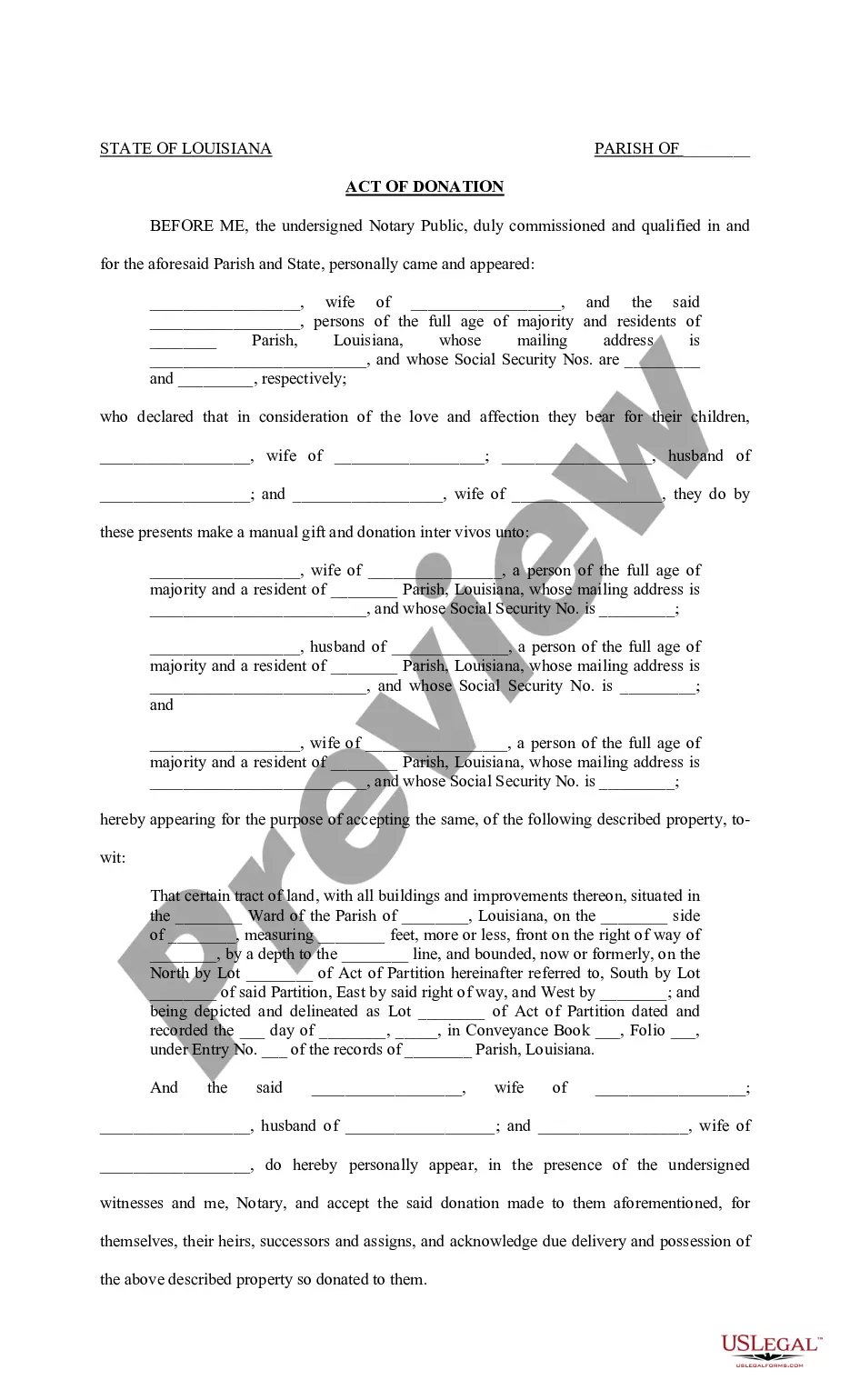

Shreveport Louisiana Act of Donation Real Estate from Parents to Children is a legal process that allows parents to transfer their property to their children without any monetary exchange. This act holds significant importance in estate planning and helps families ensure a smooth transition of property ownership. The Act of Donation Real Estate allows parents to transfer their property to their children while they are alive, as opposed to leaving it as an inheritance after their demise. This transfer can be completed through a notarial act, which serves as a legal documentation of the transfer. There are different types of Shreveport Louisiana Act of Donation Real Estate from Parents to Children, depending on the specific circumstances and intentions of the parties involved. Some common types include: 1. Absolute Donation: This type of donation gives the children full ownership rights to the property. Once the act is completed, the parents no longer have any legal rights or control over the property. 2. Usufruct Donation: With this type of donation, parents transfer the property to their children while retaining the right to use and benefit from it during their lifetime. The children become the bare owners of the property and gain full ownership rights only after the parents' demise. 3. Conditional Donation: In this scenario, parents impose certain conditions on the donation that must be met by the children. These conditions may include requirements like completing certain educational qualifications, getting married, or taking care of the parents in their old age. 4. Partial Donation: Parents can also choose to donate a fraction or a specific portion of their property to their children. This allows for a partial transfer of ownership rights while retaining ownership of the remaining portion. It is important to note that each type of Shreveport Louisiana Act of Donation Real Estate from Parents to Children has its own legal implications and should be carefully considered based on the individual circumstances of the family. Seeking professional legal advice is highly recommended ensuring compliance with all applicable laws and to understand the potential tax implications associated with the donation.

Shreveport Donation

Description

How to fill out Shreveport Louisiana Act Of Donation Real Estate From Parents To Children?

Benefit from the US Legal Forms and get immediate access to any form template you require. Our helpful platform with a huge number of templates simplifies the way to find and obtain almost any document sample you want. You can save, complete, and certify the Shreveport Louisiana Act of Donation Real Estate from Parents to Children in just a few minutes instead of browsing the web for many hours searching for an appropriate template.

Using our library is a great way to increase the safety of your form submissions. Our professional lawyers regularly check all the documents to make certain that the templates are relevant for a particular state and compliant with new acts and polices.

How do you get the Shreveport Louisiana Act of Donation Real Estate from Parents to Children? If you have a profile, just log in to the account. The Download option will be enabled on all the samples you look at. In addition, you can get all the previously saved documents in the My Forms menu.

If you don’t have an account yet, stick to the instruction below:

- Open the page with the form you need. Make sure that it is the template you were hoping to find: check its name and description, and use the Preview option if it is available. Otherwise, utilize the Search field to look for the needed one.

- Start the saving procedure. Click Buy Now and select the pricing plan that suits you best. Then, sign up for an account and pay for your order with a credit card or PayPal.

- Export the file. Pick the format to obtain the Shreveport Louisiana Act of Donation Real Estate from Parents to Children and change and complete, or sign it for your needs.

US Legal Forms is probably the most significant and reliable document libraries on the internet. We are always ready to assist you in virtually any legal procedure, even if it is just downloading the Shreveport Louisiana Act of Donation Real Estate from Parents to Children.

Feel free to make the most of our form catalog and make your document experience as convenient as possible!