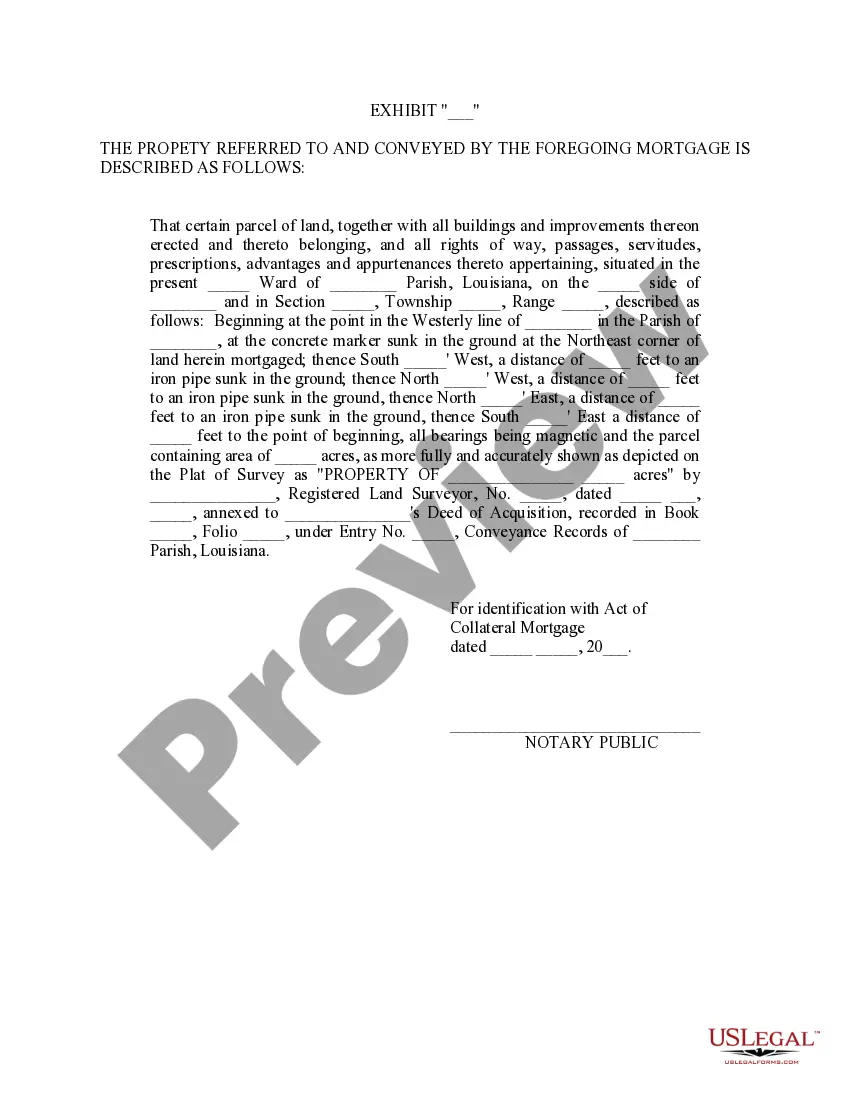

The New Orleans Louisiana Exhibit, Act of Collateral Mortgage is a legal document that serves as evidence of the collateral securing a loan in the state of Louisiana. It outlines the terms and conditions under which a borrower pledges certain assets as collateral for a mortgage. The purpose of the New Orleans Louisiana Exhibit, Act of Collateral Mortgage is to provide legal protection to the lender in case the borrower defaults on the loan. By clearly defining the collateral and its value, this document ensures that the lender can recover the outstanding balance by selling the pledged assets. Key elements included in the New Orleans Louisiana Exhibit, Act of Collateral Mortgage may consist of: 1. Collateral Description: The document specifies the nature of the collateral, such as real estate property, vehicles, equipment, securities, or any other valuable assets used to secure the loan. 2. Valuation of Collateral: The fair market value of the collateral is assessed and documented to establish its worth at the time of the agreement. This valuation is crucial for determining the maximum borrowing amount. 3. Rights and Obligations: The responsibilities and rights of both the borrower and the lender are outlined. It includes the borrower's obligation to maintain the collateral, provide insurance coverage, and avoid adding additional liens on the collateral. 4. Default and Remedies: This section describes the actions and penalties that apply if the borrower fails to meet the terms of the loan agreement. It outlines the lender's rights to foreclose on the collateral, sell it, and use the proceeds to satisfy the outstanding debt. 5. Recording and Filing: The New Orleans Louisiana Exhibit, Act of Collateral Mortgage must be recorded and filed with the appropriate county or parish office to ensure its validity and priority against other creditors. Different types or variations of the New Orleans Louisiana Exhibit, Act of Collateral Mortgage may include specific mortgage forms for different types of collateral. For instance, a mortgage form for real estate properties functions differently from a mortgage form for personal vehicles or equipment. It is crucial for both borrowers and lenders to familiarize themselves with the New Orleans Louisiana Exhibit, Act of Collateral Mortgage and comprehend its terms before entering into any loan arrangement. Seeking legal advice or assistance from a qualified professional is highly advisable to ensure compliance with state laws and regulations.

New Orleans Louisiana Exhibit, Act of Collateral Mortgage

Description

How to fill out New Orleans Louisiana Exhibit, Act Of Collateral Mortgage?

Do you need a trustworthy and inexpensive legal forms supplier to buy the New Orleans Louisiana Exhibit, Act of Collateral Mortgage? US Legal Forms is your go-to solution.

Whether you require a basic arrangement to set regulations for cohabitating with your partner or a package of documents to move your divorce through the court, we got you covered. Our platform provides more than 85,000 up-to-date legal document templates for personal and business use. All templates that we give access to aren’t universal and frameworked in accordance with the requirements of particular state and county.

To download the document, you need to log in account, find the needed form, and hit the Download button next to it. Please keep in mind that you can download your previously purchased document templates at any time in the My Forms tab.

Are you new to our platform? No worries. You can create an account with swift ease, but before that, make sure to do the following:

- Check if the New Orleans Louisiana Exhibit, Act of Collateral Mortgage conforms to the regulations of your state and local area.

- Go through the form’s details (if provided) to find out who and what the document is intended for.

- Restart the search in case the form isn’t good for your specific situation.

Now you can create your account. Then select the subscription plan and proceed to payment. Once the payment is completed, download the New Orleans Louisiana Exhibit, Act of Collateral Mortgage in any provided format. You can return to the website when you need and redownload the document without any extra costs.

Getting up-to-date legal documents has never been easier. Give US Legal Forms a try now, and forget about wasting your valuable time learning about legal papers online for good.