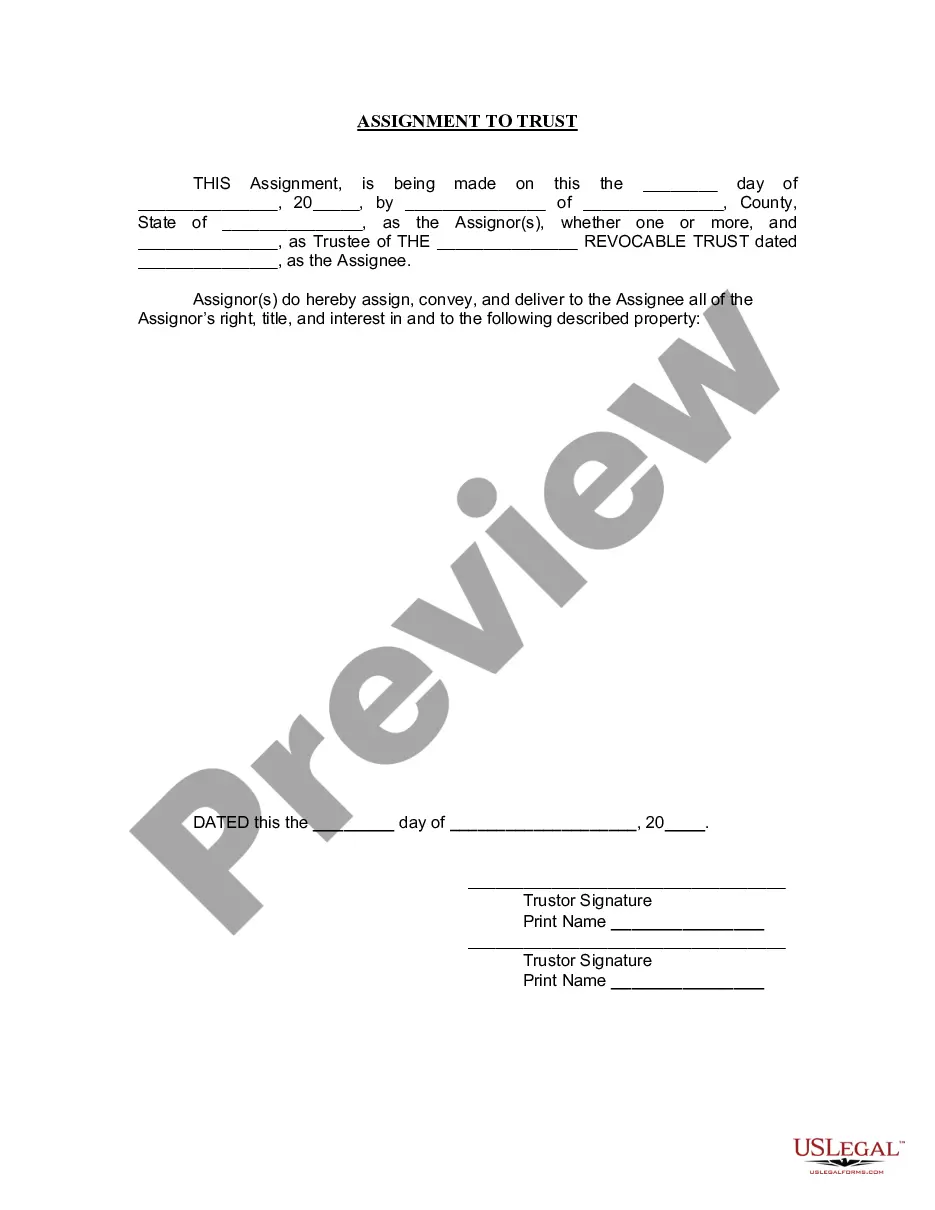

The Shreveport Louisiana Assignment to Living Trust is a legal document that allows individuals to transfer their assets and properties into a trust, managed by a designated trustee, during their lifetime. This ensures that their estate planning goals are fulfilled and that the distribution of these assets is smoothly executed upon their incapacitation or passing. Living trusts in Shreveport, Louisiana are categorized into two major types — revocable living trusts and irrevocable living trusts. While both have their own distinct features, they serve the same purpose of avoiding probate, protecting assets, and ensuring efficient asset management. A revocable living trust, also known as an inter vivos trust, provides flexibility as the granter retains the ability to modify or revoke the trust at any time during their lifetime. In this arrangement, the granter retains full control over the assets and can even act as the trustee, managing the trust's affairs. This type of trust is particularly beneficial for individuals who wish to maintain control over their assets but desire a seamless transfer of those assets to their chosen beneficiaries after their death. Conversely, an irrevocable living trust cannot be modified or revoked once it is created, providing a greater level of asset protection and potential tax benefits. By transferring assets into an irrevocable trust, the granter effectively removes these assets from their personal property and reduces their estate tax liability. Since the granter no longer has control over the assets, they appoint a trustee to manage the trust and oversee its administration according to the predetermined terms and instructions outlined in the trust document. Shreveport Louisiana Assignment to Living Trust provides numerous advantages for individuals considering estate planning. By avoiding the costly and time-consuming probate process, loved ones are spared potential conflicts. Additionally, living trusts provide privacy as they are not subject to public record, unlike wills. They also facilitate a smooth transition of assets, ensuring that beneficiaries receive their inheritances promptly and as per the granter's wishes. If you are a resident of Shreveport, Louisiana, considering assigning assets to a living trust, it is crucial to consult with an experienced estate planning attorney. They can help you navigate the legal intricacies, choose the appropriate living trust type, and tailor it to your specific needs and goals. Whether you opt for a revocable or irrevocable living trust, the assignment process will provide you and your loved ones with peace of mind, asset protection, and an efficient estate distribution.

Shreveport Louisiana Assignment to Living Trust

Description

How to fill out Shreveport Louisiana Assignment To Living Trust?

Do you need a trustworthy and affordable legal forms provider to buy the Shreveport Louisiana Assignment to Living Trust? US Legal Forms is your go-to choice.

No matter if you require a basic agreement to set regulations for cohabitating with your partner or a set of documents to advance your divorce through the court, we got you covered. Our website provides over 85,000 up-to-date legal document templates for personal and company use. All templates that we offer aren’t generic and frameworked in accordance with the requirements of specific state and county.

To download the form, you need to log in account, find the needed template, and hit the Download button next to it. Please keep in mind that you can download your previously purchased form templates at any time from the My Forms tab.

Is the first time you visit our platform? No worries. You can set up an account with swift ease, but before that, make sure to do the following:

- Check if the Shreveport Louisiana Assignment to Living Trust conforms to the regulations of your state and local area.

- Read the form’s description (if available) to learn who and what the form is good for.

- Start the search over in case the template isn’t good for your legal situation.

Now you can register your account. Then choose the subscription option and proceed to payment. As soon as the payment is done, download the Shreveport Louisiana Assignment to Living Trust in any available file format. You can get back to the website when you need and redownload the form without any extra costs.

Getting up-to-date legal documents has never been easier. Give US Legal Forms a try now, and forget about spending hours learning about legal paperwork online once and for all.