Baton Rouge Louisiana Amendment to Living Trust

Description

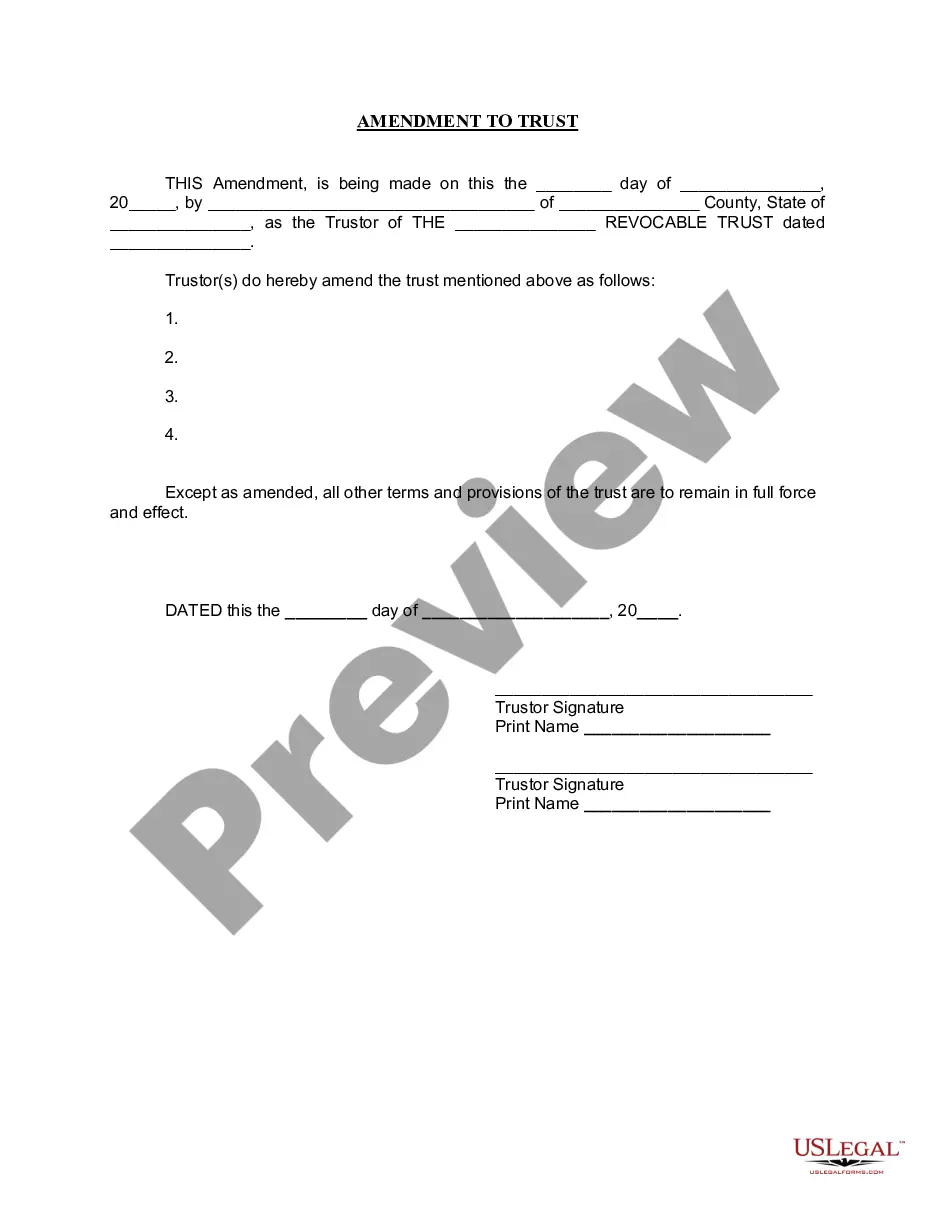

How to fill out Louisiana Amendment To Living Trust?

Utilize the US Legal Forms and gain instant access to any document sample you need.

Our user-friendly website featuring thousands of documents streamlines the process of locating and acquiring virtually any document sample you desire.

You can export, complete, and verify the Baton Rouge Louisiana Amendment to Living Trust in just a few minutes rather than spending hours online trying to locate the correct template.

Using our catalog is an excellent method to enhance the security of your document submissions.

If you haven't created an account yet, follow the instructions provided below.

- Our knowledgeable legal experts routinely examine all documents to ensure that the forms are applicable for a specific state and adhere to current laws and regulations.

- How can you obtain the Baton Rouge Louisiana Amendment to Living Trust.

- If you have an account, simply Log In to your profile.

- The Download button will become active on all documents you review.

- Additionally, you can access all previously saved forms from the My documents section.

Form popularity

FAQ

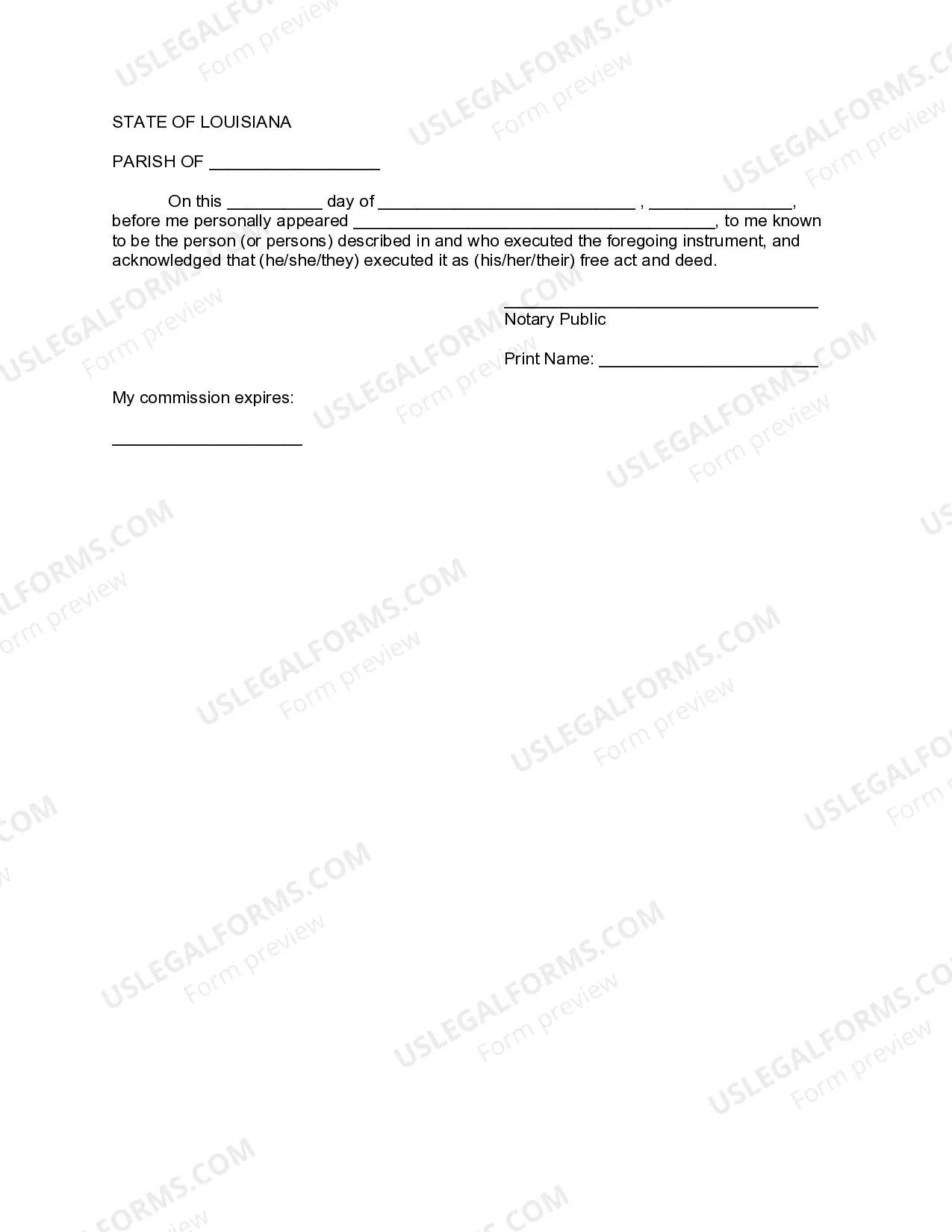

In Louisiana, a trust does not need to be recorded, but certain assets within the trust may require specific documentation or registration. It is essential to maintain precise records of trust assets, as this will facilitate smoother management and distribution. For more comprehensive estate planning solutions, consider the benefits of using uslegalforms. Their resources can simplify the management of your Baton Rouge Louisiana Amendment to Living Trust.

The best way to amend a trust involves preparing a trust amendment document that clearly outlines the changes you wish to make. Ensure this amendment is signed and dated to make it legally binding. Consulting with an estate planning attorney can provide guidance tailored to your unique needs. Using uslegalforms can also streamline this process, ensuring that your Baton Rouge Louisiana Amendment to Living Trust adheres to state requirements.

Choosing between a will and a trust in Louisiana depends on your personal circumstances. A living trust offers benefits such as avoiding probate and maintaining privacy, while a will is generally simpler to create. If you prefer to have more control over your assets during your lifetime and ensure a smooth transition after your death, a Baton Rouge Louisiana Amendment to Living Trust may be the better choice.

An amendment to the trust agreement is a formal change made to the original trust document. This can involve adding or removing assets, altering beneficiaries, or adjusting terms to reflect your current wishes. In Baton Rouge, making amendments is a straightforward process that can help ensure your trust remains up to date with your evolving situation and desires.

In Louisiana, a living trust functions as a legal document that holds your assets and outlines how they will be managed during your lifetime and distributed after your death. Unlike a will, a trust bypasses the probate process, allowing for quicker distribution of your estate. It grants you flexibility, as you can modify it as your circumstances change. The Baton Rouge Louisiana Amendment to Living Trust allows you to update these provisions when necessary.

The best way to set up a living trust in Baton Rouge is to start with clear objectives. First, identify your assets and decide how you want them distributed upon your passing. Consulting a local attorney who specializes in estate planning can help you create a trust that meets both your needs and state laws. Utilizing platforms like uslegalforms can simplify the paperwork and ensure compliance with local regulations.

An amendment makes specific changes to an existing trust document, while an amendment and restatement involves rewriting the entire trust document to incorporate changes. When making a Baton Rouge Louisiana Amendment to Living Trust, you may opt for restatement if substantial revisions are needed, providing clarity and coherence to the terms. Understanding this distinction ensures your trust accurately reflects your intentions.

The settlor, also known as the grantor or trustor, is the individual who creates the trust and populates it with assets. In a Baton Rouge Louisiana Amendment to Living Trust, the settlor defines the terms and conditions under which the trust operates. This role is crucial, as it determines how the trust will be managed and who will benefit from it.

An amendment to a trust involves making changes to the original trust document, such as altering beneficiaries, updating trustee information, or adjusting terms. In the context of a Baton Rouge Louisiana Amendment to Living Trust, this process allows you to keep your estate plan aligned with your current wishes. Regularly reviewing and amending your trust is a good practice as life circumstances change.

The key difference between a revocable and irrevocable trust lies in control and flexibility. Revocable trusts can be altered or terminated at any time by the grantor, while irrevocable trusts generally cannot be changed after they are created. Choosing the right type of trust is essential when drafting a Baton Rouge Louisiana Amendment to Living Trust, as it impacts estate taxes and asset protection.