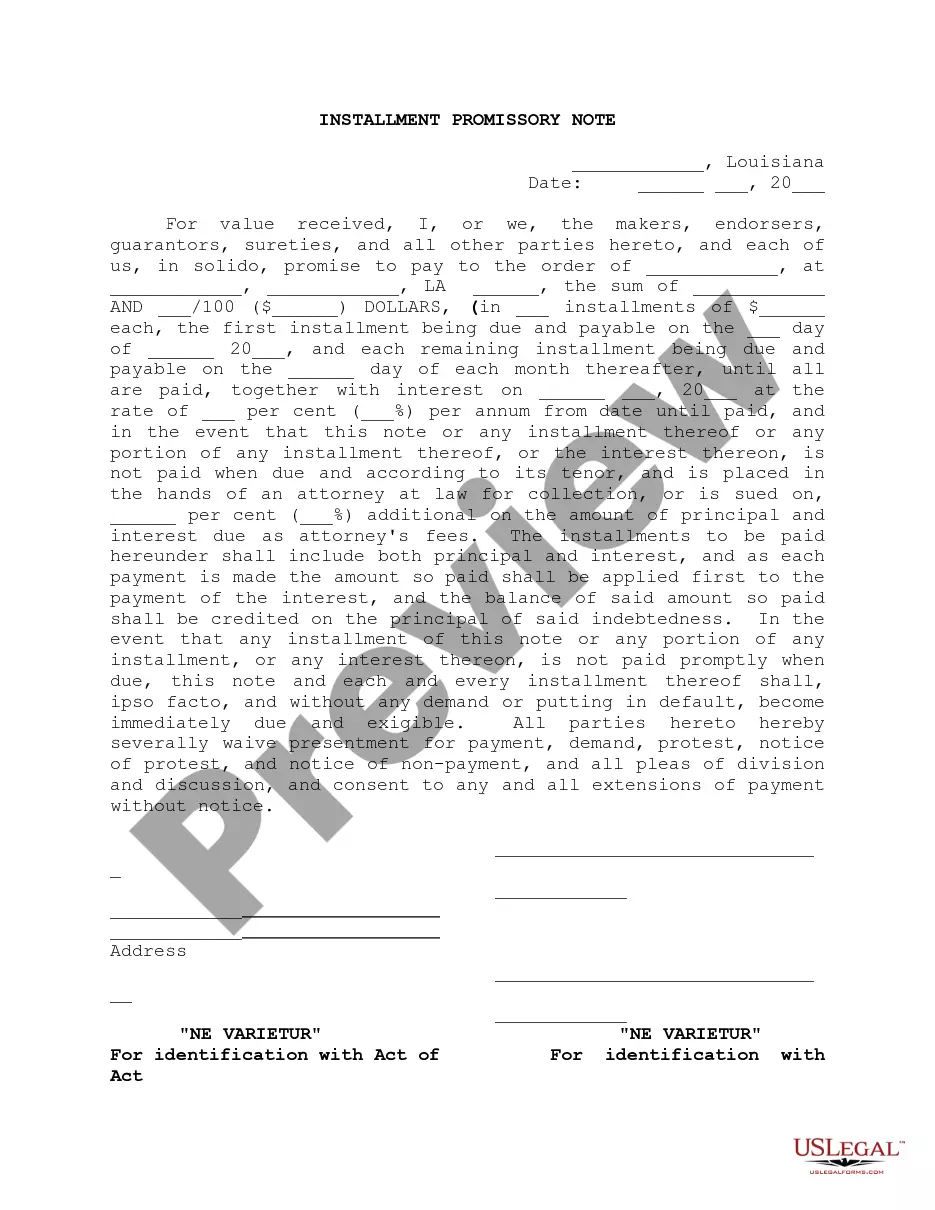

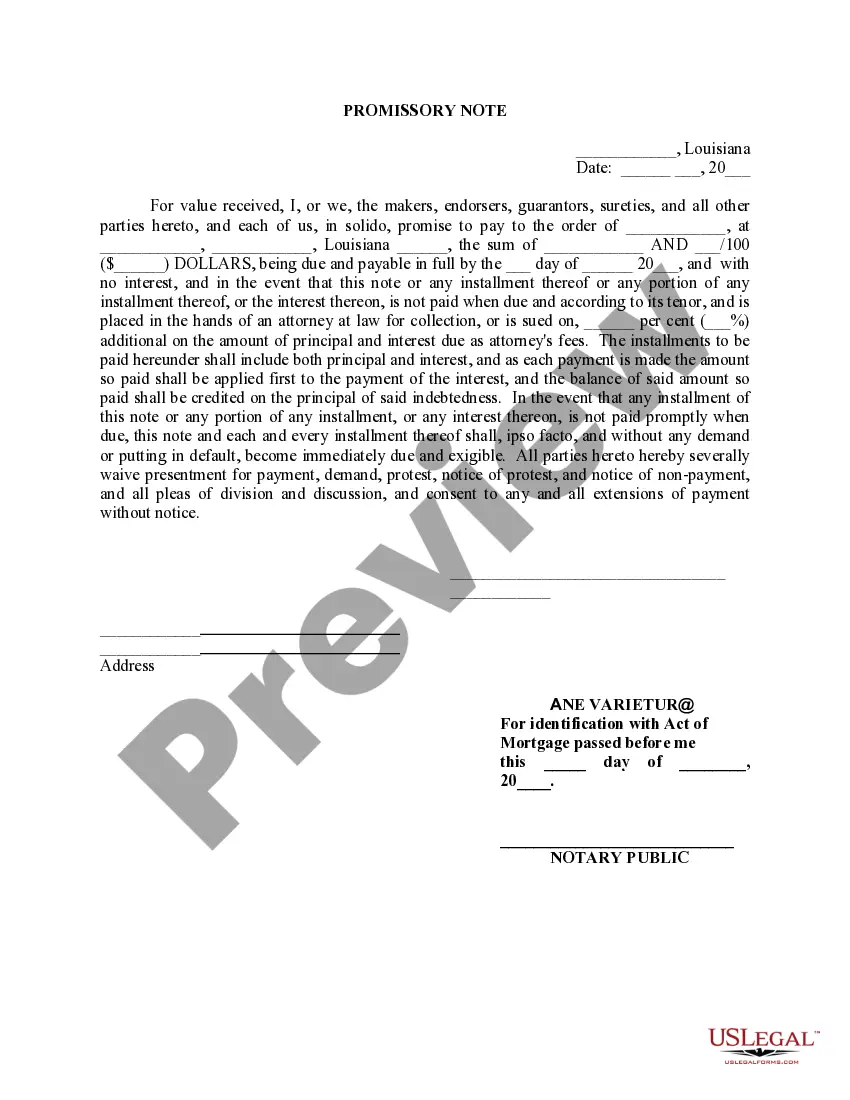

A Baton Rouge Louisiana Installment Promissory Note Ne Variety is a legal document that outlines the terms and conditions of a loan agreement between a borrower and a lender in Baton Rouge, Louisiana. This type of promissory note ensures that the terms of the loan cannot be altered or modified without the consent of both parties involved. The Baton Rouge Louisiana Installment Promissory Note Ne Variety is primarily used in conjunction with two other key legal documents, namely the Act of Collateral Mortgage and the Act of Subordination, to provide additional security and protection for both the borrower and the lender. The Act of Collateral Mortgage is a legal instrument that grants the lender a security interest in collateral, typically in the form of a property or asset owned by the borrower. This collateral serves as a form of insurance for the lender in case the borrower defaults on the loan. By signing this act, the borrower acknowledges that their property can be seized and sold to repay the outstanding debt in the event of default. The Act of Subordination, on the other hand, refers to a legal agreement where one creditor agrees to subordinate their claim on a borrower's asset to another creditor. In the context of a Baton Rouge Louisiana Installment Promissory Note Ne Variety, this act typically involves a lender who holds a higher-ranking security interest, such as a first mortgage, agreeing to allow another lender, typically a second mortgage holder, to have priority over their claim on the collateral property. Different types of Baton Rouge Louisiana Installment Promissory Note Ne Variety may exist depending on the specific circumstances and terms of the loan agreement. These variations could include adjustable interest rates, fixed interest rates, balloon payments, or interest-only payments. It is important for both the borrower and the lender to understand the implications and legalities associated with a Baton Rouge Louisiana Installment Promissory Note Ne Variety, as well as the Acts of Collateral Mortgage and Subordination. Seeking professional legal advice when drafting or entering into such agreements is highly advisable to ensure compliance with state and federal laws and to protect the rights and interests of all parties involved.

Baton Rouge Louisiana Installment Promissory Note Ne Varietur, for Identification with Act of Collateral Mortgage and with Act of Subordination

Description

How to fill out Louisiana Installment Promissory Note Ne Varietur, For Identification With Act Of Collateral Mortgage And With Act Of Subordination?

Acquiring validated templates tailored to your local regulations can be difficult unless you utilize the US Legal Forms library.

It’s an online database of over 85,000 legal documents for both personal and business purposes as well as various real-life circumstances.

All the paperwork is appropriately categorized by usage area and jurisdiction, making it as straightforward as 1-2-3 to find the Baton Rouge Louisiana Installment Promissory Note Ne Varietur, for Identification with Act of Collateral Mortgage and with Act of Subordination.

Maintaining paperwork organized and within legal requirements is of utmost significance. Take advantage of the US Legal Forms library to always have vital document templates for any requirements at your fingertips!

- For those already acquainted with our catalog and have utilized it previously, acquiring the Baton Rouge Louisiana Installment Promissory Note Ne Varietur, for Identification with Act of Collateral Mortgage and with Act of Subordination requires just a few clicks.

- Simply sign in to your account, select the document, and click Download to store it on your device.

- This process will take only a few additional steps for new users.

- Follow the steps outlined below to initiate the most comprehensive online form collection.

- Examine the Preview mode and form description. Ensure you’ve chosen the right one that aligns with your needs and fully meets your local jurisdiction regulations.

Form popularity

FAQ

In Louisiana, a promissory note does not always need to be notarized, although notarization can provide added legal protection. When creating a Baton Rouge Louisiana Installment Promissory Note Ne Varietur, it may be beneficial to have the document notarized to reinforce its validity. You may want to consult legal resources available through uslegalforms to navigate this process effectively.

The 90-day rule in Louisiana refers to a provision in state law that relates to the enforcement of certain financial rights, especially regarding promissory notes and mortgages. In the context of a Baton Rouge Louisiana Installment Promissory Note Ne Varietur, this rule can impact timing for enforcing payment or reclaiming collateral. It is crucial to understand this rule to protect your interests when entering into any financial agreement.

An example of a promissory note could be a document stating that John agrees to repay $10,000 to Sarah within five years, with a 5% interest rate. The note would specify monthly installments, detailing payment methods and consequences for non-payment. Such an example aligns with the Baton Rouge Louisiana Installment Promissory Note Ne Varietur, for Identification with Act of Collateral Mortgage and with Act of Subordination, keeping legal and financial terms clear.

A promissory note generally includes the title at the top, followed by the date, the parties involved, and the amount borrowed. Next, it should outline the payment schedule and any penalties for late payments. Adhering to the format recommended for a Baton Rouge Louisiana Installment Promissory Note Ne Varietur, for Identification with Act of Collateral Mortgage and with Act of Subordination will help ensure clarity and compliance.

In Louisiana, a promissory note must clearly state the principal amount, the repayment terms, and the interest rate. The note should also identify the borrower and lender, with their signatures providing legal validity. For a Baton Rouge Louisiana Installment Promissory Note Ne Varietur, for Identification with Act of Collateral Mortgage and with Act of Subordination, additional details about collateral may be necessary.

Yes, you can create your own promissory note, but it’s essential to include all legal requirements to ensure its validity. In Baton Rouge Louisiana, leveraging an Installment Promissory Note Ne Varietur, for Identification with Act of Collateral Mortgage and with Act of Subordination ensures compliance with local laws and protects your interests. Using templates from uslegalforms simplifies the process and helps avoid potential pitfalls.

While promissory notes can be useful, there are some disadvantages to consider. For instance, if the borrower defaults, recovering the funds can be challenging without collateral. This is where an Installment Promissory Note Ne Varietur, for Identification with Act of Collateral Mortgage and with Act of Subordination becomes crucial, as it provides legal support and security for the lender.