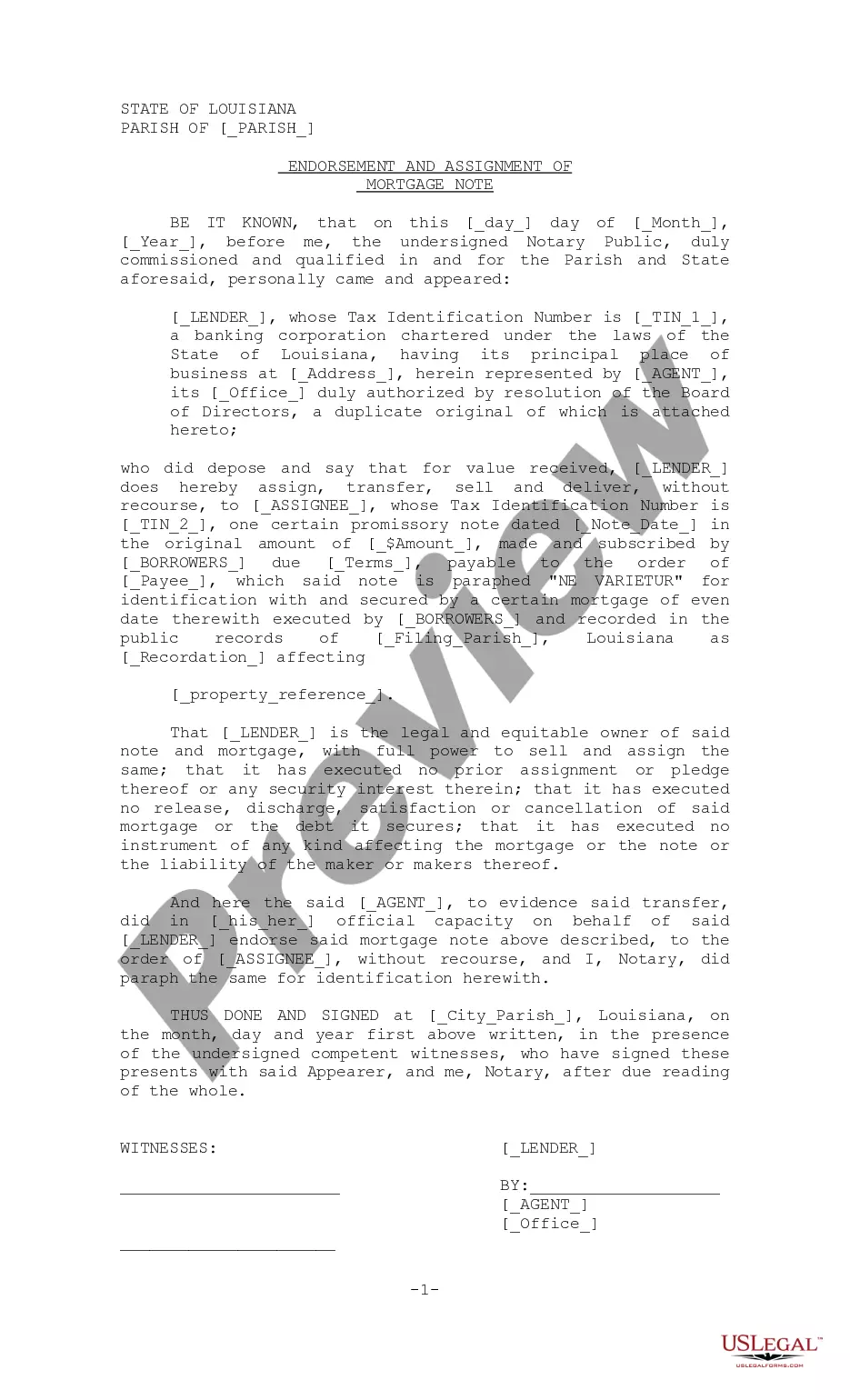

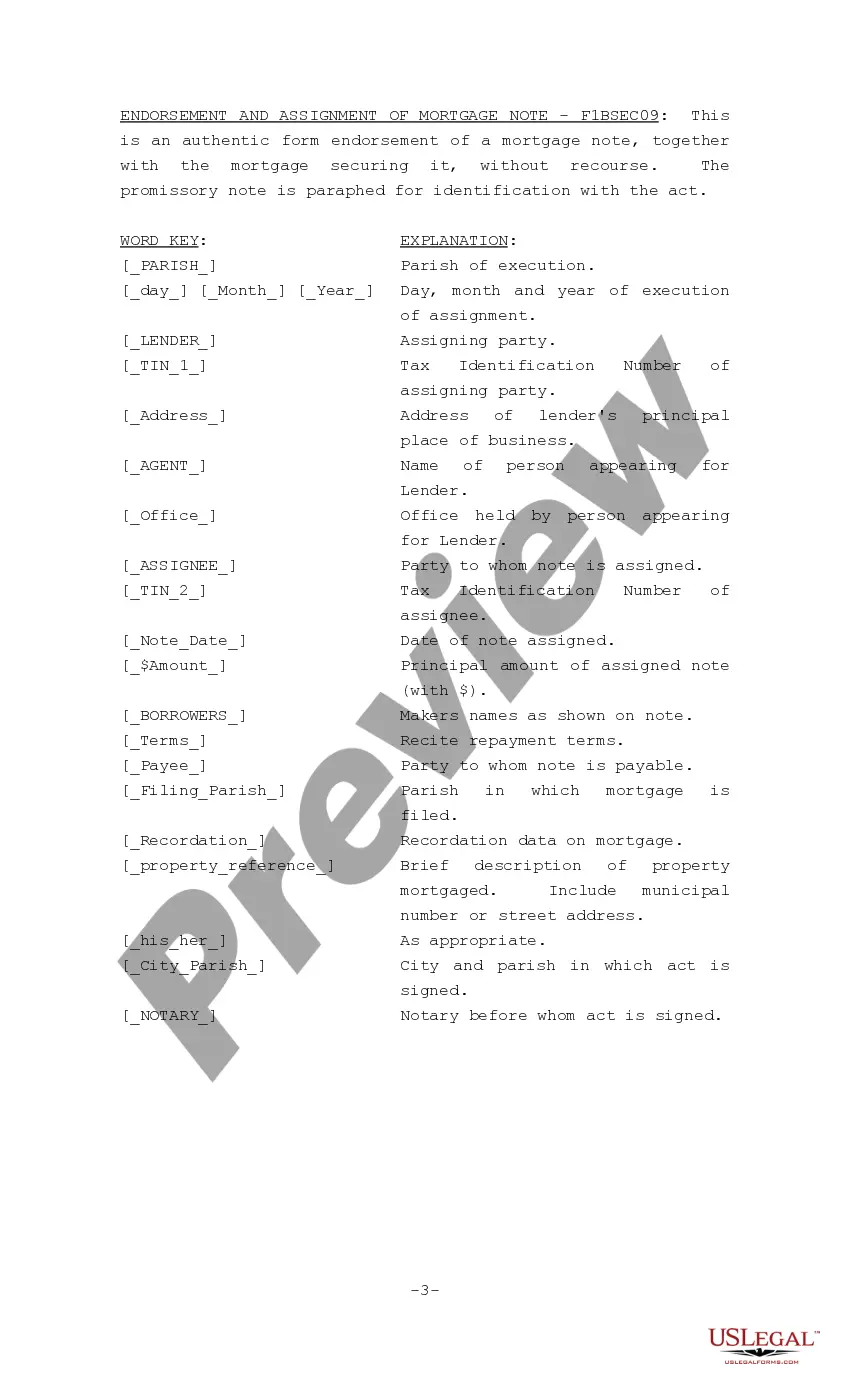

Shreveport Louisiana Endorsement and Assignment of Mortgage Note is an important legal process that involves the transfer of ownership rights and interests in a mortgage note from one party to another in the city of Shreveport, Louisiana. This legal document serves as evidence of the endorsement and assignment of the mortgage note, which is crucial for documenting the change of ownership and protecting the interests of both parties involved. The endorsement of a mortgage note refers to the act of signing, usually on the back of the note, to transfer the ownership rights to another party. By endorsing the note, the original note holder (endorser) acknowledges that they have received the agreed-upon payment or consideration from the new note holder (endorsed). This endorsement legally transfers the ownership of the mortgage note to the endorsed, who then becomes the new rightful holder of the note. On the other hand, the assignment of a mortgage note involves the formal transfer of ownership rights from one party to another. This assignment can be made through a separate legal document or by including an assignment clause within the note itself. An assignment of mortgage note provides a clear chain of ownership, ensuring that the endorsed has the proper legal rights to enforce the terms and conditions of the mortgage. In Shreveport, Louisiana, several types of endorsements and assignments of mortgage notes can occur, depending on the specific circumstances and parties involved. Some common types include: 1. Blank Endorsement: This type of endorsement occurs when the original note holder endorses the back of the note without specifying the new note holder. The blank endorsement allows the note to be transferred by mere delivery, giving the potential holder the right to endorse and assign it further. 2. Special Endorsement: A special endorsement involves the specific endorsement of the note to a named party as the new note holder. This type of endorsement restricts further transfer, as the note becomes payable only to the named endorsed. 3. Partial Endorsement: A partial endorsement occurs when only a portion of the mortgage note is endorsed to a new party. This can happen when the note holder wants to transfer a specific interest or portion of the note. It's important for all parties involved in the endorsement and assignment of mortgage notes in Shreveport, Louisiana, to fully understand the legal implications and requirements of such transactions. Seeking legal advice or consulting with a qualified professional, such as a real estate attorney or mortgage specialist, is highly recommended ensuring compliance with state laws and to protect the interests of both the note holder and the endorsed.

Shreveport Louisiana Endorsement and Assignment of Mortgage Note

Description

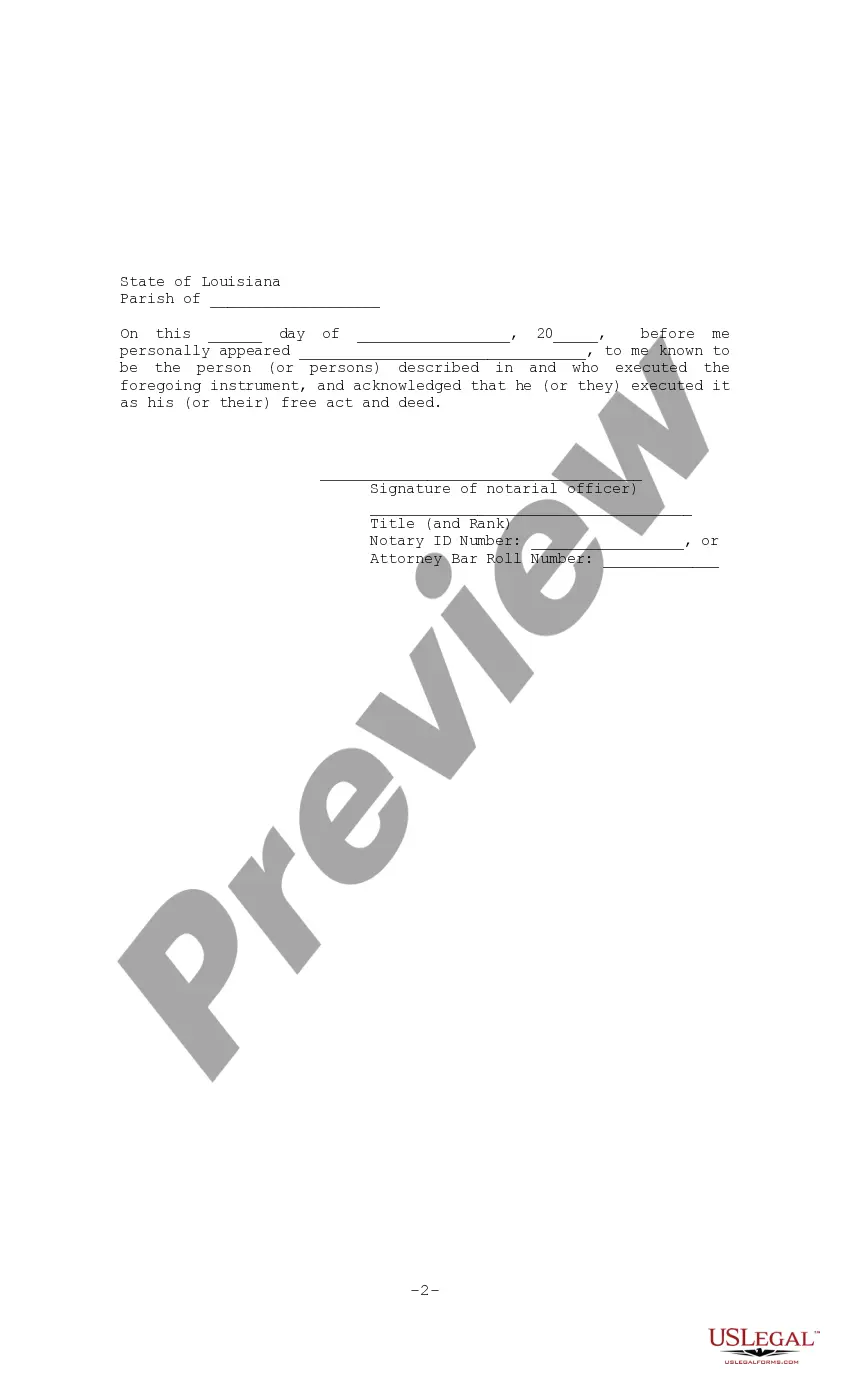

How to fill out Shreveport Louisiana Endorsement And Assignment Of Mortgage Note?

If you are looking for a legitimate document, it’s incredibly challenging to discover a superior platform than the US Legal Forms website – likely the most comprehensive collections available online.

Here you can obtain a vast array of templates for business and personal use categorized by types and regions, or keywords.

Utilizing our premium search function, acquiring the latest Shreveport Louisiana Endorsement and Assignment of Mortgage Note is as simple as 1-2-3.

Complete the payment. Use your credit card or PayPal account to finish the registration process.

Obtain the form. Choose the file format and download it to your device. Edit the document. Complete, modify, print, and sign the downloaded Shreveport Louisiana Endorsement and Assignment of Mortgage Note.

- Additionally, the significance of each record is validated by a team of professional attorneys who frequently assess the templates on our site and update them according to the latest state and county regulations.

- If you are already familiar with our system and possess an account, all you need to obtain the Shreveport Louisiana Endorsement and Assignment of Mortgage Note is to Log In to your account and click the Download button.

- If you are using US Legal Forms for the first time, simply refer to the instructions provided below.

- Ensure you have opened the form you wish to use. Review its description and utilize the Preview feature to assess its content. If it does not meet your requirements, use the Search option at the top of the page to find the required document.

- Verify your choice. Click the Buy now button. Then, select your desired pricing plan and provide information to set up an account.

Form popularity

FAQ

No, the assignment of a mortgage does not automatically indicate foreclosure. It simply transfers the mortgage interest from one party to another. However, if payments remain unpaid after the assignment, the new lender may initiate foreclosure proceedings. Understanding the nuances of the Shreveport Louisiana Endorsement and Assignment of Mortgage Note can clarify your rights and responsibilities. For comprehensive support, US Legal Forms can guide you through the complexities of mortgage processes.

If the assignment of a mortgage is not recorded, it may lead to potential disputes regarding ownership rights in the future. Without proper recording, third parties could challenge the assignment, which complicates the collection of payments. In Shreveport, Louisiana, recording the assignment is essential for establishing clear ownership and protecting your interests. For streamlined solutions, consider using US Legal Forms to ensure all documents are filed correctly.

Typically, the assignment of a mortgage is signed by the original lender or their authorized representative. In some cases, the borrower may also need to acknowledge the assignment, especially when it involves significant changes. It’s important to note that in Shreveport, Louisiana, having this document properly executed ensures validity. If you need assistance, US Legal Forms provides templates and guidance for this process.

The assignment document for a mortgage is a legal paperwork that transfers the rights and interests of the original lender to a new lender or assignee. This document plays a crucial role in the real estate process in Shreveport, Louisiana, particularly in the context of the Endorsement and Assignment of Mortgage Note. By completing this assignment, you ensure that the new lender has the authority to collect payments and enforce the terms of the mortgage. Utilizing resources like US Legal Forms can simplify obtaining this document.

An allonge to promissory note is different from an assignment. An assignment in this context is what gives a party the legal designation and right to move forward with legal action on a property, whereas an allonge is an endorsement that allows you to collect on the promissory note.

An allonge is considered an extension of the instrument itself. The purpose of an allonge in most loan transactions is to transfer the negotiable instrument to the lender if there has been an event of default and the lender is enforcing its rights under the credit agreement.

The most common example of an Assignment of Mortgage is when a mortgage lender transfers/sells the mortgage to another lender. This can be done more than once until the balance is paid. The lender does not have to inform the borrower that the mortgage is being assigned to another party.

A promissory note refers to a written document stating that a certain amount of money will be paid to someone by a specified date. Generally, it is not necessary for the note to be recorded officially. The borrower is required to sign the note, but the lender may choose not to sign it.

Endorsements. When an investor purchases a loan, the previous owner will sign or ?endorse? the note, formally indicating that the note is being transferred to a new owner. This process is called ?endorsement.? An entity that owns the loan has standing to initiate a foreclosure.