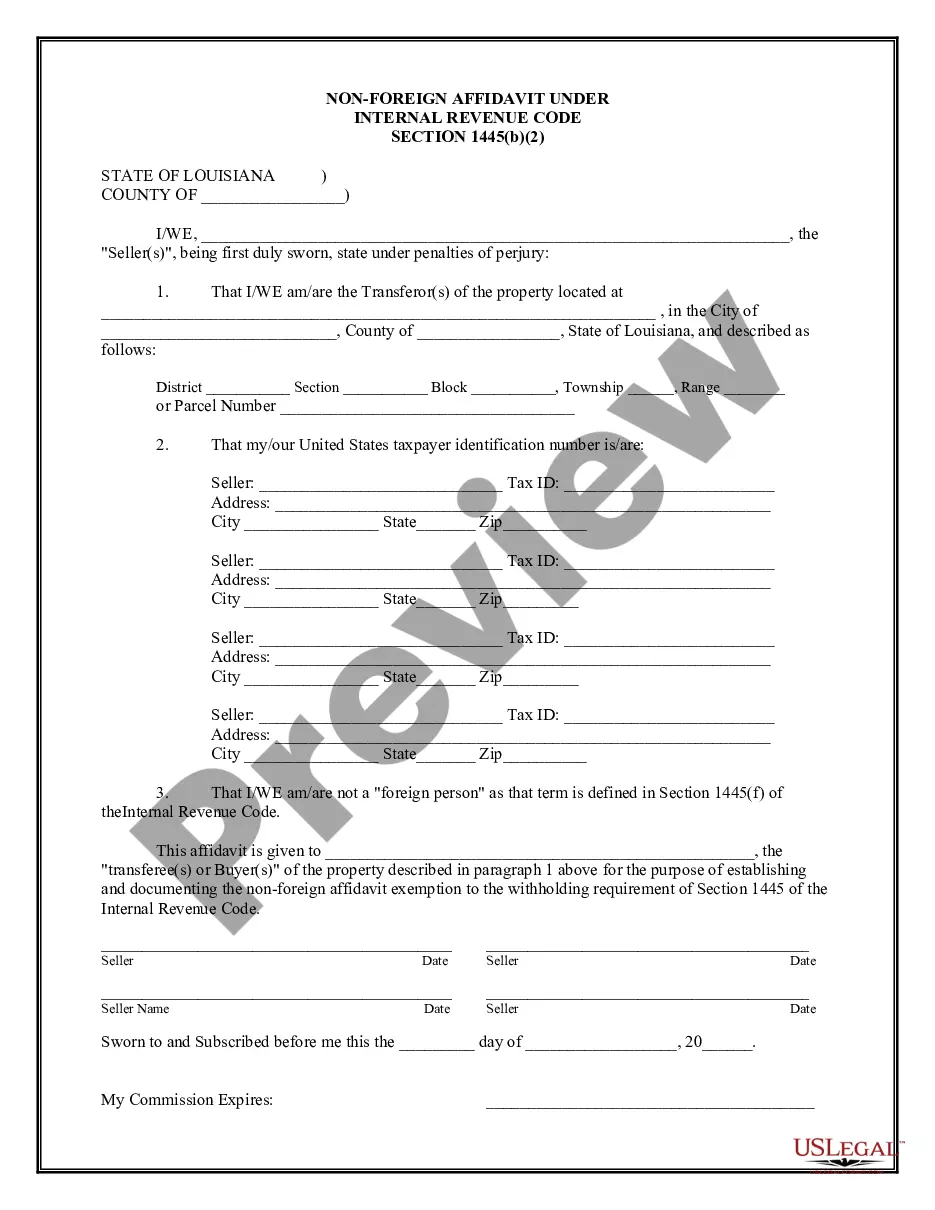

New Orleans Louisiana Non-Foreign Affidavit Under IRC 1445: A Comprehensive Guide Introduction: In the realm of property transactions, New Orleans, Louisiana, has specific regulations governing non-foreign individuals or entities participating in real estate deals. One such requirement is the New Orleans Louisiana Non-Foreign Affidavit Under IRC 1445, which plays a crucial role in property transfers involving non-foreign parties. This comprehensive guide aims to provide a detailed description of what this affidavit entails, its purpose, and any different types that may exist. What is the New Orleans Louisiana Non-Foreign Affidavit Under IRC 1445? The New Orleans Louisiana Non-Foreign Affidavit Under IRC 1445 is a legally binding document that serves as proof or certification asserting the non-foreign status of a party involved in a property transaction. It specifically relates to transactions subject to the provisions of Internal Revenue Code (IRC) Section 1445. Purpose and Importance: The purpose of this affidavit is to confirm that the seller, buyer, or any other party with an interest in the real estate transaction is not considered a foreign person as defined by the IRS. Under IRC Section 1445, any purchaser (transferee) acquiring US real property interests must withhold a specific percentage of the total purchase price or the amount realized by the foreign seller. However, this withholding requirement is not applicable if the seller provides a valid Non-Foreign Affidavit. The affidavit acts as a declaration made under oath, helping to establish the non-foreign status of the involved party. It provides assurance to the Internal Revenue Service (IRS) that appropriate taxes will be paid, thereby granting exemption from the withholding obligation. Different Types of New Orleans Louisiana Non-Foreign Affidavit Under IRC 1445: While there may not be distinct types of Non-Foreign Affidavit specific to New Orleans, the underlying purpose and content of the affidavit remain consistent. However, it is important to note that there might be variations in language or format, as long as they adhere to the IRS requirements. Key Elements of the Affidavit: 1. Identification: The affidavit must include the full legal name, address, and taxpayer identification number of the declaring, who may be the seller or any party with an interest in the transaction. 2. Certification of Non-Foreign Status: This section should include a statement confirming that the declaring is not a foreign person within the meaning of IRC Section 1445. 3. Signature and Sworn Oath: The affidavit must be signed by the declaring before a notary public or other authorized personnel. The declaring must declare, under penalty of perjury, that the information provided is true and correct to the best of their knowledge and belief. Submitting the Affidavit: Once completed and duly signed, the Non-Foreign Affidavit is typically submitted to the relevant parties involved in the real estate transaction. This may include the buyer, the buyer's attorney, the settlement agent, or the title company responsible for the closing process. Retaining a copy of the affidavit is advisable for record-keeping purposes. Conclusion: Understanding the New Orleans Louisiana Non-Foreign Affidavit Under IRC 1445 is essential when engaging in real estate transactions within the jurisdiction. In compliance with IRS regulations, this affidavit enables non-foreign parties to exempt themselves from the withholding requirements associated with the purchase of US real property interests. While there may not be different types of this affidavit, its components, purpose, and submission protocols remain consistent, safeguarding the smooth execution of property transfers in New Orleans, Louisiana.

New Orleans Louisiana Non-Foreign Affidavit Under IRC 1445

Description

How to fill out New Orleans Louisiana Non-Foreign Affidavit Under IRC 1445?

We always want to minimize or prevent legal damage when dealing with nuanced legal or financial affairs. To accomplish this, we apply for legal solutions that, as a rule, are extremely expensive. However, not all legal issues are as just complex. Most of them can be taken care of by ourselves.

US Legal Forms is an online catalog of up-to-date DIY legal forms addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your affairs into your own hands without the need of using services of an attorney. We provide access to legal document templates that aren’t always openly accessible. Our templates are state- and area-specific, which considerably facilitates the search process.

Take advantage of US Legal Forms whenever you need to get and download the New Orleans Louisiana Non-Foreign Affidavit Under IRC 1445 or any other document quickly and securely. Simply log in to your account and click the Get button next to it. If you happened to lose the form, you can always re-download it from within the My Forms tab.

The process is just as effortless if you’re new to the website! You can create your account in a matter of minutes.

- Make sure to check if the New Orleans Louisiana Non-Foreign Affidavit Under IRC 1445 complies with the laws and regulations of your your state and area.

- Also, it’s crucial that you check out the form’s outline (if available), and if you notice any discrepancies with what you were looking for in the first place, search for a different form.

- Once you’ve made sure that the New Orleans Louisiana Non-Foreign Affidavit Under IRC 1445 is proper for your case, you can pick the subscription plan and proceed to payment.

- Then you can download the form in any available format.

For over 24 years of our existence, we’ve served millions of people by offering ready to customize and up-to-date legal forms. Make the most of US Legal Forms now to save efforts and resources!