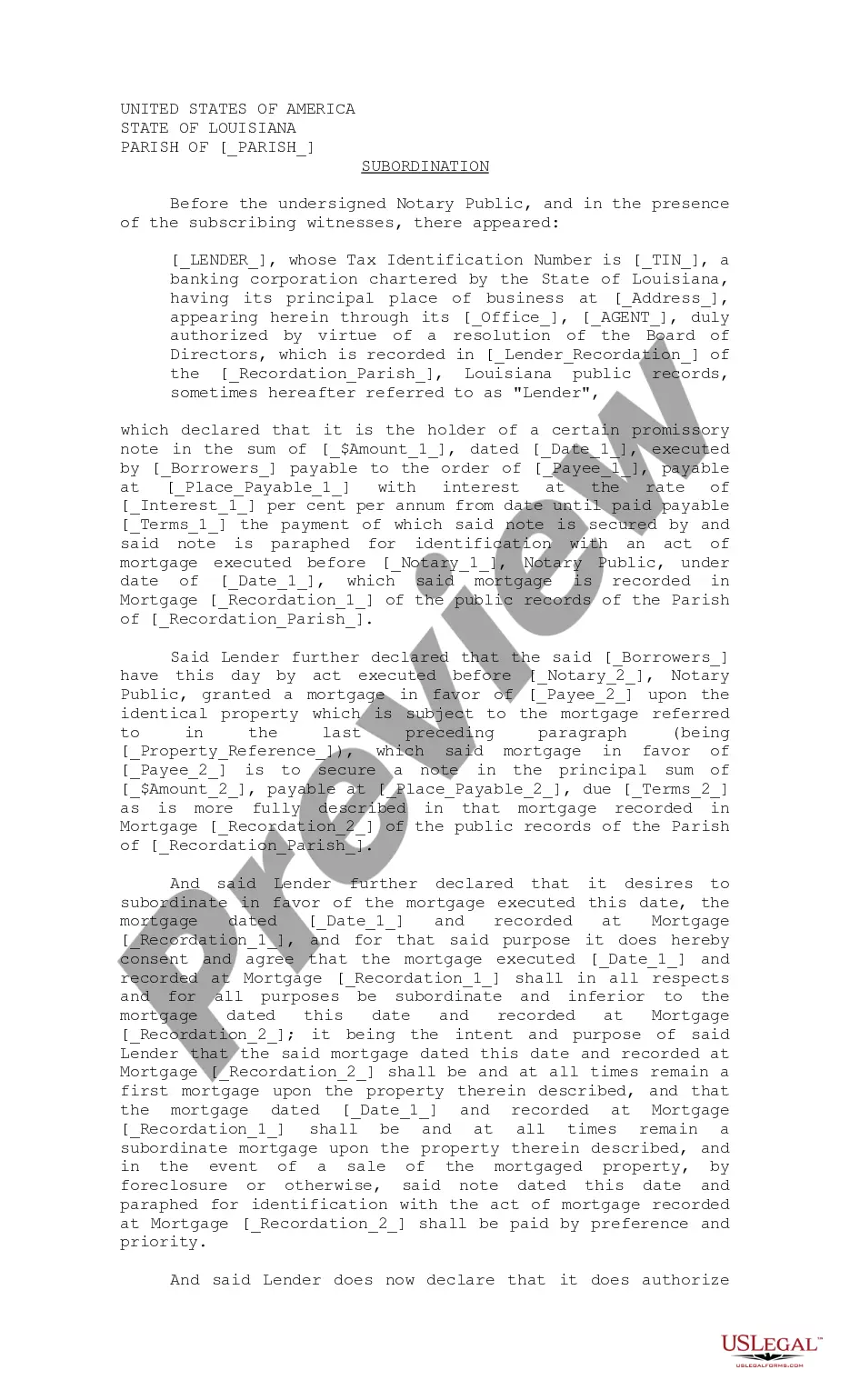

New Orleans Louisiana Subordination of Mortgage refers to a legal process where a homeowner or property owner in New Orleans, Louisiana voluntarily agrees to prioritize the claims of a certain mortgage or lien over another existing mortgage or lien on the same property. This is usually done to facilitate the refinancing of a home loan, taking out a second mortgage or line of credit, or for other purposes that involve adding a new lien on the property. In essence, subordination of mortgage allows a property owner to rearrange the order of priority of their mortgage or lien holders, thereby enabling them to secure additional financing without violating the terms of their existing mortgage. This process is crucial in situations where a homeowner wishes to access the equity in their home or fund any other major investment or project. Different Types of New Orleans Louisiana Subordination of Mortgage: 1. First mortgage subordination: This type of subordination occurs when a homeowner wishes to refinance their first mortgage while maintaining the priority of an existing second mortgage. By obtaining the consent of the second mortgage lender, the homeowner can proceed with refinancing their first mortgage without paying off the second mortgage. 2. Second mortgage subordination: In certain cases, a homeowner may want to obtain a second mortgage or line of credit, while keeping the existing first mortgage intact. By obtaining a subordination agreement from the first mortgage lender, the homeowner ensures that the new second mortgage is granted a secondary lien position, i.e., it becomes subordinate to the first mortgage. 3. Inter-creditor subordination: This type of subordination primarily occurs between two or more mortgage lenders, where the priority of the claims of each lender in the event of foreclosure is agreed upon. For instance, if a homeowner has both a primary mortgage and a home equity line of credit, the lenders can negotiate to establish the order in which they will be repaid should foreclosure occur. The process of New Orleans Louisiana Subordination of Mortgage involves drafting a subordination agreement, which outlines the terms of the new lien's priority, obtaining the consent of the existing lien holder(s), and recording the agreement with the relevant authorities to ensure its legal validity and enforceability. Overall, New Orleans Louisiana Subordination of Mortgage plays a vital role in facilitating various financial transactions for homeowners and property owners while maintaining the necessary legal framework and protection of the rights of all mortgage or lien holders involved.

New Orleans Louisiana Subordination of Mortgage

Description

How to fill out New Orleans Louisiana Subordination Of Mortgage?

Utilize the US Legal Forms to gain instant access to any document you require. Our helpful website featuring a vast array of forms enables you to locate and acquire nearly any sample document you need.

You can download, fill out, and validate the New Orleans Louisiana Subordination of Mortgage within minutes, rather than spending hours online searching for a suitable template.

Using our catalog is an excellent way to enhance the security of your document submissions. Our knowledgeable legal experts consistently review all records to ensure that the templates are suitable for a specific state and comply with new rules and regulations.

How can you obtain the New Orleans Louisiana Subordination of Mortgage? If you already possess a profile, simply Log In to your account. The Download button will be activated for all the documents you access. Furthermore, you can find all previously saved documents in the My documents section.

US Legal Forms is one of the most significant and trustworthy document libraries online. Our team is always prepared to assist you with any legal situation, even if it simply involves downloading the New Orleans Louisiana Subordination of Mortgage.

Feel free to take advantage of our form catalog and simplify your document experience as much as possible!

- Visit the page with the document you need. Ensure it is the template you are searching for: verify its title and description and utilize the Preview feature when available. Alternatively, use the Search box to locate what you require.

- Initiate the download process. Click Buy Now and select your desired pricing plan. Next, register for an account and complete your order using a credit card or PayPal.

- Download the file. Choose the format to obtain the New Orleans Louisiana Subordination of Mortgage and modify, complete, or sign it according to your needs.

Form popularity

FAQ

To cancel a mortgage in Louisiana, you need to file a formal request with your local parish clerk of court. The process typically involves obtaining a payoff statement from your lender and then following the steps outlined for a mortgage release. For those navigating the complexities of New Orleans Louisiana Subordination of Mortgage, it can be beneficial to use platforms like uslegalforms, which offer guidance and resources to streamline the cancellation process. Proper documentation is crucial to ensure the mortgage is officially canceled.

A subordinate deed of trust mortgage is a secondary lien on a property, which means it comes after other liens in terms of repayment priority. In the context of New Orleans Louisiana Subordination of Mortgage, having a subordinate deed allows homeowners to access additional financing while still maintaining their original mortgage. This type of financing can be a useful tool for leveraging home equity for renovations or other expenses. Always consult with a professional to understand how subordinating a deed of trust affects your financial situation.

To subordinate a mortgage, you need to consult with both your current and prospective lenders. Initiate the process by requesting your current lender to draft a subordination agreement. Once this is approved, ensure that both parties properly record the New Orleans Louisiana Subordination of Mortgage to safeguard your financial interests.

To subordinate a mortgage, you must obtain approval from your current lender and your new lender. Start by discussing your plans with your existing lender and request a subordination agreement. Once the agreement is in place, file the necessary paperwork with the new lender, ensuring the New Orleans Louisiana Subordination of Mortgage is executed correctly to maintain your interests.

Obtaining a subordination agreement involves working with your lender and possibly a legal professional. First, you need to request the agreement from your existing lender, who will review your situation. After reaching an understanding, the lender will draft the subordination agreement, outlining the terms and conditions associated with the New Orleans Louisiana Subordination of Mortgage.

An example of a subordination agreement would be a document executed between two lenders where one agrees to place its lien below that of another. This scenario frequently arises in real estate transitions or refinancing situations. By recognizing the importance of such agreements, especially in New Orleans Louisiana Subordination of Mortgage contexts, you can better navigate your real estate financing options.

Typically, the lender preparing the new mortgage will draft the subordination agreement. However, it can also involve legal professionals, brokers, or the homeowner in coordinating all relevant details. This collaborative approach ensures that the New Orleans Louisiana Subordination of Mortgage is accurately documented and all parties are protected.

The purpose of a subordination agreement is to establish the order of priority for loans secured by real estate. This is crucial in protecting lenders' rights and ensuring clarity in the event of foreclosure. In the context of New Orleans Louisiana Subordination of Mortgage, these agreements help determine which mortgage has the first claim to the property.

A mortgage certificate in Louisiana serves as proof that a mortgage is officially recorded with the parish. This certificate contains essential details such as the parties involved, the amounts, and any conditions applicable to the mortgage. Understanding the importance of a mortgage certificate is vital for anyone engaged in the New Orleans Louisiana Subordination of Mortgage, as it protects your ownership interest.

A subordination of mortgage occurs when an existing mortgage is restructured so that another mortgage takes priority over it. This process allows homeowners to refinance or obtain new loans while acknowledging the previous debt. In the realm of New Orleans Louisiana Subordination of Mortgage, this strategy can enhance your financial flexibility and enable better mortgage options.