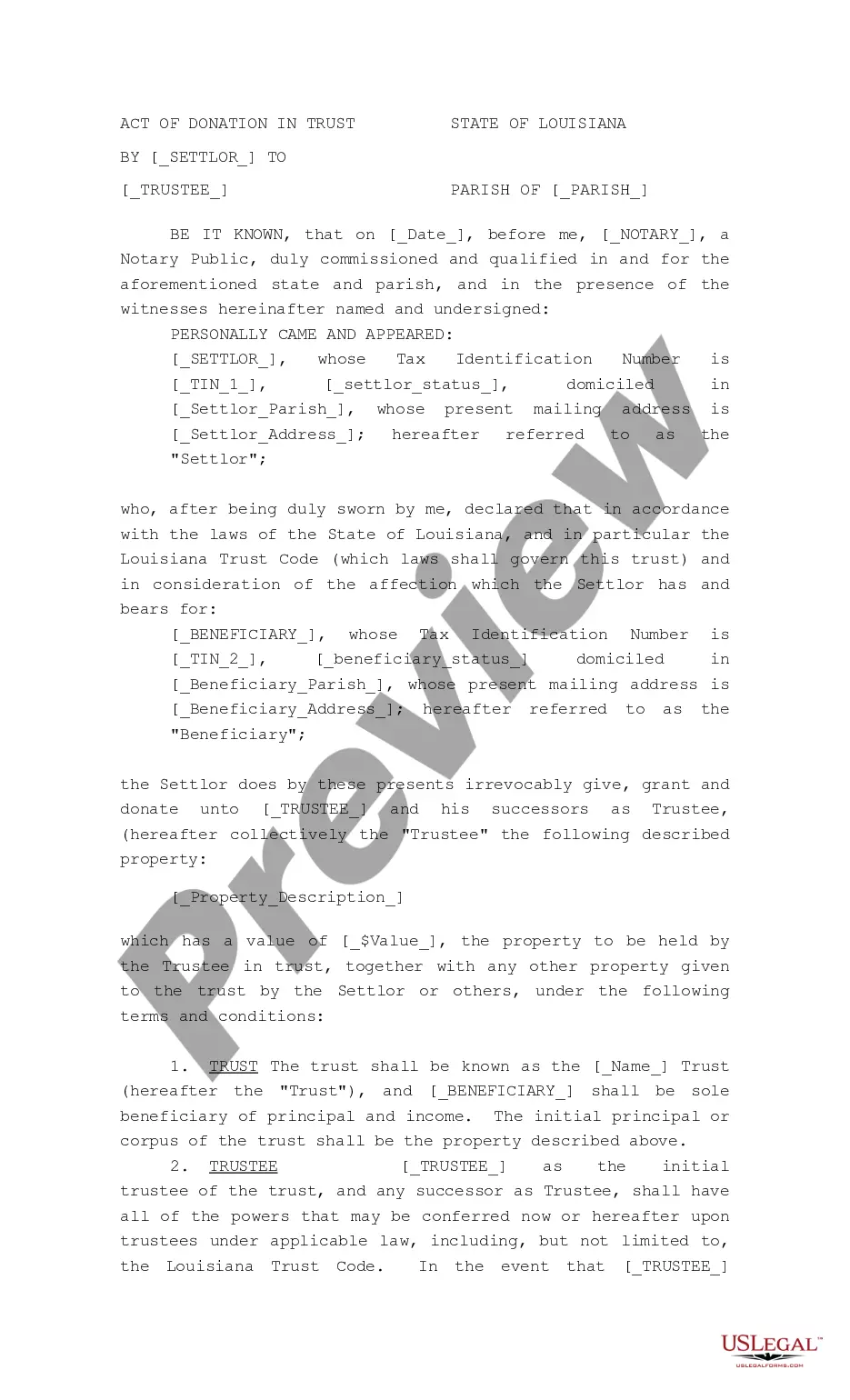

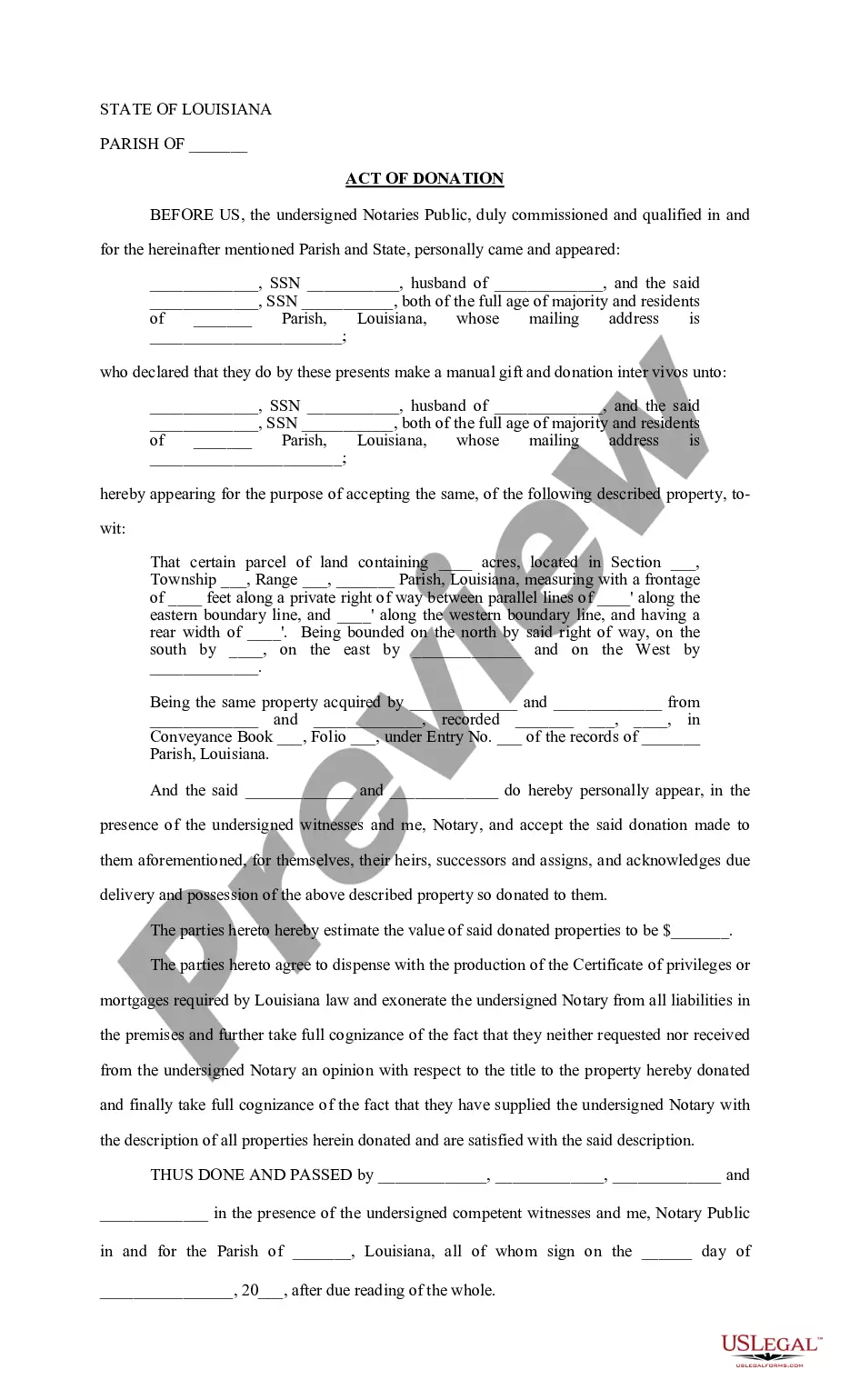

New Orleans Louisiana Act of Donation in Trust by Settlor to Trustee

Description

How to fill out Louisiana Act Of Donation In Trust By Settlor To Trustee?

Are you in search of a dependable and budget-friendly supplier of legal forms to acquire the New Orleans Louisiana Act of Donation in Trust by Settlor to Trustee? US Legal Forms is your preferred option.

Whether you require a straightforward arrangement to establish guidelines for living together with your partner or a collection of documents to progress your divorce through the legal system, we have you covered. Our site features over 85,000 current legal document templates for both personal and business use. All templates we provide are not generic and tailored according to the stipulations of individual states and regions.

To obtain the form, you must Log In to your account, locate the necessary template, and click the Download button adjacent to it. Please keep in mind that you can access your previously acquired document templates at any time through the My documents tab.

Is this your first visit to our platform? No problem. You can create an account within minutes, but prior to that, ensure to do the following.

Now you can register your account. Next, choose the subscription option and continue to payment. After the payment is finalized, download the New Orleans Louisiana Act of Donation in Trust by Settlor to Trustee in any of the available formats. You can return to the website whenever necessary and redownload the form at no extra charge.

Finding current legal documents has never been simpler. Try US Legal Forms today, and say goodbye to spending hours searching for legal papers online.

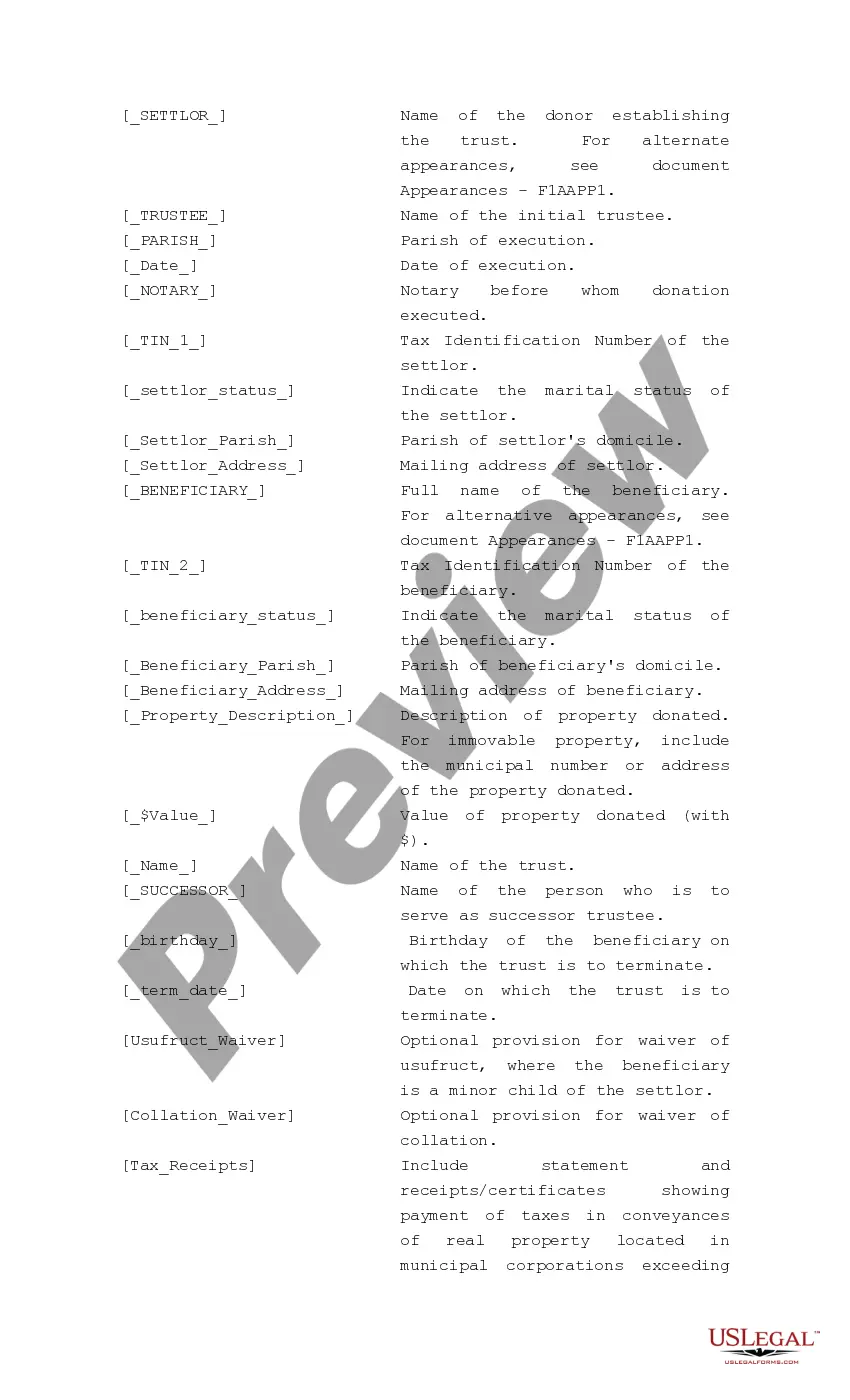

- Verify that the New Orleans Louisiana Act of Donation in Trust by Settlor to Trustee complies with your state and local regulations.

- Review the details of the form (if provided) to determine who and what the form is applicable for.

- Initiate the search again if the template does not fit your legal situation.

Form popularity

FAQ

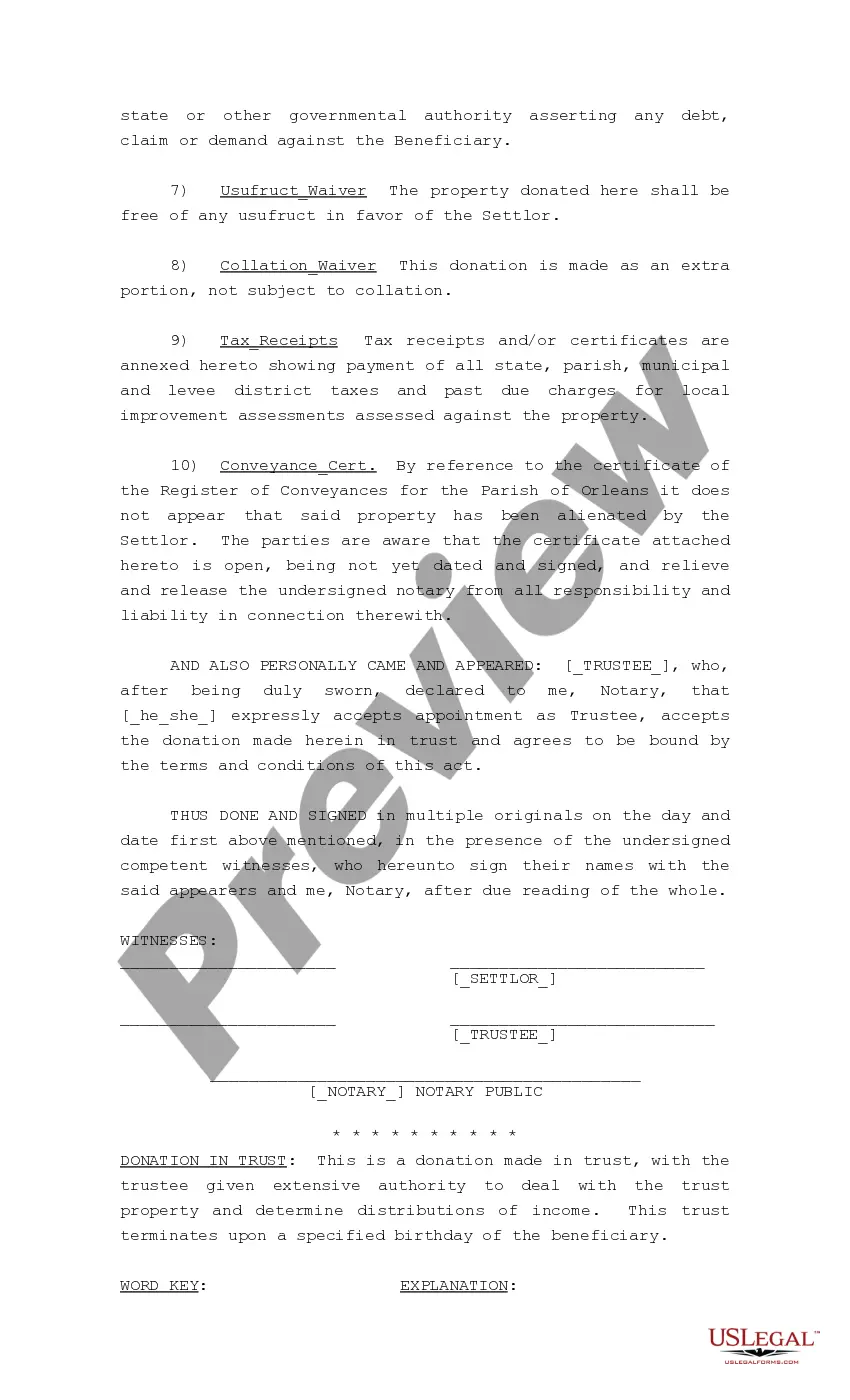

To do an act of donation for a car in Louisiana, you need to create a written document specifying the gift. This document must then be notarized to fulfill legal requirements. Utilizing the New Orleans Louisiana Act of Donation in Trust by Settlor to Trustee helps you navigate this process smoothly, ensuring that the transfer of ownership is legitimate and recognized by the state.

Yes, you can donate a house to a family member in Louisiana using an act of donation. This legal framework allows you to transfer ownership to a loved one without requiring any payment. With the New Orleans Louisiana Act of Donation in Trust by Settlor to Trustee, you can complete the process seamlessly and ensure all necessary steps are followed.

An act of donation title transfer involves changing the ownership of property from one individual to another as a gift. This process is officially documented in writing and requires notarization to be enforceable. The New Orleans Louisiana Act of Donation in Trust by Settlor to Trustee streamlines this title transfer process, protecting both the donor and the recipient.

Yes, an act of donation in Louisiana requires notarization to be legally effective. The presence of a notary provides authenticity and ensures that the transaction is valid. When drafting a New Orleans Louisiana Act of Donation in Trust by Settlor to Trustee, it is crucial to have a qualified notary involved to complete the process properly.

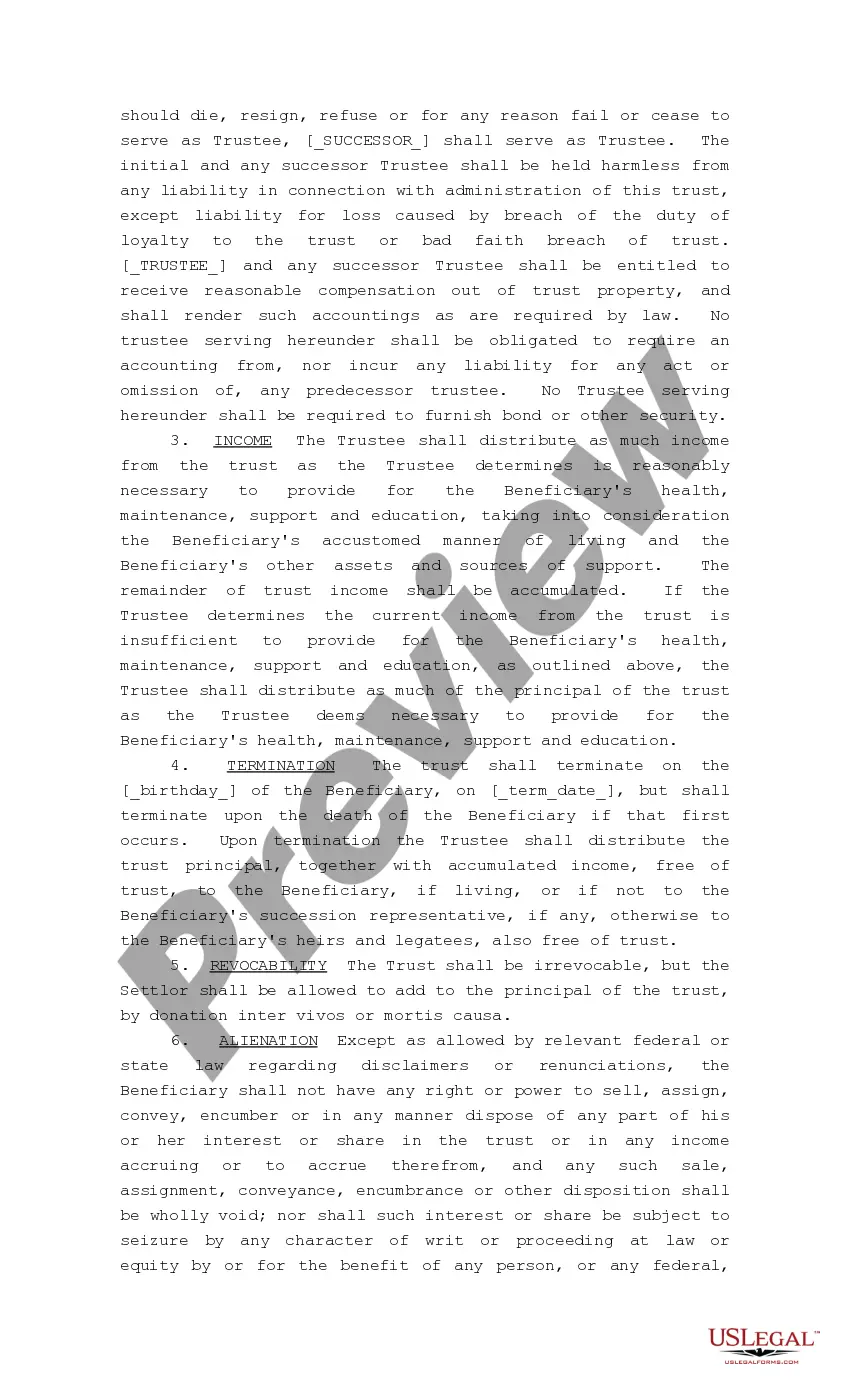

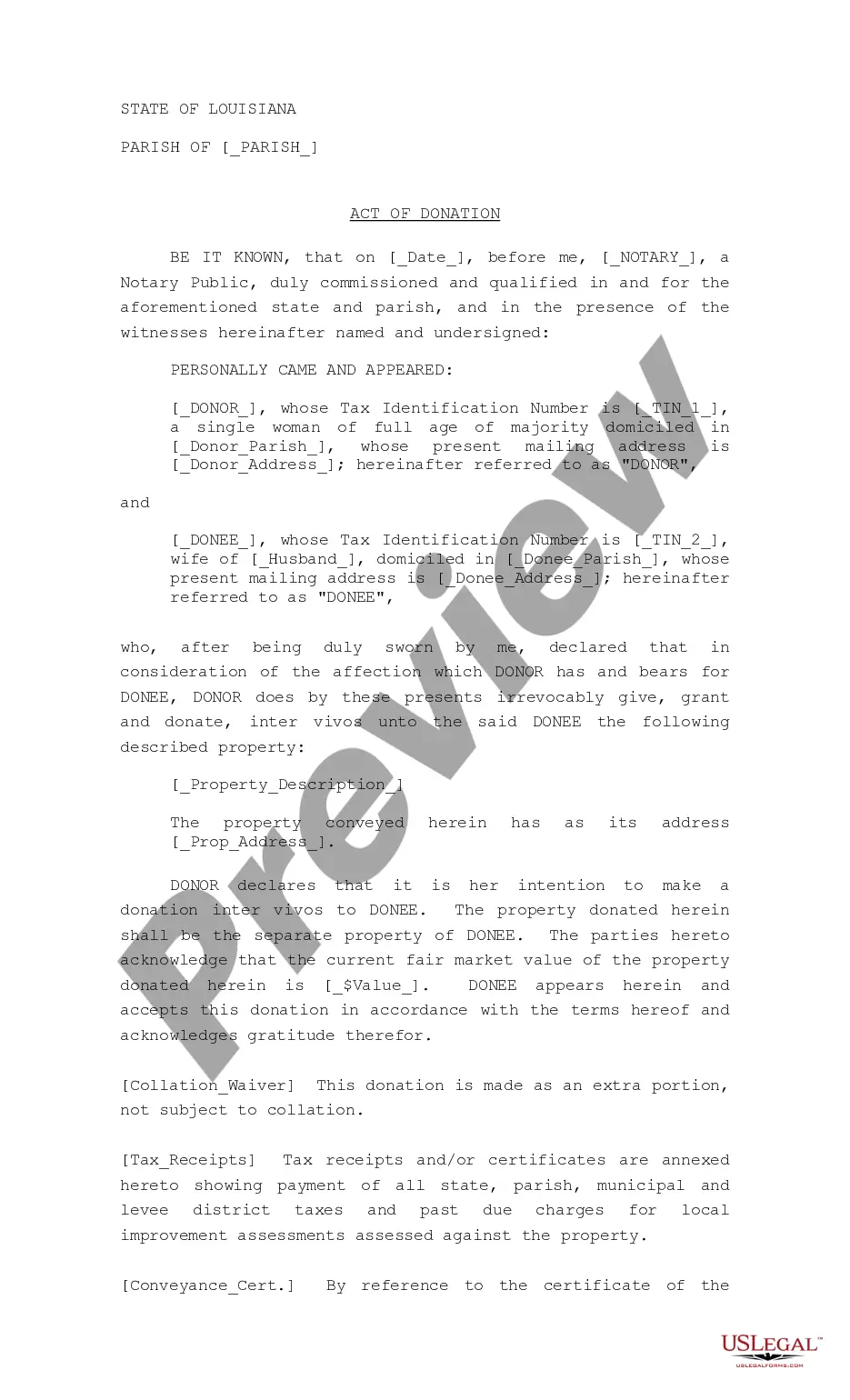

In Louisiana, an act of donation allows a person to transfer ownership of property to another without needing any payment. This legal process involves the settlor, who is the person making the donation, and the trustee, who receives the property in trust. The New Orleans Louisiana Act of Donation in Trust by Settlor to Trustee facilitates this transfer, ensuring that both parties follow state laws.

The laws governing property donation in Louisiana, particularly under the framework of the New Orleans Louisiana Act of Donation in Trust by Settlor to Trustee, require adherence to specific regulations regarding ownership transfer. Proper documentation and legal procedures must be followed to ensure valid property donations. Consulting a professional on this matter can help ensure you meet all legal requirements.

A trustee may have the authority to make gifts from the trust under the New Orleans Louisiana Act of Donation in Trust by Settlor to Trustee, but this power requires careful consideration. Gifts must align with the trust’s purpose and the best interests of the beneficiaries. It's advisable to seek guidance from legal experts to navigate these decisions prudently.

Yes, a trustee can claim reasonable expenses from the trust, provided that these expenses are for the administration of the trust. The New Orleans Louisiana Act of Donation in Trust by Settlor to Trustee allows trustees to be reimbursed for necessary expenses that benefit the trust and its beneficiaries. Proper documentation and transparency are crucial to maintain trust governance.

Distributions from a trust can be considered gifts, particularly if they are made to beneficiaries without any obligation of repayment. Under the New Orleans Louisiana Act of Donation in Trust by Settlor to Trustee, these distributions should be clearly outlined in the trust document to prevent confusion. Understanding the distinction between distributions and gifts is important for tax and legal purposes.

A trustee can give gifts from a trust, but they must act within the guidelines established by the New Orleans Louisiana Act of Donation in Trust by Settlor to Trustee. The trustee's authority typically depends on the terms of the trust document. It's essential to consult with a legal professional to ensure compliance with applicable laws and protect the interests of the beneficiaries.