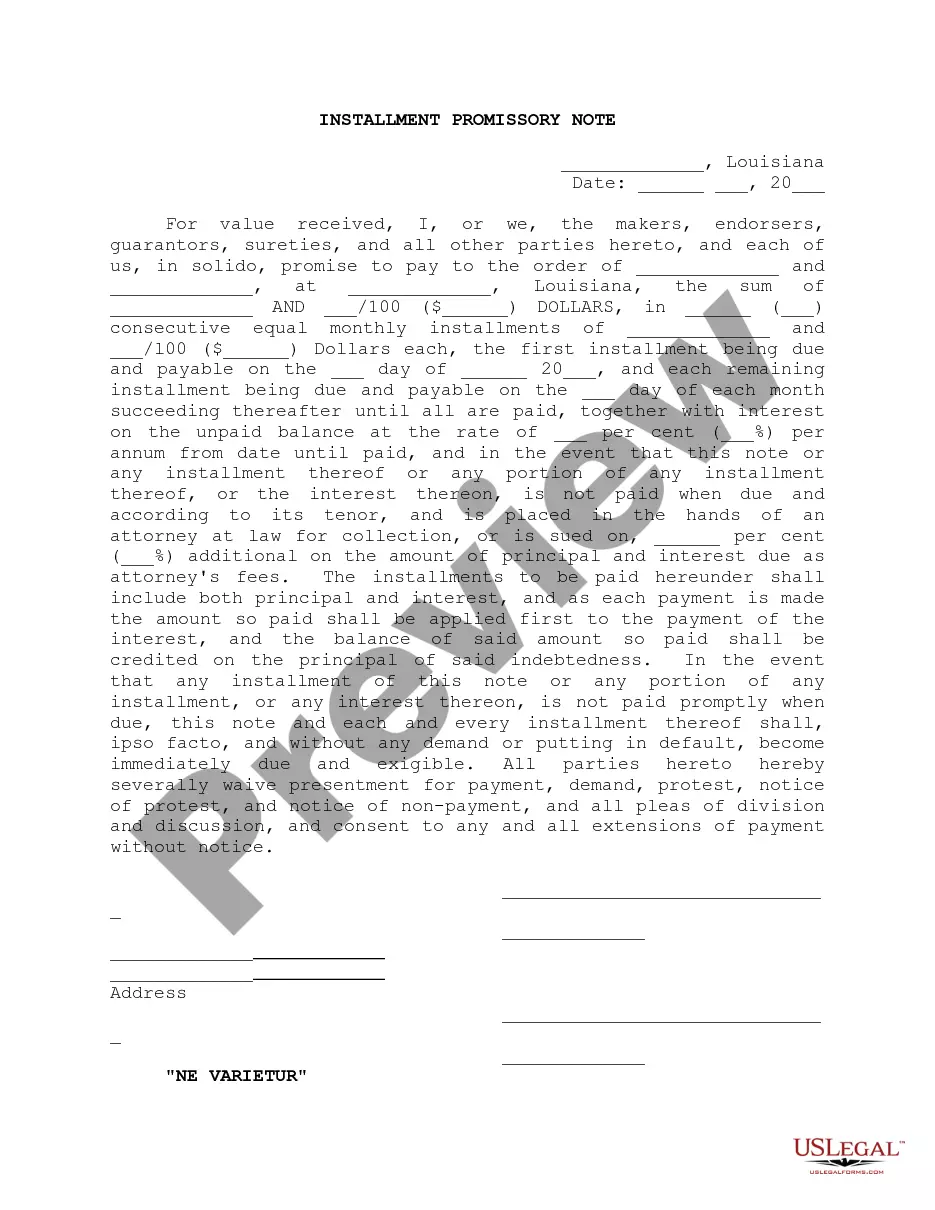

A Baton Rouge Louisiana Installment Promissory Note Ne Variety, for Identification with Act of Collateral Mortgage, is a legal document executed between a borrower and a lender in Baton Rouge, Louisiana. This document serves as evidence of a debt and establishes the terms and conditions under which the borrower agrees to repay the loan amount received from the lender. Keywords: Baton Rouge, Louisiana, Installment Promissory Note, Ne Variety, Identification, Collateral Mortgage. Types of Baton Rouge Louisiana Installment Promissory Note Ne Variety, for Identification with Act of Collateral Mortgage: 1. Residential Property Installment Promissory Note: This type of promissory note is used when the loan is secured by residential property in Baton Rouge, Louisiana. It outlines the details of the loan amount, the interest rate, the repayment terms, and the consequences of defaulting on the loan. 2. Commercial Property Installment Promissory Note: When the loan is secured by commercial property, this type of promissory note is used. It includes specific clauses relevant to commercial real estate transactions and may include provisions related to lease agreements, rent payments, and property usage. 3. Vehicle Installment Promissory Note: This type of promissory note is used when the loan is secured by a vehicle, such as a car or a boat. It includes the make, model, and identification details of the vehicle, along with clauses related to insurance, maintenance, and title transfer upon full repayment of the loan. 4. Business Installment Promissory Note: If the loan is extended to a business entity rather than an individual, this type of promissory note is utilized. It outlines the loan terms, repayment schedule, and any specific terms related to the business's operations that may affect the loan repayment, such as revenue-based payments or royalties. Regardless of the type, Baton Rouge Louisiana Installment Promissory Note Ne Variety, for Identification with Act of Collateral Mortgage always includes essential elements such as the names and addresses of both parties, the principal loan amount, the interest rate, the payment schedule, any applicable late fees or penalties, and provisions for default and remedies available to the lender in case of default. It is crucial to consult legal professionals or experts specializing in Louisiana laws to ensure compliance with specific regulations and to draft the appropriate promissory note to protect the rights and interests of both parties involved.

Baton Rouge Louisiana Installment Promissory Note Ne Varietur, for Identification with Act of Collateral Mortgage

Description

How to fill out Baton Rouge Louisiana Installment Promissory Note Ne Varietur, For Identification With Act Of Collateral Mortgage?

Do you require a trustworthy and affordable legal forms supplier to purchase the Baton Rouge Louisiana Installment Promissory Note Ne Varietur, for Identification with Act of Collateral Mortgage? US Legal Forms is your best choice.

Whether you need a simple agreement to establish rules for living together with your partner or a collection of documents to facilitate your separation or divorce through the legal system, we’ve got you covered. Our site provides over 85,000 current legal document templates for personal and business purposes. All templates we offer aren’t generic and tailored to meet the requirements of specific state and county.

To download the form, you need to Log In to your account, locate the required template, and click the Download button next to it. Please note that you can download your previously acquired document templates at any time from the My documents tab.

Is this your first visit to our website? No problem. You can create an account in a few minutes, but first, ensure that you do the following.

Now you can set up your account. Then select the subscription plan and proceed to payment. Once the payment is finalized, download the Baton Rouge Louisiana Installment Promissory Note Ne Varietur, for Identification with Act of Collateral Mortgage in any offered format. You can return to the website at any time and redownload the form free of charge.

Obtaining current legal forms has never been simpler. Give US Legal Forms a try today, and stop wasting hours searching for legal documents online.

- Verify if the Baton Rouge Louisiana Installment Promissory Note Ne Varietur, for Identification with Act of Collateral Mortgage adheres to your state and local regulations.

- Review the form’s description (if available) to determine who and what the form is suitable for.

- Start the search again if the template doesn’t fit your legal situation.

Form popularity

FAQ

In Louisiana, a promissory note must be in writing, clearly state the amount owed, and include the terms of repayment. It is also important to include signatures from both parties involved in the agreement. Utilizing platforms like uslegalforms can simplify the process, especially when preparing a Baton Rouge Louisiana Installment Promissory Note Ne Varietur, for Identification with Act of Collateral Mortgage.

A vendor's lien is a legal claim that allows a seller to secure payment for a property sold, often until the buyer pays in full. In Louisiana, this concept provides sellers with protections against unpaid purchases. If you're dealing with a Baton Rouge Louisiana Installment Promissory Note Ne Varietur, for Identification with Act of Collateral Mortgage, understanding this lien can be beneficial.

You can obtain a promissory note from various sources, including legal forms websites and financial institutions. Many platforms offer customizable templates to fit your needs. For a Baton Rouge Louisiana Installment Promissory Note Ne Varietur, for Identification with Act of Collateral Mortgage, consider using uslegalforms to streamline the process and ensure compliance with local laws.

In Louisiana, a promissory note does not always require notarization to be enforceable. However, notarization can add an extra layer of legal protection and verify identities. If you're drafting a Baton Rouge Louisiana Installment Promissory Note Ne Varietur, for Identification with Act of Collateral Mortgage, consider having it notarized to bolster its authenticity.

The 90 day rule in Louisiana refers to a statute of limitations that affects promissory notes and other written contracts. Generally, creditors have 90 days to enforce claims regarding unpaid debts. If you are dealing with a Baton Rouge Louisiana Installment Promissory Note Ne Varietur, for Identification with Act of Collateral Mortgage, understanding this rule can help you manage your financial obligations effectively.

To release a vendor's lien in Texas, you must file a Release of Lien document with the county clerk where the lien was recorded. This process typically involves providing proof that the debt has been satisfied. If you are using a Baton Rouge Louisiana Installment Promissory Note Ne Varietur, for Identification with Act of Collateral Mortgage, understanding how liens function in Texas can help maintain clear titles and ownership of property.

To establish a lien in Louisiana, specific requirements must be met, including providing detailed documentation of the debt and ensuring the filing occurs within the designated timeframe. It is crucial for creditors to follow proper procedures to enforce their rights. By understanding the role of a Baton Rouge Louisiana Installment Promissory Note Ne Varietur, for Identification with Act of Collateral Mortgage, you can navigate these requirements confidently.

A judgement lien in Louisiana allows a creditor to place a claim on a debtor's property following a court judgement. This lien ensures that the creditor can recover amounts owed if the property is sold. If your financial dealings include a Baton Rouge Louisiana Installment Promissory Note Ne Varietur, for Identification with Act of Collateral Mortgage, this lien type can impact property transfers and financing.

In Louisiana, a contractor has a specific timeframe to file a lien, typically within 12 months after completing the work or providing materials. This time limit emphasizes the importance of timely action to secure your rights. If you are dealing with a Baton Rouge Louisiana Installment Promissory Note Ne Varietur, for Identification with Act of Collateral Mortgage, understanding these timelines is vital for protecting your interests.

Yes, there is a general format for a promissory note, particularly for a Baton Rouge Louisiana Installment Promissory Note Ne Varietur, for Identification with Act of Collateral Mortgage. Typically, the document should begin with the title, followed by the date, and the names of the involved parties. Next, you include details such as the amount, interest rate, repayment terms, and any conditions for default. By following this structure, you ensure clarity and legal strength.