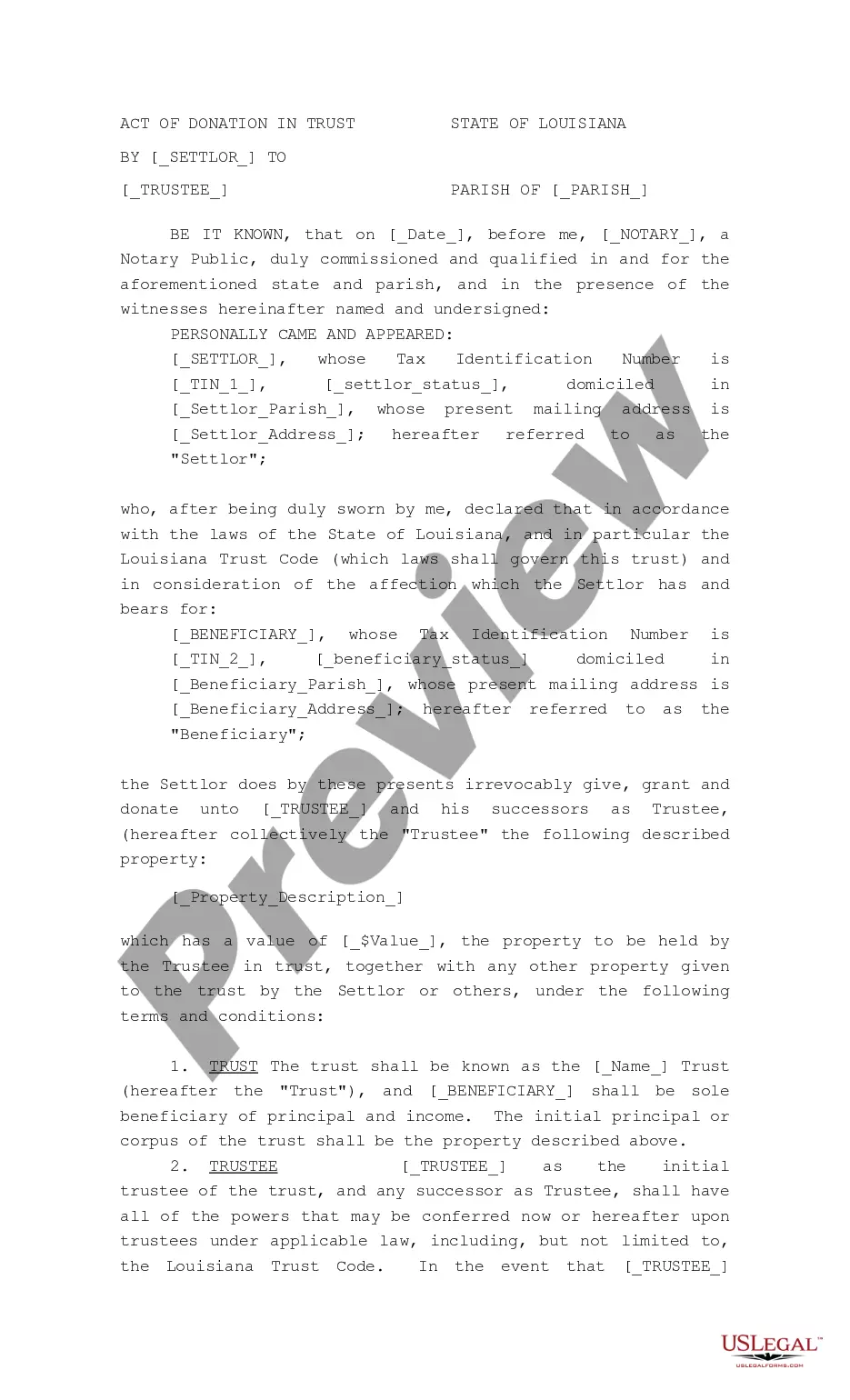

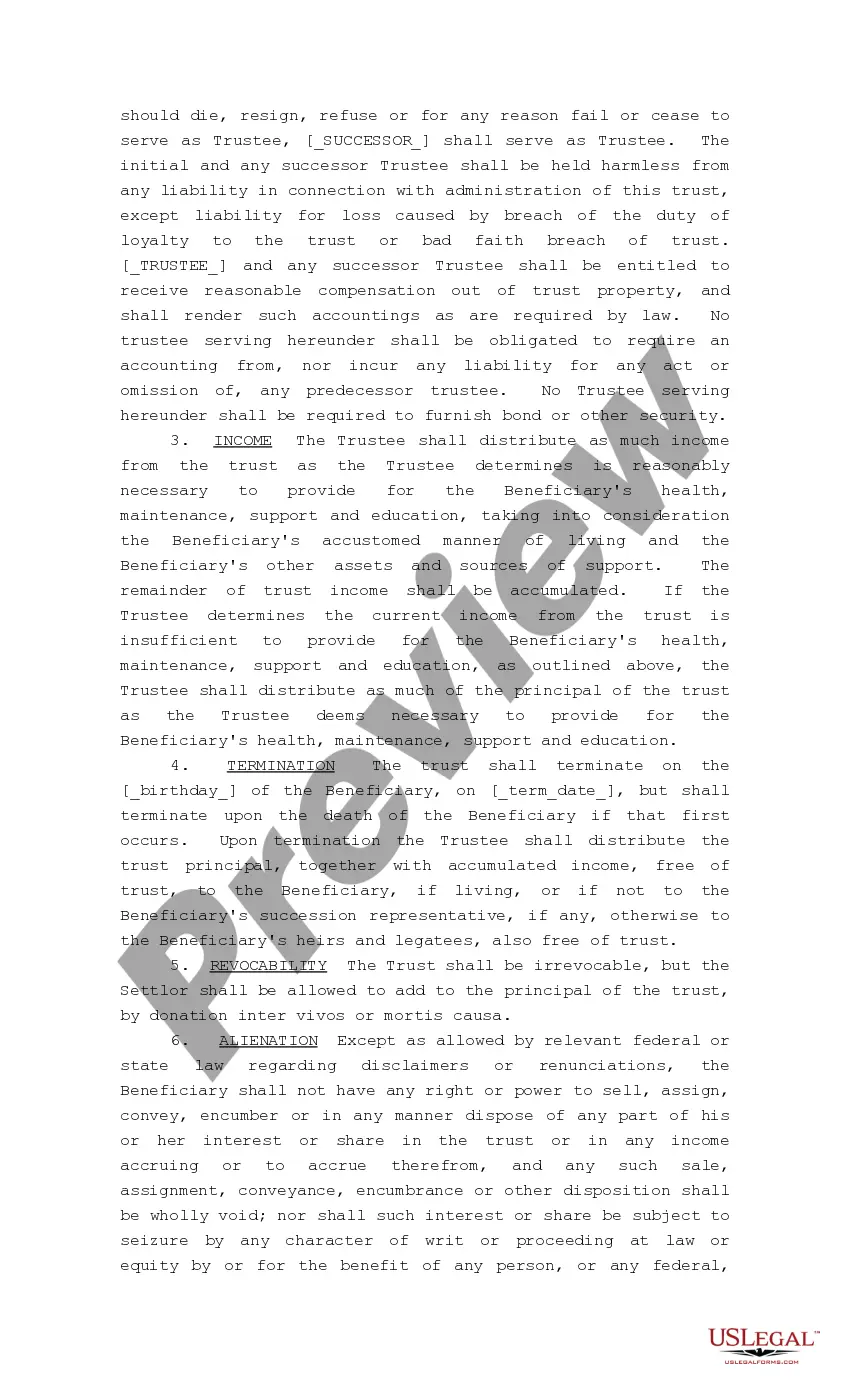

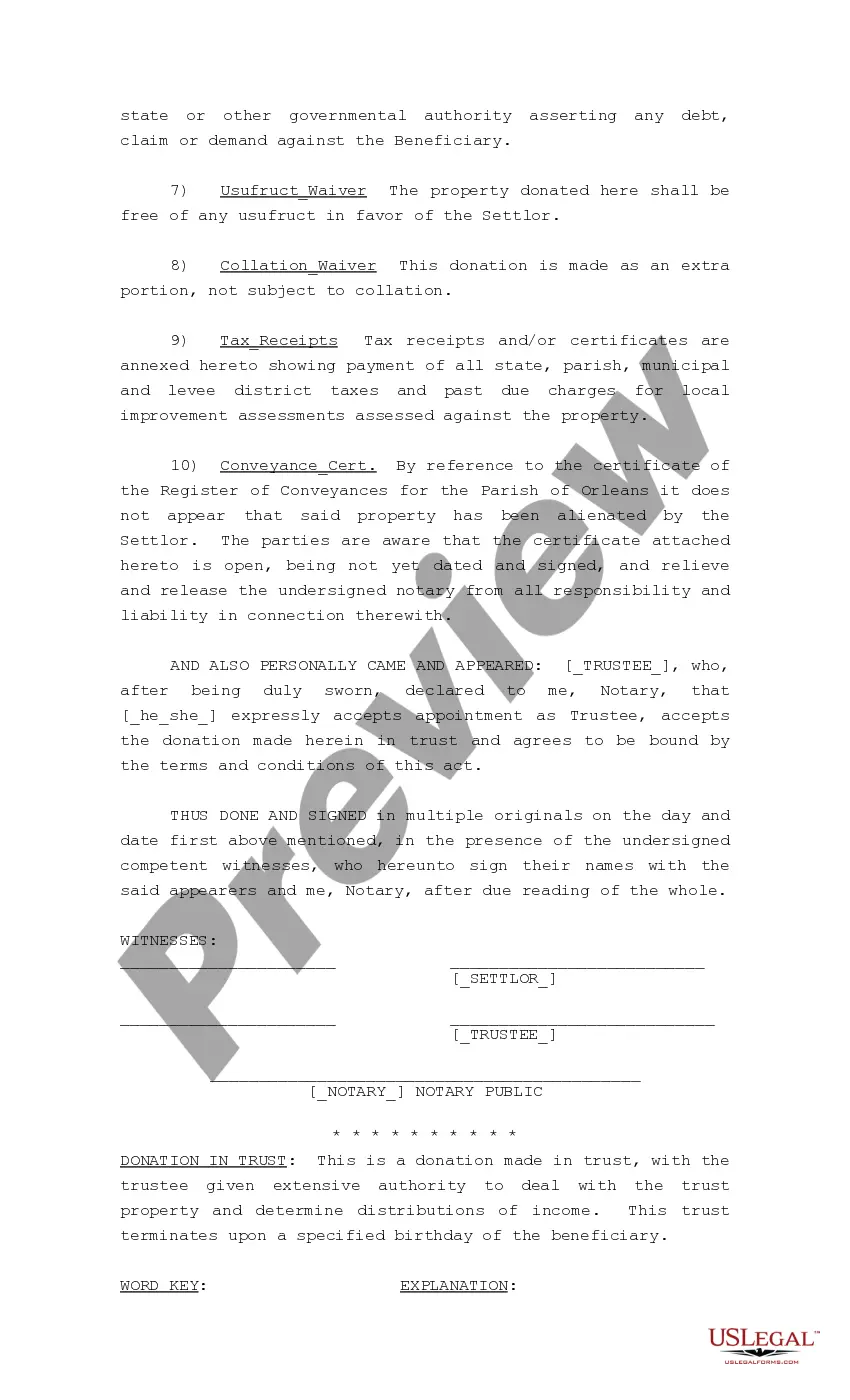

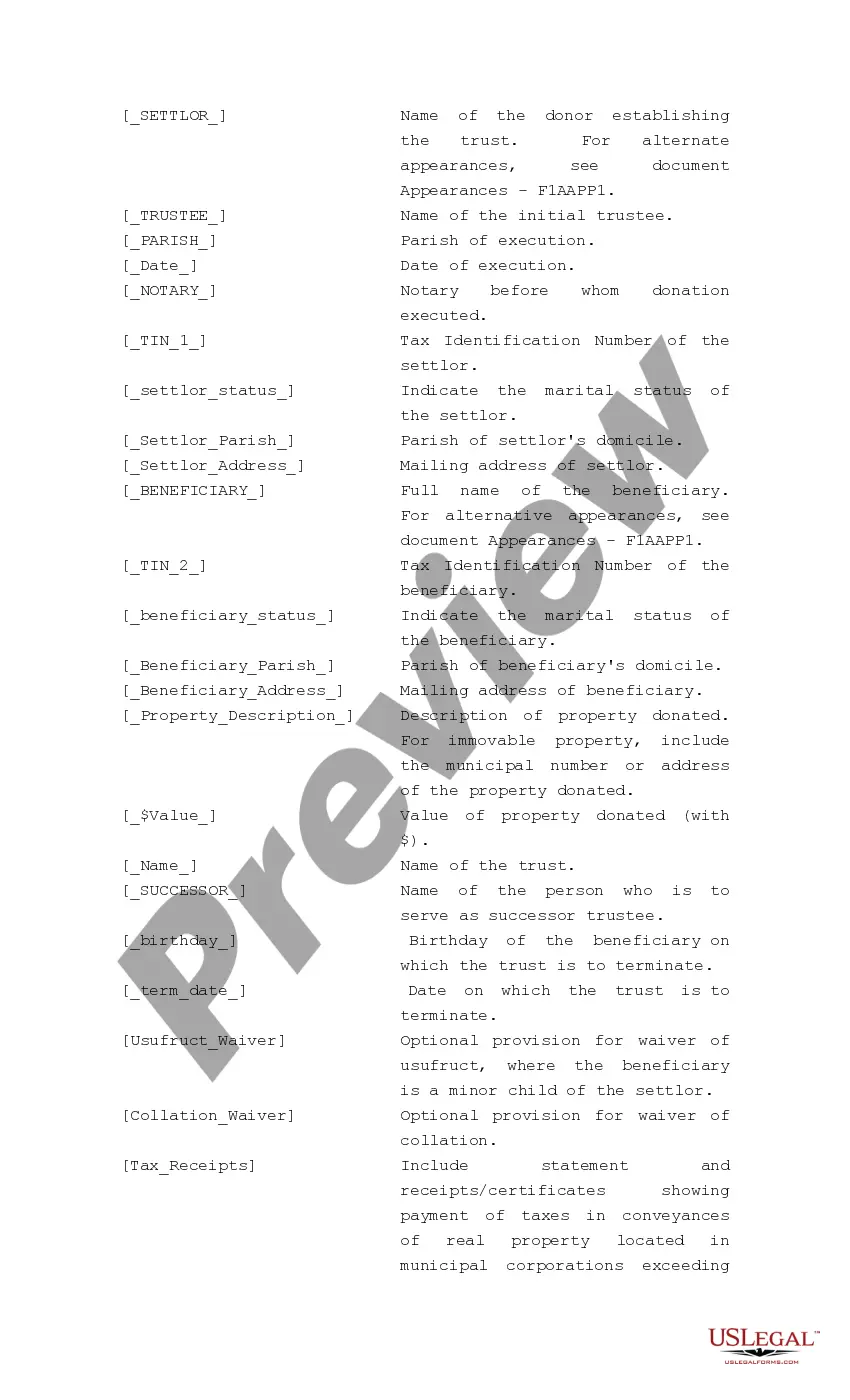

The Shreveport Louisiana Act of Donation in Trust by Settler to Trustee is a legal document that establishes a trust agreement between a settler, who is the individual creating the trust, and a trustee, who is responsible for managing and administering the trust assets. This act of donation in trust is governed by the laws of Shreveport, Louisiana, and specifies the terms and conditions under which the trust operates. The act of donation in trust can encompass various types, including revocable and irrevocable trusts. A revocable trust allows the settler to maintain control over their assets during their lifetime and make changes to the trust as needed. On the other hand, an irrevocable trust cannot be modified or revoked by the settler once it is established, providing a more secure and permanent structure for asset protection and estate planning purposes. The Shreveport Louisiana Act of Donation in Trust outlines specific provisions such as the identification of the settler, trustee, and beneficiaries. It includes details about the assets being transferred into the trust, which may include real estate, financial accounts, business interests, or personal property. The act also specifies the powers and responsibilities of the trustee, including investment management, distribution of income or principal, and the handling of any tax or legal matters related to the trust. Furthermore, the act of donation in trust describes the purpose of the trust, such as providing for the settler's family members, supporting charitable causes, or ensuring continuity of a business enterprise. It may also discuss restrictions and limitations on how the trust assets can be used or distributed to the beneficiaries. In summary, the Shreveport Louisiana Act of Donation in Trust by Settler to Trustee establishes a legally binding agreement between the settler and trustee, allowing for the creation and management of a trust. The different types of acts of donation in trust include revocable and irrevocable trusts, each suited to different goals and circumstances. Properly executed, this act enables individuals to protect and preserve their assets, provide for their loved ones, and leave a lasting legacy.

Shreveport Louisiana Act of Donation in Trust by Settlor to Trustee

Description

How to fill out Shreveport Louisiana Act Of Donation In Trust By Settlor To Trustee?

Are you in search of a reliable and affordable provider of legal forms to purchase the Shreveport Louisiana Act of Donation in Trust from Settlor to Trustee? US Legal Forms is your perfect option.

Whether you need a simple contract to establish rules for living with your partner or a collection of papers to facilitate your divorce process through the court, we have you covered. Our service offers over 85,000 current legal document templates for personal and business purposes. All templates we present are tailored and designed in accordance with the specifications of individual states and regions.

To retrieve the document, you must sign in to your account, find the necessary form, and click the Download button adjacent to it. Please consider that you can download your previously acquired document templates at any time from the My documents section.

Is this your first visit to our site? No problem. You can establish an account with great ease, but before that, ensure to do the following.

Now you can set up your account. Then select the subscription option and continue to payment. Once the payment is completed, download the Shreveport Louisiana Act of Donation in Trust from Settlor to Trustee in any available format. You can return to the website at any time and redownload the document at no additional cost.

Acquiring up-to-date legal documents has never been simpler. Try US Legal Forms now, and put an end to wasting your valuable time searching for legal documents online once and for all.

- Verify that the Shreveport Louisiana Act of Donation in Trust from Settlor to Trustee complies with the laws of your state and local jurisdiction.

- Review the form's description (if available) to understand who and what the document is suitable for.

- Restart the search if the form does not fit your particular situation.

Form popularity

FAQ

In Louisiana, the powers of a trustee include managing trust assets, making investment decisions, and distributing funds to beneficiaries based on the terms of the trust. These powers must be exercised in good faith and in adherence to the trust's purpose. The Shreveport Louisiana Act of Donation in Trust by Settlor to Trustee outlines these responsibilities, ensuring that trustees act within legal frameworks.

Yes, you can donate a house to a family member in Louisiana through an act of donation. This process allows you to transfer ownership while retaining certain benefits. When considering this, it is advisable to look into the Shreveport Louisiana Act of Donation in Trust by Settlor to Trustee to understand better how to structure the donation.

Trustees possess various powers ranging from managing investments to distributing income or principal to beneficiaries. They have a fiduciary duty to act in the best interests of the beneficiaries and must follow the trust's guidelines. Familiarity with the Shreveport Louisiana Act of Donation in Trust by Settlor to Trustee is essential for trustees to fulfill their responsibilities responsibly.

A trustee has the power to manage, invest, and distribute the assets within a trust. This role includes making decisions that align with the trust's objectives and the wishes of the settlor. By utilizing the Shreveport Louisiana Act of Donation in Trust by Settlor to Trustee, the trustee can execute their duties confidently and in accordance with legal standards.

Yes, a trust can own property in Louisiana. When establishing a trust, such as under the Shreveport Louisiana Act of Donation in Trust by Settlor to Trustee, the trust itself becomes the legal owner of the assets. This offers various advantages, including asset protection and estate planning benefits for the settlor and beneficiaries.

Yes, a trustee does have control over the trust's assets. The trustee manages and administers the property according to the terms set by the settlor. Understanding the Shreveport Louisiana Act of Donation in Trust by Settlor to Trustee can help both the settlor and trustee navigate their roles and responsibilities effectively.

Yes, you can complete an act of donation in Louisiana. This legal instrument allows you to transfer ownership of property or assets to another person without expecting anything in return. When structuring this act, it is beneficial to consider the Shreveport Louisiana Act of Donation in Trust by Settlor to Trustee to ensure clarity and compliance with local laws.

A trustee acts on behalf of the beneficiaries named in the trust. This person or entity is responsible for managing the trust assets in accordance with the terms established by the settlor. The Shreveport Louisiana Act of Donation in Trust by Settlor to Trustee helps clarify this relationship, ensuring that the trustee operates in the best interests of those meant to benefit from the trust.

The trustee acting on behalf of the trust is the individual or entity designated to manage and administer the trust's assets. This role involves handling investments, distributions, and upholding the terms set forth in the trust document. Under the Shreveport Louisiana Act of Donation in Trust by Settlor to Trustee, the trustee must act impartially and prioritize the interests of the beneficiaries at all times.

Whether you are a trustee on behalf of a trust depends on your designation within the trust structure. If you have been appointed by the settlor, you assume the role of managing the trust assets and executing its terms. The Shreveport Louisiana Act of Donation in Trust by Settlor to Trustee outlines the responsibilities and expectations placed on a trustee, ensuring a clear understanding of your obligations.