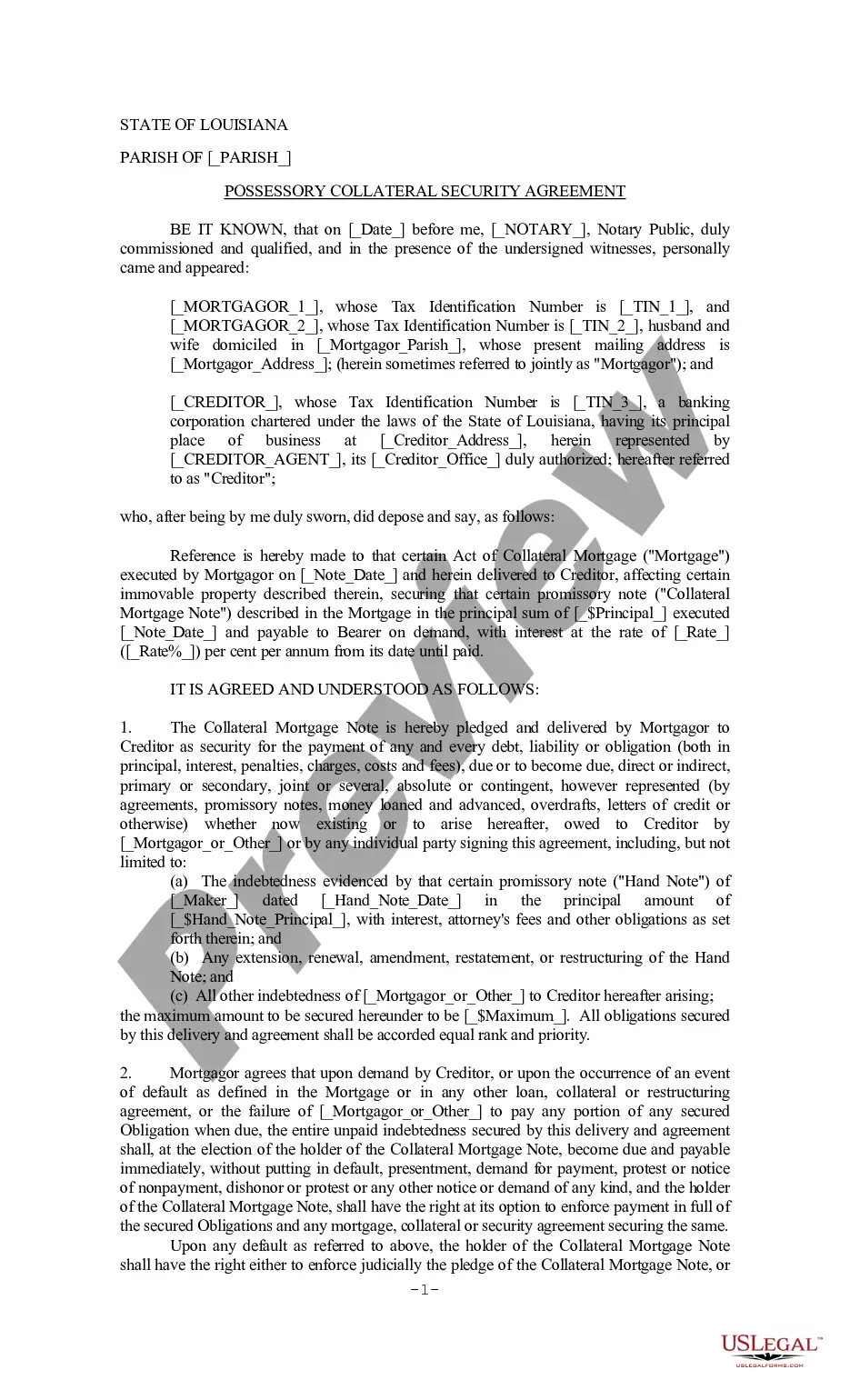

Shreveport Louisiana Possessor Collateral Security Agreement is a legal document outlining the terms and conditions for securing a loan or credit facility by pledging collateral in Shreveport, Louisiana. This agreement serves as a guarantee to the lender that the borrower will repay the debt by granting the lender rights over specific assets if the borrower fails to fulfill their obligations. Possessor collateral refers to tangible assets that can be physically possessed by the lender in case of default. Keywords associated with Shreveport Louisiana Possessor Collateral Security Agreement may include: Shreveport, Louisiana, legal document, security agreement, collateral, loan, credit facility, guarantee, lender, borrower, debt, obligations, tangible assets, possession, default. There might be different types of Shreveport Louisiana Possessor Collateral Security Agreements based on specific situations and asset types. Some common types include: 1. Equipment Possessor Collateral Security Agreement: Used when machinery, vehicles, or other equipment is pledged as collateral to secure a loan. 2. Real Estate Possessor Collateral Security Agreement: Involves the use of real property, such as land or buildings, as collateral to secure a loan. 3. Inventory Possessor Collateral Security Agreement: Applies when a business pledges its inventory, including raw materials, finished products, or goods in storage, as collateral for financing. 4. Accounts Receivable Possessor Collateral Security Agreement: This type of agreement involves the use of accounts receivable as collateral, where outstanding customer invoices are assigned to the lender for security purposes. 5. Securities Possessor Collateral Security Agreement: Used when stocks, bonds, or other investment securities are pledged as collateral, providing lenders with a claim on these financial assets in case of default. These various types of Shreveport Louisiana Possessor Collateral Security Agreements cater to different industries and asset classes, ensuring lenders have a legally binding right to possess and sell the pledged collateral in the event of loan default or non-payment.

Shreveport Louisiana Possessory Collateral Security Agreement

Description

How to fill out Shreveport Louisiana Possessory Collateral Security Agreement?

If you’ve previously utilized our service, Log In to your account and retrieve the Shreveport Louisiana Possessory Collateral Security Agreement on your device by selecting the Download button. Ensure your subscription is active. If not, extend it in accordance with your payment plan.

If this is your initial interaction with our service, follow these straightforward steps to obtain your file.

You have indefinite access to every document you have purchased: you can find it in your profile within the My documents section whenever you need to access it again. Utilize the US Legal Forms service to quickly find and save any template for your personal or business requirements!

- Confirm you have located a suitable document. Review the description and utilize the Preview option, if available, to verify if it fulfills your needs. If it doesn’t match your criteria, employ the Search tab above to find the right one.

- Purchase the template. Click the Buy Now button and select a monthly or yearly subscription plan.

- Create an account and process your payment. Use your credit card information or the PayPal option to finalize the payment.

- Receive your Shreveport Louisiana Possessory Collateral Security Agreement. Choose the file format for your document and save it to your device.

- Complete your sample. Print it out or utilize professional online editors to fill it out and sign it digitally.

Form popularity

FAQ

The primary purpose of a collateral agreement is to provide security for a lender by establishing a legal claim on an asset. This arrangement reassures lenders that they can recover losses if the borrower fails to meet their obligations. Employing a Shreveport Louisiana Possessory Collateral Security Agreement can enhance trust and facilitate smoother financial transactions by clearly defining responsibilities.

A pledge agreement involves transferring possession of an asset to secure a debt, while a security agreement creates a legal claim over the collateral without changing possession. Both types of agreements play critical roles in financial transactions. When utilizing a Shreveport Louisiana Possessory Collateral Security Agreement, understanding these differences is vital for effective asset management.

A collateral agreement with the IRS involves a taxpayer offering property as security for a tax liability. This ensures the IRS has a claim to the property until the taxpayer resolves their obligation. In the context of a Shreveport Louisiana Possessory Collateral Security Agreement, this method provides a clear structure for resolving tax debts while protecting the taxpayer's interests.

A collateral source in Louisiana refers to any secondary source of funds, such as insurance proceeds, that may cover a financial obligation. This concept can affect legal claims and settlements depending on the case. Incorporating a Shreveport Louisiana Possessory Collateral Security Agreement can enhance your financial strategy by addressing these possibilities.

A pledge agreement involves transferring possession of an asset to a lender as security for a debt. On the other hand, a collateral agreement keeps possession with the borrower while allowing the lender a claim on the asset. Knowing the distinctions is important in the context of a Shreveport Louisiana Possessory Collateral Security Agreement.

One key disadvantage is that your property may be at risk if you cannot make payments. Additionally, the process can be complex and may involve additional fees. Understanding the implications of a Shreveport Louisiana Possessory Collateral Security Agreement is crucial before proceeding.

A pledge agreement specifically deals with the act of offering an asset as collateral and transferring possession. In contrast, a security agreement is broader, establishing a security interest in various types of collateral without necessarily transferring possession. Both are critical documents in a Shreveport Louisiana Possessory Collateral Security Agreement, ensuring clarity and protection for all parties involved.

A pledge involves transferring possession of an asset to secure a debt, while surety refers to a third party agreeing to assume responsibility if the debtor defaults. Both are mechanisms to enhance credit security, but they operate differently. In the context of a Shreveport Louisiana Possessory Collateral Security Agreement, understanding these differences can help you choose the best option for your financial needs.

A pledge agreement outlines the terms under which one party offers an asset as security for a debt or obligation. This document specifies the rights and responsibilities of both parties involved. Understanding a Shreveport Louisiana Possessory Collateral Security Agreement is essential for anyone looking to secure their financial transactions responsibly.

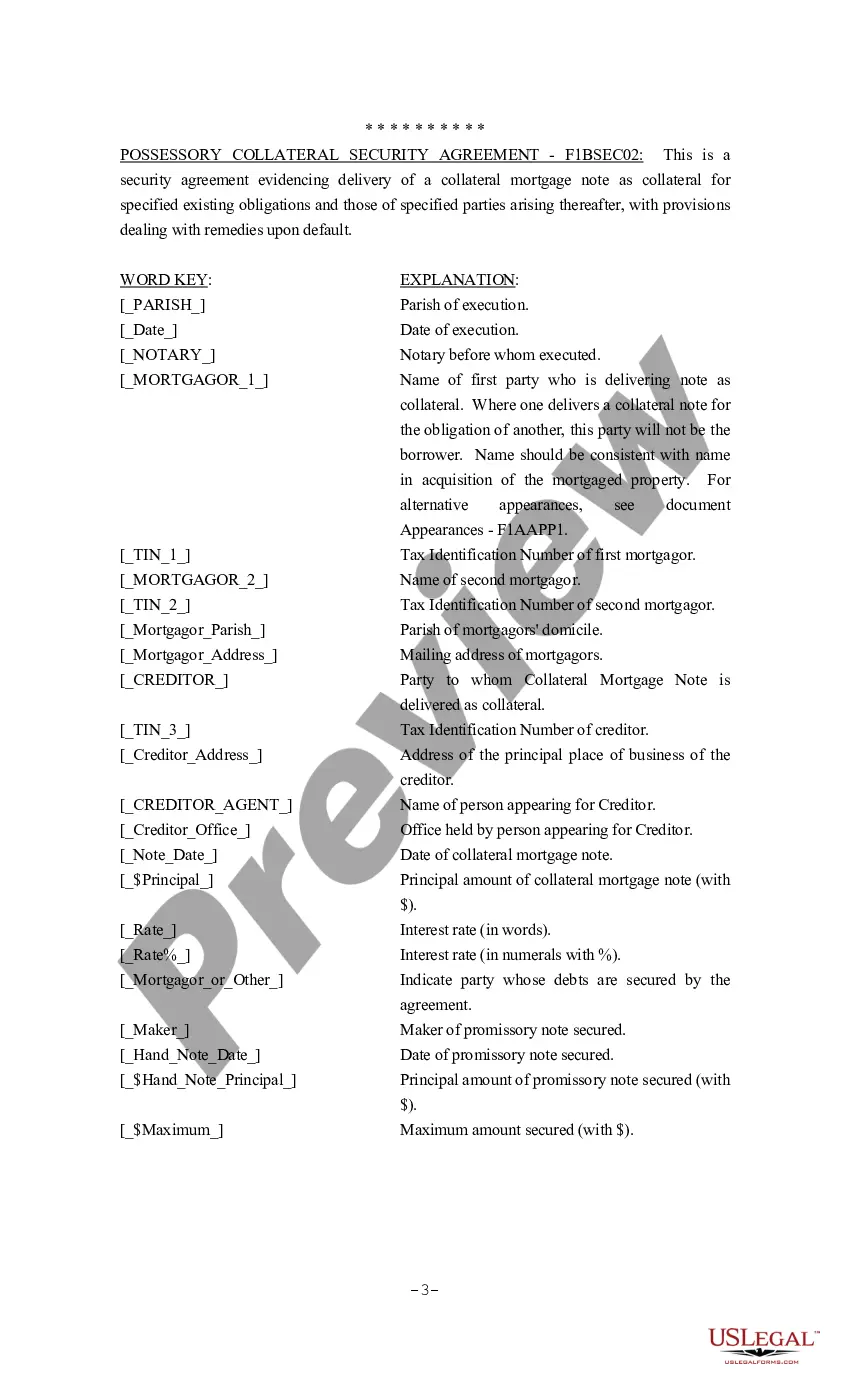

To write a security contract agreement, first clearly define the parties involved and outline the terms of the agreement. Next, describe the collateral with specific details and state the conditions for default. Using user-friendly platforms like UsLegalForms can aid you in drafting a thorough Shreveport Louisiana Possessory Collateral Security Agreement.