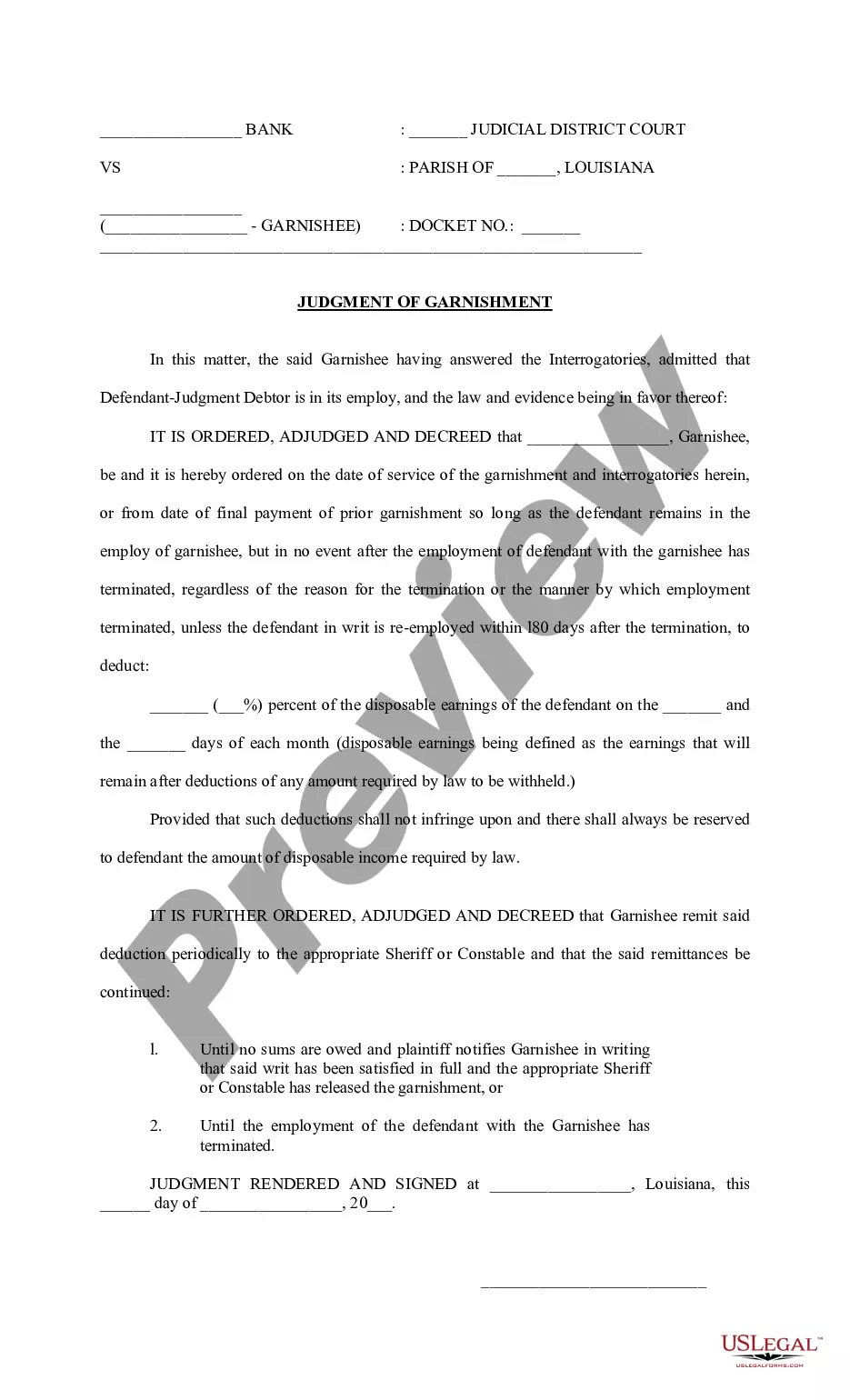

Title: Shreveport Louisiana Judgment of Garnishment Explained: Types and Detailed Description Introduction: In Shreveport, Louisiana, the Judgment of Garnishment is a legal process that allows a creditor to collect a debt owed by an individual or organization. By obtaining a court order, the creditor can seize a portion of the debtor's wages or other assets to satisfy the debt. This article provides a detailed description of the Shreveport Louisiana Judgment of Garnishment, including its types and how it works in different scenarios. Types of Shreveport Louisiana Judgment of Garnishment: 1. Wage Garnishment: This type of garnishment enables a creditor to collect unpaid debts directly from a debtor's wages or salary. Once a judgment is obtained, a portion of the debtor's earnings is deducted by their employer and sent to the creditor until the original debt, plus any applicable interest and fees, is repaid. 2. Bank Account Garnishment: In cases where a debtor fails to pay their outstanding debt, the creditor may seek a bank account garnishment. This allows the creditor to freeze and seize funds in the debtor's bank account, up to the amount owed. Once the judgment is in place, the financial institution is bound to hold the funds and release them to the creditor for debt satisfaction. 3. Property Garnishment: Property garnishment permits creditors to collect debts by pursuing the seizure and sale of a debtor's non-exempt personal property. This can include vehicles, real estate, valuable possessions, or other assets that hold value. The proceeds from the sale are applied towards the debt owed. Detailed Description of Shreveport Louisiana Judgment of Garnishment: The process of obtaining a Shreveport Louisiana Judgment of Garnishment begins with the creditor filing a lawsuit and obtaining a judgment in their favor. This involves proving the debt owed through evidence and possibly obtaining a default judgment if the debtor fails to respond to the lawsuit. Once the judgment is secured, the creditor must seek a Garnishment Order from the court, specifying the type of garnishment they wish to pursue (wage, bank account, or property). The order is then served to the debtor's employer, financial institution, or the Sheriff's Office, depending on the type of garnishment. Upon receipt of the Garnishment Order, the garnishee (employer, financial institution, etc.) is legally obligated to comply with the court order and begin withholding funds from the debtor's wages, freezing their bank accounts, or seizing their property, as applicable. The garnishee must then distribute the withheld funds or liquidate the seized property to satisfy the outstanding debt. It is essential to note that certain exemptions and limitations exist regarding the amount of funds that can be garnished to ensure the debtor's basic needs are met. The Louisiana laws governing garnishment procedures also outline the debtor's rights, such as receiving proper notice and an opportunity to challenge the garnishment in court. Conclusion: Shreveport Louisiana Judgment of Garnishment is a legal avenue for creditors to collect unpaid debts from debtors. Whether it involves wage, bank account, or property garnishment, the process adheres to specific rules and procedures to protect the rights of all parties involved. By understanding how this process works, individuals and organizations in Shreveport can navigate these situations more effectively.

Shreveport Louisiana Judgment of Garnishment

Description

How to fill out Shreveport Louisiana Judgment Of Garnishment?

No matter the social or professional status, filling out law-related forms is an unfortunate necessity in today’s world. Too often, it’s virtually impossible for a person with no law education to create this sort of papers from scratch, mostly because of the convoluted jargon and legal subtleties they involve. This is where US Legal Forms comes to the rescue. Our platform offers a huge collection with over 85,000 ready-to-use state-specific forms that work for practically any legal situation. US Legal Forms also is a great asset for associates or legal counsels who want to save time using our DYI forms.

No matter if you require the Shreveport Louisiana Judgment of Garnishment or any other paperwork that will be good in your state or county, with US Legal Forms, everything is at your fingertips. Here’s how to get the Shreveport Louisiana Judgment of Garnishment quickly using our reliable platform. In case you are already a subscriber, you can go on and log in to your account to download the needed form.

Nevertheless, in case you are new to our library, ensure that you follow these steps before obtaining the Shreveport Louisiana Judgment of Garnishment:

- Be sure the form you have found is specific to your area since the regulations of one state or county do not work for another state or county.

- Review the form and go through a short outline (if available) of cases the paper can be used for.

- If the form you picked doesn’t suit your needs, you can start again and look for the needed form.

- Click Buy now and choose the subscription plan that suits you the best.

- utilizing your credentials or create one from scratch.

- Pick the payment gateway and proceed to download the Shreveport Louisiana Judgment of Garnishment once the payment is through.

You’re good to go! Now you can go on and print out the form or fill it out online. Should you have any issues getting your purchased forms, you can quickly access them in the My Forms tab.

Regardless of what situation you’re trying to sort out, US Legal Forms has got you covered. Try it out today and see for yourself.