The Shreveport Louisiana Act of Donation is a legal document that allows a married couple to transfer ownership of real estate to an individual without any monetary consideration. This act is commonly used in estate planning, gifting, or asset protection strategies. It is important to understand the key elements and types of Shreveport Louisiana Act of Donation Real Estate from Husband and Wife to Individual. The Act of Donation involves several significant aspects. Firstly, it requires the consent and agreement between the husband and wife to donate the property to a specific individual. This agreement must be voluntary and made without any undue influence or coercion. The act should be carefully drafted by an experienced attorney to ensure compliance with Louisiana's civil law system. In regard to the types of Shreveport Louisiana Act of Donation Real Estate from Husband and Wife to Individual, there are a few variations to consider: 1. Absolute Donation: This type of donation transfers full ownership and control of the property to the individual without any restrictions or conditions. The recipient becomes the sole owner of the property and can use, sell, or manage it at their discretion. 2. Usufruct Donation: In this case, the donor (the husband and wife) retain the right to use and enjoy the property during their lifetime, while granting the recipient the remainder interest. The recipient will take full ownership only after the death of both donors. This form of donation is often used to safeguard the donor's rights to occupy or generate income from the property until their passing. 3. Share Donation: Rather than conveying the entire property, the donor may choose to donate a specific percentage or share of real estate to the individual. This allows the donor to retain partial ownership and control over the property while gifting the recipient a beneficial interest. 4. Conditional Donation: In some instances, the donation may include specific conditions or restrictions imposed by the husband and wife. For instance, the couple may require the recipient to use the property for a specific purpose, such as establishing a charitable organization or preserving historical significance. The Shreveport Louisiana Act of Donation Real Estate from Husband and Wife to Individual is a legal mechanism that facilitates the smooth transfer of property while ensuring the rights and intentions of the donors and recipients are protected. To execute such an act, it is advisable to consult with a qualified attorney who specializes in Louisiana real estate and civil law.

Shreveport Louisiana Act of Donation Real Estate from Husband and Wife to Individual

Category:

State:

Louisiana

City:

Shreveport

Control #:

LA-5231

Format:

Word;

Rich Text

Instant download

Description

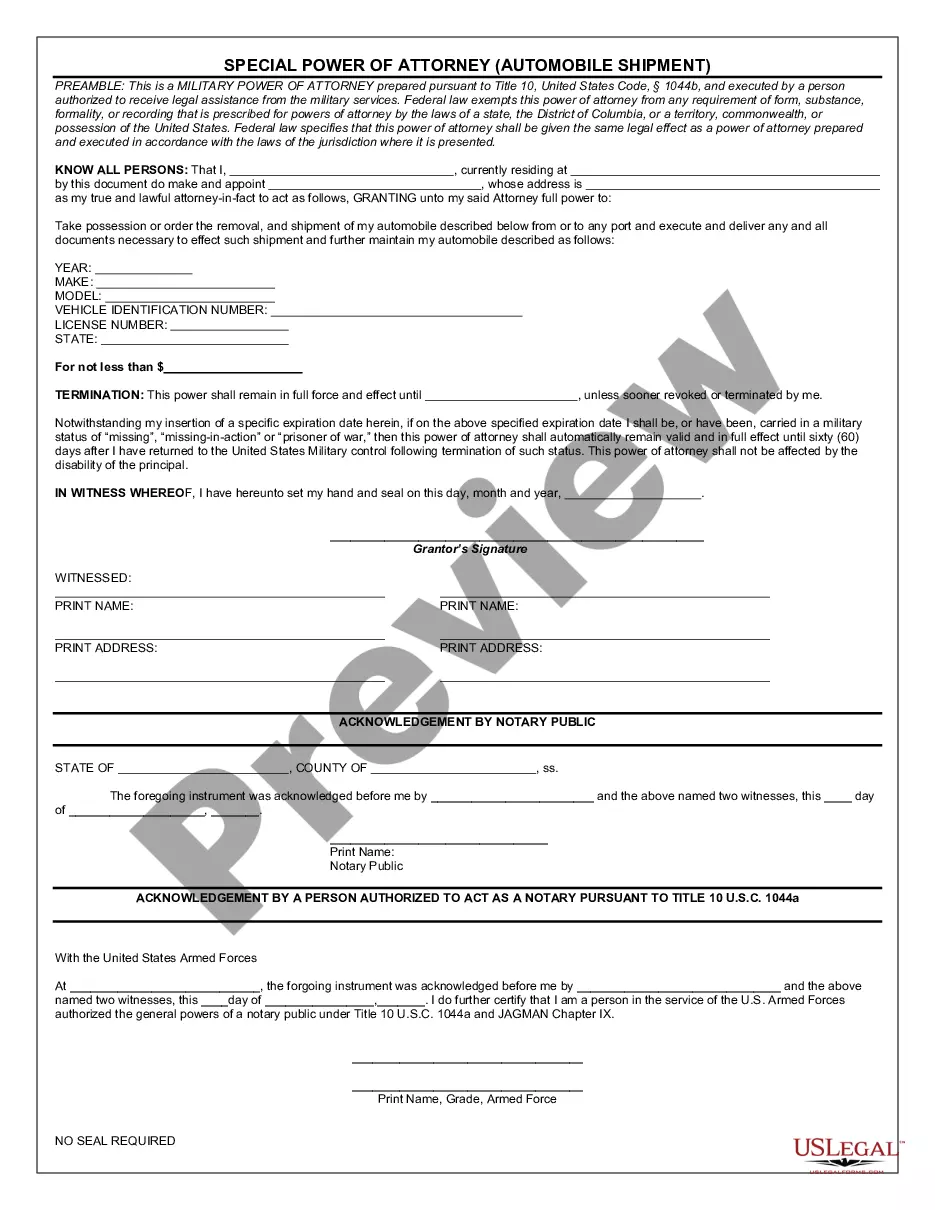

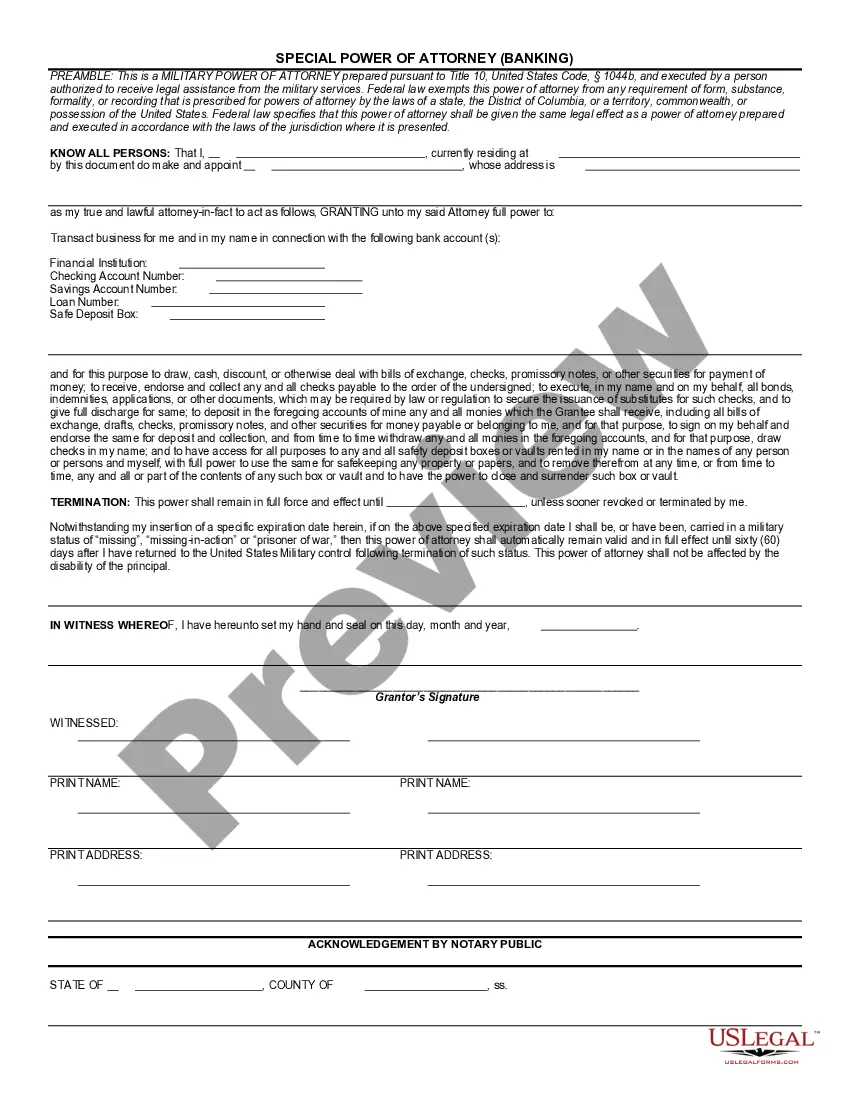

This is an example of a donation of immovable property from a married couple to a single person, without conditions. A donation inter vivos (between living persons) is an act by which the donor divests himself, at present and irrevocably, of the thing given, in favor of the donee who accepts it. See La. C.C. Article 1536. The parties agree to dispense with production of a certificate of privileges or mortgages, and confirm that no title opinion was requested in connection with the act of donation.

The Shreveport Louisiana Act of Donation is a legal document that allows a married couple to transfer ownership of real estate to an individual without any monetary consideration. This act is commonly used in estate planning, gifting, or asset protection strategies. It is important to understand the key elements and types of Shreveport Louisiana Act of Donation Real Estate from Husband and Wife to Individual. The Act of Donation involves several significant aspects. Firstly, it requires the consent and agreement between the husband and wife to donate the property to a specific individual. This agreement must be voluntary and made without any undue influence or coercion. The act should be carefully drafted by an experienced attorney to ensure compliance with Louisiana's civil law system. In regard to the types of Shreveport Louisiana Act of Donation Real Estate from Husband and Wife to Individual, there are a few variations to consider: 1. Absolute Donation: This type of donation transfers full ownership and control of the property to the individual without any restrictions or conditions. The recipient becomes the sole owner of the property and can use, sell, or manage it at their discretion. 2. Usufruct Donation: In this case, the donor (the husband and wife) retain the right to use and enjoy the property during their lifetime, while granting the recipient the remainder interest. The recipient will take full ownership only after the death of both donors. This form of donation is often used to safeguard the donor's rights to occupy or generate income from the property until their passing. 3. Share Donation: Rather than conveying the entire property, the donor may choose to donate a specific percentage or share of real estate to the individual. This allows the donor to retain partial ownership and control over the property while gifting the recipient a beneficial interest. 4. Conditional Donation: In some instances, the donation may include specific conditions or restrictions imposed by the husband and wife. For instance, the couple may require the recipient to use the property for a specific purpose, such as establishing a charitable organization or preserving historical significance. The Shreveport Louisiana Act of Donation Real Estate from Husband and Wife to Individual is a legal mechanism that facilitates the smooth transfer of property while ensuring the rights and intentions of the donors and recipients are protected. To execute such an act, it is advisable to consult with a qualified attorney who specializes in Louisiana real estate and civil law.

Free preview

How to fill out Shreveport Louisiana Act Of Donation Real Estate From Husband And Wife To Individual?

If you’ve already used our service before, log in to your account and save the Shreveport Louisiana Act of Donation Real Estate from Husband and Wife to Individual on your device by clicking the Download button. Make sure your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, adhere to these simple steps to obtain your document:

- Make sure you’ve located a suitable document. Read the description and use the Preview option, if any, to check if it meets your requirements. If it doesn’t suit you, use the Search tab above to find the appropriate one.

- Purchase the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Create an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Obtain your Shreveport Louisiana Act of Donation Real Estate from Husband and Wife to Individual. Opt for the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to every piece of paperwork you have bought: you can locate it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to rapidly locate and save any template for your individual or professional needs!