclosure, lawsuit, power of sale clause, sales proceeds, debt collection.

New Orleans Louisiana Petition for Deficiency Judgment

Description

How to fill out New Orleans Louisiana Petition For Deficiency Judgment?

We always want to minimize or avoid legal issues when dealing with nuanced law-related or financial affairs. To accomplish this, we sign up for attorney services that, usually, are extremely costly. However, not all legal issues are equally complex. Most of them can be taken care of by ourselves.

US Legal Forms is an online library of updated DIY legal documents addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your affairs into your own hands without the need of turning to a lawyer. We provide access to legal form templates that aren’t always publicly available. Our templates are state- and area-specific, which significantly facilitates the search process.

Benefit from US Legal Forms whenever you need to get and download the New Orleans Louisiana Petition for Deficiency Judgment or any other form easily and securely. Simply log in to your account and click the Get button next to it. If you happened to lose the form, you can always re-download it in the My Forms tab.

The process is just as straightforward if you’re new to the platform! You can create your account in a matter of minutes.

- Make sure to check if the New Orleans Louisiana Petition for Deficiency Judgment adheres to the laws and regulations of your your state and area.

- Also, it’s crucial that you go through the form’s description (if available), and if you spot any discrepancies with what you were looking for in the first place, search for a different template.

- Once you’ve made sure that the New Orleans Louisiana Petition for Deficiency Judgment would work for your case, you can choose the subscription plan and make a payment.

- Then you can download the form in any available file format.

For over 24 years of our presence on the market, we’ve served millions of people by providing ready to customize and up-to-date legal documents. Take advantage of US Legal Forms now to save efforts and resources!