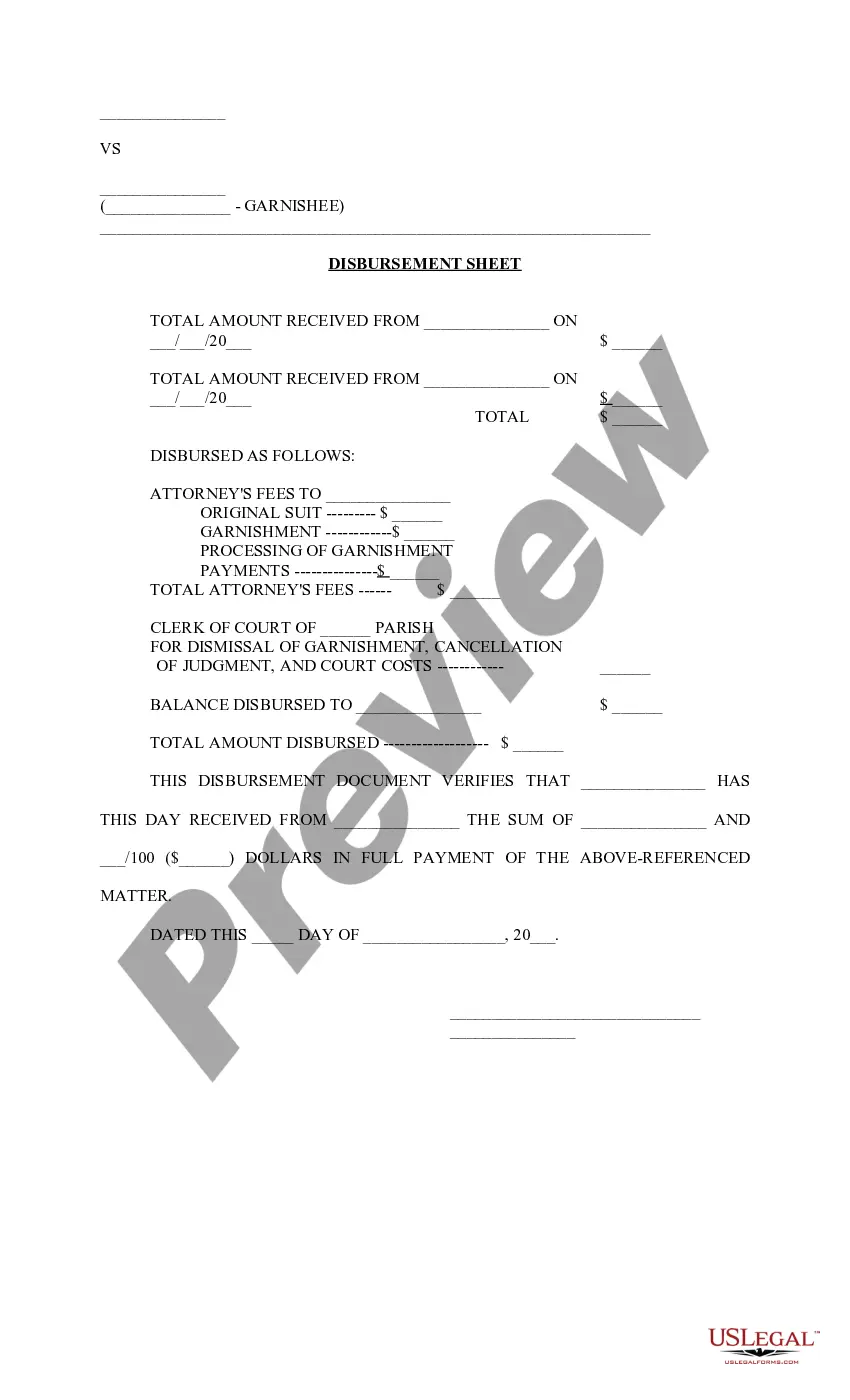

Shreveport Louisiana Disbursement Sheet on Garnishment: A Comprehensive Overview A Shreveport Louisiana Disbursement Sheet on Garnishment is a legal document that outlines the distribution of funds collected through garnishment. Garnishment is a legal procedure in which a creditor obtains a court order to seize a portion of a debtor's wages or assets to satisfy a debt. This process helps creditors collect what is owed to them by diverting funds directly from the debtor's income or bank accounts. The disbursement sheet serves as a detailed record of how the collected funds are to be allocated among the parties involved. It ensures that the creditor receives the appropriate amount owed, while also addressing any necessary fees, taxes, or other obligations. This document helps maintain transparency throughout the garnishment process and allows for accountability. Types of Shreveport Louisiana Disbursement Sheets on Garnishment: 1. Wage Garnishment Disbursement Sheet: This type of disbursement sheet specifically pertains to garnishing a debtor's wages. It outlines the proportion of income to be withheld from the debtor's paycheck and the frequency of disbursements. The sheet also ensures that any court-ordered fees, taxes, or support payments are accurately deducted before distributing the funds to the creditor. 2. Bank Account Garnishment Disbursement Sheet: When a creditor seeks to garnish a debtor's bank account, a bank account garnishment disbursement sheet is utilized. It specifies the amount or percentage to be seized from the account and the procedure for distributing the collected funds. The document may include details about fees, taxes, or other obligations that must be fulfilled before disbursing the remaining balance to the creditor. 3. Asset Garnishment Disbursement Sheet: In some cases, a creditor may seek to garnish specific assets owned by the debtor, such as a vehicle or real estate. An asset garnishment disbursement sheet is used to determine how the proceeds from the sale or seizure of these assets will be disbursed. It outlines the expenses associated with the sale or ownership transfer, any fees or taxes to be paid, and the allocation of the remaining funds to the creditor. It is important to note that the specifics of a Shreveport Louisiana Disbursement Sheet on Garnishment may vary depending on the nature of the debt, the court's orders, and the individual circumstances of the garnishment case. These sheets are tailored to accurately reflect the unique conditions of each garnishment process to ensure proper distribution and compliance with legal requirements. Keywords: Shreveport Louisiana, disbursement sheet, garnishment, wage garnishment, bank account garnishment, asset garnishment, creditor, debtor, legal document, funds, distribution, transparency, fees, taxes, court order, seizure, income.

Shreveport Louisiana Disbursement Sheet on Garnishment

Description

How to fill out Shreveport Louisiana Disbursement Sheet On Garnishment?

Take advantage of the US Legal Forms and get immediate access to any form template you need. Our beneficial platform with thousands of document templates makes it simple to find and get virtually any document sample you require. It is possible to save, fill, and certify the Shreveport Louisiana Disbursement Sheet on Garnishment in just a few minutes instead of browsing the web for hours trying to find the right template.

Using our library is an excellent way to increase the safety of your document submissions. Our experienced legal professionals on a regular basis check all the documents to make sure that the templates are appropriate for a particular region and compliant with new laws and polices.

How can you get the Shreveport Louisiana Disbursement Sheet on Garnishment? If you already have a profile, just log in to the account. The Download button will appear on all the samples you view. Additionally, you can find all the earlier saved files in the My Forms menu.

If you haven’t registered an account yet, follow the tips below:

- Find the form you need. Make certain that it is the template you were hoping to find: check its title and description, and take take advantage of the Preview option if it is available. Otherwise, use the Search field to find the appropriate one.

- Launch the downloading process. Select Buy Now and choose the pricing plan that suits you best. Then, sign up for an account and pay for your order with a credit card or PayPal.

- Export the document. Indicate the format to get the Shreveport Louisiana Disbursement Sheet on Garnishment and change and fill, or sign it for your needs.

US Legal Forms is probably the most extensive and reliable document libraries on the internet. We are always happy to assist you in any legal case, even if it is just downloading the Shreveport Louisiana Disbursement Sheet on Garnishment.

Feel free to take full advantage of our platform and make your document experience as convenient as possible!