Shreveport Louisiana Sale and Mortgage: Explained When it comes to the real estate market in Shreveport, Louisiana, the terms "sale" and "mortgage" play crucial roles in the process of buying and financing properties. Whether you are a first-time homebuyer or a seasoned real estate investor, understanding the dynamics of Shreveport Louisiana Sale and Mortgage is essential. 1. Shreveport Louisiana Sale: In the real estate context, a sale refers to the act of transferring ownership of a property from the seller to the buyer. Numerous types of sale transactions take place in Shreveport, Louisiana, catering to various needs and preferences. Here are a few key sale types: a. Residential Sales: This category includes the buying and selling of single-family homes, townhouses, condominium units, and other residential properties in Shreveport. Residential sales offer opportunities for individuals and families looking to establish their homes or expand their real estate portfolios. b. Commercial Sales: In Shreveport's thriving business landscape, commercial sales involve the buying and selling of properties used for business purposes. These include office buildings, retail spaces, industrial facilities, and more. Entrepreneurs and investors can explore opportunities to set up or expand their commercial ventures. c. Land Sales: Shreveport is known for its vast open spaces, and land sales play a vital role in catering to individuals or corporations seeking land for agricultural, recreational, or development purposes. These transactions involve parcels of land with various zoning classifications, catering to different land-use requirements. 2. Shreveport Louisiana Mortgage: In Shreveport, Louisiana, mortgage processes help individuals and businesses access the necessary financing to purchase properties. Here are a few notable types of mortgages encountered in the area: a. Conventional Mortgages: Conventional mortgages are the most common type, primarily offered by banks, credit unions, and other financial institutions. They typically require a down payment and assess borrower eligibility based on credit scores, income, and debt-to-income ratios. b. FHA Loans: The Federal Housing Administration (FHA) offers mortgage insurance programs that are especially popular among first-time homebuyers. FHA loans often have more flexible qualification requirements and lower down payment options. c. VA Loans: Available exclusively to veterans, active-duty service members, and surviving spouses, VA loans provide excellent benefits, including competitive interest rates, zero or low down payment requirements, and no private mortgage insurance (PMI). d. USDA Loans: These mortgage options cater to buyers looking to finance rural properties. Offered through the United States Department of Agriculture (USDA), these loans provide low-interest options with no down payment requirement. In Shreveport, Louisiana, understanding the diverse sale and mortgage options is crucial for anyone interested in the real estate market. Whether looking to buy a home, expand a business, or invest in land, familiarizing yourself with these relevant keywords will help guide you through the process with confidence.

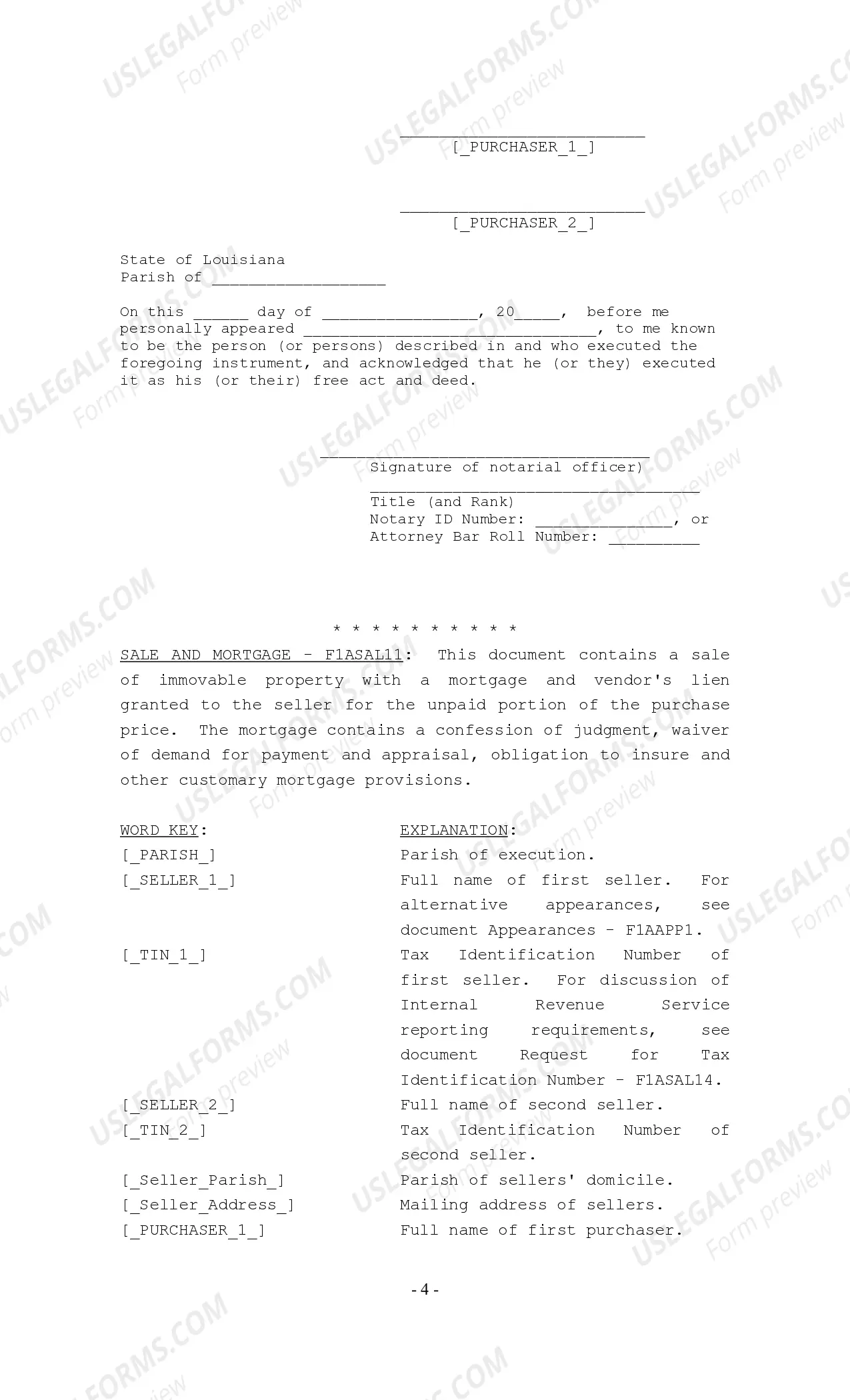

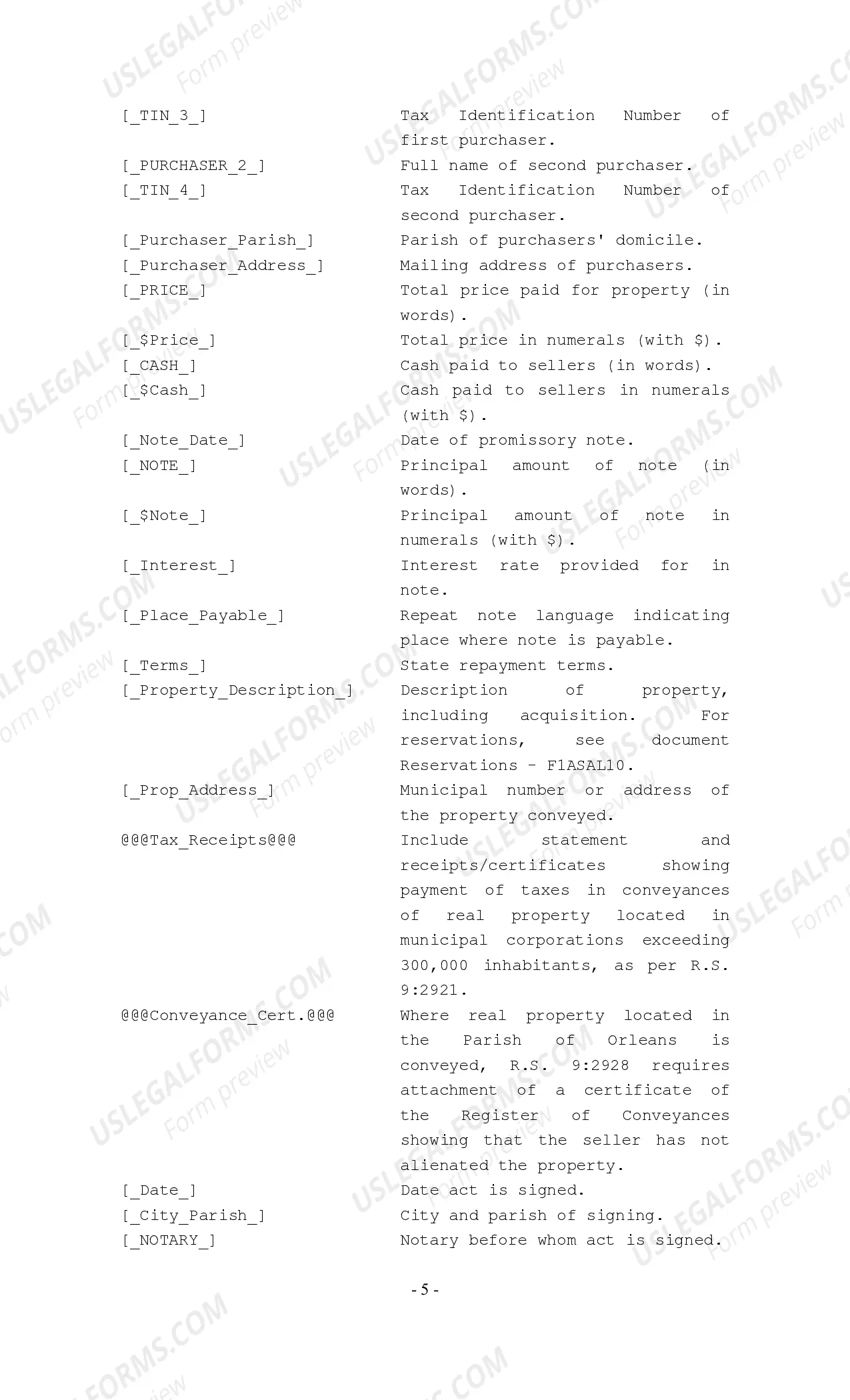

Shreveport Louisiana Sale and Mortgage

Description

How to fill out Shreveport Louisiana Sale And Mortgage?

No matter the social or professional status, completing law-related documents is an unfortunate necessity in today’s world. Too often, it’s almost impossible for a person without any legal background to create this sort of paperwork cfrom the ground up, mostly because of the convoluted terminology and legal subtleties they involve. This is where US Legal Forms comes in handy. Our service offers a huge library with more than 85,000 ready-to-use state-specific documents that work for almost any legal scenario. US Legal Forms also serves as a great resource for associates or legal counsels who want to to be more efficient time-wise utilizing our DYI tpapers.

No matter if you need the Shreveport Louisiana Sale and Mortgage or any other paperwork that will be valid in your state or county, with US Legal Forms, everything is on hand. Here’s how to get the Shreveport Louisiana Sale and Mortgage in minutes employing our trusted service. If you are already an existing customer, you can go ahead and log in to your account to get the appropriate form.

Nevertheless, if you are unfamiliar with our library, ensure that you follow these steps before downloading the Shreveport Louisiana Sale and Mortgage:

- Ensure the form you have found is suitable for your area considering that the regulations of one state or county do not work for another state or county.

- Preview the document and go through a short outline (if provided) of scenarios the paper can be used for.

- If the form you chosen doesn’t meet your requirements, you can start over and search for the suitable form.

- Click Buy now and choose the subscription option you prefer the best.

- Access an account {using your credentials or create one from scratch.

- Select the payment method and proceed to download the Shreveport Louisiana Sale and Mortgage as soon as the payment is done.

You’re good to go! Now you can go ahead and print out the document or fill it out online. In case you have any problems getting your purchased documents, you can easily access them in the My Forms tab.

Whatever situation you’re trying to sort out, US Legal Forms has got you covered. Give it a try now and see for yourself.