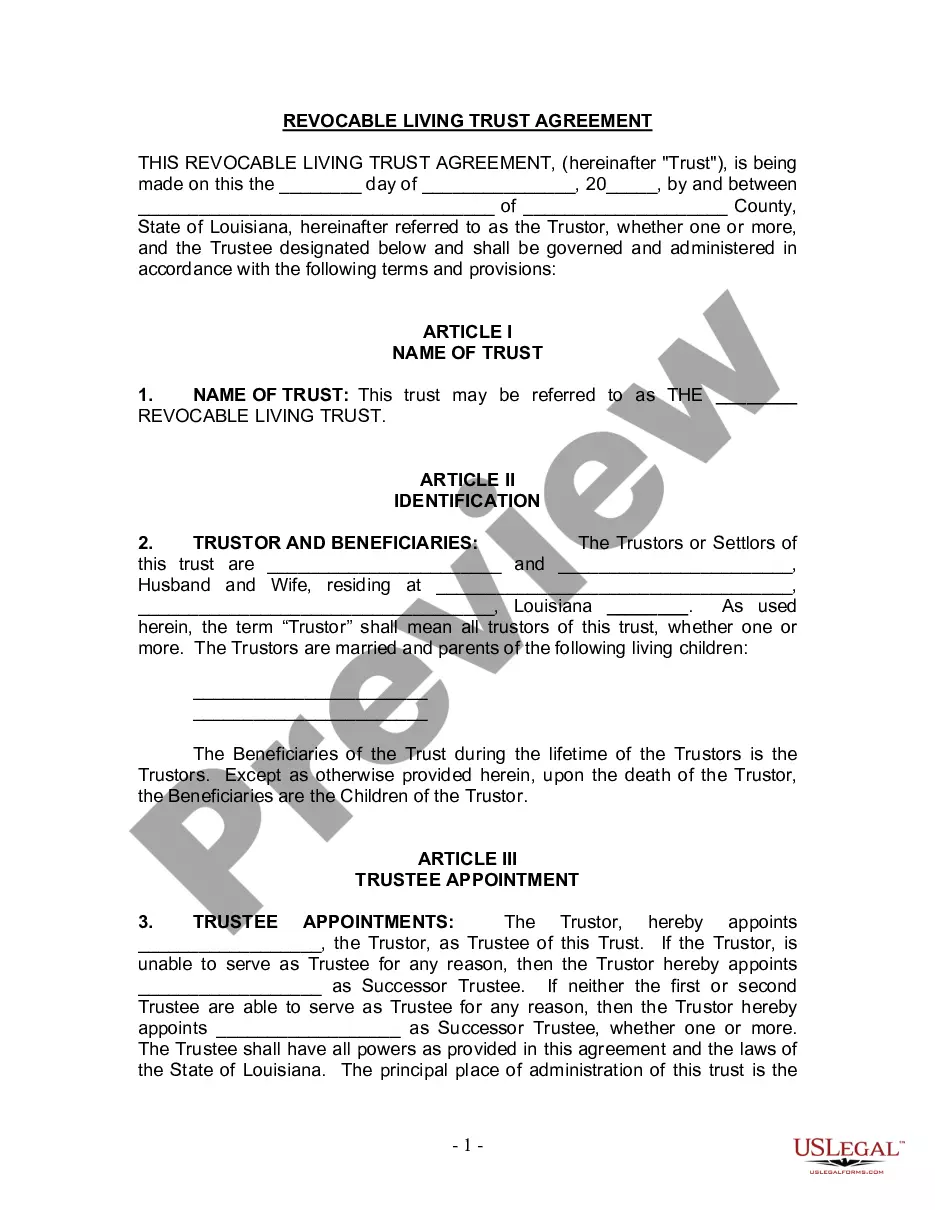

Baton Rouge Louisiana Living Trust for Husband and Wife with Minor and or Adult Children

Description

How to fill out Louisiana Living Trust For Husband And Wife With Minor And Or Adult Children?

Regardless of social or professional standing, filling out legal documents is an unfortunate requirement in today's society.

Often, it is nearly impossible for someone without legal training to generate such paperwork from the beginning, largely due to the intricate terminology and legal nuances they entail.

This is where US Legal Forms proves useful.

Verify that the template you've located is suitable for your region since the laws of one state or locality may not apply to another.

Review the form and check a brief summary (if available) of situations the document can be utilized for.

- Our service provides an extensive assortment featuring over 85,000 ready-to-use state-specific forms suitable for almost any legal situation.

- US Legal Forms is also a remarkable resource for partners or legal advisers looking to save time with our do-it-yourself forms.

- Whether you need the Baton Rouge Louisiana Living Trust for Husband and Wife with Minor and or Adult Children or any other document appropriate for your state or locality, US Legal Forms puts everything at your disposal.

- Here’s a quick guide on how to obtain the Baton Rouge Louisiana Living Trust for Husband and Wife with Minor and or Adult Children efficiently using our trustworthy service.

- If you're already a customer, you can proceed to Log In to your account to access the necessary form.

- But if you're unfamiliar with our library, be sure to follow these steps before acquiring the Baton Rouge Louisiana Living Trust for Husband and Wife with Minor and or Adult Children.

Form popularity

FAQ

Yes, Louisiana does tax trust income, but the rates and rules can vary. A Baton Rouge Louisiana Living Trust for Husband and Wife with Minor and or Adult Children must file tax returns if it generates income. It's important to consult a tax professional to understand your obligations and to ensure compliance with state tax laws.

Creating a Baton Rouge Louisiana Living Trust for Husband and Wife with Minor and or Adult Children involves several key steps. First, identify the assets you want to place in the trust and choose a reliable trustee. Next, formally draft the trust document, which outlines your wishes for asset distribution. Using platforms like uslegalforms can simplify this process, providing templates and guidance tailored to Louisiana laws.

In Louisiana, a Baton Rouge Louisiana Living Trust for Husband and Wife with Minor and or Adult Children typically does not need to be recorded, making it a private agreement. However, if the trust holds real estate, it may be necessary to file certain documents with the local parish. Always consider consulting with an expert in estate planning to ensure your trust is set up correctly and fulfills all legal obligations.

A Baton Rouge Louisiana Living Trust for Husband and Wife with Minor and or Adult Children operates by placing your assets into the trust while you're alive. You retain control over these assets, and upon your passing, they are managed by a designated trustee according to your instructions. This process allows for a quicker distribution of assets to your beneficiaries, ensuring they receive what you intended without the delays of probate.

In Louisiana, a Baton Rouge Louisiana Living Trust for Husband and Wife with Minor and or Adult Children does not necessarily need to be notarized, but having it notarized can add a layer of legitimacy and protection. Notarization can help validate the creator's intentions and prevent potential disputes among heirs. It's advisable to consult with an attorney or a professional service to ensure your trust meets all legal requirements.

Choosing between a will and a Baton Rouge Louisiana Living Trust for Husband and Wife with Minor and or Adult Children often depends on your family's needs. A trust can provide more privacy and avoid the lengthy probate process associated with wills. While a will becomes a matter of public record, a trust allows for a smoother transition of assets upon death. Consider your specific situation when deciding, as a trust often offers more control over your estate.

A surviving spouse trust is designed to provide financial security for the remaining spouse while preserving assets for children. It allows the surviving spouse to benefit from the trust assets during their lifetime, ensuring that your Baton Rouge Louisiana Living Trust for Husband and Wife with Minor and or Adult Children functions as intended. This arrangement offers peace of mind for families navigating complex estate planning issues.

Creating a trust in Louisiana involves drafting the trust document and designating assets to be included in the trust. A Baton Rouge Louisiana Living Trust for Husband and Wife with Minor and or Adult Children is a great option for protecting your family's future. Using services like USLegalForms makes this process easier, as they provide clear instructions and forms you can easily fill out.

To get a living trust in Louisiana, you can start by researching the requirements specific to your situation. Using a trusted platform like USLegalForms, you can access the necessary documents and templates tailored for a Baton Rouge Louisiana Living Trust for Husband and Wife with Minor and or Adult Children. Completing these forms online simplifies the process, ensuring that your trust is set up correctly.

The least expensive way to set up a Baton Rouge Louisiana Living Trust for Husband and Wife with Minor and or Adult Children typically involves using online legal services, such as USLegalForms. These platforms offer affordable templates that guide you through the process. By following their straightforward instructions, you can create a trust without incurring high attorney fees.