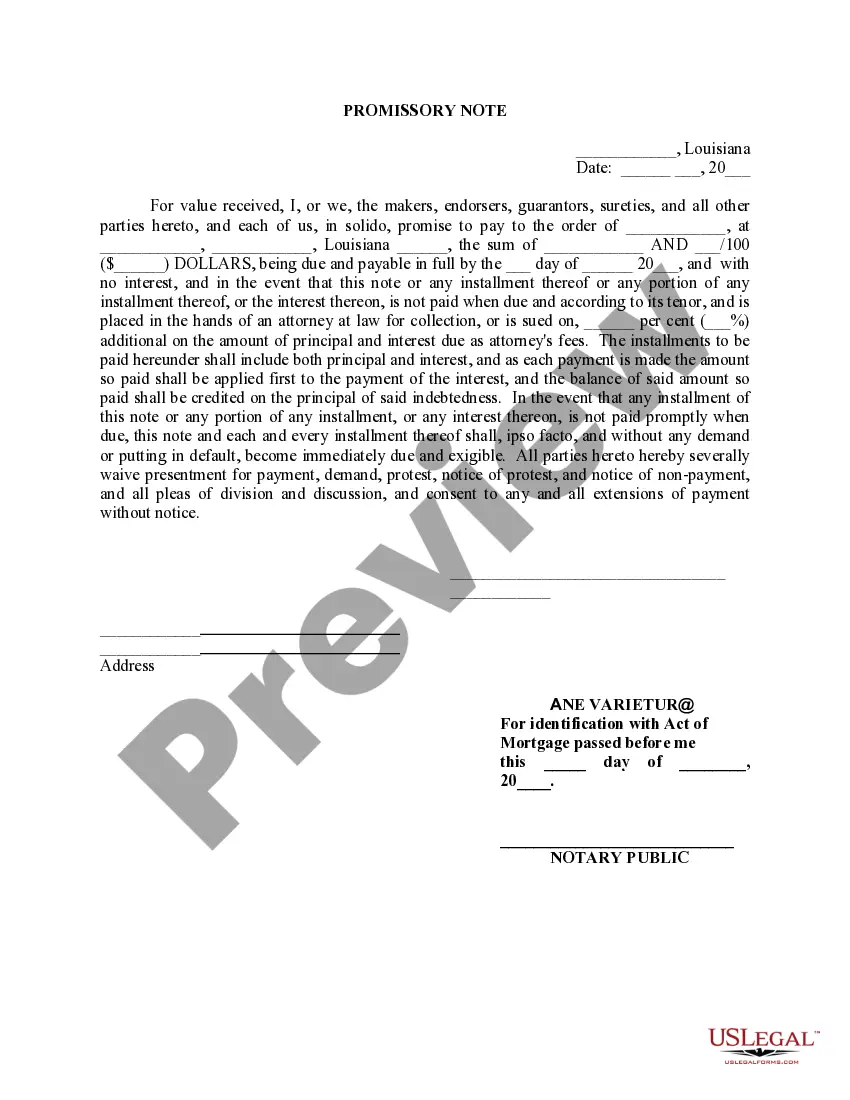

Shreveport Louisiana Promissory Note Ne Variety, for Identification with Act of Collateral Mortgage is a legally binding document that outlines the terms and conditions of a loan agreement between a lender and a borrower in Shreveport, Louisiana. This type of promissory note is used specifically in the context of collateral mortgages, which are mortgages secured by a borrower's property or assets. In Shreveport, Louisiana, there are several types of promissory notes commonly used in conjunction with collateral mortgages. These include: 1. Fixed-Rate Promissory Note: This type of promissory note specifies a fixed interest rate that remains constant throughout the loan term. Borrowers in Shreveport can opt for a fixed-rate promissory note to secure predictable monthly payments. 2. Adjustable-Rate Promissory Note: Unlike a fixed-rate promissory note, an adjustable-rate promissory note in Shreveport features an interest rate that fluctuates periodically based on changes in the market. This type of note allows for potential fluctuations in interest rates, which can result in varying monthly payments over time. 3. Balloon Payment Promissory Note: This promissory note in Shreveport involves regular payments over a set period, typically with a lower monthly payment amount. However, at the end of the loan term, a large lump sum, known as a balloon payment, must be paid in full. This type of note is often utilized for short-term financing or when the borrower expects to have a significant sum available at the end of the term. Shreveport Louisiana Promissory Note Ne Variety, for Identification with Act of Collateral Mortgage serves as a legal guarantee for the lender that the borrower will repay the loan according to the agreed-upon terms. The note typically includes details such as the principal amount borrowed, the interest rate, the repayment schedule, any penalties for late payments or default, and the consequences of failure to adhere to the terms. The "Ne Variety" clause in this promissory note ensures that any alterations or amendments made to the note require the signatures of all parties involved. This clause aims to protect the original agreement from potential fraudulent changes, emphasizing the importance of maintaining the integrity and accuracy of the document. In conjunction with the promissory note, the Act of Collateral Mortgage serves as additional security for the lender. This document grants the lender the right to foreclose on the borrower's property or assets in the event of default or failure to repay the loan. The Act of Collateral Mortgage is recorded in the public records, providing notice to other potential creditors or interested parties of the lender's lien against the collateral. In summary, the Shreveport Louisiana Promissory Note Ne Variety, for Identification with Act of Collateral Mortgage encompasses various types of promissory notes used in conjunction with collateral mortgages. It provides a comprehensive framework for loan agreements in Shreveport, ensuring transparency, security, and legal enforceability for both parties involved.

Shreveport Louisiana Promissory Note Ne Varietur, for Identification with Act of Collateral Mortgage

Description

How to fill out Shreveport Louisiana Promissory Note Ne Varietur, For Identification With Act Of Collateral Mortgage?

If you are looking for an applicable form template, it’s incredibly challenging to locate a more user-friendly service than the US Legal Forms website – arguably the most extensive libraries on the web.

With this collection, you can access numerous templates for business and personal purposes by categories and states, or keywords.

With our sophisticated search feature, locating the latest Shreveport Louisiana Promissory Note Ne Varietur, for Identification with Act of Collateral Mortgage is as simple as 1-2-3.

Obtain the template. Specify the file format and download it to your computer.

Make alterations. Complete, amend, print, and sign the acquired Shreveport Louisiana Promissory Note Ne Varietur, for Identification with Act of Collateral Mortgage. Every template you add to your account has no expiration and belongs to you indefinitely. You can conveniently access them via the My documents menu, so if you need an additional copy for review or printing, feel free to return and download it again at any time.

- If you already understand our system and possess a registered account, all you need to do to acquire the Shreveport Louisiana Promissory Note Ne Varietur, for Identification with Act of Collateral Mortgage is to sign in to your account and click the Download option.

- If you are utilizing US Legal Forms for the first time, simply follow the steps below.

- Ensure you have accessed the form you need. Review its description and use the Preview feature to view its contents. If it doesn’t satisfy your requirements, use the Search option at the top of the page to find the correct document.

- Confirm your selection. Click the Buy now option. Then, select your desired pricing plan and provide information to create an account.

- Complete the transaction. Use your credit card or PayPal account to finish the registration process.

Form popularity

FAQ

In every Shreveport Louisiana Promissory Note Ne Varietur, for Identification with Act of Collateral Mortgage, essential elements are crucial for its validity. This includes the names and addresses of both the lender and the borrower, the borrowing amount, and any applicable interest rates. You must also specify the repayment schedule and a clear statement regarding late fees or default. Lastly, signatures of both parties validate the agreement, ensuring its legality.

While collateral mortgages provide benefits, they also have disadvantages worth considering. One major drawback is that if a borrower defaults, they risk losing their property, which can lead to foreclosure. Additionally, collateral mortgages may involve complicated terms that can lead to confusion. Familiarizing yourself with a Shreveport Louisiana Promissory Note Ne Varietur, for Identification with Act of Collateral Mortgage can help clarify these risks and ensure that borrowers make well-informed decisions when entering such agreements.

The main distinction between a Home Equity Line of Credit (HELOC) and a collateral mortgage is how they utilize home equity. A HELOC provides a line of credit based on available equity, enabling borrowers to withdraw funds as needed. In contrast, a collateral mortgage secures one or more loans against property but involves more rigid repayment schedules. For effective navigation of financial decisions, understanding a Shreveport Louisiana Promissory Note Ne Varietur, for Identification with Act of Collateral Mortgage can equip borrowers with the knowledge to choose the right option.

A collateral source in Louisiana refers to resources that provide benefits or support outside the main compensation system. This term often appears in legal contexts where additional financial aids, such as insurance proceeds, may affect damage claims. Recognizing the role of a collateral source is crucial, especially when drafting a Shreveport Louisiana Promissory Note Ne Varietur, for Identification with Act of Collateral Mortgage. Thus, understanding how these sources interact can help in structuring effective agreements.

In Louisiana, a handwritten will, also known as a holographic will, does not have to be notarized to be valid. However, it must be in the handwriting of the testator and include their signature for it to hold up in court. If you are drafting a Shreveport Louisiana Promissory Note Ne Varietur, for Identification with Act of Collateral Mortgage, ensuring clarity and legality in all written documents is crucial, just as it is with wills.

The term ne Varietur is used in legal contexts to signify that a document should not be altered or changed from its original form. This phrase emphasizes the importance of maintaining the integrity of the document. In the context of a Shreveport Louisiana Promissory Note Ne Varietur, for Identification with Act of Collateral Mortgage, it underscores the requirement that the terms of the note remain unchanged to ensure validity.

For a promissory note to be valid, it must include essential elements such as the amount owed, the repayment terms, and the signatures of both parties involved. Clarity is key, as ambiguity can lead to misunderstandings and legal issues. When preparing a Shreveport Louisiana Promissory Note Ne Varietur, for Identification with Act of Collateral Mortgage, ensuring these elements are present is vital for enforceability.

No, a promissory note does not necessarily need to be notarized in Louisiana to be enforceable. However, notarization can provide an additional layer of authenticity and may simplify the process should legal actions arise. When dealing with a Shreveport Louisiana Promissory Note Ne Varietur, for Identification with Act of Collateral Mortgage, having notarization may help reinforce its validity.

In Louisiana, the statute of limitations for a promissory note is generally ten years. This means that if a creditor wants to enforce the note, they must do so within this timeframe. It is important to monitor the date of the promissory note, especially in the context of a Shreveport Louisiana Promissory Note Ne Varietur, for Identification with Act of Collateral Mortgage, to ensure compliance and protect your rights.