Title: Shreveport Louisiana Follow-up Letter to Bank regarding Restitution Offer in Bank Fraud Case Introduction: The Shreveport Louisiana Follow-up Letter to Bank regarding Restitution Offer in Bank Fraud Case is a crucial correspondence that aims to address a fraudulent incident with a financial institution located in Shreveport. This letter serves as a testament to the victim's pursuit of justice and restitution while maintaining a professional and formal tone. Below, you will find the different types of Shreveport Louisiana Follow-up Letters to the Bank regarding Restitution Offer in Bank Fraud Case. 1. Personal Shreveport Louisiana Follow-up Letter to Bank regarding Restitution Offer in Bank Fraud Case: This type of follow-up letter is written by an individual victim of bank fraud in Shreveport to their respective financial institution. It details the specific incident, the impact it has had on the victim, and the request for a restitution offer to be considered seriously. The letter will adopt a personal tone to convey the emotional distress faced by the victim. 2. Business Shreveport Louisiana Follow-up Letter to Bank regarding Restitution Offer in Bank Fraud Case: This letter is drafted by a business entity that has fallen victim to bank fraud in Shreveport. It outlines the fraudulent incident's repercussions on their operations, finances, and reputation. The business follow-up letter emphasizes the need for a fair and substantial restitution offer to facilitate their recovery and regain trust in the banking system. 3. Legal Shreveport Louisiana Follow-up Letter to Bank regarding Restitution Offer in Bank Fraud Case: This type of follow-up letter is drafted by legal counsel representing victims of bank fraud in Shreveport. The letter presents a legal perspective on the case, highlighting the severity of the fraudulent activities and the potential legal consequences if a satisfactory restitution offer is not made promptly. It focuses on the bank's liability and the importance of reaching a fair resolution. Key Elements of the Follow-up Letter: 1. Detailed Description of the Fraudulent Incident: Provide a clear and concise explanation of the bank fraud case, including dates, parties involved, transactions affected, etc. Ensure the bank is fully aware of the fraudulent activities that have taken place. 2. Impact on the Victim/Business: Articulate the adverse consequences suffered as a result of the bank fraud incident. This could include financial losses, compromised credit ratings, reputation damage, emotional distress, or even negative effects on staff morale and operations (in the case of businesses). 3. Expression of the Need for Restitution: Assert the victim's right to fair compensation for the losses incurred. Emphasize the importance of financial restitution to recover from the negative repercussions of the bank fraud and restore confidence in the banking relationship. 4. Supporting Documentation: Include any essential supporting evidence, such as police reports, transaction records, or other relevant documentation that strengthens the case for restitution. 5. Request for Prompt Action: Urge the bank to respond promptly to the restitution offer presented, emphasizing the urgency and expectations of the victim/business. Request a timeline for resolution and a contact person within the bank with whom further communication can be established. Conclusion: The Shreveport Louisiana Follow-up Letter to the Bank regarding Restitution Offer is an essential means to communicate the gravity of the bank fraud case and the need for restitution. Whether written in a personal, business, or legal context, these letters should provide a comprehensive overview of the incident, the impact on the victim, and the expectation for compensation.

Shreveport Louisiana Follow-up Letter to Bank regarding Restitution Offer in Bank Fraud Case

Description

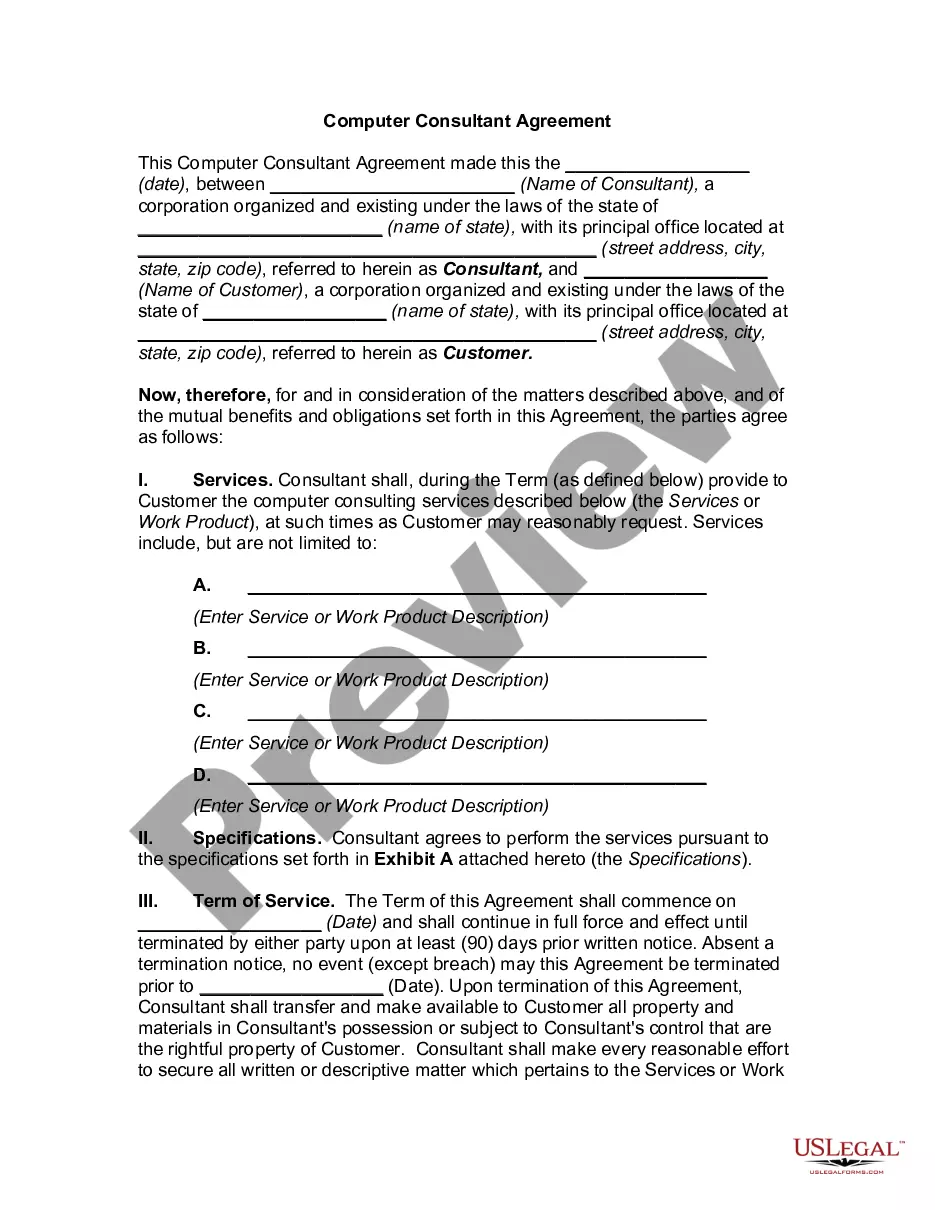

How to fill out Louisiana Follow-up Letter To Bank Regarding Restitution Offer In Bank Fraud Case?

No matter one’s social or career position, filling out legal documents remains an unfortunate requirement in the current professional landscape.

Often, it is nearly impossible for someone without a legal background to draft such documents independently, primarily because of the complicated terminology and legal specifics they entail. This is where US Legal Forms steps in to assist.

Our platform features an extensive assortment of over 85,000 ready-to-use, state-specific forms suitable for nearly any legal situation. US Legal Forms is also an excellent tool for associates or legal advisors seeking to save time with our DIY forms.

If the form you selected does not meet your requirements, you can start over and look for the necessary document.

Click Buy now and select the subscription plan that suits you best. Authenticate yourself with your credentials or create a new account from scratch. Choose the payment method and proceed to download the Shreveport Louisiana Follow-up Letter to Bank regarding Restitution Offer in Bank Fraud Case as soon as your payment is processed. You're all set! Now you can print the document or fill it out online. If you encounter any issues finding your purchased forms, you can easily access them in the My documents section. Whatever legal matter you're trying to resolve, US Legal Forms has you covered. Give it a try today and see the benefits for yourself.

- Whether you need the Shreveport Louisiana Follow-up Letter to Bank regarding Restitution Offer in Bank Fraud Case or any other document valid in your state or locality, with US Legal Forms, everything is readily accessible.

- Here’s how you can acquire the Shreveport Louisiana Follow-up Letter to Bank regarding Restitution Offer in Bank Fraud Case in just minutes using our trustworthy platform.

- If you are already a customer, feel free to Log In to your account to retrieve the needed form.

- However, if you are new to our platform, ensure you follow these steps before obtaining the Shreveport Louisiana Follow-up Letter to Bank regarding Restitution Offer in Bank Fraud Case.

- Ensure the selected form is appropriate for your locality, as the regulations of one state or region do not apply to another.

- Examine the document and read a brief overview (if available) of the situations for which the document can be utilized.

Form popularity

FAQ

Bank fraud in Louisiana involves deceptive practices aimed at gaining unauthorized access to a bank's benefits or funds. This includes activities such as check forgery, identity theft, and fraudulent wire transfers. If you are facing issues related to a bank fraud case, a well-crafted Shreveport Louisiana Follow-up Letter to Bank regarding Restitution Offer in Bank Fraud Case can be crucial for your legal recourse.

Email fraud is primarily investigated by the Federal Bureau of Investigation (FBI) and local authorities. Users should report phishing attempts or suspicious emails through platforms like the Internet Crime Complaint Center (IC3). For those affected by email scams related to bank fraud, a Shreveport Louisiana Follow-up Letter to Bank regarding Restitution Offer in Bank Fraud Case can serve as a formal measure to seek redress.

Investigating financial fraud typically involves gathering documentation, consulting legal experts, and filing reports with appropriate authorities. Individuals may also want to work with professionals who specialize in forensic accounting to trace illegal financial activities. If you are preparing a Shreveport Louisiana Follow-up Letter to Bank regarding Restitution Offer in Bank Fraud Case, having a clear investigation strategy can strengthen your position.

In the United States, the postal inspection service oversees cases of bank fraud that occur through the mail. They collaborate with local law enforcement and federal agencies to address these serious crimes. If you find yourself needing to submit a Shreveport Louisiana Follow-up Letter to Bank regarding Restitution Offer in Bank Fraud Case, understanding this investigative process can help you navigate the situation more effectively.

If you are the victim of fraud, you may face financial loss and potential damage to your credit. The bank will investigate, and you will likely need to take proactive steps to recover your funds. Utilizing tools like uslegalforms to draft a Shreveport Louisiana Follow-up Letter to Bank regarding Restitution Offer in Bank Fraud Case can be crucial in successfully navigating your recovery process.

To claim fraud on your bank account, contact your bank's customer service or fraud department right away. Provide them with details about the unauthorized activity, and follow their instructions for filing a claim. Creating a clear, concise Shreveport Louisiana Follow-up Letter to Bank regarding Restitution Offer in Bank Fraud Case can further ensure your claim is processed efficiently with the necessary documentation.

If you are a victim of bank fraud, the first step is to report it to your bank immediately. Next, you should document all communications and transactions related to the fraud. Writing a Shreveport Louisiana Follow-up Letter to Bank regarding Restitution Offer in Bank Fraud Case can also strengthen your case for retrieving lost funds, and uslegalforms provides templates to simplify this process.

Upon reporting fraud, your bank typically creates a case and assigns it to a fraud investigator. They will investigate the claims, gather necessary evidence, and often reach out to you for additional details. If you need assistance drafting a Shreveport Louisiana Follow-up Letter to Bank regarding Restitution Offer in Bank Fraud Case, consider using uslegalforms to create a professional letter.

When you report fraud, your bank initiates an investigation. They collect information from you, review account activity, and may freeze your account to prevent further unauthorized transactions. In the context of a Shreveport Louisiana Follow-up Letter to Bank regarding Restitution Offer in Bank Fraud Case, it is essential to clearly document your issue for a more efficient resolution.

If you find yourself a victim of a scam, your bank may help you recover some or all of your funds, depending on the circumstances. It is crucial to report the incident as soon as possible, providing all relevant details. Utilizing a structured approach like the Shreveport Louisiana Follow-up Letter to Bank regarding Restitution Offer in Bank Fraud Case can strengthen your case. This letter serves as an effective tool in managing your claim and ensuring clear communication with your bank.