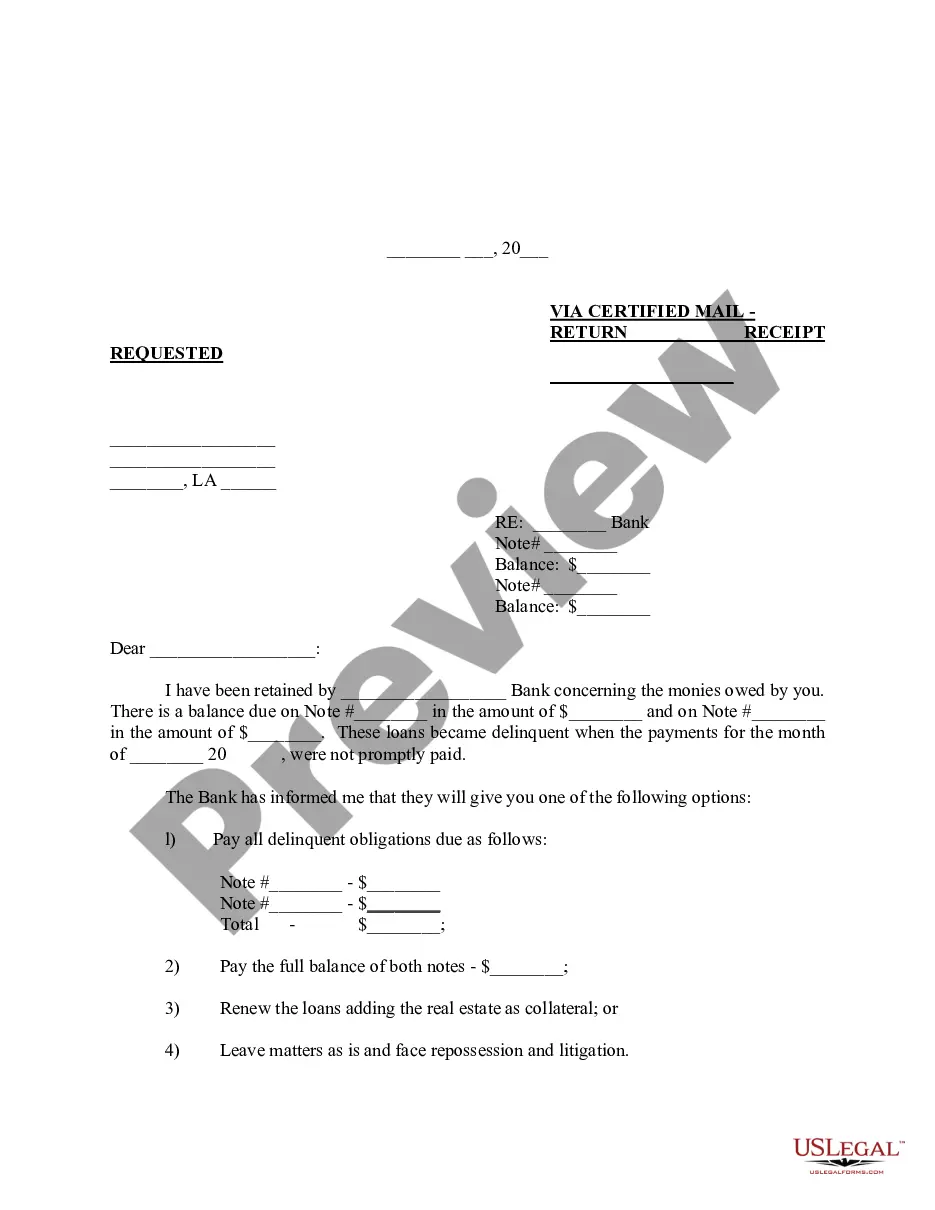

New Orleans Louisiana Demand Letter — Repaymenbanknoteses is a written document sent by a creditor to a debtor located in New Orleans, Louisiana, requesting the repayment of outstanding debts related to banknotes. This letter holds legal significance as it outlines a formal demand for repayment in a clear and concise manner. Keywords: New Orleans, Louisiana, demand letter, repayment, banknotes, creditor, debtor, outstanding debts, legal significance, formal demand, clear and concise. Different types of New Orleans Louisiana Demand Letter — Repaymenbanknoteses may include: 1. Standard Demand Letter: This is a general type of demand letter used by creditors to request repayment of banknotes. It outlines the terms of the loan agreement, outstanding balance, and a specific deadline for repayment. 2. Final Demand Letter: In cases where prior attempts at communication and collection efforts have been unsuccessful, a final demand letter is sent. It emphasizes the urgency of repayment and warns of potential legal consequences if the debt is not settled promptly. 3. Promissory Note Demand Letter: This type of demand letter is specific to the repayment of promissory notes. It addresses the terms and conditions of the promissory note agreement, including the outstanding balance, interest rates, and any applicable penalties for late payment. 4. Bank Loan Demand Letter: If the outstanding debts relate to a bank loan, a bank loan demand letter may be issued. It includes details such as loan account information, repayment schedule, and the consequences of non-payment, such as credit score reduction or legal action. 5. Commercial Demand Letter: This type of demand letter is used in commercial transactions where a business or organization is seeking repayment of banknotes from another business entity. It may contain additional information specific to commercial contracts, such as trade agreements, warranties, and the impact of non-payment on future business relationships. 6. Consumer Demand Letter: A consumer demand letter is employed when an individual, usually a consumer, is the debtor in question. It outlines the relevant laws protecting consumers' rights, any applicable interest rates or fees, and the consequences of non-payment, such as collection agency involvement or credit score damage. New Orleans Louisiana Demand Letter — Repaymenbanknoteses serves as an essential tool for creditors to assert their rights and seek repayment within the legal framework established by relevant authorities.

New Orleans Louisiana Demand Letter - Repayment of Bank Notes

Description

How to fill out New Orleans Louisiana Demand Letter - Repayment Of Bank Notes?

Finding verified templates specific to your local regulations can be difficult unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both individual and professional needs and any real-life situations. All the documents are properly categorized by area of usage and jurisdiction areas, so locating the New Orleans Louisiana Demand Letter - Repayment of Bank Notes becomes as quick and easy as ABC.

For everyone already acquainted with our service and has used it before, obtaining the New Orleans Louisiana Demand Letter - Repayment of Bank Notes takes just a couple of clicks. All you need to do is log in to your account, opt for the document, and click Download to save it on your device. The process will take just a couple of more steps to complete for new users.

Follow the guidelines below to get started with the most extensive online form collection:

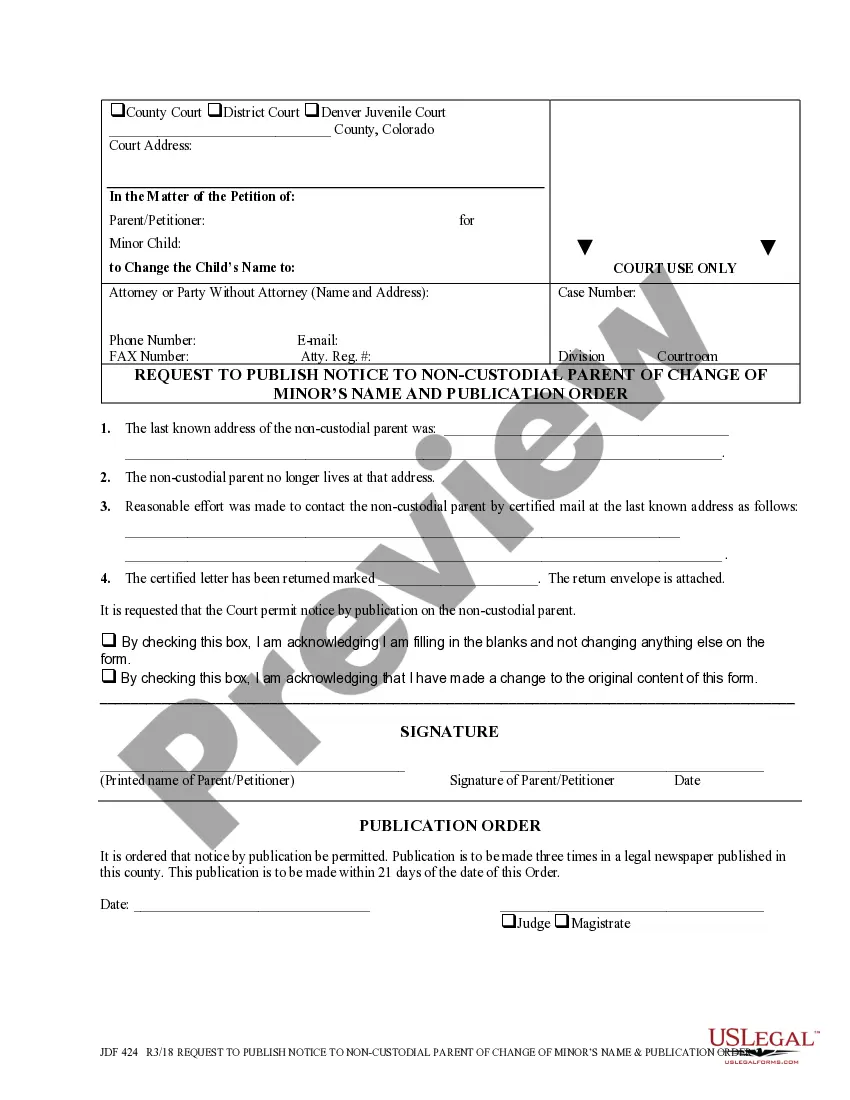

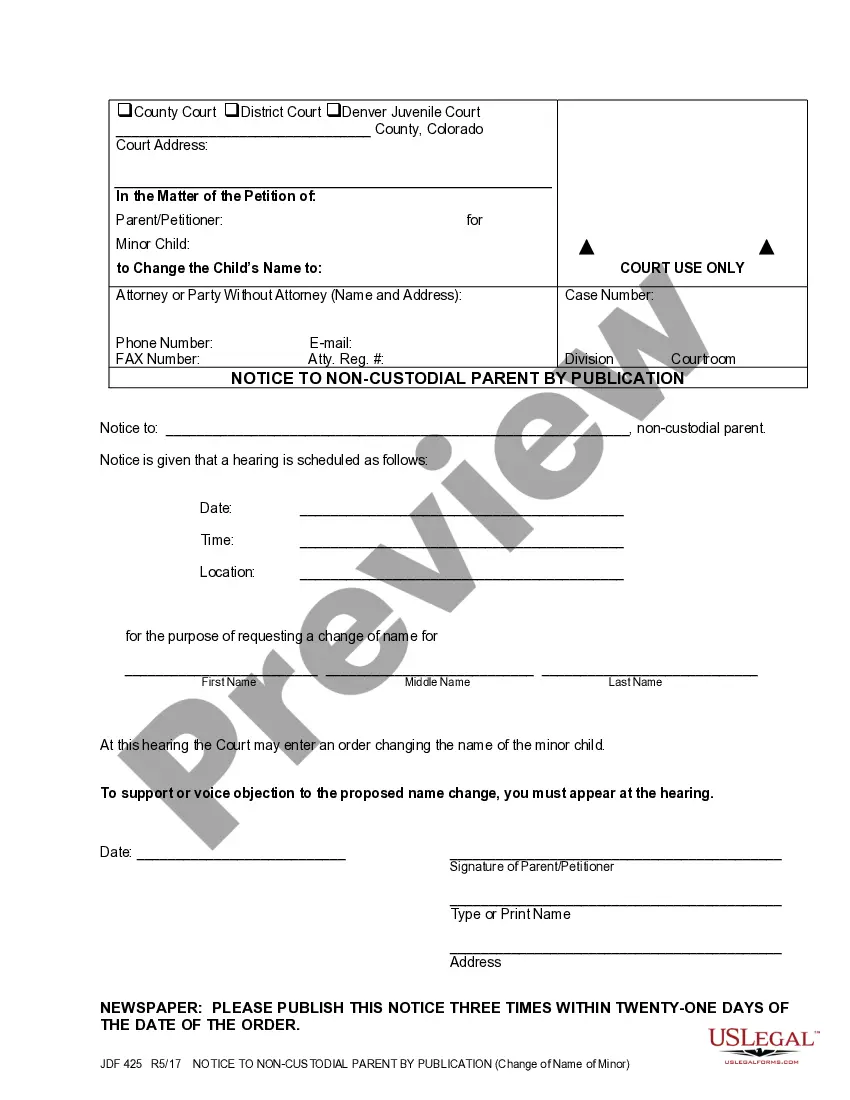

- Look at the Preview mode and form description. Make sure you’ve picked the correct one that meets your requirements and fully corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you find any inconsistency, use the Search tab above to obtain the correct one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and select the subscription plan you prefer. You should register an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the subscription.

- Download the New Orleans Louisiana Demand Letter - Repayment of Bank Notes. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Benefit from the US Legal Forms library to always have essential document templates for any needs just at your hand!