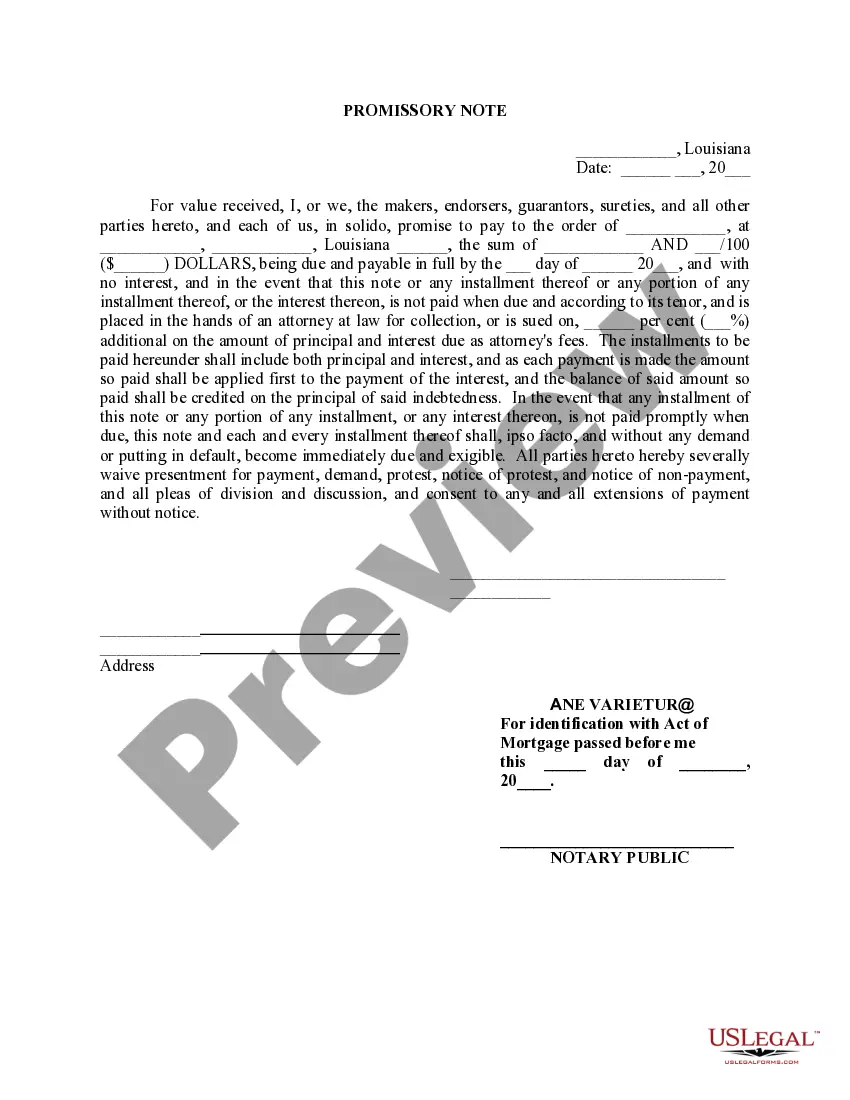

A New Orleans Louisiana promissory note Ne Variety, for Identification with Act of Collateral Mortgage is a legal document that outlines the terms and conditions of a loan agreement between a borrower and a lender in the context of a collateral mortgage. This type of promissory note is specific to the state of Louisiana and ensures that the terms of the loan cannot be altered or modified without the consent of both parties. The Ne Variety clause in the promissory note acts as a safeguard, preventing any alterations to the note before or after it is signed. This ensures that the terms and conditions agreed upon by both the borrower and the lender remain intact and cannot be modified without their mutual consent. It provides a level of certainty and legal protection for both parties involved in the transaction. There are various types of New Orleans Louisiana promissory notes Ne Variety, each tailored to specific loan agreements and circumstances. Some common variations may include: 1. Fixed-Rate Promissory Note Ne Variety: This type of promissory note establishes a fixed interest rate that remains unchanged throughout the loan term. Both the borrower and lender agree upon a specific interest rate at the time of signing the note, which will apply until the loan is repaid in full. 2. Adjustable-Rate Promissory Note Ne Variety: This promissory note includes an adjustable interest rate, which may change periodically based on specific factors such as market conditions or an underlying index. The terms of the note will outline how and when the interest rate adjustments occur. 3. Balloon Payment Promissory Note Ne Variety: A balloon payment promissory note involves regular payments for a specified period, followed by a lump-sum payment, known as the balloon payment. This type of note is commonly used when the borrower intends to sell the collateral property or refinance the loan before the balloon payment becomes due. 4. Secured Promissory Note Ne Variety: This variation of the promissory note includes the pledge of collateral, typically in the form of real estate or personal property. In the event of default, the lender can seize the collateral to satisfy the outstanding debt. It is essential to consult with a legal expert or an attorney familiar with New Orleans and Louisiana state laws to ensure that the specific requirements and regulations are met when drafting and executing a promissory note Ne Variety with Act of Collateral Mortgage in New Orleans, Louisiana. This will help protect the rights and interests of all parties involved in the loan agreement.

New Orleans Louisiana Promissory Note Ne Varietur, for Identification with Act of Collateral Mortgage

Description

How to fill out New Orleans Louisiana Promissory Note Ne Varietur, For Identification With Act Of Collateral Mortgage?

We consistently endeavor to minimize or avert legal complications when engaging with intricate law-related or financial matters.

To achieve this, we seek out lawyer services which are typically very costly.

Nevertheless, not all legal challenges are similarly intricate.

Many of them can be managed by ourselves.

Utilize US Legal Forms whenever you need to locate and retrieve the New Orleans Louisiana Promissory Note Ne Varietur, for Identification with Act of Collateral Mortgage or any other document promptly and securely.

- US Legal Forms is an online repository of current self-service legal documents encompassing everything from wills and powers of attorney to articles of incorporation and petitions for dissolution.

- Our platform empowers you to manage your matters without consulting a lawyer.

- We offer access to legal form samples that are not always readily available to the public.

- Our samples are tailored for specific states and regions, which greatly simplifies the search process.

Form popularity

FAQ

A multiple indebtedness mortgage in Louisiana allows a borrower to consolidate several debts under a single mortgage. This type of mortgage serves as a security for various loans, making repayment more manageable. By organizing your finances in this way, you can utilize a New Orleans Louisiana Promissory Note Ne Varietur, for Identification with Act of Collateral Mortgage, to streamline your obligations. US Legal Forms offers resources to help you understand and implement this option efficiently.

In Louisiana, a promissory note must include essential elements such as the principal amount, interest rate, maturity date, and signatures of the parties involved. Additionally, it's important to note that the form and content should be clear and concise to meet legal standards. Utilizing a resource like uslegalforms can help you craft a precise New Orleans Louisiana Promissory Note Ne Varietur, for Identification with Act of Collateral Mortgage.

The conditions for a promissory note typically include a clear statement of the amount owed, repayment terms, and the interest rate. The borrower must also agree to the terms, making the note legally binding. When dealing with a New Orleans Louisiana Promissory Note Ne Varietur, for Identification with Act of Collateral Mortgage, ensure that these conditions are explicitly documented to avoid disputes.

In Louisiana, it is advisable for promissory notes to be notarized to enhance their legal standing. A notary public can verify the identity of the individuals involved and ensure that all parties willingly sign the document. This process adds an extra layer of authenticity to the instrument, especially for a New Orleans Louisiana Promissory Note Ne Varietur, for Identification with Act of Collateral Mortgage.

Reporting a promissory note on your taxes is essential for compliance. When dealing with the New Orleans Louisiana Promissory Note Ne Varietur, for Identification with Act of Collateral Mortgage, you should report any interest earned on the note as part of your taxable income. Additionally, if you sold the note, you might need to report capital gains. It’s advisable to consult a tax professional to ensure you meet all reporting requirements accurately.

The document that creates a lien and acts as security for a promissory note is typically called a mortgage agreement or deed of trust. In the case of the New Orleans Louisiana Promissory Note Ne Varietur, for Identification with Act of Collateral Mortgage, this document legally secures the lender's interest in the property linked to the note. It’s essential to ensure that this document is properly recorded with local authorities to establish the lien's priority.

Claiming a promissory note involves several key steps. First, you must verify that you are the rightful owner of the New Orleans Louisiana Promissory Note Ne Varietur, for Identification with Act of Collateral Mortgage. You will need to present the original note and fulfill any conditions outlined within it to claim the owed amount, ensuring that all information is correctly recorded and submitted according to local regulations.

While it is not mandatory to hire a lawyer to write a promissory note, especially one aligned with the New Orleans Louisiana Promissory Note Ne Varietur, for Identification with Act of Collateral Mortgage, consulting a legal professional can offer valuable insights. A lawyer can ensure the document meets all legal requirements and correctly reflects the terms of the agreement. This can help avoid complications down the line.

To claim a promissory note in relation to the New Orleans Louisiana Promissory Note Ne Varietur, for Identification with Act of Collateral Mortgage, you need to first gather all relevant documents. This includes the original note and any accompanying collateral agreements. Present these documents to the lender or relevant financial institution, and ensure you follow their specific claiming procedures to facilitate a smooth process.

A collateral mortgage note is a legal document that outlines the terms of the collateral mortgage agreement. It specifies the borrower's obligations and the lender's rights, especially regarding the property used as collateral. When drafting a New Orleans Louisiana Promissory Note Ne Varietur, for Identification with Act of Collateral Mortgage, make sure this note clearly states all terms to avoid potential conflicts later.