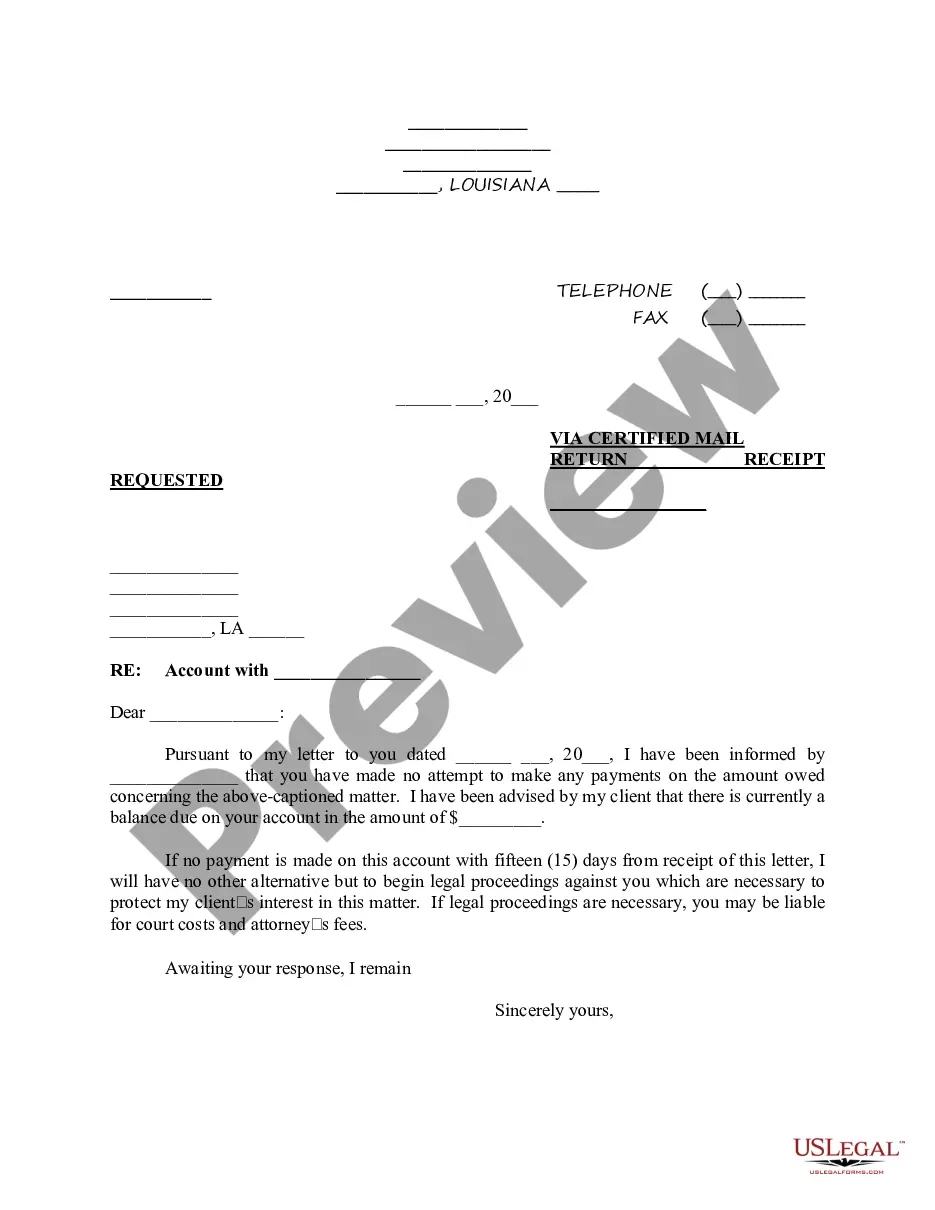

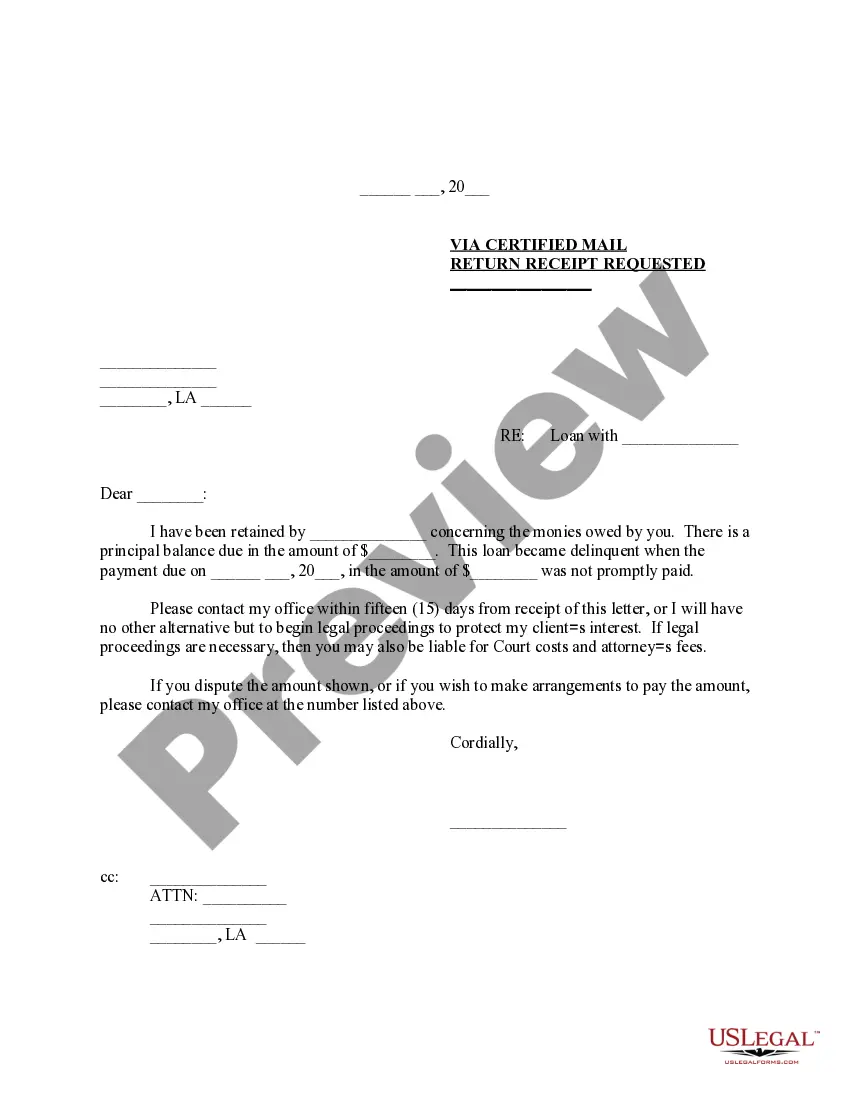

Baton Rouge Louisiana Demand Letter - Payment of Account

Description

How to fill out Louisiana Demand Letter - Payment Of Account?

We consistently aim to reduce or evade legal repercussions when addressing intricate legal or financial issues.

To achieve this, we enroll in lawyer services that, generally, are exceedingly pricey.

Nonetheless, not every legal situation is this intricate. Many of them can be managed by ourselves.

US Legal Forms is an online directory of current DIY legal documents covering everything from wills and powers of attorney to articles of incorporation and petitions for dissolution.

Just Log In to your account and click the Get button beside it. If you happen to misplace the document, you can always re-download it in the My documents tab. The procedure is equally straightforward if you're unfamiliar with the platform! You can create your account in just a few minutes. Ensure to verify if the Baton Rouge Louisiana Demand Letter - Payment of Account complies with the laws and regulations of your state and locale. Furthermore, it’s essential that you review the form’s outline (if available), and if you notice any inconsistencies with what you initially sought, look for an alternative template. Once you’ve confirmed that the Baton Rouge Louisiana Demand Letter - Payment of Account is appropriate for your situation, you can select the subscription option and continue to payment. You can then download the document in any file format that is available. For over 24 years of our operation, we’ve assisted millions of individuals by providing ready-to-customize and current legal documents. Take advantage of US Legal Forms now to conserve time and resources!

- Our collection enables you to take your issues into your own hands without relying on a lawyer.

- We offer access to legal form templates that aren't always readily available.

- Our templates are specific to states and regions, which significantly simplifies the searching process.

- Benefit from US Legal Forms whenever you need to locate and download the Baton Rouge Louisiana Demand Letter - Payment of Account or any other form efficiently and securely.

Form popularity

FAQ

A letter of demand for outstanding payment is a formal request sent to a debtor seeking settlement of an unpaid obligation. This letter typically details the amount owed, the reasons for the debt, and a deadline for payment. Using a Baton Rouge Louisiana Demand Letter - Payment of Account offers a structured approach to recover outstanding funds effectively.

When writing a letter requesting payment, start with a polite introduction and state the purpose of your letter clearly. Include the specifics of the debt, such as the amount due and the payment method. A Baton Rouge Louisiana Demand Letter - Payment of Account can help you maintain clarity and professionalism throughout your request.

The primary document used to demand payment is a demand letter. This letter should detail the amount owed, the reasons for the debt, and any relevant deadlines. By using a Baton Rouge Louisiana Demand Letter - Payment of Account, you ensure that your request is formal and well-structured, which can encourage prompt compliance.

To write a letter demanding a payment, start with your contact information, then the recipient’s details. Clearly state the purpose of the letter, including the total amount owed and any relevant dates. Utilizing a Baton Rouge Louisiana Demand Letter - Payment of Account template helps ensure that you cover all necessary points effectively.

When writing a final demand for payment letter, clearly outline the outstanding amount and previous communications regarding the debt. Emphasize that this is your last attempt to resolve the matter amicably before considering legal steps. A well-crafted Baton Rouge Louisiana Demand Letter - Payment of Account can convey seriousness while still maintaining professionalism.

You can send a demand letter for payment either through certified mail or an email with a read receipt. Ensure you keep a copy of the letter for your records. Using a professionally crafted Baton Rouge Louisiana Demand Letter - Payment of Account enhances your credibility and can motivate the recipient to act quickly.

Making a demand for payment involves creating a document that outlines the details of the debt. Specify the amount due, the due date, and the payment method acceptable. A well-structured Baton Rouge Louisiana Demand Letter - Payment of Account formally communicates your expectations and encourages prompt payment.

To demand a payment, you should first draft a clear and direct demand letter. Begin by stating the amount owed, the reason for the debt, and a deadline for payment. This letter serves as an official request and can be essential when pursuing legal action later. Utilizing a Baton Rouge Louisiana Demand Letter - Payment of Account template can streamline the process.

A written demand is a formal request documented in writing, asking for payment or action to be taken. This type of letter lays out the facts and specifies what is required. In the context of a Baton Rouge Louisiana Demand Letter - Payment of Account, the clarity and formality of your written demand can pressure the debtor to respond promptly.

A demand writer is typically a professional or service that assists in creating demand letters for clients. They ensure that the content is legally sound and effective in conveying the urgency of the matter. If you need assistance with a Baton Rouge Louisiana Demand Letter - Payment of Account, consider a specialized platform like uslegalforms for reliable support.