New Orleans Louisiana Mortgage to Secure Future Advances: A Detailed Description If you are a resident of the vibrant city of New Orleans, Louisiana, and looking for a way to secure future advances, then a New Orleans Louisiana Mortgage can be the ideal solution for you. This detailed description will delve into the concept of a mortgage and how it can help you secure future advances to achieve your financial goals. A mortgage is essentially a loan that is secured by real estate property. In the case of New Orleans Louisiana Mortgage to Secure Future Advances, it refers to a mortgage specifically designed to provide homeowners in New Orleans with the means to access additional funds in the future. This enables individuals to tap into the equity built in their property and leverage it to fund various needs, such as home improvements, education expenses, debt consolidation, or to invest in other ventures. Types of New Orleans Louisiana Mortgage to Secure Future Advances: 1. Home Equity Line of Credit (HELOT): This type of mortgage allows homeowners to borrow against their home equity as needed, similar to a credit card. The borrower receives a line of credit, and they can withdraw funds up to a predetermined credit limit during a specified period called the "draw period." Helots typically have a variable interest rate, making them flexible but subject to market fluctuations. 2. Cash-Out Refinance: With a cash-out refinance mortgage, homeowners refinance their existing mortgage for an amount greater than the outstanding balance. The difference between the new loan amount and the current mortgage balance is received by the borrower in cash, which can be used for future advances. Cash-out refinances often have fixed interest rates, providing stability in repayment. 3. Second Mortgage or Home Equity Loan: This type of mortgage involves obtaining a separate loan, either as a lump sum or as a line of credit, using the home equity as collateral. Second mortgages usually have fixed interest rates and terms, allowing borrowers to access a predetermined amount of funds for future advances while keeping their primary mortgage intact. Benefits of New Orleans Louisiana Mortgage to Secure Future Advances: 1. Flexibility: These mortgage options offer flexibility by allowing homeowners to utilize their property's equity when the need arises, granting them the freedom to pursue various financial endeavors. 2. Lower Interest Rates: Since mortgages are secured loans, they often come with lower interest rates compared to unsecured loans or credit cards, making them a cost-effective borrowing option. 3. Potential Tax Benefits: In some cases, the interest paid on a New Orleans Louisiana Mortgage to Secure Future Advances may be tax-deductible. It is recommended to consult with a tax professional to determine eligibility for any tax benefits. 4. Wealth Building: As property values appreciate over time, homeowners who secure future advances through a mortgage can potentially build wealth through the growing equity in their homes. In conclusion, a New Orleans Louisiana Mortgage to Secure Future Advances provides homeowners in New Orleans with an effective financial tool to access additional funds while leveraging the equity in their property. By utilizing options such as a Home Equity Line of Credit, Cash-Out Refinance, or Second Mortgage, homeowners can tap into their property's value, providing them with the means to accomplish various financial goals and secure their future advances.

New Orleans Louisiana Mortgage to Secure Future Advances

State:

Louisiana

City:

New Orleans

Control #:

LA-706-M

Format:

Word;

Rich Text

Instant download

Description

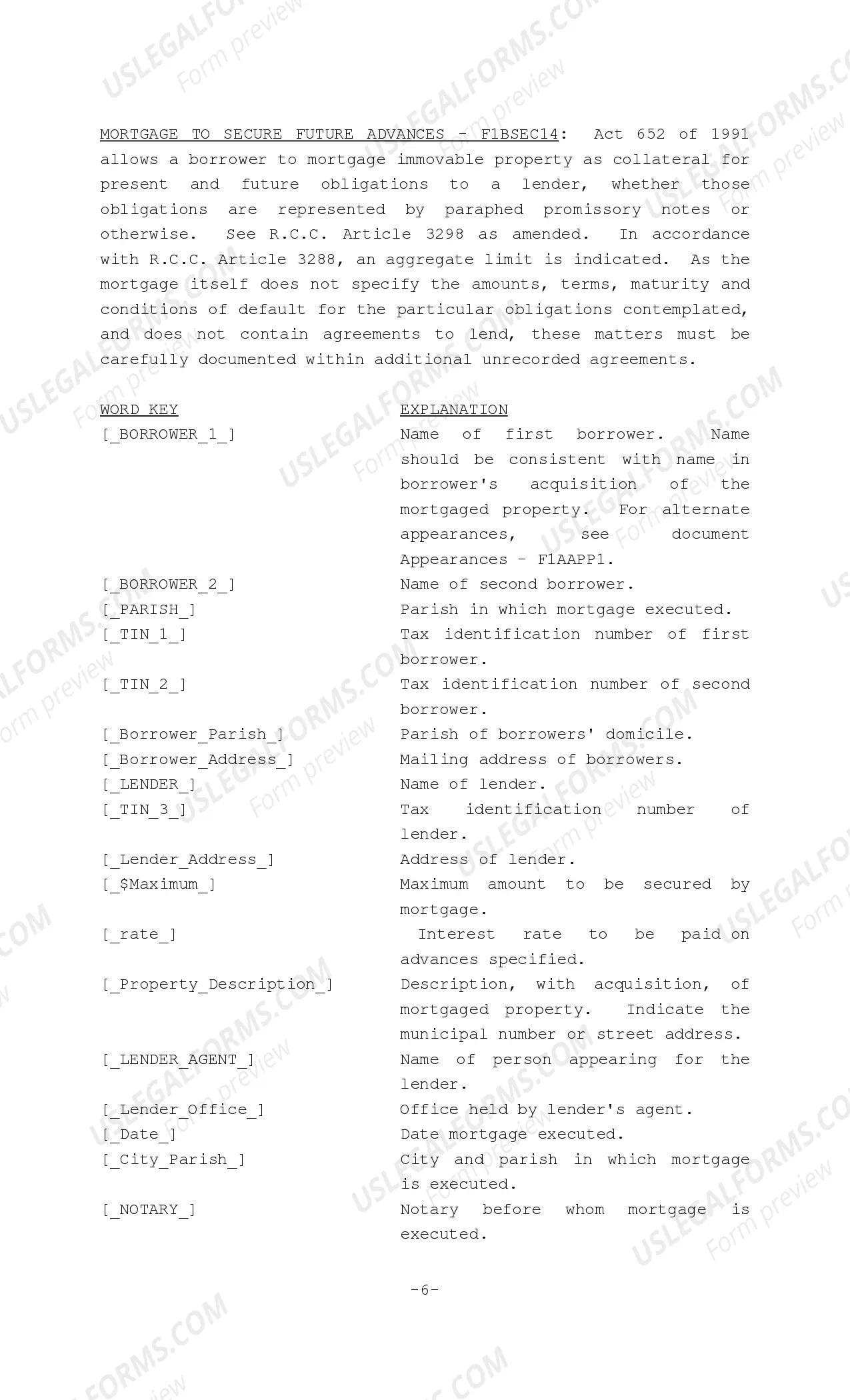

In this document, a borrower mortgages immovable property as collateral for present and future obligations to a lender. This may be done whether those obligations are represented by paraphed promissory notes or otherwise. See La. R.C.C. Article 3298, as amended. In accordance with La R.C.C. Article 3288, an aggregate limit is indicated. As the mortgage itself does not specify the amounts, terms, maturity and conditions of default for the particular obligations contemplated, and does not contain agreements to lend, these matters must be carefully documented within additional unrecorded agreements.

New Orleans Louisiana Mortgage to Secure Future Advances: A Detailed Description If you are a resident of the vibrant city of New Orleans, Louisiana, and looking for a way to secure future advances, then a New Orleans Louisiana Mortgage can be the ideal solution for you. This detailed description will delve into the concept of a mortgage and how it can help you secure future advances to achieve your financial goals. A mortgage is essentially a loan that is secured by real estate property. In the case of New Orleans Louisiana Mortgage to Secure Future Advances, it refers to a mortgage specifically designed to provide homeowners in New Orleans with the means to access additional funds in the future. This enables individuals to tap into the equity built in their property and leverage it to fund various needs, such as home improvements, education expenses, debt consolidation, or to invest in other ventures. Types of New Orleans Louisiana Mortgage to Secure Future Advances: 1. Home Equity Line of Credit (HELOT): This type of mortgage allows homeowners to borrow against their home equity as needed, similar to a credit card. The borrower receives a line of credit, and they can withdraw funds up to a predetermined credit limit during a specified period called the "draw period." Helots typically have a variable interest rate, making them flexible but subject to market fluctuations. 2. Cash-Out Refinance: With a cash-out refinance mortgage, homeowners refinance their existing mortgage for an amount greater than the outstanding balance. The difference between the new loan amount and the current mortgage balance is received by the borrower in cash, which can be used for future advances. Cash-out refinances often have fixed interest rates, providing stability in repayment. 3. Second Mortgage or Home Equity Loan: This type of mortgage involves obtaining a separate loan, either as a lump sum or as a line of credit, using the home equity as collateral. Second mortgages usually have fixed interest rates and terms, allowing borrowers to access a predetermined amount of funds for future advances while keeping their primary mortgage intact. Benefits of New Orleans Louisiana Mortgage to Secure Future Advances: 1. Flexibility: These mortgage options offer flexibility by allowing homeowners to utilize their property's equity when the need arises, granting them the freedom to pursue various financial endeavors. 2. Lower Interest Rates: Since mortgages are secured loans, they often come with lower interest rates compared to unsecured loans or credit cards, making them a cost-effective borrowing option. 3. Potential Tax Benefits: In some cases, the interest paid on a New Orleans Louisiana Mortgage to Secure Future Advances may be tax-deductible. It is recommended to consult with a tax professional to determine eligibility for any tax benefits. 4. Wealth Building: As property values appreciate over time, homeowners who secure future advances through a mortgage can potentially build wealth through the growing equity in their homes. In conclusion, a New Orleans Louisiana Mortgage to Secure Future Advances provides homeowners in New Orleans with an effective financial tool to access additional funds while leveraging the equity in their property. By utilizing options such as a Home Equity Line of Credit, Cash-Out Refinance, or Second Mortgage, homeowners can tap into their property's value, providing them with the means to accomplish various financial goals and secure their future advances.

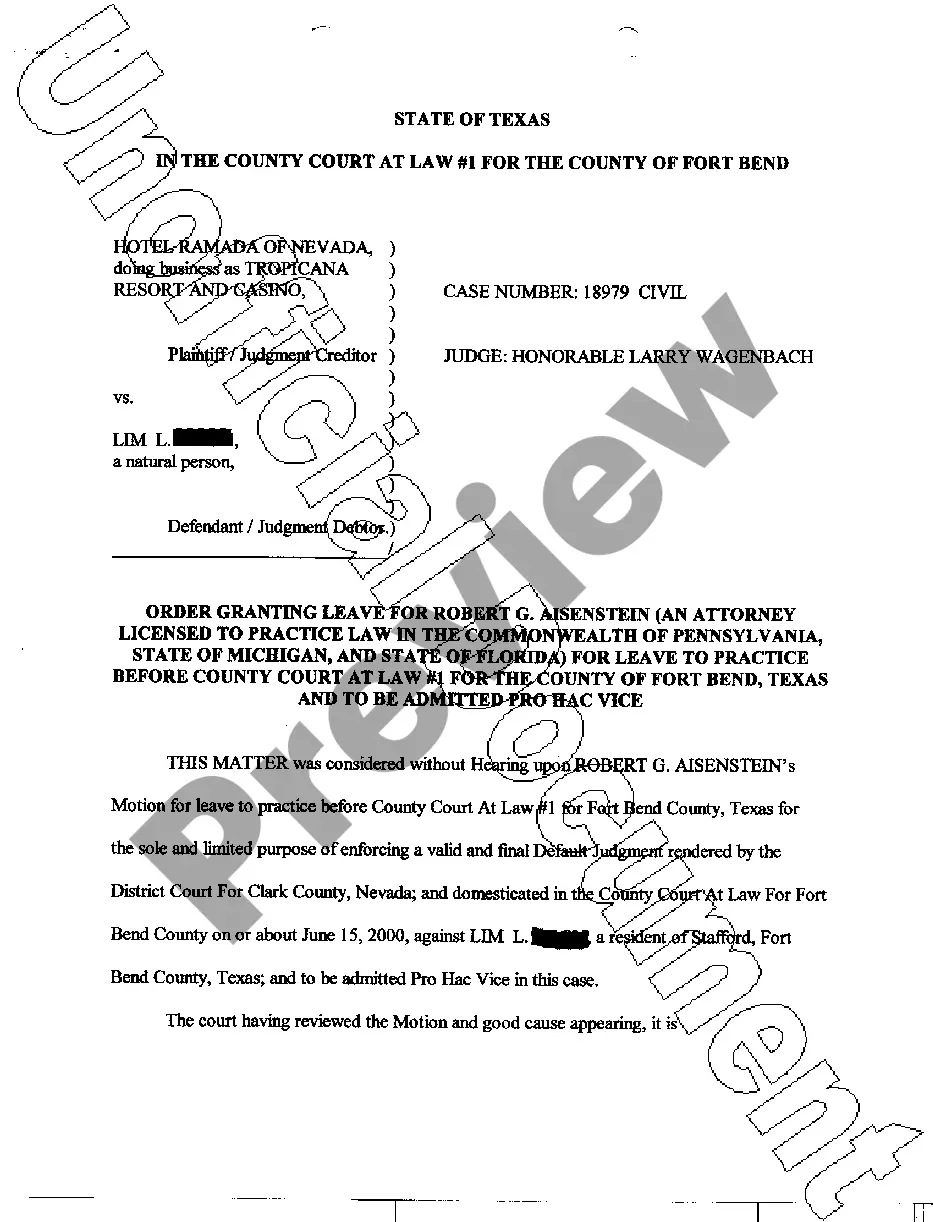

Free preview

How to fill out New Orleans Louisiana Mortgage To Secure Future Advances?

If you’ve already used our service before, log in to your account and download the New Orleans Louisiana Mortgage to Secure Future Advances on your device by clicking the Download button. Make certain your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, follow these simple actions to get your document:

- Make sure you’ve located the right document. Look through the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t suit you, use the Search tab above to obtain the proper one.

- Buy the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Create an account and make a payment. Utilize your credit card details or the PayPal option to complete the transaction.

- Get your New Orleans Louisiana Mortgage to Secure Future Advances. Opt for the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to each piece of paperwork you have bought: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to quickly locate and save any template for your individual or professional needs!