The Shreveport Louisiana Demand Letter — Payment of Account 2nd Letter is a document used for requesting payment of an outstanding bill or debt from a debtor in Shreveport, Louisiana. This letter serves as a legally formal communication, urging the recipient to fulfill their financial obligations promptly. It provides an opportunity for parties involved to resolve disputes and avoid potential legal actions. Keywords: Shreveport Louisiana, Demand Letter, Payment of Account, 2nd Letter, debt, outstanding bill, legal communication, financial obligations, resolve disputes, legal actions. Types of Shreveport Louisiana Demand Letter — Payment of Account 2nd Letter: 1. Delinquent Account Payment Demand Letter: This type of demand letter is sent when a debtor has failed to make payment on time for an outstanding account balance. It emphasizes the urgency of settling the debt promptly and may include details such as the amount owed, due date, and any applicable late fees or interest. 2. Overdue Invoice Payment Demand Letter: This variation of the demand letter focuses specifically on unpaid invoices. It highlights the unpaid amounts, invoice numbers, and the consequences of not promptly remitting payment. Additionally, it may mention potential legal actions or credit score implications if payment is not made promptly. 3. Collection Agency Demand Letter: In some cases, the creditor may hire a collection agency to recover the unpaid debt. The collection agency can send a demand letter on behalf of the creditor. This letter may contain the same information as the previous types but will include references to the agency's involvement in the collection process, and their authority to take further actions if the debtor fails to comply. 4. Final Payment Demand Letter: If previous attempts to resolve the matter have been unsuccessful, a final payment demand letter is sent as a last resort before initiating legal proceedings. This letter firmly states that no further negotiation or leniency will be provided, and legal action will be pursued if the debtor fails to pay within a specified timeframe. 5. Friendly Reminder Payment Demand Letter: In some instances, the creditor may choose to adopt a less confrontational approach and send a friendly reminder letter. This type of letter emphasizes the importance of settling the debt while maintaining a cordial tone. It may serve as a gentle nudge to the debtor, highlighting the benefits of prompt payment and avoiding potential consequences. Remember, it is crucial to seek professional legal advice when drafting and sending a Shreveport Louisiana Demand Letter — Payment of Account 2nd Letter, as specific legal requirements and regulations may vary based on jurisdiction.

Shreveport Louisiana Demand Letter - Payment of Account 2nd Letter

Category:

State:

Louisiana

City:

Shreveport

Control #:

LA-5195

Format:

Word;

Rich Text

Instant download

Description

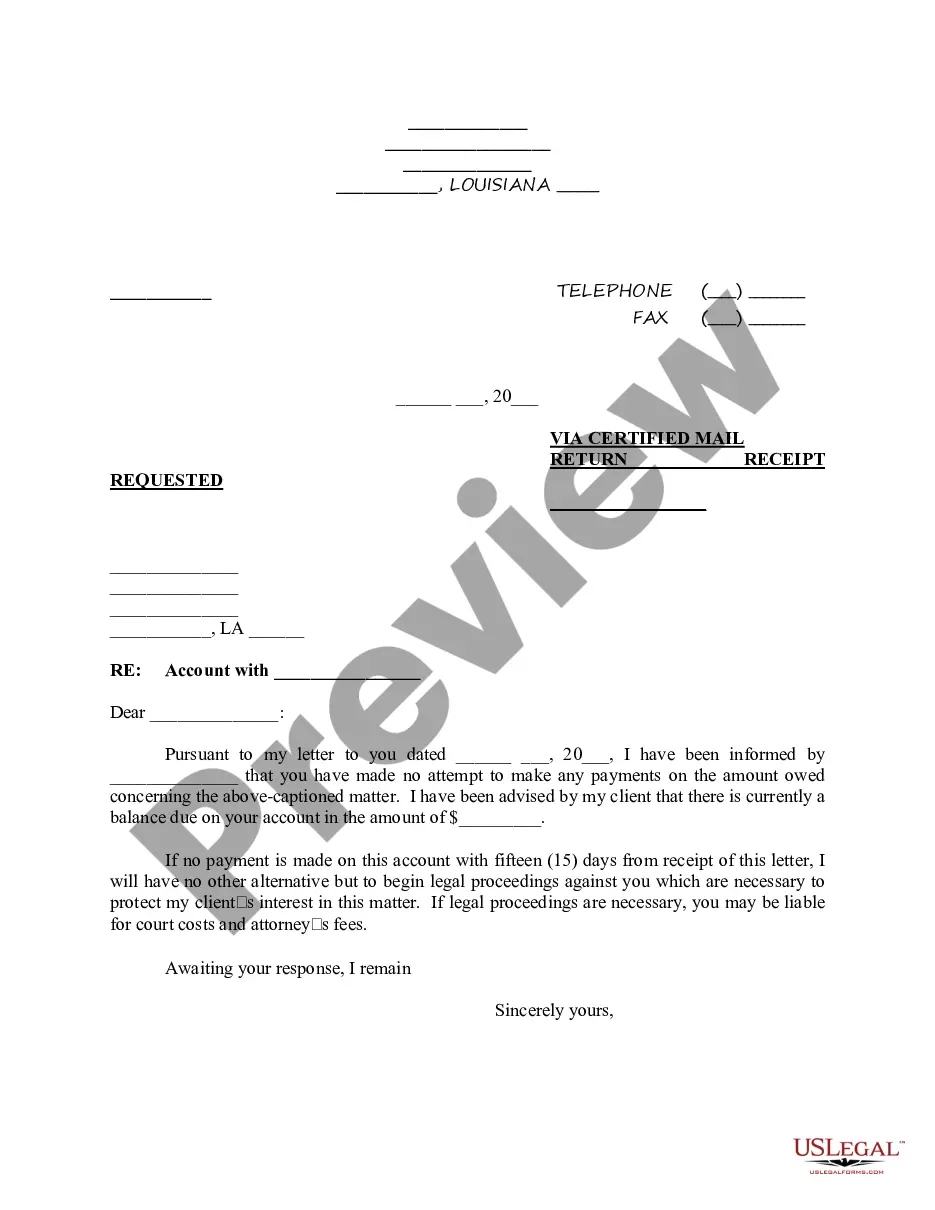

This is an example of a follow-up letter to a demand letter requesting payment on a past-due account. The attorney for the creditor(s) informs the debtor that he/she has a time frame within which to contact the attorney’s office regarding the debt, or face legal proceedings.

The Shreveport Louisiana Demand Letter — Payment of Account 2nd Letter is a document used for requesting payment of an outstanding bill or debt from a debtor in Shreveport, Louisiana. This letter serves as a legally formal communication, urging the recipient to fulfill their financial obligations promptly. It provides an opportunity for parties involved to resolve disputes and avoid potential legal actions. Keywords: Shreveport Louisiana, Demand Letter, Payment of Account, 2nd Letter, debt, outstanding bill, legal communication, financial obligations, resolve disputes, legal actions. Types of Shreveport Louisiana Demand Letter — Payment of Account 2nd Letter: 1. Delinquent Account Payment Demand Letter: This type of demand letter is sent when a debtor has failed to make payment on time for an outstanding account balance. It emphasizes the urgency of settling the debt promptly and may include details such as the amount owed, due date, and any applicable late fees or interest. 2. Overdue Invoice Payment Demand Letter: This variation of the demand letter focuses specifically on unpaid invoices. It highlights the unpaid amounts, invoice numbers, and the consequences of not promptly remitting payment. Additionally, it may mention potential legal actions or credit score implications if payment is not made promptly. 3. Collection Agency Demand Letter: In some cases, the creditor may hire a collection agency to recover the unpaid debt. The collection agency can send a demand letter on behalf of the creditor. This letter may contain the same information as the previous types but will include references to the agency's involvement in the collection process, and their authority to take further actions if the debtor fails to comply. 4. Final Payment Demand Letter: If previous attempts to resolve the matter have been unsuccessful, a final payment demand letter is sent as a last resort before initiating legal proceedings. This letter firmly states that no further negotiation or leniency will be provided, and legal action will be pursued if the debtor fails to pay within a specified timeframe. 5. Friendly Reminder Payment Demand Letter: In some instances, the creditor may choose to adopt a less confrontational approach and send a friendly reminder letter. This type of letter emphasizes the importance of settling the debt while maintaining a cordial tone. It may serve as a gentle nudge to the debtor, highlighting the benefits of prompt payment and avoiding potential consequences. Remember, it is crucial to seek professional legal advice when drafting and sending a Shreveport Louisiana Demand Letter — Payment of Account 2nd Letter, as specific legal requirements and regulations may vary based on jurisdiction.

Free preview

How to fill out Shreveport Louisiana Demand Letter - Payment Of Account 2nd Letter?

If you’ve already used our service before, log in to your account and download the Shreveport Louisiana Demand Letter - Payment of Account 2nd Letter on your device by clicking the Download button. Make sure your subscription is valid. If not, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple steps to get your document:

- Ensure you’ve located an appropriate document. Read the description and use the Preview option, if any, to check if it meets your requirements. If it doesn’t suit you, use the Search tab above to obtain the proper one.

- Buy the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Register an account and make a payment. Utilize your credit card details or the PayPal option to complete the transaction.

- Obtain your Shreveport Louisiana Demand Letter - Payment of Account 2nd Letter. Choose the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to each piece of paperwork you have bought: you can locate it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to rapidly locate and save any template for your personal or professional needs!