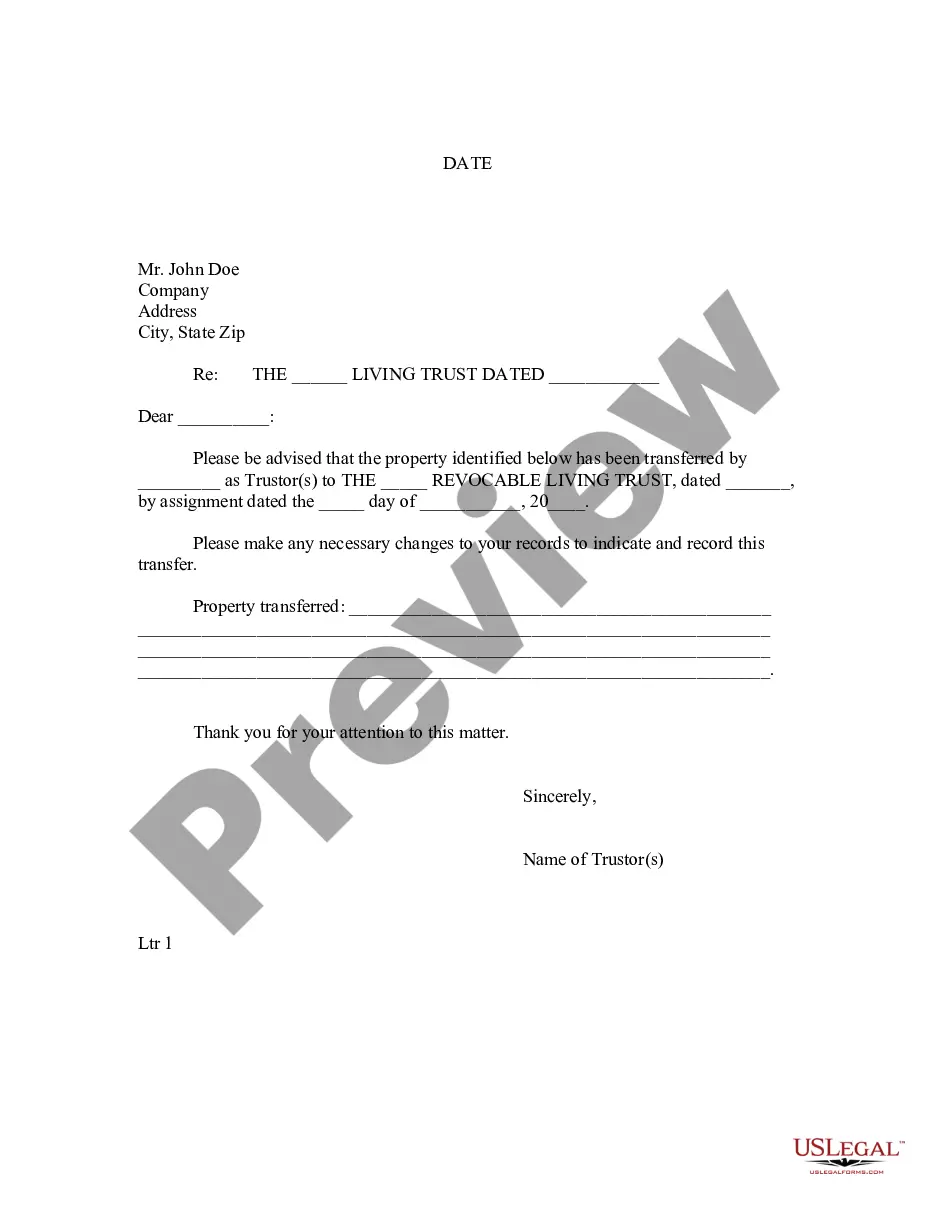

Shreveport, Louisiana is a vibrant city located in Caddo Parish in Northwest Louisiana. Known for its rich history, diverse culture, and southern charm, Shreveport attracts both locals and tourists alike. The city offers a wide range of activities, attractions, and amenities that cater to people of all ages and interests. When it comes to legal matters such as trusts, it is crucial to maintain proper communication with all involved parties. The Shreveport Louisiana Letter to Lien holder to Notify of Trust is an essential document used to inform lien holders about the establishment of a trust for a specific property. This letter serves as an official notification to lien holders, providing them with important information about the trust and its effect on the lien. It allows lien holders to update their records accordingly, ensuring accurate documentation of the property's ownership. The Shreveport Louisiana Letter to Lien holder to Notify of Trust typically includes specific details to properly identify the property and highlight the relevant trust arrangement. This includes the property's legal description, address, and any other identification details necessary for proper identification. Moreover, it is important to specify the type of trust being created in the letter. Shreveport, Louisiana recognizes various types of trusts, including revocable living trusts, irrevocable trusts, testamentary trusts, and special needs trusts. Each type of trust has different characteristics and purposes, catering to a range of individual needs and circumstances. For instance, a revocable living trust allows the creator of the trust (known as the granter) to maintain control over the assets and modify or revoke the trust as they see fit. On the other hand, an irrevocable trust cannot be modified or revoked once established, providing greater asset protection and tax benefits. Testamentary trusts are created through a person's will and only go into effect upon their death. These trusts are typically used for estate planning purposes and allow for the distribution of assets according to the individual's wishes. Finally, special needs trusts are designed to provide for individuals with disabilities without jeopardizing their eligibility for government benefits. These trusts ensure that beneficiaries receive financial support while still maintaining their access to programs such as Medicaid or Supplemental Security Income (SSI). In summary, the Shreveport Louisiana Letter to Lien holder to Notify of Trust serves as an official communication channel between the property owner and the lien holder. It allows for the necessary updates to lien records while providing essential information about the establishment of a trust. Understanding the different types of trusts recognized in Shreveport is important to ensure proper documentation and compliance with relevant laws and regulations.

Shreveport Louisiana Letter to Lienholder to Notify of Trust

Description

How to fill out Shreveport Louisiana Letter To Lienholder To Notify Of Trust?

Regardless of one's social or professional standing, finishing legal paperwork is a regrettable requirement in the current professional landscape.

Frequently, it's nearly impossible for an individual without a legal background to formulate such documents from the ground up, primarily due to the intricate terminology and legal subtleties involved.

This is where US Legal Forms comes to the rescue.

Ensure the template you have located is appropriate for your area, as the laws of one state or region may not apply to another.

Review the document and read a brief description (if available) of situations for which the document may be utilized.

- Our service provides an extensive catalog featuring over 85,000 ready-to-use state-specific documents applicable to virtually any legal situation.

- US Legal Forms also acts as an excellent resource for associates or legal advisors aiming to save time by using our DIY forms.

- Whether you need the Shreveport Louisiana Letter to Lienholder to Notify of Trust or any other document that is legitimate in your state or locality, with US Legal Forms, everything is readily available.

- Here’s how to obtain the Shreveport Louisiana Letter to Lienholder to Notify of Trust in just minutes using our trusted service.

- If you’re already a subscriber, simply Log In to your account to access the correct form.

- However, if you are new to our collection, make sure to follow these steps before downloading the Shreveport Louisiana Letter to Lienholder to Notify of Trust.

Form popularity

FAQ

To show that a lien has officially been removed on a property, you have to file a document called a ?lien release? in the real property records of the county where the property is located. A release of lien simply means removing the lien claim from a specific property.

When you borrow money to purchase a car, the lender files a lien on the vehicle with the state to insure that if the loan defaults, the lender can take the car. When the debt is fully repaid, a release of the lien is provided by the lender.

(b) If the lender is out of business and no longer available, their lien may be released by the following procedure: (1) A certified letter, restricted delivery, requesting a lien release and listing the year, make, and vehicle identification number is to be sent to the lender's address listed on the Motor Vehicle

If you don't have the California Certificate of Title, you need to use an Application for Replacement or Transfer of Title (REG 227) to transfer ownership. The lienholder's release, if any, must be notarized. The buyer should then bring the completed form to a DMV office and we will issue a new registration and title.

Add or Remove a Lien on a Vehicle To add or remove a lien on your vehicle title, visit your local county tax office. The title fee is $28 or $33, depending on your county, and must be paid at time of application. Please contact your local county tax office for the exact cost.

PLEASE NOTE: When you sell a vehicle, you do not need to remove a lien from the certificate of title. You can give the original title and the original lien release to the buyer.

If your local DMV does not provide online access to titles, it is possible to visit their local office and request a title report. This report will provide lien information and in most cases will alert you to any accidents the car has been involved in.

Lien release letters should have a conspicuous title such as ?Release of Lien? at the top of the page. The first paragraph should list the date the lien was placed on the property and the names and addresses of both the lienholder and the owner of the property.

To release a lien, the lien holder must sign and date two (2) release of lien forms. Mail one (1), signed and dated, copy of a lien release to the Oklahoma Tax Commission, P.O. Box 269061 Oklahoma City, Ok 73126, and one (1), signed and dated, copy of the lien release to the debtor.

O If the lienholder is an individual, a notice of release (lien release section of DOR-4809) must be completed, signed, and notarized. An estate executor may release the lien by submitting the above with an original or certified copy of the probate court order. information is legible.