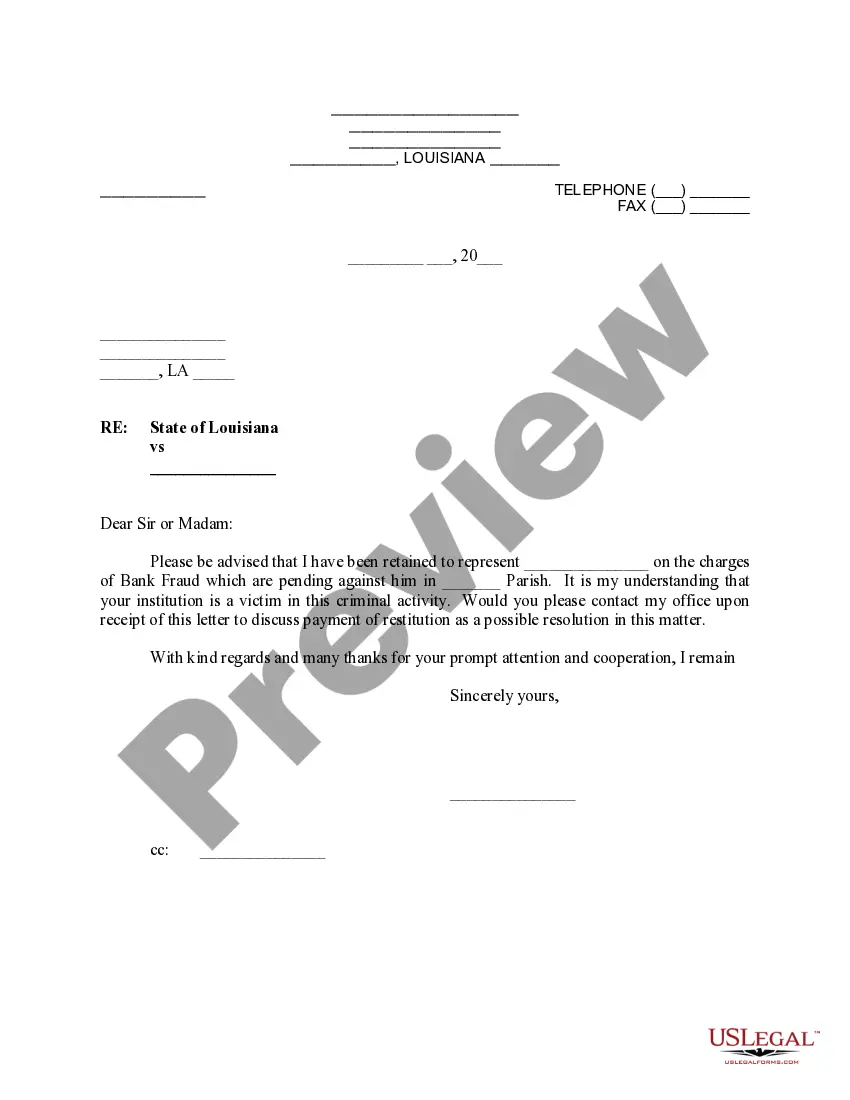

**Title: Shreveport Louisiana Letter to Bank regarding Restitution Offer in Bank Fraud Case** **Keywords: Shreveport Louisiana, letter, bank, restitution offer, bank fraud case, fraud victim, legal process, financial loss, compensation, cooperation, resolution, financial institution, legal representation.** **Introduction:** In the case of a bank fraud incident, victims in Shreveport, Louisiana often find it necessary to write a letter to their respective banks to communicate their desire for restitution and request compensation for the financial loss incurred. This detailed description will shed light on the purpose, significance, and key elements to include in a Shreveport Louisiana Letter to Bank regarding a restitution offer in a bank fraud case. Additionally, it will address potential variations of such letters based on different circumstances. **Main Body:** 1. Overview of the Bank Fraud Incident: — Begin the letter by briefly summarizing the bank fraud incident that occurred, specifying the date(s) and type(s) of fraudulent activities involved. — Mention any evidence or information discovered during the investigation that supports the victim's claim. — Emphasize the impact the fraud has had on the victim's financial situation, personal life, and trust in the banking system. 2. Request for Restitution Offer: — Clearly state the purpose of the letter, which is to request a restitution offer from the bank to compensate for the losses suffered due to the bank fraud. — Express the victim's desire for a fair and just resolution through cooperation between the bank and the affected customer. — Highlight the importance of prompt action to restore the victim's faith in the banking institution. 3. Supporting Documentation and Information: — Encourage the bank to review any supporting documents, such as account statements, transaction records, or correspondence related to the fraudulent activities. — Offer cooperation and provide assistance in gathering additional evidence required to expedite the investigation process. — Request a meeting or call with a representative from the bank to discuss the case in more detail and provide any further evidence if needed. 4. Financial Compensation: — State the desired amount of restitution the victim is seeking, taking into consideration the documented financial losses incurred. — Explain the methodology used to calculate the requested compensation, including any interest accrued. — Clarify that the restitution amount is aimed at making the victim whole, covering financial losses, legal fees, and any related expenses. 5. Legal Representation: — Inform the bank if the victim is represented by legal counsel or if they intend to seek professional assistance. — Note that the victim is willing to work directly with the bank but also reserves the right to involve their attorney if necessary. — Provide the contact information of the victim's legal representative, if applicable. **Possible Variations of Shreveport Louisiana Letter to Bank regarding a Restitution Offer in a Bank Fraud Case:** — Shreveport Louisiana Letter to Bank regarding Restitution Offer in Identity Theft Case — Shreveport Louisiana Letter to Bank regarding Restitution Offer in Check Fraud Case — Shreveport Louisiana Letter to Bank regarding Restitution Offer in Investment Fraud Case — Shreveport Louisiana Letter to Bank regarding Restitution Offer in Online Banking Fraud Case — Shreveport Louisiana Letter to Bank regarding Restitution Offer in Employee Embezzlement Case Note: The variations listed above signify specific instances of bank fraud cases, highlighting the need for restitution offers and specifying the nature of the fraud involved.

Shreveport Louisiana Letter to Bank regarding Restitution Offer in Bank Fraud Case

Description

How to fill out Shreveport Louisiana Letter To Bank Regarding Restitution Offer In Bank Fraud Case?

Are you searching for a reliable and affordable provider of legal forms to acquire the Shreveport Louisiana Letter to Bank concerning Restitution Offer in Bank Fraud Case? US Legal Forms is your ultimate answer.

Whether you need a straightforward arrangement to establish guidelines for living with your partner or a collection of documents to facilitate your divorce through the court, we have you covered. Our site features over 85,000 current legal document templates for individual and business use. All templates that we provide are tailored and structured in accordance with the regulations of specific states and counties.

To obtain the document, you must Log In to your account, locate the desired form, and click the Download button adjacent to it. Please bear in mind that you can access your previously acquired form templates at any time in the My documents section.

Are you unfamiliar with our platform? No problem. You can establish an account with ease, but first, ensure that you do the following.

Now you can create your account. Then select the subscription plan and move forward to payment. Once the payment is completed, download the Shreveport Louisiana Letter to Bank regarding Restitution Offer in Bank Fraud Case in any available file format. You can revisit the website at any time and redownload the document without any additional fees.

Finding current legal documents has never been simpler. Try US Legal Forms today, and say goodbye to wasting your precious time searching for legal papers online once and for all.

- Verify if the Shreveport Louisiana Letter to Bank concerning Restitution Offer in Bank Fraud Case aligns with the laws of your state and local jurisdiction.

- Examine the form’s specifics (if available) to ascertain who and what the document is applicable for.

- Initiate a new search if the form isn’t suitable for your particular situation.

Form popularity

FAQ

Writing a letter to the bank involves a straightforward approach. Start with your contact information, followed by the bank’s information, and a concise introduction of your issue. Incorporating 'Shreveport Louisiana Letter to Bank regarding Restitution Offer in Bank Fraud Case' will help direct your request to the appropriate resolution path.

To write a formal letter requesting a correction from your bank, use a professional tone and format. Clearly state the reason for your letter and the specific correction needed. Citing 'Shreveport Louisiana Letter to Bank regarding Restitution Offer in Bank Fraud Case' in your letter can provide context and support your request.

When writing to your bank about a wrong transaction, keep your language clear and precise. Start by stating the purpose of your letter, followed by a description of the mistake. Referencing the 'Shreveport Louisiana Letter to Bank regarding Restitution Offer in Bank Fraud Case' could be beneficial in aligning your request with standard practices.

You should inform your bank about wrong transactions by writing a detailed letter that outlines the specifics of the erroneous transaction. Be sure to include your account information, the date of the transaction, and any relevant documentation. Mentioning 'Shreveport Louisiana Letter to Bank regarding Restitution Offer in Bank Fraud Case' will clarify the context of your communication.

Begin your letter by clearly stating your concern about the incorrect transaction. Include the transaction details, such as date, amount, and the nature of the error. Using 'Shreveport Louisiana Letter to Bank regarding Restitution Offer in Bank Fraud Case' can help guide the bank in processing your request efficiently.

To write a letter to your bank manager regarding fraud, start with a clear subject line, such as 'Fraud Notification'. Introduce yourself, explain the situation succinctly, and include important details about the fraudulent activity. It is essential to reference 'Shreveport Louisiana Letter to Bank regarding Restitution Offer in Bank Fraud Case' for clarity on your request.

Lying to a bank can lead to severe legal consequences, including criminal charges. It's important to understand that providing false information can not only damage your relationship with the institution but can also result in prosecution. If you find yourself in a complicated situation involving dishonesty, consider a Shreveport Louisiana Letter to Bank regarding Restitution Offer in Bank Fraud Case as a potential way to address past missteps. Transparency is always the best policy for rebuilding trust.

A classic example of bank account fraud is when someone uses stolen information to access another person's account for unauthorized withdrawals. This could involve using personal details to forge checks or transfer funds illegally. If you find yourself a victim, seeking assistance is vital, possibly including a Shreveport Louisiana Letter to Bank regarding Restitution Offer in Bank Fraud Case to recover losses. Prompt action can significantly mitigate damages.

Fraud can take many forms, but the three primary types are theft, deception, and breach of trust. In the context of bank fraud, these types often overlap. Understanding these categories can help you navigate issues such as a Shreveport Louisiana Letter to Bank regarding Restitution Offer in Bank Fraud Case. Knowing the types of fraud is crucial for protecting your financial interests.

Louisiana Revised Statute 14.67 addresses the crime of bank fraud specifically, outlining the legal definitions and penalties associated with such acts. Understanding this law is vital for anyone facing allegations or involved in a restitution offer. Utilizing a Shreveport Louisiana Letter to Bank regarding Restitution Offer in Bank Fraud Case can clarify your rights and responsibilities under this statute.