A Baton Rouge Louisiana Promissory Note is a legally binding written agreement that outlines the terms and conditions under which one party, known as the borrower, promises to repay a specific sum of money to another party, known as the lender. This document serves as evidence of a debt and includes details such as the loan amount, interest rate, repayment schedule, and any additional terms agreed upon between the parties involved. The Baton Rouge Louisiana Promissory Note is commonly used in various financial transactions, including personal loans, business loans, student loans, and real estate financing. This legal document helps protect the rights and interests of both the borrower and the lender, ensuring clarity and enforceability of the loan agreement. In Baton Rouge, Louisiana, there are different types of Promissory Notes, each serving specific purposes: 1. Secured Promissory Note: This type of note is backed by collateral such as real estate or personal assets. In case of default, the lender has the right to seize the collateral to fulfill the repayment obligation. 2. Unsecured Promissory Note: Unlike a secured note, an unsecured Promissory Note does not require collateral. The borrower's creditworthiness is primarily relied upon, making it crucial for borrowers to have a good credit history to obtain such loans. 3. Demand Promissory Note: With a demand note, the lender has the right to demand repayment in full at any time. This type of note provides flexibility to the lender in terms of repayment. 4. Installment Promissory Note: An installment note outlines a fixed repayment schedule, specifying the periodic payments, interest rate, and the duration over which the loan is to be repaid. This type of note suits borrowers who prefer a structured payment plan. 5. Balloon Promissory Note: A balloon note is characterized by lower monthly payments throughout the repayment term, followed by a larger final payment or "balloon payment" at the end. This type of note can be favorable for borrowers who anticipate increased income or expect to refinance before the balloon payment becomes due. Regardless of the type of Promissory Note used in Baton Rouge, Louisiana, it is crucial for both parties to carefully review and understand the terms and conditions before signing. Consulting with legal professionals or financial advisors is recommended to ensure compliance with local laws and to protect the rights and interests of all parties involved.

Baton Rouge Louisiana Promissory Note

Category:

State:

Louisiana

City:

Baton Rouge

Control #:

LA-5412

Format:

Word;

Rich Text

Instant download

Description

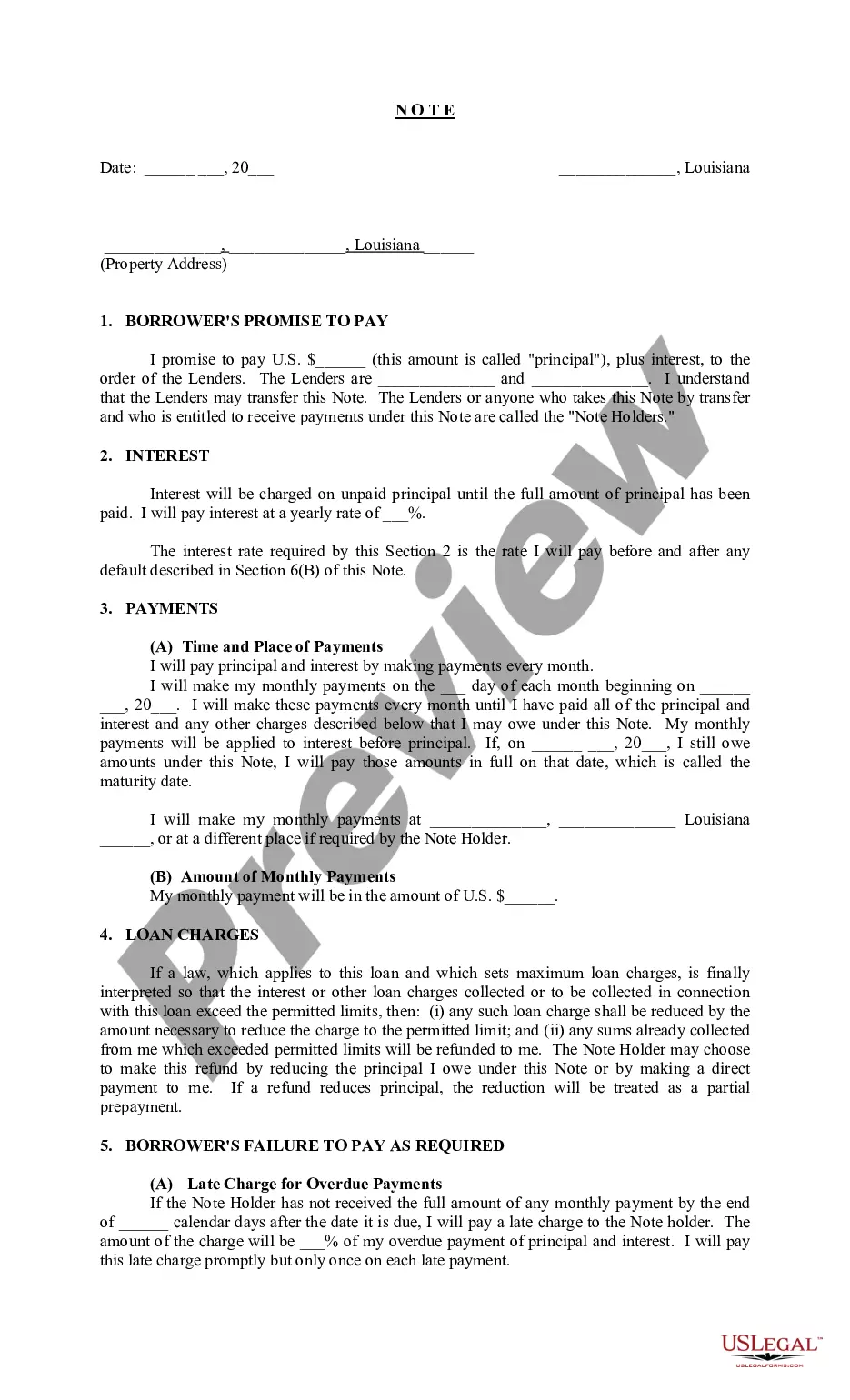

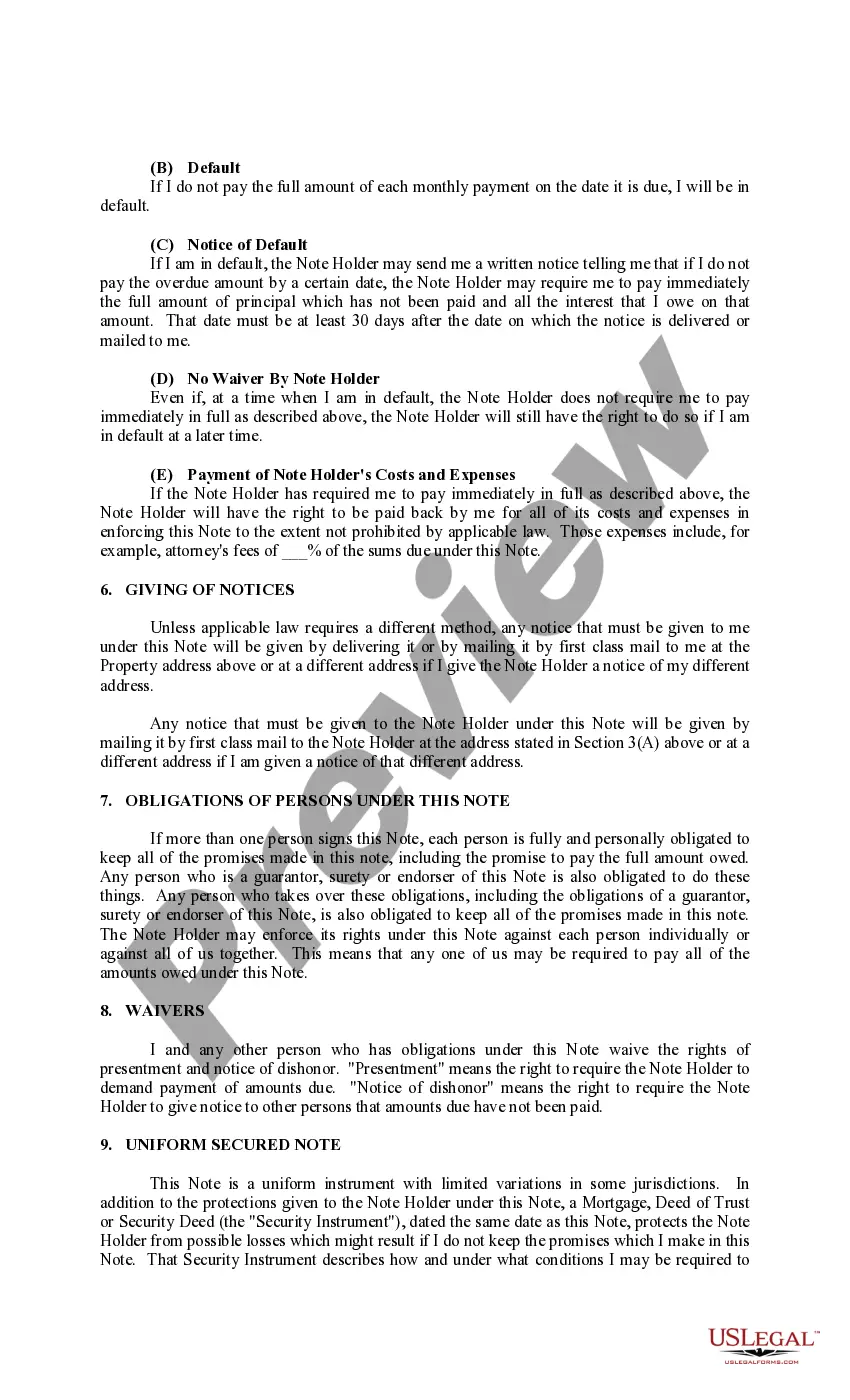

This is an example of an installment promissory note, in which the loan is repaid in fixed installments at regular intervals (for example, month, quarter, or semi-annual) as specified in the note, along with interest. This is a uniform secured note; in this case it is paraphed "ne varietur" for identification with a Credit Sale. This example is fairly detailed, addressing many provisions and conditions of the loan.

A Baton Rouge Louisiana Promissory Note is a legally binding written agreement that outlines the terms and conditions under which one party, known as the borrower, promises to repay a specific sum of money to another party, known as the lender. This document serves as evidence of a debt and includes details such as the loan amount, interest rate, repayment schedule, and any additional terms agreed upon between the parties involved. The Baton Rouge Louisiana Promissory Note is commonly used in various financial transactions, including personal loans, business loans, student loans, and real estate financing. This legal document helps protect the rights and interests of both the borrower and the lender, ensuring clarity and enforceability of the loan agreement. In Baton Rouge, Louisiana, there are different types of Promissory Notes, each serving specific purposes: 1. Secured Promissory Note: This type of note is backed by collateral such as real estate or personal assets. In case of default, the lender has the right to seize the collateral to fulfill the repayment obligation. 2. Unsecured Promissory Note: Unlike a secured note, an unsecured Promissory Note does not require collateral. The borrower's creditworthiness is primarily relied upon, making it crucial for borrowers to have a good credit history to obtain such loans. 3. Demand Promissory Note: With a demand note, the lender has the right to demand repayment in full at any time. This type of note provides flexibility to the lender in terms of repayment. 4. Installment Promissory Note: An installment note outlines a fixed repayment schedule, specifying the periodic payments, interest rate, and the duration over which the loan is to be repaid. This type of note suits borrowers who prefer a structured payment plan. 5. Balloon Promissory Note: A balloon note is characterized by lower monthly payments throughout the repayment term, followed by a larger final payment or "balloon payment" at the end. This type of note can be favorable for borrowers who anticipate increased income or expect to refinance before the balloon payment becomes due. Regardless of the type of Promissory Note used in Baton Rouge, Louisiana, it is crucial for both parties to carefully review and understand the terms and conditions before signing. Consulting with legal professionals or financial advisors is recommended to ensure compliance with local laws and to protect the rights and interests of all parties involved.

Free preview

How to fill out Baton Rouge Louisiana Promissory Note?

If you’ve already used our service before, log in to your account and save the Baton Rouge Louisiana Promissory Note on your device by clicking the Download button. Make sure your subscription is valid. Otherwise, renew it according to your payment plan.

If this is your first experience with our service, adhere to these simple steps to get your document:

- Make sure you’ve located an appropriate document. Read the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t fit you, use the Search tab above to find the appropriate one.

- Buy the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Register an account and make a payment. Utilize your credit card details or the PayPal option to complete the transaction.

- Get your Baton Rouge Louisiana Promissory Note. Opt for the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to every piece of paperwork you have bought: you can find it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to quickly locate and save any template for your personal or professional needs!