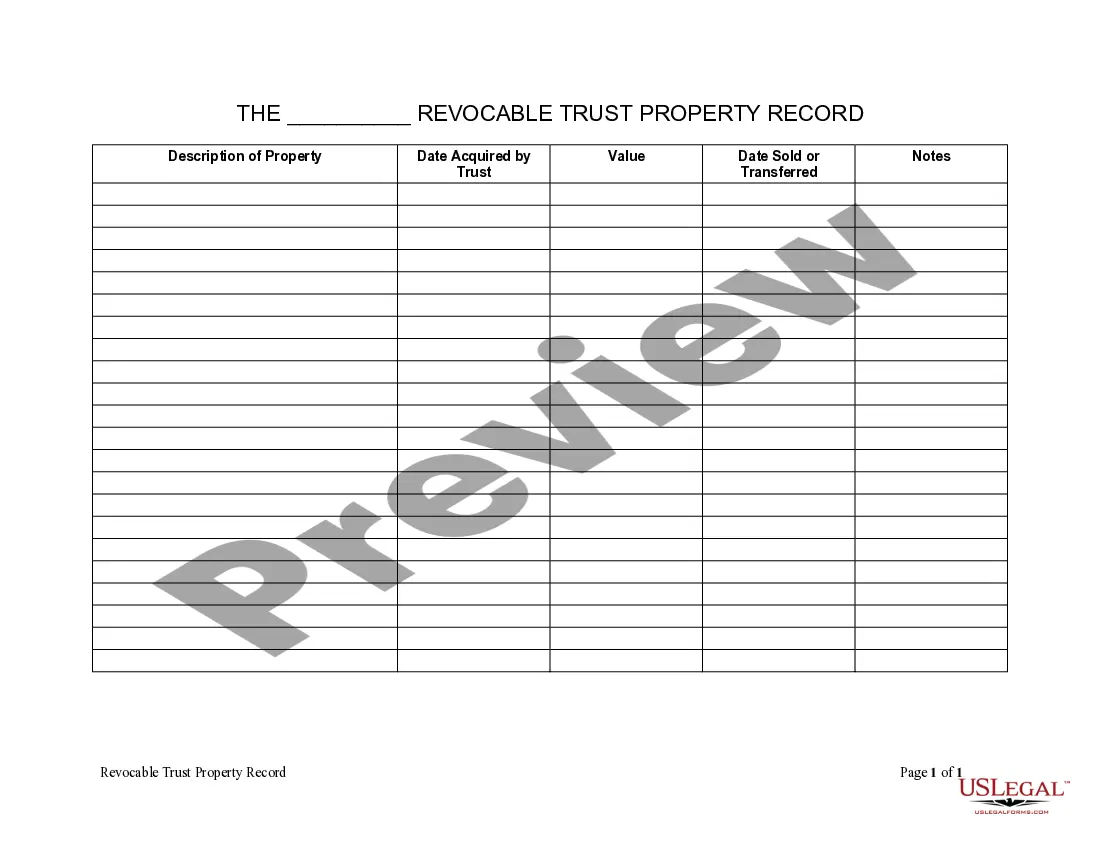

Shreveport Louisiana Living Trust Property Record is a comprehensive documentation of all real estate assets included within a living trust in Shreveport, Louisiana. This record serves as an essential tool for the trustee and beneficiaries to manage and administer the trust property effectively. It contains specific details about the properties held within the trust, including legal descriptions, addresses, tax information, and ownership history. The Shreveport Louisiana Living Trust Property Record is essential for ensuring accurate ownership identification, conducting property assessments, and facilitating smooth asset distribution when the trust is dissolved or transferred. It provides a centralized location for all property-related information, easing the administrative burden for trustees and streamlining the trust settlement process. There are multiple types of Shreveport Louisiana Living Trust Property Records that may be encountered, depending on the nature of the trust and its assets. Some common types include: 1. Residential Properties: This category includes records pertaining to single-family homes, townhouses, condominiums, and other residential dwellings held within the living trust. It encompasses details such as the property's physical attributes, assessed value, and any mortgage or lien information. 2. Commercial Properties: Shreveport Louisiana Living Trust Property Records also cover commercial real estate assets such as office buildings, retail spaces, industrial warehouses, and vacant land intended for commercial development. These records provide information about the property's size, zoning regulations, existing leases, and rental income. 3. Rental Properties: If the living trust includes properties intended for rental income, specific records may be maintained for each rental unit. These records typically include tenant information, lease agreements, rent payment history, and maintenance records. 4. Vacation Properties: Trusts that include vacation homes or properties used for recreational purposes require dedicated records. These records encompass details about the property's seasonal usage, availability for rent, and any relevant regulations or permits required for short-term rentals. 5. Land and Lots: Shreveport Louisiana Living Trust Property Records may also include undeveloped land or vacant lots held within the trust. These records outline the property's legal description, size, zoning restrictions, and any potential development plans or permits. Accurately maintaining the Shreveport Louisiana Living Trust Property Record is crucial for ensuring the effective management, protection, and eventual distribution of trust assets. It serves as a comprehensive resource for trustees, beneficiaries, legal professionals, and other interested parties involved in the administration of the living trust.

Shreveport Louisiana Living Trust Property Record

Description

How to fill out Shreveport Louisiana Living Trust Property Record?

No matter the social or professional status, completing legal forms is an unfortunate necessity in today’s professional environment. Very often, it’s almost impossible for someone with no law education to draft this sort of papers from scratch, mainly due to the convoluted jargon and legal subtleties they involve. This is where US Legal Forms comes in handy. Our service provides a massive library with more than 85,000 ready-to-use state-specific forms that work for pretty much any legal scenario. US Legal Forms also serves as a great asset for associates or legal counsels who want to to be more efficient time-wise using our DYI forms.

Whether you want the Shreveport Louisiana Living Trust Property Record or any other document that will be valid in your state or area, with US Legal Forms, everything is at your fingertips. Here’s how to get the Shreveport Louisiana Living Trust Property Record in minutes employing our reliable service. In case you are presently a subscriber, you can proceed to log in to your account to get the appropriate form.

However, if you are new to our library, ensure that you follow these steps prior to obtaining the Shreveport Louisiana Living Trust Property Record:

- Ensure the form you have found is specific to your area considering that the rules of one state or area do not work for another state or area.

- Review the form and read a brief description (if available) of cases the paper can be used for.

- In case the form you picked doesn’t meet your needs, you can start over and look for the necessary form.

- Click Buy now and pick the subscription plan that suits you the best.

- Log in to your account login information or register for one from scratch.

- Select the payment gateway and proceed to download the Shreveport Louisiana Living Trust Property Record once the payment is through.

You’re all set! Now you can proceed to print the form or fill it out online. If you have any problems getting your purchased forms, you can easily find them in the My Forms tab.

Whatever situation you’re trying to sort out, US Legal Forms has got you covered. Try it out now and see for yourself.