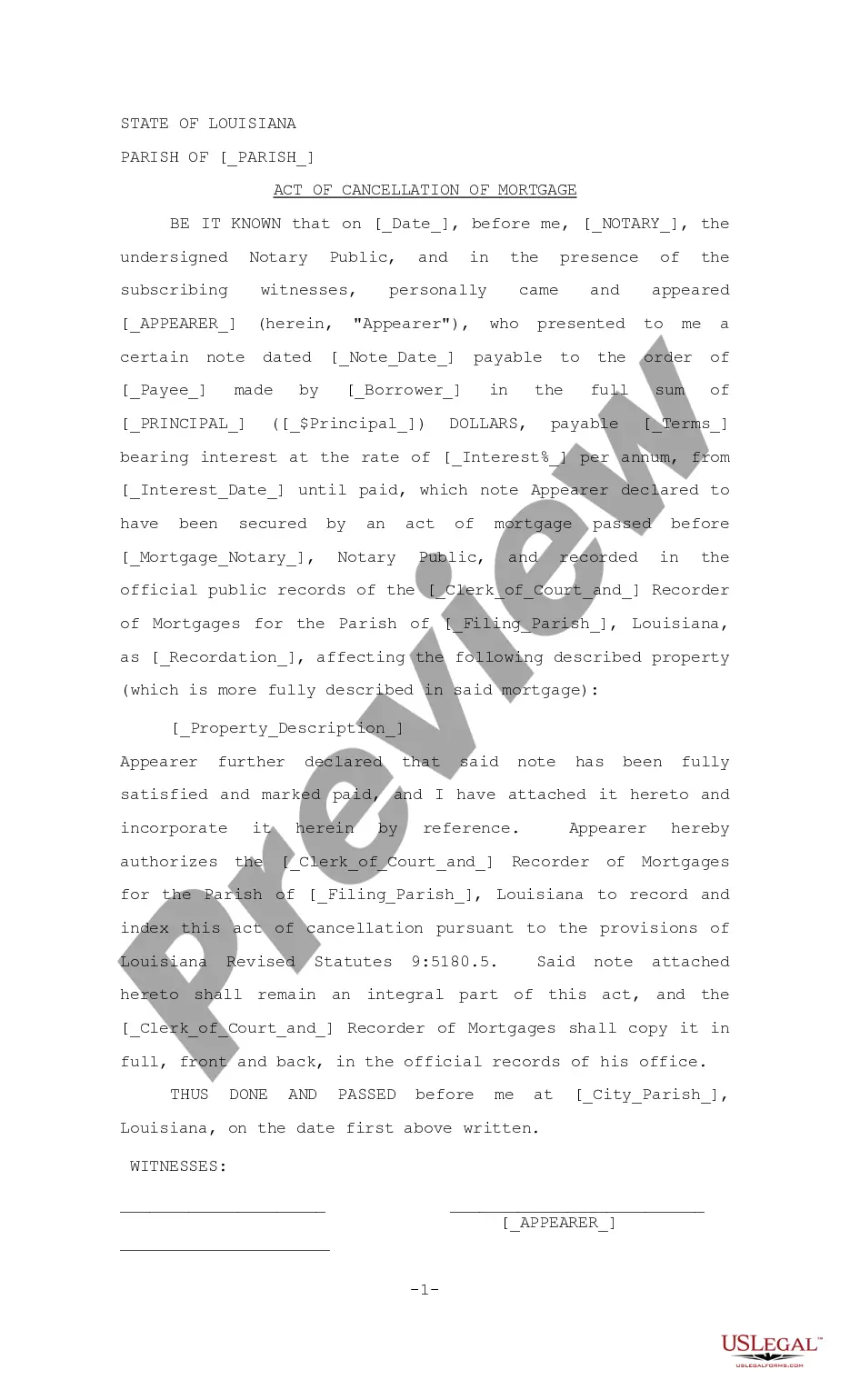

The Baton Rouge Louisiana Act of Cancellation of Mortgage is a legal provision that allows individuals or entities to formally cancel or release a mortgage lien on a property in the city of Baton Rouge, Louisiana. This act is designed to provide a clear and legal process for eliminating the mortgage lien and ensuring that the property is free from any encumbrances. The act of cancellation of mortgage is an essential step in the property transfer process as it grants the property owner a clear title, removing any legal claims or liabilities associated with the mortgage. By canceling the mortgage lien, the property owner gains full and unrestricted ownership rights, enabling them to sell, refinance, or transfer the property without any hindrance. There are various types of Baton Rouge Louisiana Act of Cancellation of Mortgage, each serving specific purposes: 1. Voluntary Cancellation: This type of cancellation occurs when the property owner has paid off the mortgage in full. The mortgage lender or financial institution issues a release of mortgage document, which is then recorded in the appropriate public records office to cancel the mortgage lien officially. 2. Cancellation by Satisfaction: In situations where the mortgage loan is paid off through refinancing or when the mortgage has reached its maturity date, the lender files a satisfaction of mortgage with the proper authorities to cancel the mortgage lien. This type of cancellation typically involves the cooperation of the lender and the borrower. 3. Judicial Cancellation: In some cases, a property owner may need to pursue a legal process to cancel a mortgage lien. This can occur due to various reasons, such as errors in the original mortgage documentation, fraud, or other legal disputes. Judicial cancellation involves filing a lawsuit and obtaining a court order to nullify the mortgage lien. It is vital to complete the act of cancellation of mortgage accurately and in compliance with the laws and regulations of Baton Rouge, Louisiana. This typically involves preparing the necessary documentation, such as a release of mortgage or satisfaction of mortgage, and submitting it to the appropriate offices, such as the local clerk of court or recorder of mortgages, for recording. By following the appropriate procedures outlined in the Baton Rouge Louisiana Act of Cancellation of Mortgage, property owners can safeguard their ownership rights and ensure that their property is free from any claims or encumbrances related to the mortgage. It is advisable to seek legal counsel or consult with a qualified real estate professional to navigate the intricacies of the act and ensure a smooth cancellation process.

Baton Rouge Louisiana Act of Cancellation of Mortgage

Description

How to fill out Baton Rouge Louisiana Act Of Cancellation Of Mortgage?

Finding verified templates specific to your local laws can be difficult unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both personal and professional needs and any real-life situations. All the documents are properly categorized by area of usage and jurisdiction areas, so searching for the Baton Rouge Louisiana Act of Cancellation of Mortgage gets as quick and easy as ABC.

For everyone already acquainted with our catalogue and has used it before, obtaining the Baton Rouge Louisiana Act of Cancellation of Mortgage takes just a few clicks. All you need to do is log in to your account, select the document, and click Download to save it on your device. This process will take just a couple of additional steps to complete for new users.

Adhere to the guidelines below to get started with the most extensive online form library:

- Check the Preview mode and form description. Make certain you’ve selected the correct one that meets your needs and fully corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you find any inconsistency, utilize the Search tab above to find the correct one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and choose the subscription plan you prefer. You should register an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the service.

- Download the Baton Rouge Louisiana Act of Cancellation of Mortgage. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Benefit from the US Legal Forms library to always have essential document templates for any demands just at your hand!