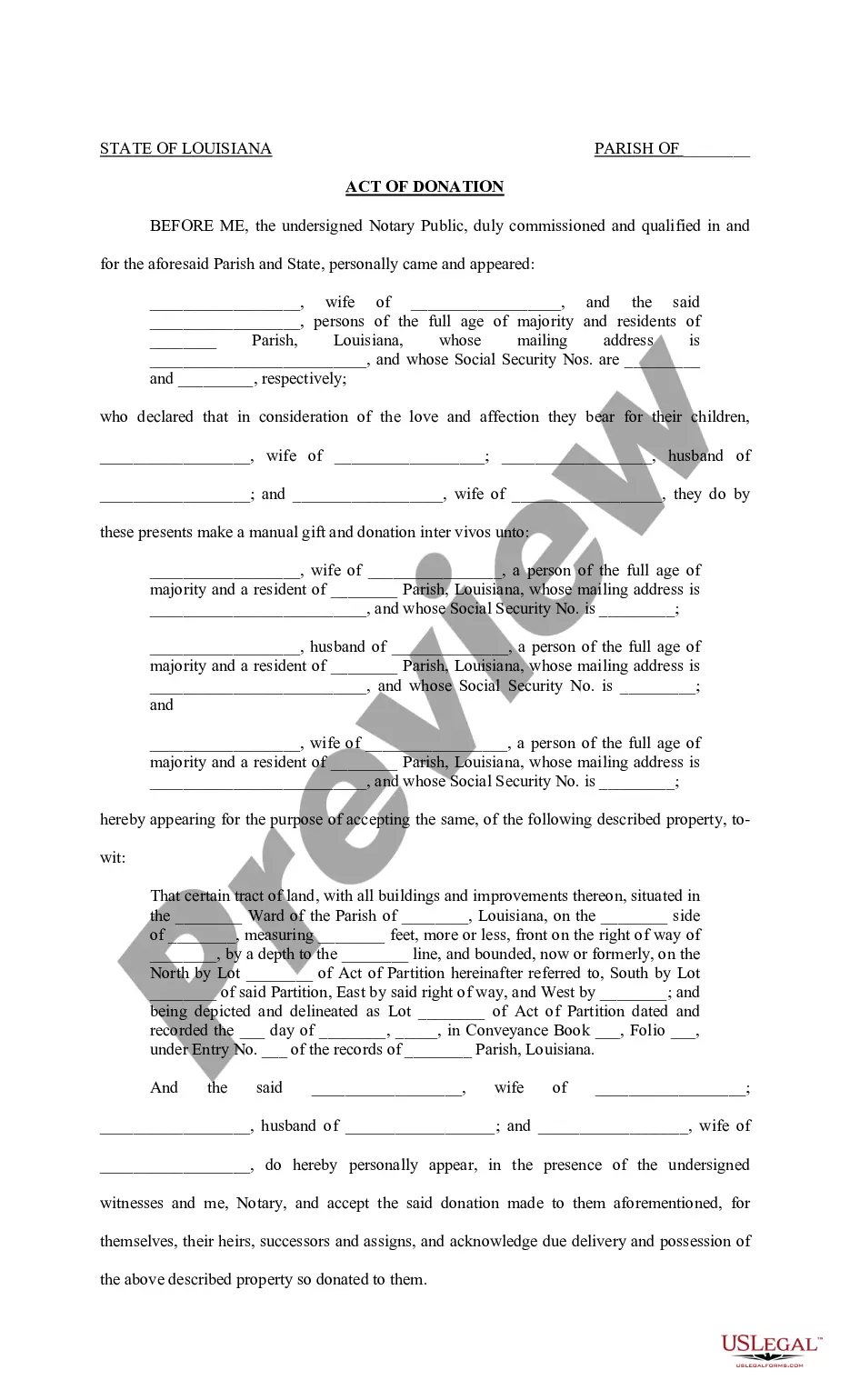

The Baton Rouge Louisiana Act of Donation Real Estate from Parents to Children is a legal process that allows parents to transfer ownership of their real estate property to their children as a gift. This act holds significant importance for individuals looking to safeguard their assets and ensure smooth property transfers within their family. Here's a detailed description of the Baton Rouge Louisiana Act of Donation Real Estate from Parents to Children, including its types: 1. Definition: The Baton Rouge Louisiana Act of Donation Real Estate from Parents to Children is a legal instrument used to transfer ownership of real estate property from parents to their children. It involves a voluntary gift of property without any consideration, affirmed through a notarized act of donation. 2. Purpose: The act aims to provide parents with the means to transfer their property to their children during their lifetime, eliminating the need for complex probate procedures, potential conflicts, and inheritance taxes. 3. Requirements: To execute a valid Baton Rouge Louisiana Act of Donation, parents must be legal owners of the property and possess mental capacity to make decisions. The children, as done BS, must also be legally competent and consent to the donation. 4. Procedure: The act commences with the preparation of a notarized act of donation, clearly stating the intentions, details of the property, and conditions, if any. The document should comply with local laws, including legal descriptions and the acknowledgment of all parties involved. 5. Act of Donation Types: a. Simple Act of Donation: This involves transferring ownership without restrictions or conditions, where children gain complete control over the property. b. Conditional Act of Donation: In this type, specific conditions are imposed on the donated property, such as limitations on usage, sale, or transfer, for the benefit of the children. c. Observatory Act of Donation: This enables parents to retain certain rights or benefits over the property, such as the right to live in the donated property until their demise or receive income generated from it. 6. Tax Implications: While the Baton Rouge Louisiana Act of Donation Real Estate from Parents to Children eliminates the need for inheritance taxes at the time of property transfer, it is essential to consult with tax professionals to understand any potential tax consequences, such as property tax reassessment. 7. Advantages: a. Avoidance of Probate: By transferring ownership during the parents' lifetime, the act eliminates the need for probate, ensuring a smooth transition of property to the children with reduced legal complexities. b. Asset Protection: The act shields the property from potential creditors or legal disputes, safeguarding it for the children's benefit. c. Potential Tax Savings: By gifting the property, parents can efficiently mitigate inheritance and estate taxes, resulting in potential tax savings for the family. In conclusion, the Baton Rouge Louisiana Act of Donation Real Estate from Parents to Children offers a legal avenue for parents to gift their property to their children, providing advantages such as probate avoidance, asset protection, and potential tax savings. However, consulting with legal professionals familiar with local laws and individual circumstances is crucial before proceeding with the act.

Baton Rouge Louisiana Act of Donation Real Estate from Parents to Children

Description

How to fill out Baton Rouge Louisiana Act Of Donation Real Estate From Parents To Children?

Finding verified templates specific to your local regulations can be difficult unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both individual and professional needs and any real-life situations. All the documents are properly categorized by area of usage and jurisdiction areas, so searching for the Baton Rouge Louisiana Act of Donation Real Estate from Parents to Children becomes as quick and easy as ABC.

For everyone already familiar with our catalogue and has used it before, getting the Baton Rouge Louisiana Act of Donation Real Estate from Parents to Children takes just a couple of clicks. All you need to do is log in to your account, choose the document, and click Download to save it on your device. The process will take just a couple of more steps to make for new users.

Adhere to the guidelines below to get started with the most extensive online form library:

- Look at the Preview mode and form description. Make sure you’ve picked the correct one that meets your requirements and totally corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you find any inconsistency, utilize the Search tab above to get the correct one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and select the subscription plan you prefer. You should create an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the service.

- Download the Baton Rouge Louisiana Act of Donation Real Estate from Parents to Children. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Take advantage of the US Legal Forms library to always have essential document templates for any needs just at your hand!