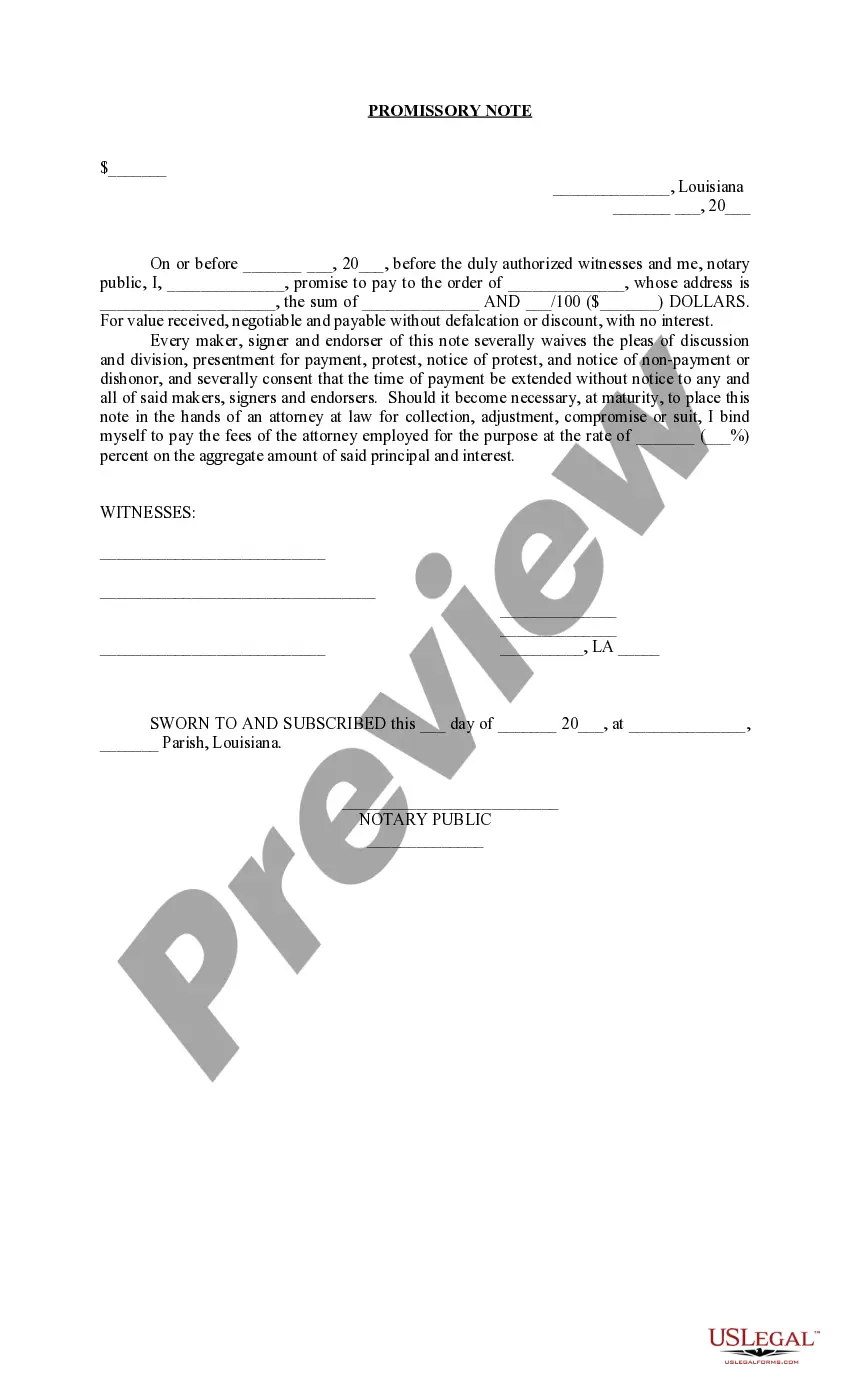

Title: Shreveport Louisiana Installment Promissory Note with No Interest Accruing: Understanding the Types and Benefits Introduction: In Shreveport, Louisiana, individuals and businesses often find themselves in need of financial assistance. To facilitate loans, the concept of an Installment Promissory Note with No Interest Accruing has gained popularity. This comprehensive guide will delve into the different types of promissory notes available in Shreveport, explaining their benefits and outlining key features. 1. Unsecured Personal Installment Promissory Note: For personal financial needs, Shreveport residents can opt for an Unsecured Personal Installment Promissory Note with No Interest Accruing. This type of note allows borrowers to obtain funds without the burden of accumulating interest, making it an attractive option for those seeking financial stability and flexibility. 2. Secured Business Installment Promissory Note: Entrepreneurs in Shreveport can benefit from Secured Business Installment Promissory Notes with No Interest Accruing. Aimed towards small and medium-sized businesses, this note type provides a practical solution for accessing capital while avoiding interest charges. By securing the loan with collateral, businesses can minimize risks and enjoy manageable repayment plans. 3. Real Estate Installment Promissory Note: For individuals investing in Shreveport's real estate market, the Real Estate Installment Promissory Note with No Interest Accruing can be an invaluable tool. This note enables buyers to finance property purchases without accruing interest, resulting in reduced overall borrowing costs and increased affordability. Key Features and Benefits: a) No Interest Accrual: One of the most prominent advantages of these promissory notes is the absence of interest, ensuring borrowers can repay the borrowed sum without the additional financial burden. b) Flexible Repayment Terms: Shreveport Louisiana Installment Promissory Notes offer flexible repayment options, allowing borrowers to determine a suitable repayment timeline that aligns with their financial capabilities. c) Convenience and Accessibility: Obtaining these promissory notes is relatively straightforward, with a range of financial institutions, credit unions, and private lenders in Shreveport offering such products. d) Reduced Financial Stress: By eliminating interest accrual, borrowers can experience reduced financial stress, maximizing their ability to manage their finances effectively. Conclusion: Shreveport Louisiana Installment Promissory Notes with No Interest Accruing are a valuable financial tool for individuals and businesses seeking flexible and interest-free financing solutions. Whether it is for personal expenses, business initiatives, or real estate ventures, understanding the different types and benefits of these promissory notes can empower borrowers to make informed decisions and achieve their financial goals efficiently.

Shreveport Louisiana Installment Promissory Note with No Interest Accruing

Description

How to fill out Shreveport Louisiana Installment Promissory Note With No Interest Accruing?

If you are searching for a valid form, it’s difficult to choose a more convenient service than the US Legal Forms website – one of the most comprehensive libraries on the internet. With this library, you can find thousands of templates for organization and personal purposes by types and states, or keywords. With our advanced search option, getting the newest Shreveport Louisiana Installment Promissory Note with No Interest Accruing is as elementary as 1-2-3. Moreover, the relevance of every record is proved by a group of expert lawyers that regularly check the templates on our platform and revise them according to the newest state and county demands.

If you already know about our system and have an account, all you need to receive the Shreveport Louisiana Installment Promissory Note with No Interest Accruing is to log in to your profile and click the Download button.

If you use US Legal Forms the very first time, just refer to the instructions listed below:

- Make sure you have discovered the form you require. Look at its explanation and use the Preview function to explore its content. If it doesn’t suit your needs, utilize the Search field at the top of the screen to discover the proper file.

- Affirm your selection. Click the Buy now button. After that, select your preferred pricing plan and provide credentials to register an account.

- Process the transaction. Make use of your bank card or PayPal account to complete the registration procedure.

- Receive the form. Pick the format and save it on your device.

- Make modifications. Fill out, modify, print, and sign the obtained Shreveport Louisiana Installment Promissory Note with No Interest Accruing.

Each and every form you add to your profile has no expiry date and is yours forever. You can easily gain access to them via the My Forms menu, so if you need to get an extra duplicate for enhancing or creating a hard copy, you may return and download it once again anytime.

Make use of the US Legal Forms extensive catalogue to gain access to the Shreveport Louisiana Installment Promissory Note with No Interest Accruing you were looking for and thousands of other professional and state-specific samples on one website!