The Shreveport Louisiana Act of Donation Stock — Parent to Children is a legal provision that allows parents to transfer ownership of stock to their children through a donation process. This act serves as an effective estate planning tool for parents who wish to pass on their stock assets to their children while minimizing tax implications. Under this act, parents can make a formal donation of stock to their children, which transfers the ownership of the stock from the parent to the child. The act outlines the specific steps and requirements that need to be followed in order to successfully complete the donation process. The Shreveport Louisiana Act of Donation Stock — Parent to Children ensures that the transfer of stock is done legally, preserving the rights and responsibilities associated with stock ownership. By utilizing this act, parents can transfer stock to their children without the need for a lengthy and complex probate process. There are different types of Shreveport Louisiana Act of Donation Stock — Parent to Children, each targeting various aspects of stock transfers and ownership. These types include: 1. Lifetime Donation: This type of act allows parents to make a stock donation during their lifetime, while they are still alive. By making lifetime donations, parents can witness the transfer of stock ownership and provide guidance to their children regarding the management of the stock. 2. Testamentary Donation: This type of act enables parents to include provisions for stock donation in their will. The donation will take effect only after the parent's death. Testamentary donations provide parents with the flexibility to decide the timing and conditions for the stock transfer, ensuring that it aligns with their overall estate plan. 3. Restricted Stock Donation: In some cases, parents may choose to place restrictions on stock donation, limiting the child's ability to sell or transfer the stock for a certain period of time. These restrictions can be based on specific conditions, such as the child reaching a certain age or achieving certain milestones. Restricted stock donations allow parents to exercise control over their stock assets even after the transfer. 4. Charitable Stock Donation: This type of act allows parents to donate stock to charitable organizations while still benefiting their children. Parents can direct a portion or all of the donated stock's proceeds to be used for their children's education, medical expenses, or other specific purposes. Charitable stock donations can provide both tax benefits and a sense of philanthropy. The Shreveport Louisiana Act of Donation Stock — Parent to Children offers parents a valuable tool to pass on their stock assets to their children in a seamless and legally compliant manner. It is useful to consult with an experienced attorney specializing in estate planning and stock transfers to ensure the act is executed correctly and in accordance with individual circumstances.

Shreveport Louisiana Act of Donation Stock - Parent to Children

Category:

State:

Louisiana

City:

Shreveport

Control #:

LA-5230

Format:

Word;

Rich Text

Instant download

Description

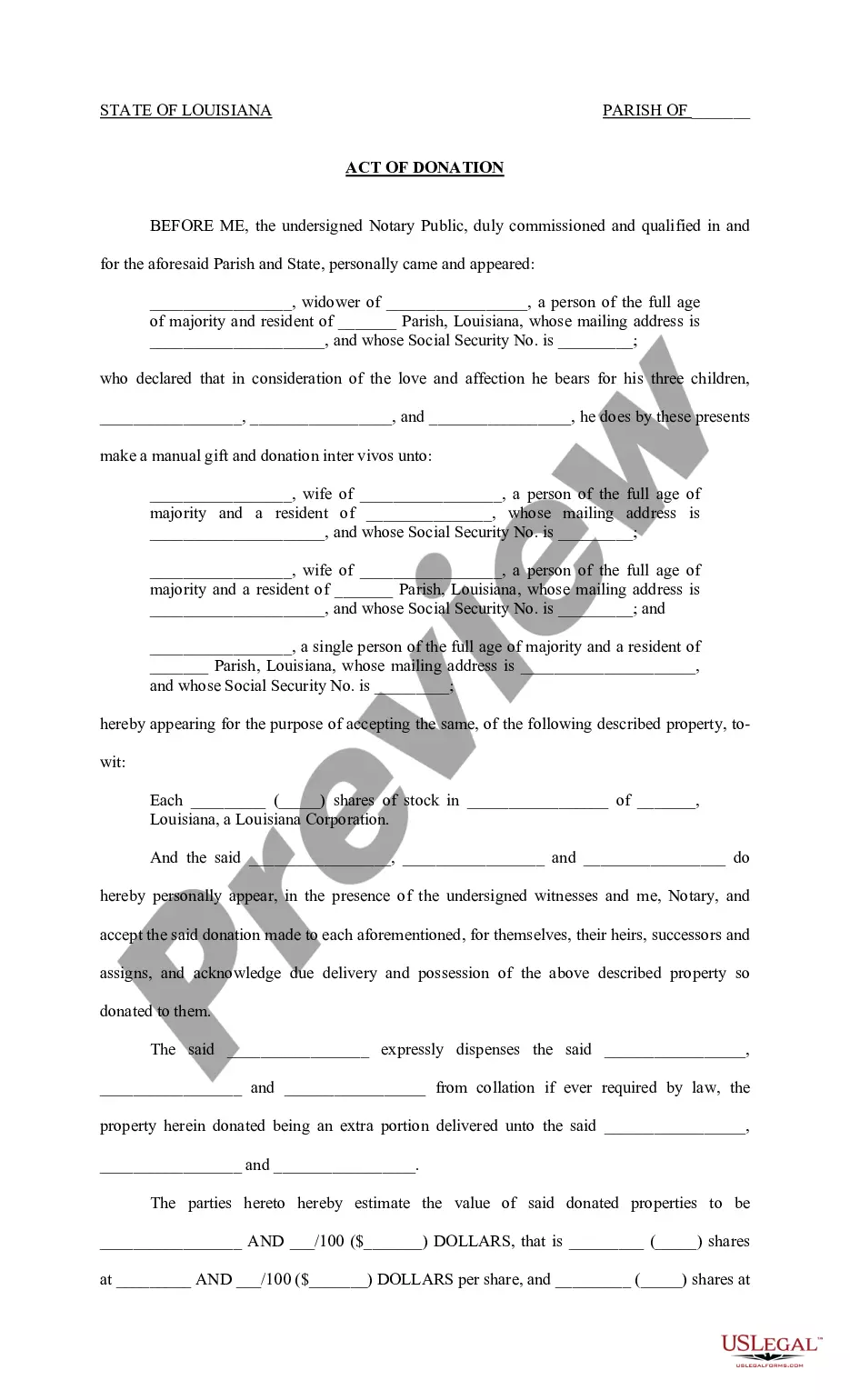

This is an example of a donation of stock shares from a widowed parent to his adult children, without conditions. A donation inter vivos (between living persons) is an act by which the donor divests himself, at present and irrevocably, of the thing given, in favor of the donee who accepts it. See La. C.C. Article 1536. The donor reserves for himself usufruct in and to the donated property, including any and all dividends paid.

The Shreveport Louisiana Act of Donation Stock — Parent to Children is a legal provision that allows parents to transfer ownership of stock to their children through a donation process. This act serves as an effective estate planning tool for parents who wish to pass on their stock assets to their children while minimizing tax implications. Under this act, parents can make a formal donation of stock to their children, which transfers the ownership of the stock from the parent to the child. The act outlines the specific steps and requirements that need to be followed in order to successfully complete the donation process. The Shreveport Louisiana Act of Donation Stock — Parent to Children ensures that the transfer of stock is done legally, preserving the rights and responsibilities associated with stock ownership. By utilizing this act, parents can transfer stock to their children without the need for a lengthy and complex probate process. There are different types of Shreveport Louisiana Act of Donation Stock — Parent to Children, each targeting various aspects of stock transfers and ownership. These types include: 1. Lifetime Donation: This type of act allows parents to make a stock donation during their lifetime, while they are still alive. By making lifetime donations, parents can witness the transfer of stock ownership and provide guidance to their children regarding the management of the stock. 2. Testamentary Donation: This type of act enables parents to include provisions for stock donation in their will. The donation will take effect only after the parent's death. Testamentary donations provide parents with the flexibility to decide the timing and conditions for the stock transfer, ensuring that it aligns with their overall estate plan. 3. Restricted Stock Donation: In some cases, parents may choose to place restrictions on stock donation, limiting the child's ability to sell or transfer the stock for a certain period of time. These restrictions can be based on specific conditions, such as the child reaching a certain age or achieving certain milestones. Restricted stock donations allow parents to exercise control over their stock assets even after the transfer. 4. Charitable Stock Donation: This type of act allows parents to donate stock to charitable organizations while still benefiting their children. Parents can direct a portion or all of the donated stock's proceeds to be used for their children's education, medical expenses, or other specific purposes. Charitable stock donations can provide both tax benefits and a sense of philanthropy. The Shreveport Louisiana Act of Donation Stock — Parent to Children offers parents a valuable tool to pass on their stock assets to their children in a seamless and legally compliant manner. It is useful to consult with an experienced attorney specializing in estate planning and stock transfers to ensure the act is executed correctly and in accordance with individual circumstances.

Free preview

How to fill out Shreveport Louisiana Act Of Donation Stock - Parent To Children?

If you’ve already used our service before, log in to your account and save the Shreveport Louisiana Act of Donation Stock - Parent to Children on your device by clicking the Download button. Make sure your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, follow these simple steps to obtain your document:

- Ensure you’ve found an appropriate document. Look through the description and use the Preview option, if any, to check if it meets your needs. If it doesn’t suit you, utilize the Search tab above to get the appropriate one.

- Purchase the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Register an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Obtain your Shreveport Louisiana Act of Donation Stock - Parent to Children. Pick the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to each piece of paperwork you have purchased: you can find it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to easily find and save any template for your personal or professional needs!