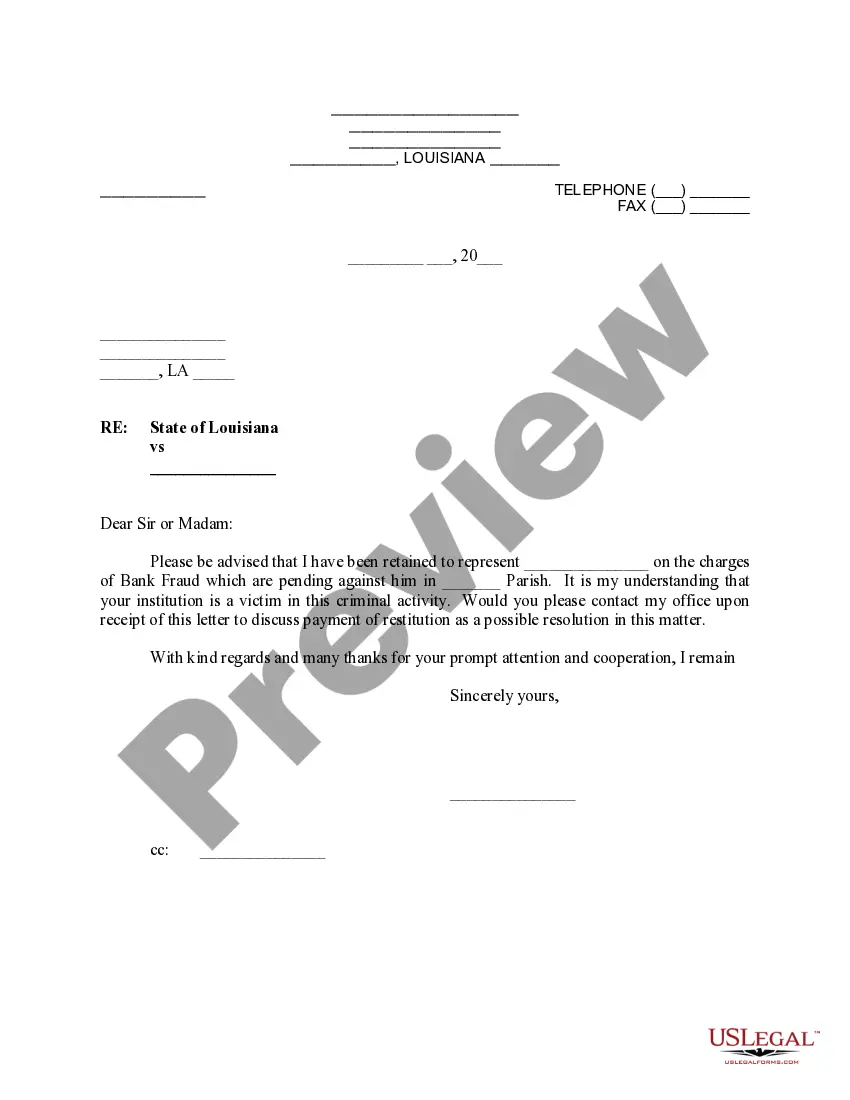

Title: Baton Rouge, Louisiana Letter to Bank: Seeking Restitution Offer in Bank Fraud Case Keywords: Baton Rouge, Louisiana, letter to bank, restitution offer, bank fraud case, content, description, types Introduction: In Baton Rouge, Louisiana, an important step in addressing a bank fraud case is to write a letter to the bank, seeking a suitable restitution offer. This detailed description aims to explain the significance of such a letter and provide relevant content for different types of Baton Rouge Louisiana letters to banks regarding restitution offers in bank fraud cases. Types of Baton Rouge, Louisiana Letters to Bank Regarding Restitution Offer in Bank Fraud Case: 1. Initial Restitution Request: This type of letter serves as an initial formal approach, requesting the bank to offer a restitution plan to the affected party in a bank fraud case. The content should include a comprehensive explanation of the fraudulent activities, the impact on the victim, and a demand for restitution that covers the losses suffered. 2. Follow-up Request for Restitution: If the initial request did not yield a satisfactory response, a follow-up letter is necessary. In this type of correspondence, it is crucial to outline the previous request, mention any relevant communication, and express the urgency of a response. Reinforce the need for a fair offer of restitution, considering the information provided in the case. Content and Structure: 1. Header: — Include the bank's name, address, and contact details on the top left-hand side. — On the top right-hand side, mention your name, address, phone number, and email address. 2. Salutation: — Greet the recipient formally, addressing them by their appropriate title (e.g., "Dear Mr./Mrs./Ms."). 3. Introduction: — Begin by introducing yourself as the victim of the bank fraud case and state your purpose for writing the letter. — Specify the relevant case number, if available, along with any relevant date(s) associated with the fraudulent activity. 4. Description of Fraud: — Provide a detailed account of the fraudulent transactions or activities that took place, including specific dates, amounts, and any supporting evidence available. — Explain how the fraud has impacted you financially, emotionally, and/or professionally. — Be concise but ensure clarity in conveying the severity of the fraud. 5. Request for Restitution: — Clearly state your expectation for a fair and reasonable restitution offer. — Indicate the desired amount or percentage of the losses to be covered. — Emphasize that the restitution should aim to make you whole and restore you to your defraud financial state. 6. Supporting Information: — Attach any evidence or documents that might strengthen your case, such as bank statements, police reports, or legal notices related to the fraud. 7. Conclusion: — Express appreciation for the bank's attention to the matter and willingness to resolve it. — Request a prompt response, setting a reasonable deadline for their reply to avoid unnecessary delays. 8. Closing: — End the letter with an appropriate closing, such as "Sincerely" or "Kind regards." — Sign your name above your typed name and include any relevant contact information. Remember to keep copies of the letter and any subsequent correspondence for your records. Conclusion: Baton Rouge, Louisiana letters to banks regarding restitution offers in bank fraud cases carry significant importance. Their content should provide a comprehensive account of the fraudulent activity, articulate the desired restitution terms, and request prompt action. Adhering to the suggested structure and including relevant supporting information can help victims of bank fraud present a compelling case to their bank.

Baton Rouge Louisiana Letter to Bank regarding Restitution Offer in Bank Fraud Case

Description

How to fill out Baton Rouge Louisiana Letter To Bank Regarding Restitution Offer In Bank Fraud Case?

Take advantage of the US Legal Forms and secure instant access to any form template you desire.

Our advantageous website with numerous documents simplifies the process of locating and acquiring nearly any document format you require.

You can download, complete, and sign the Baton Rouge Louisiana Letter to Bank concerning Restitution Offer in Bank Fraud Case in just a few moments instead of spending hours online hunting for a suitable template.

Using our repository is an excellent approach to enhance the security of your form submissions. Our knowledgeable attorneys regularly evaluate all documents to ensure that the templates are suitable for specific regions and comply with newly enacted laws and regulations.

Download the document. Specify the format to receive the Baton Rouge Louisiana Letter to Bank pertaining to Restitution Offer in Bank Fraud Case and modify and complete or sign it per your needs.

US Legal Forms is arguably the most extensive and reliable document repository available online. We are always prepared to support you in any legal procedure, even if it simply involves downloading the Baton Rouge Louisiana Letter to Bank regarding Restitution Offer in Bank Fraud Case.

- How can you access the Baton Rouge Louisiana Letter to Bank regarding Restitution Offer in Bank Fraud Case.

- If you already hold a subscription, just Log In to your account. The Download option will appear for all the documents you view. Furthermore, you can access all your previously saved documents in the My documents section.

- If you do not possess an account yet, follow the instructions listed below.

- Open the page with the form you require. Ensure that it is the form you intended to seek: verify its title and description, and use the Preview function if it is available. Otherwise, use the Search bar to find the necessary one.

- Initiate the downloading process. Click Buy Now and select the pricing plan that suits you. Then, create an account and complete your order using a credit card or PayPal.

Form popularity

FAQ

When you report fraud to your bank, they will initiate a review of your account, and they will likely freeze transactions to prevent further losses. You will be asked to provide details about the suspicious activity, and your account may be temporarily restricted. To resolve any misunderstandings or seek restitution, it may be beneficial to send a Baton Rouge Louisiana Letter to Bank regarding Restitution Offer in Bank Fraud Case.

Being charged with bank fraud can lead to severe consequences, including criminal prosecution and financial penalties. A conviction can also affect your credit score, making it difficult to obtain loans or credit in the future. If you’re facing such charges, consulting with a legal expert is essential, and they might suggest drafting a Baton Rouge Louisiana Letter to Bank regarding Restitution Offer in Bank Fraud Case.

Yes, banks take fraud charges seriously and typically conduct thorough investigations. They use various tools and resources to identify unauthorized transactions and protect their customers. If you need assistance navigating this process, a Baton Rouge Louisiana Letter to Bank regarding Restitution Offer in Bank Fraud Case can help clarify your situation.

Bank fraud occurs when someone uses deceit to secure funds from a financial institution. In Baton Rouge, Louisiana, specific laws define what constitutes bank fraud, including identity theft, forgery, and misrepresentation. Understanding these rules is crucial if you need to write a Baton Rouge Louisiana Letter to Bank regarding Restitution Offer in Bank Fraud Case.

Banks use various strategies to prevent fraud, including advanced encryption technologies and multi-factor authentication systems. They also conduct regular audits and employ fraud detection algorithms to catch anomalies. Being aware of these measures can help you work with your bank effectively, especially if you need to discuss a Baton Rouge Louisiana Letter to Bank regarding Restitution Offer in Bank Fraud Case.

To stop fraud, promptly report the incident to your bank and law enforcement. Additionally, educate yourself on the signs of fraud to prevent future issues. If you find yourself needing to address a restitution offer specifically, drafting a Baton Rouge Louisiana Letter to Bank regarding Restitution Offer in Bank Fraud Case can streamline your communication with the bank.

You can escape from bank fraud by being proactive about your accounts. Frequently monitor your financial statements and set up alerts for any unusual activities. If you are a victim, a Baton Rouge Louisiana Letter to Bank regarding Restitution Offer in Bank Fraud Case can help you articulate your concerns and seek restitution from your bank.

To escape from bank fraud, take immediate action by analyzing your bank statements and reporting suspicious transactions. It's vital to contact your bank directly to protect your account. If you need assistance crafting a formal communication, consider using a Baton Rouge Louisiana Letter to Bank regarding Restitution Offer in Bank Fraud Case to clarify your situation and request action.

Statute addresses the crime of theft in its many forms, including those committed against financial institutions. This law highlights the seriousness of crimes like bank fraud, underscoring the necessity for restitution. When appealing for a Baton Rouge Louisiana Letter to Bank regarding Restitution Offer in Bank Fraud Case, referencing this statute can strengthen your position.

RS .1 pertains to the law regarding theft significantly connected to fraud cases in Louisiana. This statute specifically targets situations involving stealing property with the intent to benefit financially. Understanding this law is valuable when drafting a Baton Rouge Louisiana Letter to Bank regarding Restitution Offer in Bank Fraud Case, as it details possible implications of fraud.