Shreveport Louisiana Amendment to Living Trust

Description

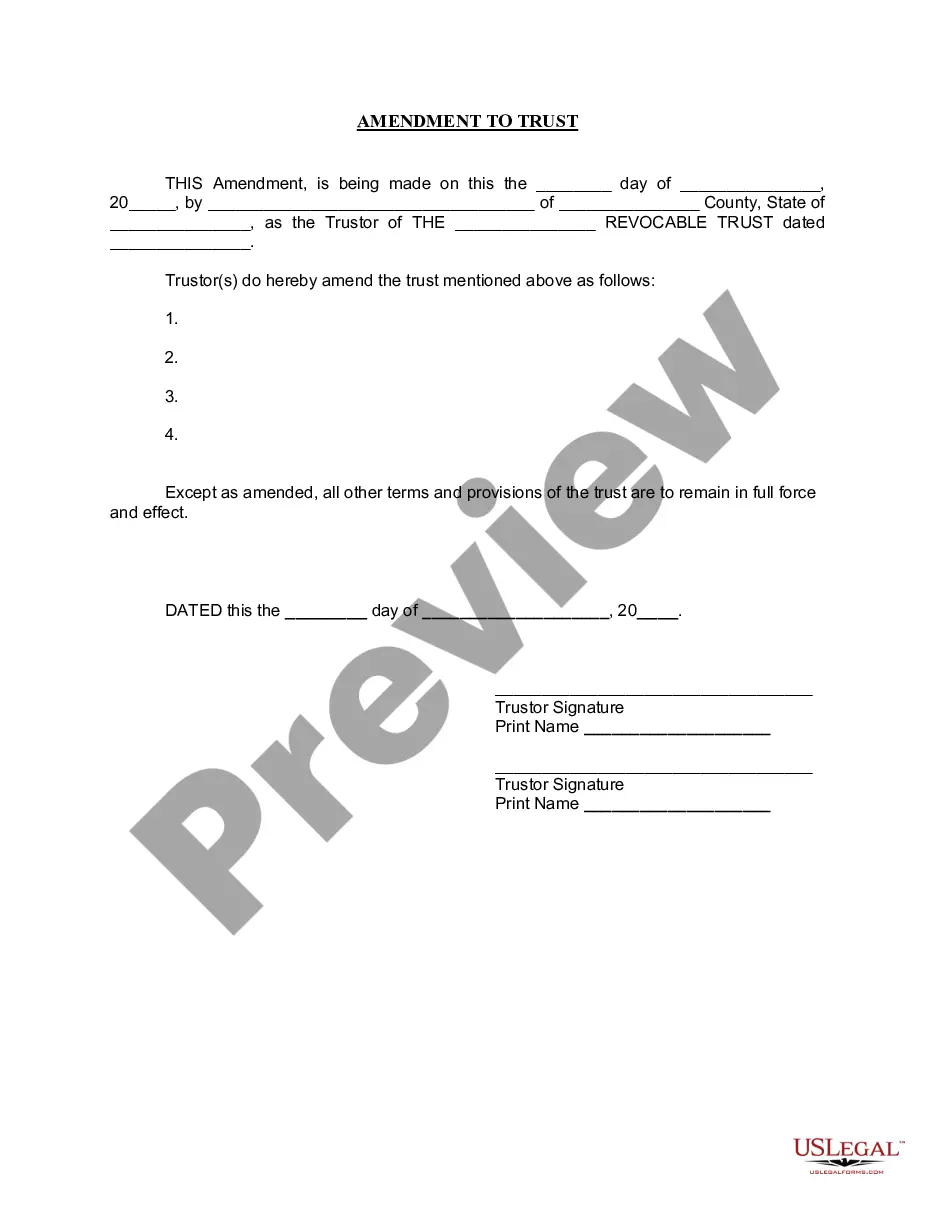

How to fill out Louisiana Amendment To Living Trust?

Finding authenticated templates tailored to your local statutes can be challenging unless you utilize the US Legal Forms repository.

It’s a digital collection of over 85,000 legal documents for both personal and business purposes, covering a variety of real-world situations.

All the paperwork is appropriately organized by category and jurisdictional regions, making the search for the Shreveport Louisiana Amendment to Living Trust as simple as one-two-three.

Maintaining documents organized and compliant with legal standards is of significant importance. Take advantage of the US Legal Forms repository to always have vital document templates for any needs at your fingertips!

- Verify the Preview mode and document description.

- Ensure you’ve picked the right one that fulfills your needs and fully aligns with your local jurisdiction standards.

- Search for an alternative template, if necessary.

- If you encounter any discrepancies, utilize the Search tab above to locate the correct one.

- If it meets your requirements, proceed to the next step.

Form popularity

FAQ

A revocable trust allows you to change or terminate the trust during your lifetime, giving you flexibility. In contrast, an irrevocable trust typically cannot be altered once established, providing benefits like tax advantages and creditor protection. Understanding these differences is crucial when considering the Shreveport Louisiana Amendment to Living Trust for your estate planning.

Amending a trust deed usually involves drafting a specific amendment that details the intended changes to the original document. It’s crucial to sign this amendment, and ideally have it notarized, depending on state requirements. Learning about the Shreveport Louisiana Amendment to Living Trust can guide you on the proper format and necessary steps in your jurisdiction.

An amendment to the trust is a legal document that modifies the terms of the existing trust. This could involve changing beneficiaries, altering trustee powers, or even updating property distributions. Reviewing the Shreveport Louisiana Amendment to Living Trust can provide insights into best practices for making these essential updates.

To change the beneficiaries of a trust, you need to create an amendment to the trust document that clearly outlines the new beneficiaries and the changes made. Make sure to follow the specific state laws applicable to the Shreveport Louisiana Amendment to Living Trust, which may require two witnesses or notarization. This ensures your changes are valid and recognized legally.

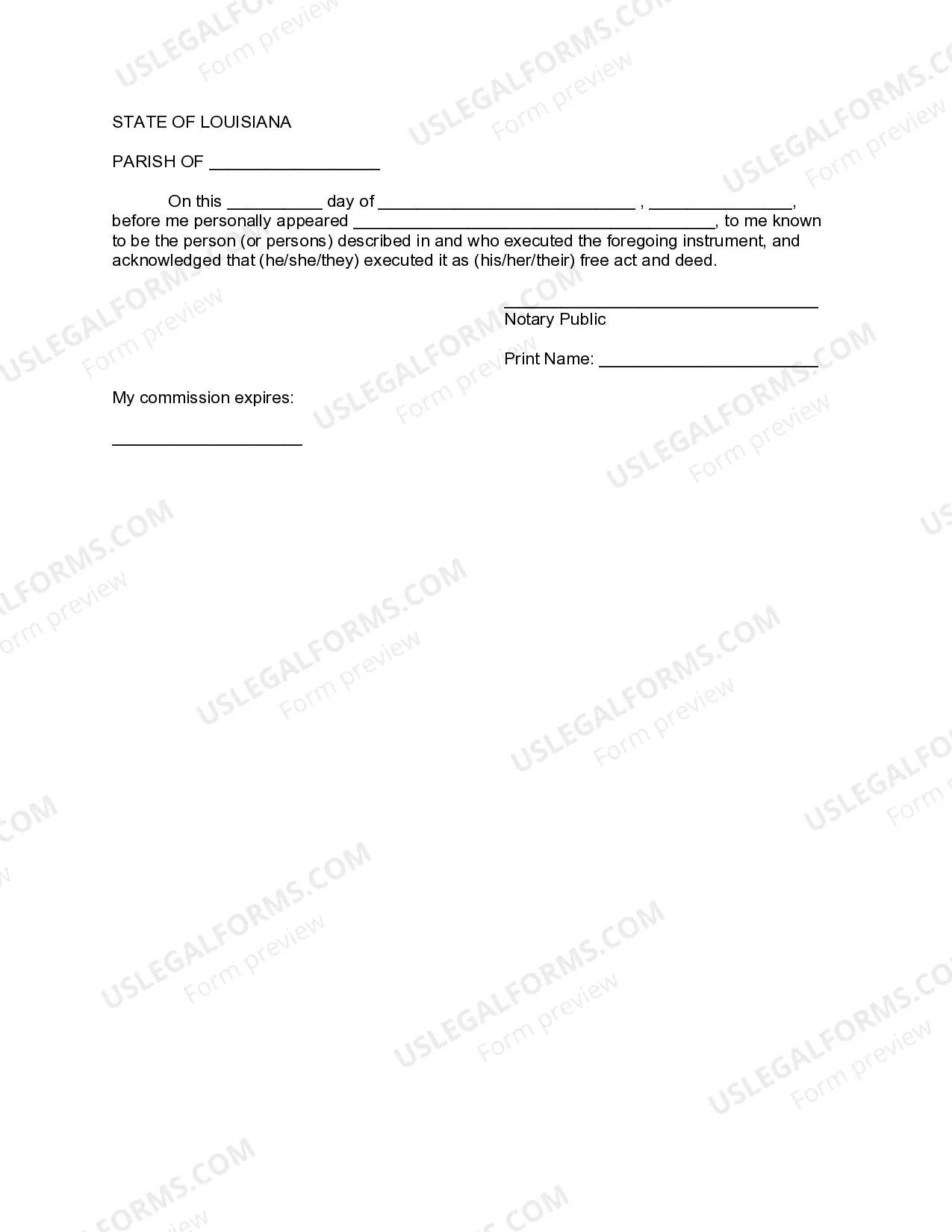

In Louisiana, it is generally not required for a trust to be notarized, but doing so can add an extra layer of legitimacy. Notarizing documents related to the Shreveport Louisiana Amendment to Living Trust may help avoid disputes among beneficiaries in the future. However, always consult a legal professional for specific advice based on your situation.

To amend a trust in Ohio, you typically need to draft a trust amendment that specifies the changes you're making. This document should be signed by you, the trust maker, and ideally, it should also be notarized to ensure its validity. Although the Shreveport Louisiana Amendment to Living Trust guidelines might be different, understanding the basics of amendments applies across state lines.

To effectively amend a trust, you should first review your original trust documents. Ensuring that you follow the specific procedures outlined within those documents is crucial, as any deviation may render the amendment invalid. In Shreveport, Louisiana, an amendment to a living trust typically requires you to create a written document detailing the changes and signing it in front of a notary. Our platform, USLegalForms, provides easy-to-use templates to help you with the Shreveport Louisiana Amendment to Living Trust process, ensuring that all legal requirements are met.

In the UK, a major mistake parents make is not considering changes in their financial situation or family structure over time. This lack of foresight can lead to a trust that no longer meets their needs. While this question is UK-centered, a Shreveport Louisiana Amendment to Living Trust equally emphasizes the necessity of regular reviews and updates to ensure your plans are effective.

The negative side of a trust often includes the costs associated with setting up and maintaining the trust. Additionally, if not managed well, it can lead to conflicts among beneficiaries. By conducting a Shreveport Louisiana Amendment to Living Trust strategically, you can streamline processes and minimize misunderstandings.

Pitfalls of setting up a trust include misunderstanding the tax implications and failing to update the trust when circumstances change. Individuals often overlook the importance of properly funding the trust as a proactive measure. When making a Shreveport Louisiana Amendment to Living Trust, it's a good time to reevaluate these factors.