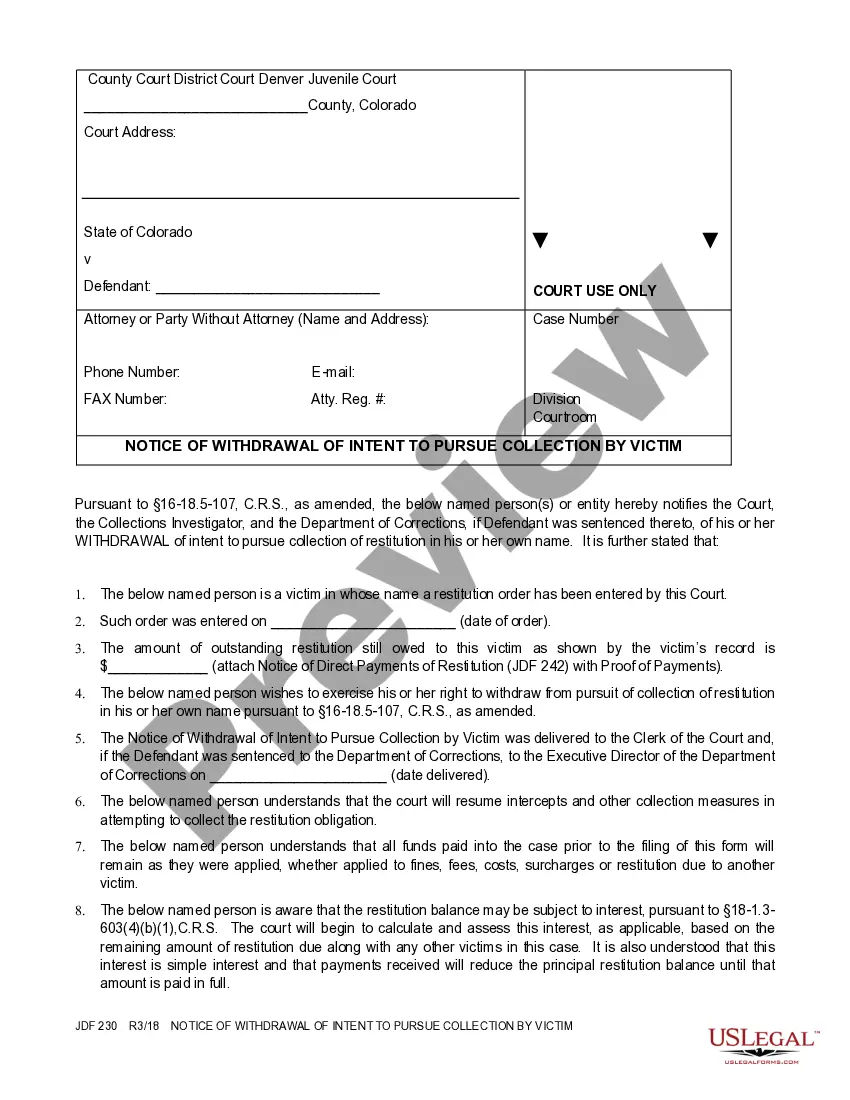

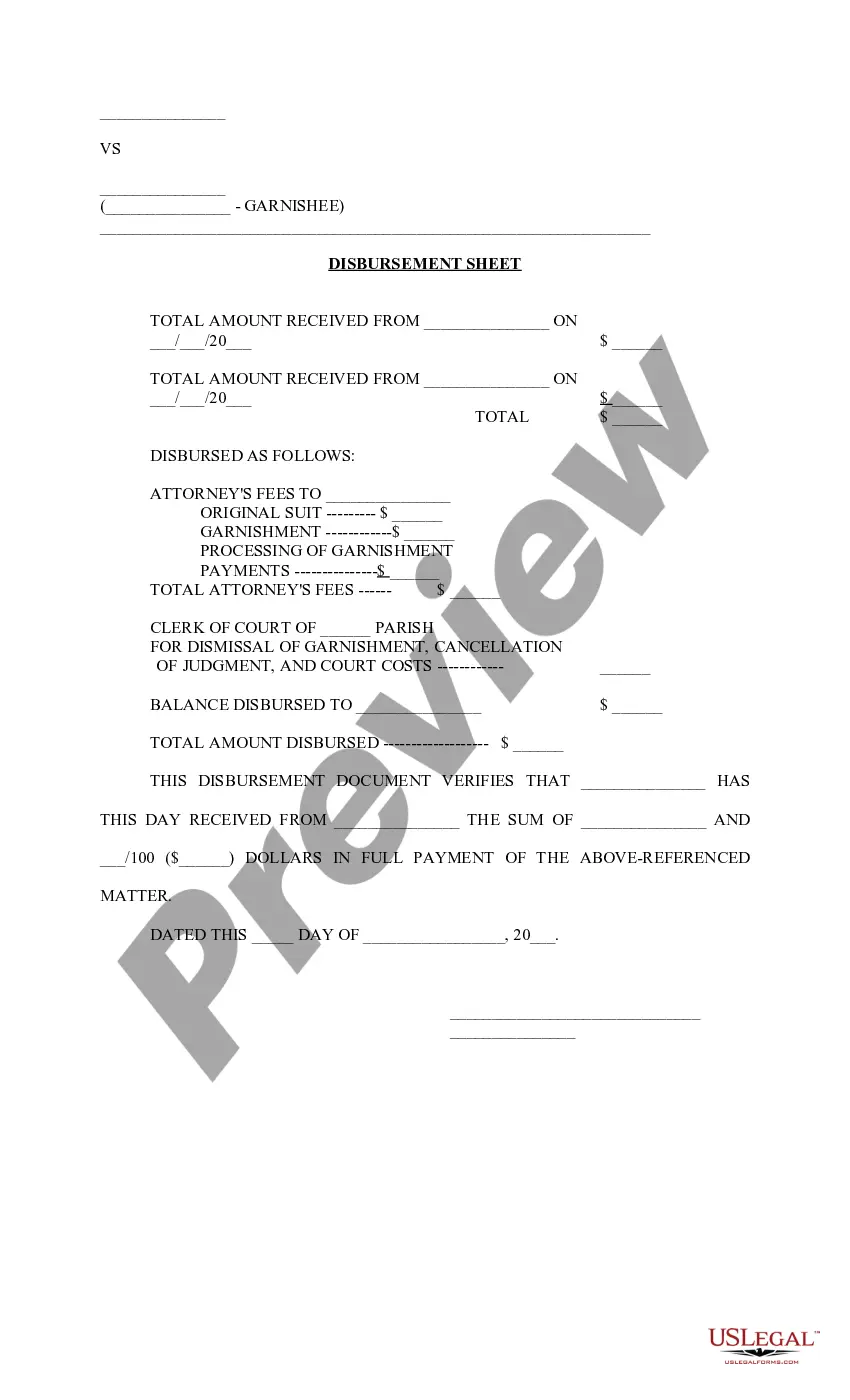

The New Orleans Louisiana Disbursement Sheet on Garnishment is a legal document related to the garnishment process in the state of Louisiana, specifically in the city of New Orleans. This sheet outlines the details and calculations of funds to be deducted from an individual's wages, bank accounts, or other assets due to a legal garnishment order. Keywords: New Orleans, Louisiana, Disbursement Sheet, Garnishment There are several types of New Orleans Louisiana Disbursement Sheets on Garnishment, including: 1. Wage Garnishment Disbursement Sheet: This type of disbursement sheet is commonly used when a court orders an individual's employer to deduct a specific portion of their wages to satisfy a debt or legal judgment. The sheet provides detailed information about the employee's earnings, the garnishment order, and the amounts to be deducted. 2. Bank Account Garnishment Disbursement Sheet: When a court orders the freezing or seizure of funds from an individual's bank account, a bank account garnishment disbursement sheet is used to outline the process. It includes details about the bank account, the garnishment order, and the specific amounts to be withheld or transferred to the creditor. 3. Property Garnishment Disbursement Sheet: In cases where assets such as real estate or personal property are subject to garnishment, a property garnishment disbursement sheet is utilized. This sheet provides a comprehensive overview of the property being seized, the garnishment order, and the steps to transfer ownership or sell the property to satisfy the debt. 4. Non-Wage Garnishment Disbursement Sheet: Non-wage garnishment includes any form of garnishment that is not directly tied to an individual's wages or bank accounts. This type of disbursement sheet encompasses various assets like tax refunds, insurance proceeds, lottery winnings, or other forms of income and assets. It details the specific amounts to be withheld or transferred to the creditor based on the garnishment order. Overall, the New Orleans Louisiana Disbursement Sheet on Garnishment is a crucial legal document that ensures transparency and compliance with garnishment orders while safeguarding the rights of both the debtor and the creditor. By utilizing different types of disbursement sheets, the garnishment process can be accurately accounted for, aiding in efficient resolution of debt-related matters.

New Orleans Louisiana Disbursement Sheet on Garnishment

Description

How to fill out New Orleans Louisiana Disbursement Sheet On Garnishment?

Do you require a reliable and cost-effective legal forms provider to obtain the New Orleans Louisiana Disbursement Sheet on Garnishment? US Legal Forms is your best option.

Whether you need a simple agreement to establish guidelines for living together with your partner or a collection of documents to facilitate your separation or divorce through the court process, we have you covered. Our site offers over 85,000 current legal document templates for personal and business use. All templates that we provide access to are not generic but tailored based on the regulations of individual states and counties.

To download the document, you must Log In to your account, search for the required template, and click the Download button next to it. Please note that you can download your previously acquired form templates at any time from the My documents section.

Is this your first visit to our site? No problem. You can easily create an account, but first, ensure that you do the following.

Now you can set up your account. Then choose your subscription plan and move forward with payment. Once the transaction is finished, download the New Orleans Louisiana Disbursement Sheet on Garnishment in any available file format. You can revisit the website anytime to redownload the form without incurring additional charges.

Finding current legal documents has never been simpler. Try US Legal Forms today, and say goodbye to spending hours searching for legal paperwork online.

- Verify if the New Orleans Louisiana Disbursement Sheet on Garnishment complies with the laws of your state and locality.

- Review the form’s description (if provided) to understand who it is suitable for and its purpose.

- Restart your search if the template does not fit your specific needs.

Form popularity

FAQ

There are generally only two ways to stop wage garnishment in Louisiana. You can either pay the amount you owe off, or you can file for bankruptcy. If you decide to pay the full amount, you can do this by either paying a one-time lump sum, or you can allow the wage garnishment to continue until the full amount is paid.

While states are free to impose stricter limits, Louisiana's law is similar to federal law. On a weekly basis, the garnishment can't exceed the lesser of: 25% of your disposable earnings for that week, or. the amount by which your disposable earnings for that week surpasses 30 times the federal minimum hourly wage.

A payday lender can only garnish your wages if it has a court order resulting from a lawsuit against you. There may be other restrictions on a payday lender's ability to garnish your wages. But it's important not to ignore any legal notices or orders.

Ways to Stop A Garnishment Paying off the debt in full. Filing an objection to the garnishment with the court if you have legal basis, such debt was a result of fraud or identity theft. Filing for court protection and debt resolution through Chapter 13 or Chapter 7 bankruptcy.

There are generally only two ways to stop wage garnishment in Louisiana. You can either pay the amount you owe off, or you can file for bankruptcy. If you decide to pay the full amount, you can do this by either paying a one-time lump sum, or you can allow the wage garnishment to continue until the full amount is paid.

If you owe monies to LDR that are collectible by distraint, the law allows LDR to garnish your wages for up to 25 percent of your pay. A notice was sent to your employer that includes your debt amount and the name of the Tax Officer assigned to your case.

Applicable to garnishments of wages, a garnishment shall not be continuing in nature and the garnishee need only respond as to property of the judgment debtor that the garnishee has in his possession or under his control at the time the garnishment interrogatories are served on him.

The garnishment law allows up to 50% of a worker's disposable earnings to be garnished for these purposes if the worker is supporting another spouse or child, or up to 60% if the worker is not. An additional 5% may be garnished for support payments more than l2 weeks in arrears.

More info

National Finance Center. Pay Tech Section Post D-41. National Finance Center.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.