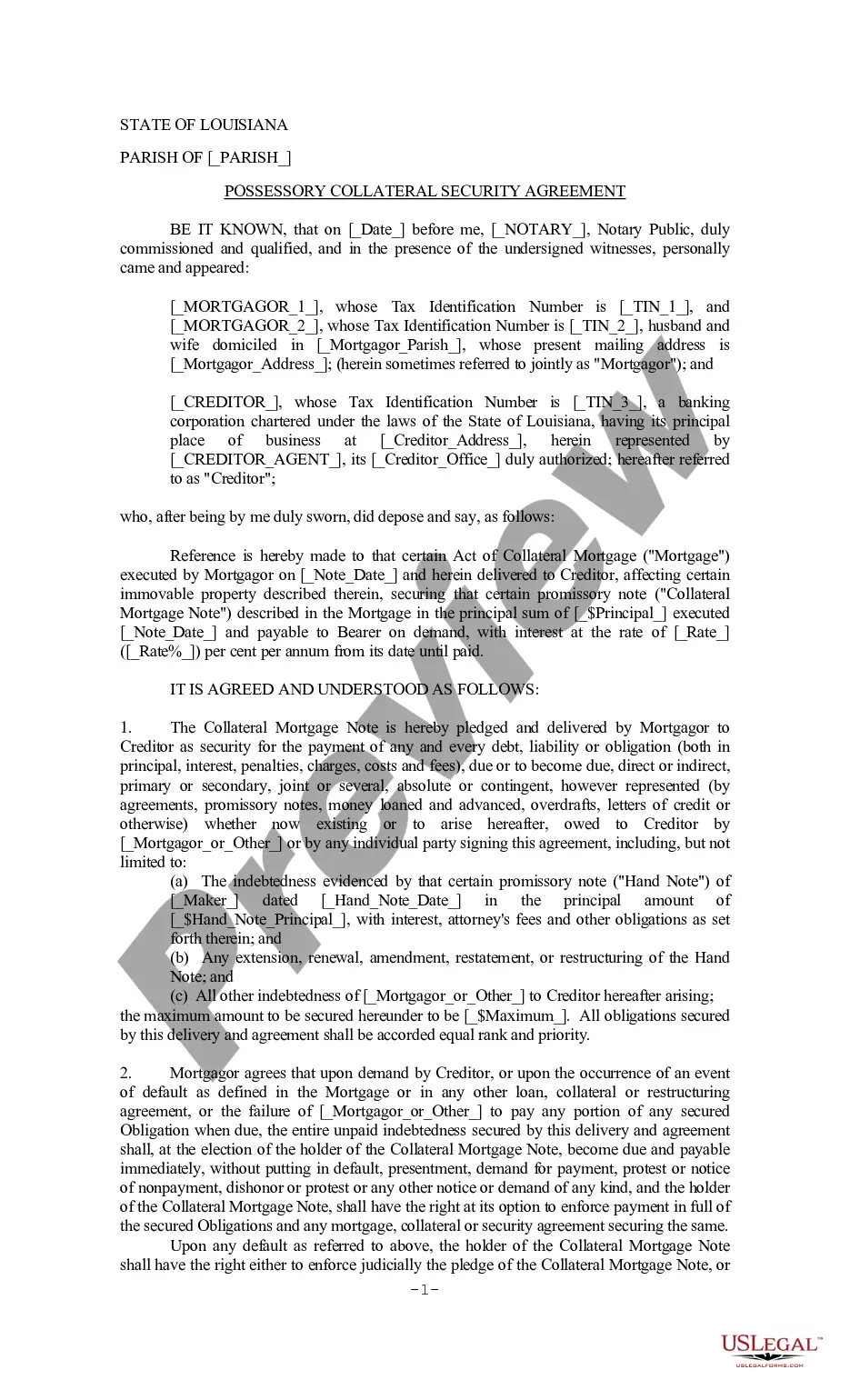

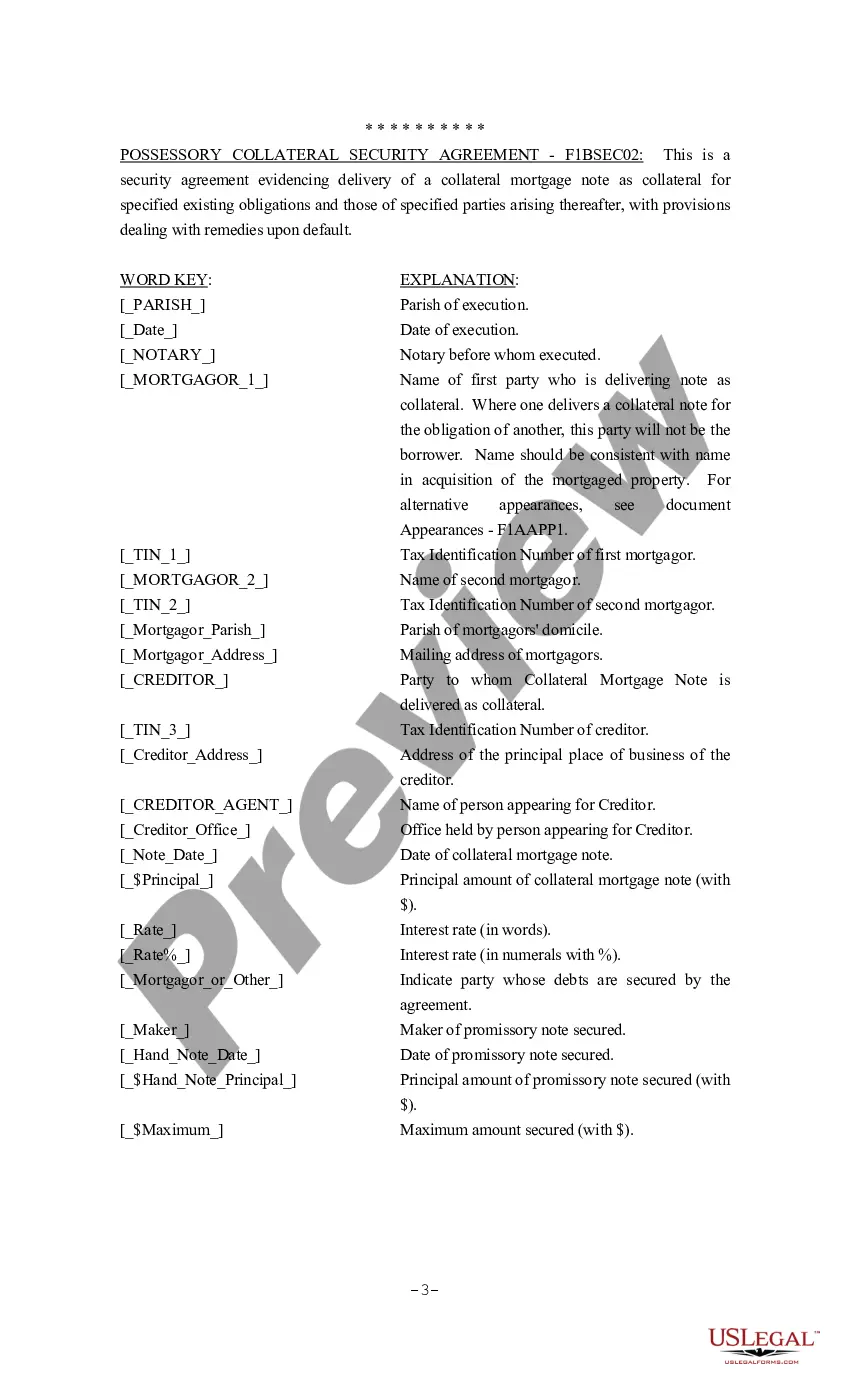

A New Orleans Louisiana Possessor Collateral Security Agreement is a legal contract that establishes a security interest in personal property to secure the performance of an obligation, such as the repayment of a loan. This type of agreement is relevant in the context of commercial lending, where a lender requires collateral to mitigate the risk associated with the loan. By entering into this agreement, the borrower grants the lender a security interest in specific assets, allowing the lender to take possession of the collateral in the event of default. There are different types of Possessor Collateral Security Agreements applicable in New Orleans, Louisiana, depending on the nature of the collateral. Some key variations include: 1. New Orleans Louisiana Possessor Collateral Security Agreement for Real Estate: This type of agreement involves the granting of a security interest in real property, such as land, buildings, or any interests therein. It enables the lender to take possession of the real estate if the borrower defaults on the loan. 2. New Orleans Louisiana Possessor Collateral Security Agreement for Vehicles: In this agreement, the collateral consists of motor vehicles, such as cars, trucks, motorcycles, or other similar assets. It provides the lender the right to take possession and sell the vehicle to recover the amount owed in case of default. 3. New Orleans Louisiana Possessor Collateral Security Agreement for Equipment: This agreement pertains to collateral that includes machinery, tools, appliances, or other equipment. Lenders often require this type of security interest to reduce the risk associated with loans provided for the acquisition or use of specific equipment. 4. New Orleans Louisiana Possessor Collateral Security Agreement for Inventory: Inventory-based collateral security agreements are relevant for businesses that rely on inventory as a financial asset. By granting a security interest in inventory, the borrower ensures that the lender can take possession of the inventory and sell it in case of non-payment or default. 5. New Orleans Louisiana Possessor Collateral Security Agreement for Accounts Receivable: This agreement focuses on collateral in the form of accounts receivable, which refers to the money owed to a business by its customers. Lenders secure their interest in these receivables, allowing them to collect the outstanding amounts directly from the customers if the borrower fails to repay the loan. The specific terms and conditions of a New Orleans Louisiana Possessor Collateral Security Agreement may vary based on the prevailing laws, the type of collateral involved, and the agreement between the lender and borrower. It is crucial for both parties to carefully negotiate and draft this agreement to ensure their rights, interests, and obligations are adequately protected.

New Orleans Louisiana Possessory Collateral Security Agreement

Description

How to fill out New Orleans Louisiana Possessory Collateral Security Agreement?

Regardless of social or professional status, filling out legal forms is an unfortunate necessity in today’s world. Very often, it’s virtually impossible for someone without any law education to draft such papers cfrom the ground up, mainly because of the convoluted terminology and legal nuances they involve. This is where US Legal Forms comes in handy. Our service provides a massive collection with more than 85,000 ready-to-use state-specific forms that work for practically any legal situation. US Legal Forms also serves as an excellent asset for associates or legal counsels who want to save time utilizing our DYI tpapers.

Whether you want the New Orleans Louisiana Possessory Collateral Security Agreement or any other document that will be valid in your state or area, with US Legal Forms, everything is at your fingertips. Here’s how to get the New Orleans Louisiana Possessory Collateral Security Agreement in minutes employing our trustworthy service. In case you are already a subscriber, you can proceed to log in to your account to download the needed form.

Nevertheless, if you are unfamiliar with our platform, make sure to follow these steps before obtaining the New Orleans Louisiana Possessory Collateral Security Agreement:

- Be sure the form you have chosen is suitable for your area considering that the regulations of one state or area do not work for another state or area.

- Review the document and read a quick outline (if provided) of scenarios the paper can be used for.

- If the form you selected doesn’t meet your needs, you can start again and search for the needed form.

- Click Buy now and choose the subscription plan that suits you the best.

- Access an account {using your credentials or create one from scratch.

- Select the payment gateway and proceed to download the New Orleans Louisiana Possessory Collateral Security Agreement once the payment is completed.

You’re all set! Now you can proceed to print out the document or fill it out online. In case you have any problems locating your purchased forms, you can easily access them in the My Forms tab.

Regardless of what case you’re trying to sort out, US Legal Forms has got you covered. Try it out now and see for yourself.