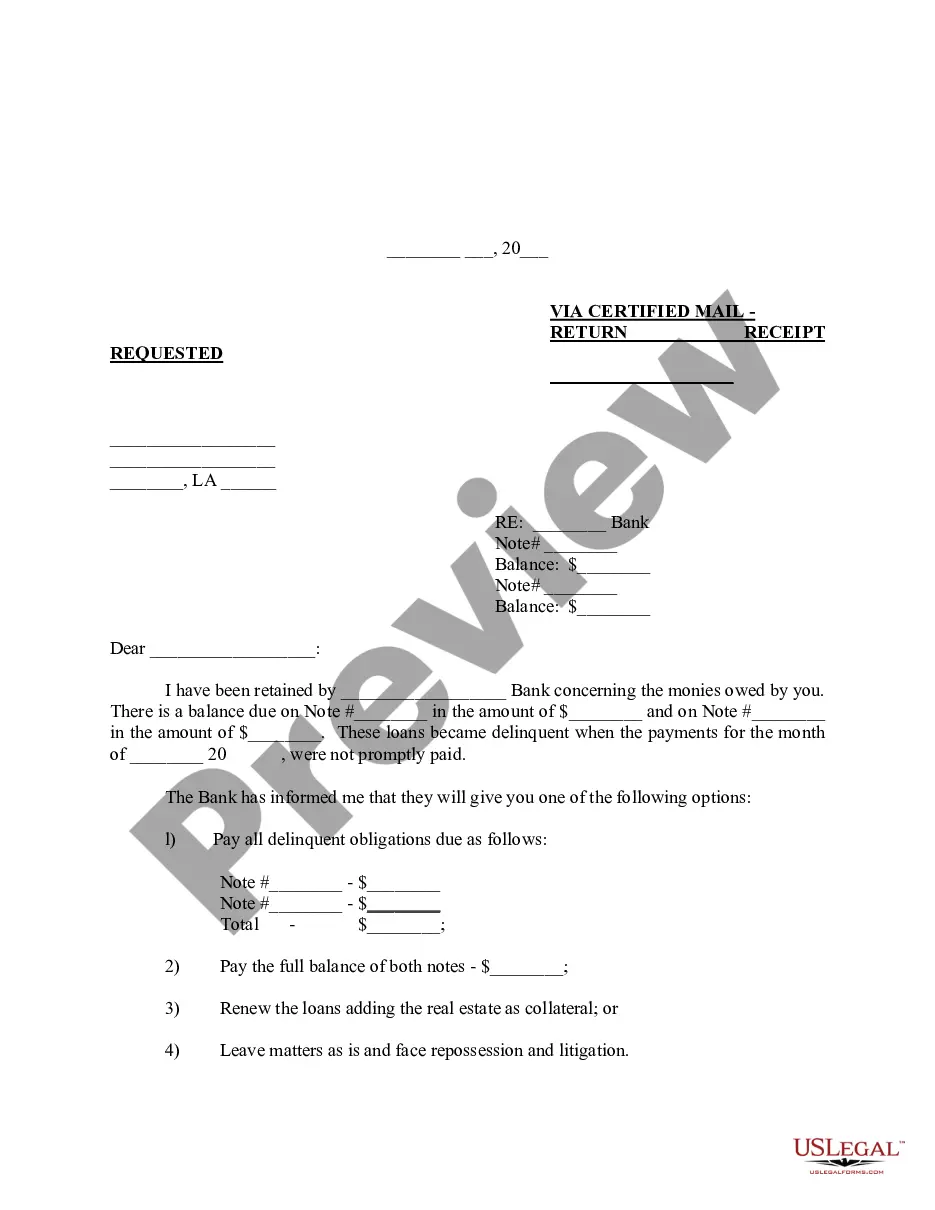

Shreveport Louisiana Demand Letter — Repaymenbanknoteses is a legally enforceable document sent by a creditor to a debtor, specifically in the context of unpaid banknotes in Shreveport, Louisiana. This letter serves as a formal demand for the repayment of the outstanding debt within a specific timeframe. Keywords: Shreveport Louisiana, Demand Letter, Repayment, banknotes, Creditor, Debtor, Unpaid Debt. There are several types of Shreveport Louisiana Demand Letters related to the repayment of banknotes based on the specific circumstances: 1. General Demand Letter: This letter is sent by a creditor to a debtor requesting the immediate repayment of outstanding banknotes. It includes information such as the amount owed, account details, original agreement, and a deadline for repayment. 2. Final Demand Letter: When previous attempts to collect the debt have been unsuccessful, a final demand letter is sent. It emphasizes the urgency of repayment, warns of potential legal action, and may notify the debtor of possible consequences such as credit damage or further collection efforts. 3. Installment Demand Letter: In cases where the debtor is unable to repay the entire debt at once, an installment demand letter is used. This letter proposes a structured repayment plan, specifying the amount and frequency of each installment payment. 4. Cease and Desist Demand Letter: If the debtor believes the debt is invalid or has been paid in full, they may respond with a cease and desist demand letter. This letter requests the creditor to cease all collection activities and provides legal reasoning or evidence to support the debtor's claim. 5. Demand Letter with Legal Warning: In situations where the creditor intends to pursue legal action to recover the debt, a demand letter with a legal warning is utilized. This letter includes a detailed explanation of the debt, a clear timeline for repayment, and a warning stating that failure to comply will result in legal proceedings. 6. Demand Letter from Debt Collection Agency: In some cases, the creditor may hire a debt collection agency to pursue repayment. In such instances, the demand letter will be issued on behalf of the agency, outlining the debt details, consequences for non-payment, and contact information for the agency handling the case. Shreveport Louisiana Demand Letter — Repaymenbanknoteses plays a crucial role in the debt collection process by formally requesting debtors to fulfill their financial obligations while adhering to legal protocols.

Shreveport Louisiana Demand Letter - Repayment of Bank Notes

Description

How to fill out Shreveport Louisiana Demand Letter - Repayment Of Bank Notes?

Finding authenticated templates tailored to your regional regulations can be difficult unless you utilize the US Legal Forms library.

It’s an online compilation of over 85,000 legal documents for both personal and professional requirements as well as various real-world scenarios.

All the files are properly categorized by area of application and jurisdictional regions, making the search for the Shreveport Louisiana Demand Letter - Repayment of Bank Notes as swift and simple as pie.

Utilize the US Legal Forms library to always have necessary document templates for any requests readily available!

- For those who are already acquainted with our library and have accessed it previously, obtaining the Shreveport Louisiana Demand Letter - Repayment of Bank Notes takes simply a few clicks.

- All you need to do is Log In to your account, select the document, and click Download to store it on your device.

- This procedure will require just a couple more steps for new users.

- Follow the instructions below to begin utilizing the most comprehensive online form archive:

- Examine the Preview mode and document description. Ensure you’ve chosen the correct one that fulfills your needs and fully adheres to your local jurisdiction requirements.

Form popularity

FAQ

To write an effective Shreveport Louisiana Demand Letter - Repayment of Bank Notes, begin with a polite yet firm introduction that states the purpose of your letter. Clearly outline the debt, including the amount owed and the due date. Next, specify the consequences of not settling the payment and provide a deadline for response. Utilize the US Legal Forms platform to find templates and guides that can streamline this process and ensure your letter is both professional and effective.

A letter of demand for outstanding payment is a formal document requesting the payment of a debt. This letter outlines the amount owed, the basis for the claim, and the timeframe for payment. Using a Shreveport Louisiana Demand Letter - Repayment of Bank Notes can effectively communicate your intent to collect the debt while laying the groundwork for potential legal action if necessary. By being clear and direct, you enhance your chances of receiving the payment promptly.

A letter of demand is primarily used to solicit repayment or compliance regarding an owed amount. In instances related to the Shreveport Louisiana Demand Letter - Repayment of Bank Notes, this letter makes your intentions clear and establishes a record of your request. It also communicates any potential consequences of not complying, thereby encouraging a quick resolution.

A letter of demand for payment is a formal document that informs the recipient of their outstanding financial obligation. Specifically, within the realm of the Shreveport Louisiana Demand Letter - Repayment of Bank Notes, this letter serves to remind individuals or businesses about past due payments. Including specific information about the debt can prompt quicker action toward settlement.

A letter of demand for refund is a specific type of correspondence that requests the return of funds due to various reasons, such as overpayment or dissatisfaction with a service. When creating a Shreveport Louisiana Demand Letter - Repayment of Bank Notes, including comprehensive details about the situation can facilitate smoother communication. This letter acts as both a formal request and a record of your intention to recover funds.

A demand notice is a formal communication that requests immediate action regarding an outstanding debt. In the context of the Shreveport Louisiana Demand Letter - Repayment of Bank Notes, it serves as a reminder to the recipient about their obligation to repay. This notice often initiates further actions if the payment is not made promptly, thus protecting your interests.

Yes, writing a demand letter for payment is an essential step in recovering funds owed to you. The Shreveport Louisiana Demand Letter - Repayment of Bank Notes provides a clear outline of the debt and specifies a timeline for payment. Using a well-structured letter can improve the chances of a favorable resolution, making it a valuable tool in your financial dealings.

A formal demand for refund is a written request that clearly outlines your claim for the return of funds. In the context of the Shreveport Louisiana Demand Letter - Repayment of Bank Notes, this letter details the reasons for your refund request and the specifics of the transaction. It serves as a critical document in negotiations, ensuring that both parties understand the expectations regarding repayment.

Writing a final letter of demand requires clarity and professionalism. Start with a concise statement indicating the purpose of the letter and include the specifics of the owed amount. Mention the urgency and the potential actions if payment is not received, particularly emphasizing the context of a Shreveport Louisiana Demand Letter - Repayment of Bank Notes.

You can send a final demand letter via certified mail, which provides proof of delivery. Ensure to maintain a copy of the letter for your records. Additionally, consider using uSlegalforms to access templates that align with your needs for a Shreveport Louisiana Demand Letter - Repayment of Bank Notes.