Baton Rouge Louisiana Subordination of Mortgage is a legal process of repositioning the priority of mortgage liens on a property. It is a crucial step taken when multiple mortgage loans are involved in a property transaction, such as refinancing or getting a home equity loan. When subordination occurs, it denotes that a new mortgage loan will take a secondary position to an existing loan or loans. This means that if a borrower defaults, the original lender will have priority in collecting the proceeds from the property's sale, whereas the subordinate lender will receive their share only if any funds remain. The subordination process in Baton Rouge, Louisiana, ensures that lenders are aware of their position in the lien hierarchy and the associated risks involved. It is essential for both lenders and borrowers to adhere to the guidelines set forth by the state's laws and regulations. There are primarily two types of Baton Rouge Louisiana Subordination of Mortgage: 1. Intercreditor Agreement: This type of subordination allows lenders to negotiate the priority of their mortgage liens. The agreement outlines the rights, responsibilities, and priorities of each lender involved. By signing this agreement, all parties involved consent to the terms and conditions set forth, ensuring a clear understanding of the hierarchy of their loans. 2. Subordination Agreement: This form of subordination is predominantly used in refinancing scenarios. It allows borrowers to secure a primary mortgage loan while maintaining an existing secondary mortgage loan. The borrowers, primary lender, and subordinate lender sign an agreement that states the primary lender's priority over the subordinate lender. This agreement provides clarity and protection to all parties involved in the transaction. In Baton Rouge, Louisiana, subordination of mortgage is a complex legal process that requires meticulous attention to detail. It is crucial to consult with legal professionals experienced in real estate and mortgage laws to ensure compliance and a smooth transaction. By understanding the different types and implications of subordination, borrowers and lenders can make informed decisions to protect their interests in property transactions.

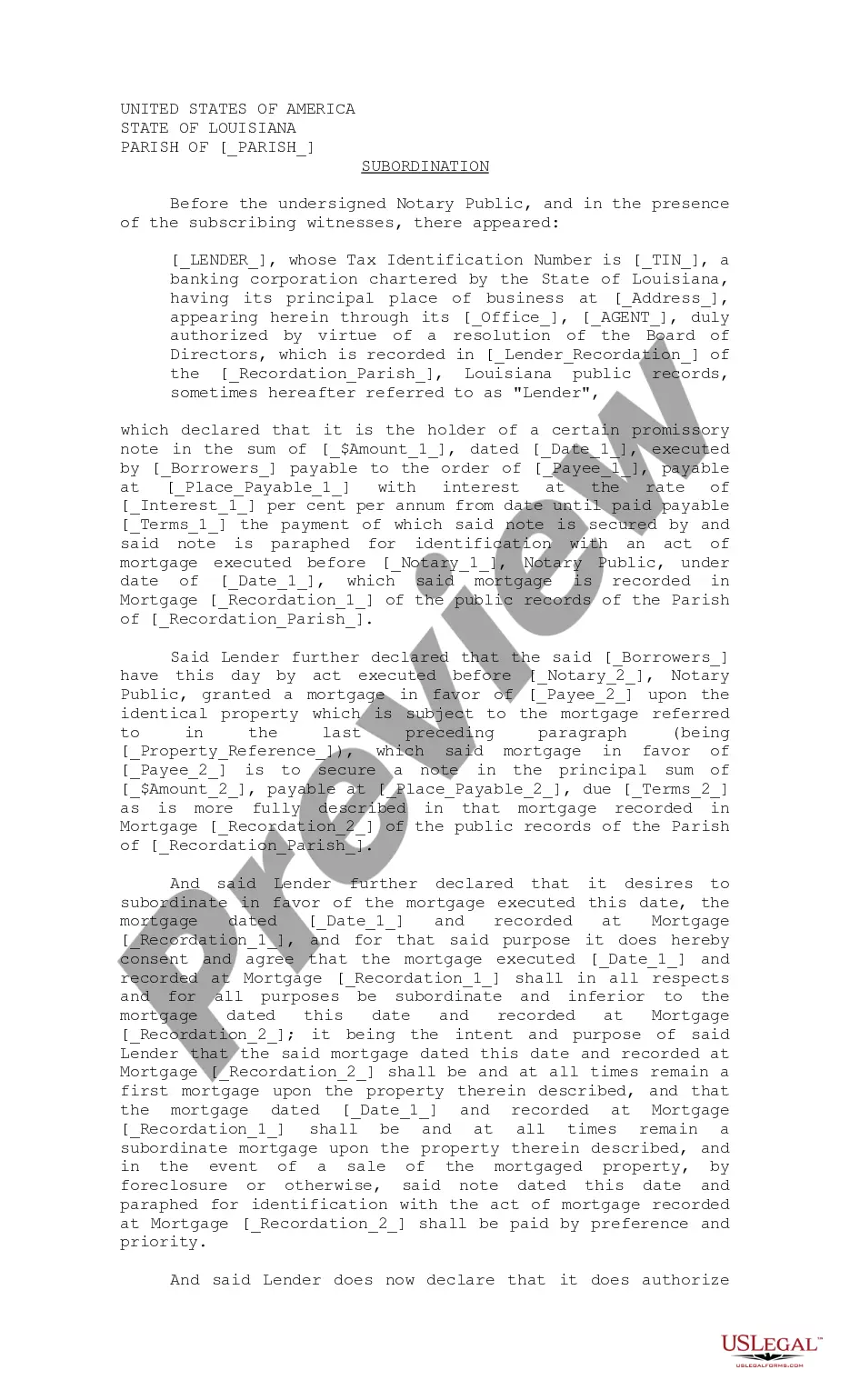

Baton Rouge Louisiana Subordination of Mortgage

Description

How to fill out Baton Rouge Louisiana Subordination Of Mortgage?

We always strive to reduce or avoid legal issues when dealing with nuanced legal or financial affairs. To do so, we apply for legal solutions that, as a rule, are very expensive. However, not all legal issues are as just complex. Most of them can be dealt with by ourselves.

US Legal Forms is an online catalog of up-to-date DIY legal documents addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your affairs into your own hands without using services of legal counsel. We provide access to legal form templates that aren’t always openly available. Our templates are state- and area-specific, which significantly facilitates the search process.

Take advantage of US Legal Forms whenever you need to find and download the Baton Rouge Louisiana Subordination of Mortgage or any other form easily and securely. Simply log in to your account and click the Get button next to it. If you happened to lose the form, you can always re-download it in the My Forms tab.

The process is just as easy if you’re unfamiliar with the platform! You can create your account within minutes.

- Make sure to check if the Baton Rouge Louisiana Subordination of Mortgage complies with the laws and regulations of your your state and area.

- Also, it’s crucial that you go through the form’s description (if provided), and if you notice any discrepancies with what you were looking for in the first place, search for a different form.

- As soon as you’ve ensured that the Baton Rouge Louisiana Subordination of Mortgage is suitable for you, you can choose the subscription plan and proceed to payment.

- Then you can download the form in any available file format.

For over 24 years of our existence, we’ve helped millions of people by providing ready to customize and up-to-date legal documents. Take advantage of US Legal Forms now to save efforts and resources!