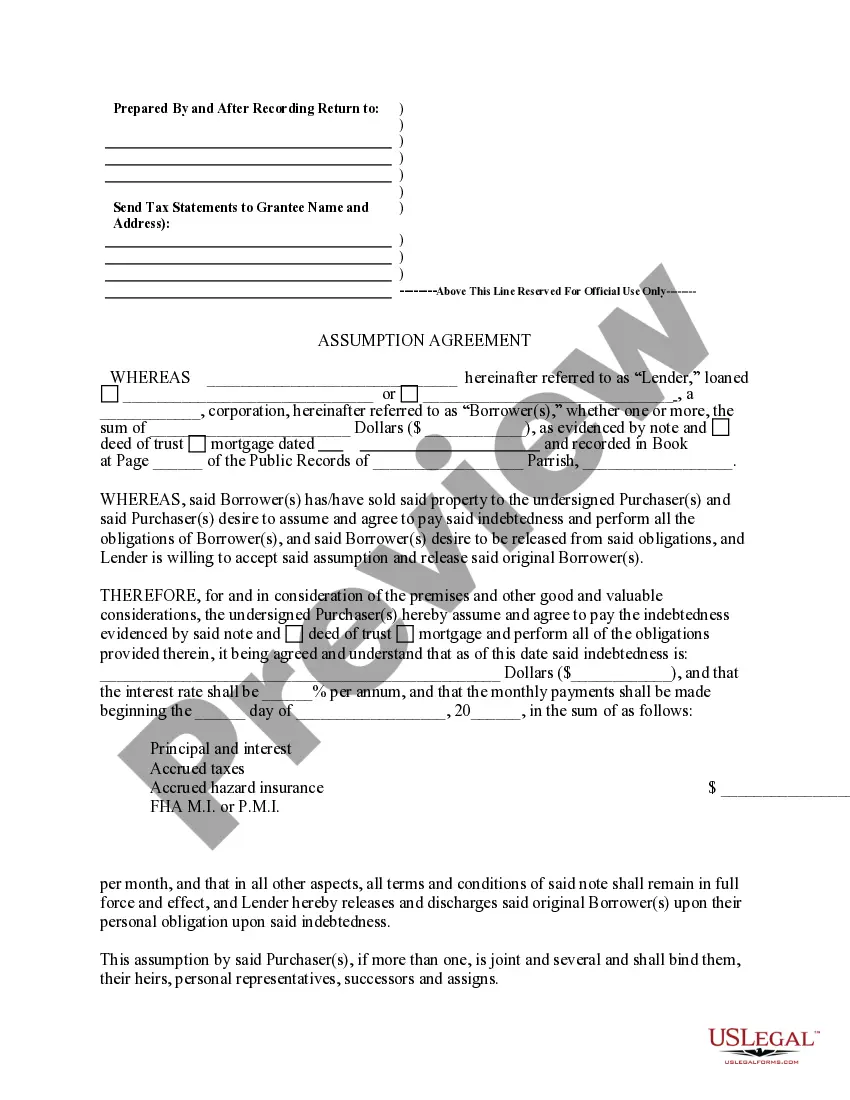

The Shreveport Louisiana Assumption Agreement of Mortgage and Release of Original Mortgagors is a legal contract that outlines the terms and conditions under which a new party assumes the responsibilities and obligations of an existing mortgage agreement. This agreement typically takes place when a property owner wishes to transfer their mortgage to another individual or entity. The primary purpose of the Shreveport Louisiana Assumption Agreement of Mortgage and Release of Original Mortgagors is to provide a clear understanding between the parties involved regarding the transfer of the mortgage. This document specifies the rights and responsibilities of the new mortgage holder, known as the "assumption," and clarifies the release of the original mortgagors from their obligations. The Shreveport Louisiana Assumption Agreement of Mortgage and Release of Original Mortgagors typically includes essential details such as the names of the original mortgagors, assumption(s), and the property address. It also outlines the terms of the mortgage assumption, including the assumption fee, interest rates, and the remaining loan balance. Furthermore, it may specify any conditions or restrictions related to the assumption, such as the requirement of lender approval. In Shreveport, Louisiana, there may be variations of the Assumption Agreement of Mortgage and Release of Original Mortgagors depending on specific circumstances or types of mortgage loans. For example: 1. Residential Mortgage Assumption Agreement: This type of agreement is typically used when an individual assumes a mortgage on a residential property, such as a house or condominium in Shreveport. 2. Commercial Mortgage Assumption Agreement: This agreement applies when a party assumes a mortgage on a commercial property, such as office buildings, retail spaces, or industrial properties. 3. Refinancing Assumption Agreement: This document is relevant when the assumption is refinancing an existing mortgage, taking on the loan while obtaining more favorable terms, such as lower interest rates or extended repayment periods. 4. Assumption Agreement with Limited Liability: In certain cases, parties may opt for an assumption agreement that limits the liability of the assumption, protecting them from default or other potential risks associated with the mortgage. It is important to note that the Shreveport Louisiana Assumption Agreement of Mortgage and Release of Original Mortgagors is a legally binding document that requires careful consideration and expert advice to ensure all parties' rights and interests are protected.

Shreveport Louisiana Assumption Agreement of Mortgage and Release of Original Mortgagors

Description

How to fill out Shreveport Louisiana Assumption Agreement Of Mortgage And Release Of Original Mortgagors?

Finding verified templates specific to your local laws can be challenging unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both individual and professional needs and any real-life situations. All the documents are properly categorized by area of usage and jurisdiction areas, so locating the Shreveport Louisiana Assumption Agreement of Mortgage and Release of Original Mortgagors gets as quick and easy as ABC.

For everyone already acquainted with our catalogue and has used it before, getting the Shreveport Louisiana Assumption Agreement of Mortgage and Release of Original Mortgagors takes just a couple of clicks. All you need to do is log in to your account, opt for the document, and click Download to save it on your device. The process will take just a couple of additional actions to complete for new users.

Follow the guidelines below to get started with the most extensive online form catalogue:

- Look at the Preview mode and form description. Make sure you’ve selected the right one that meets your needs and totally corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you see any inconsistency, use the Search tab above to get the correct one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and choose the subscription plan you prefer. You should register an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the subscription.

- Download the Shreveport Louisiana Assumption Agreement of Mortgage and Release of Original Mortgagors. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Take advantage of the US Legal Forms library to always have essential document templates for any demands just at your hand!