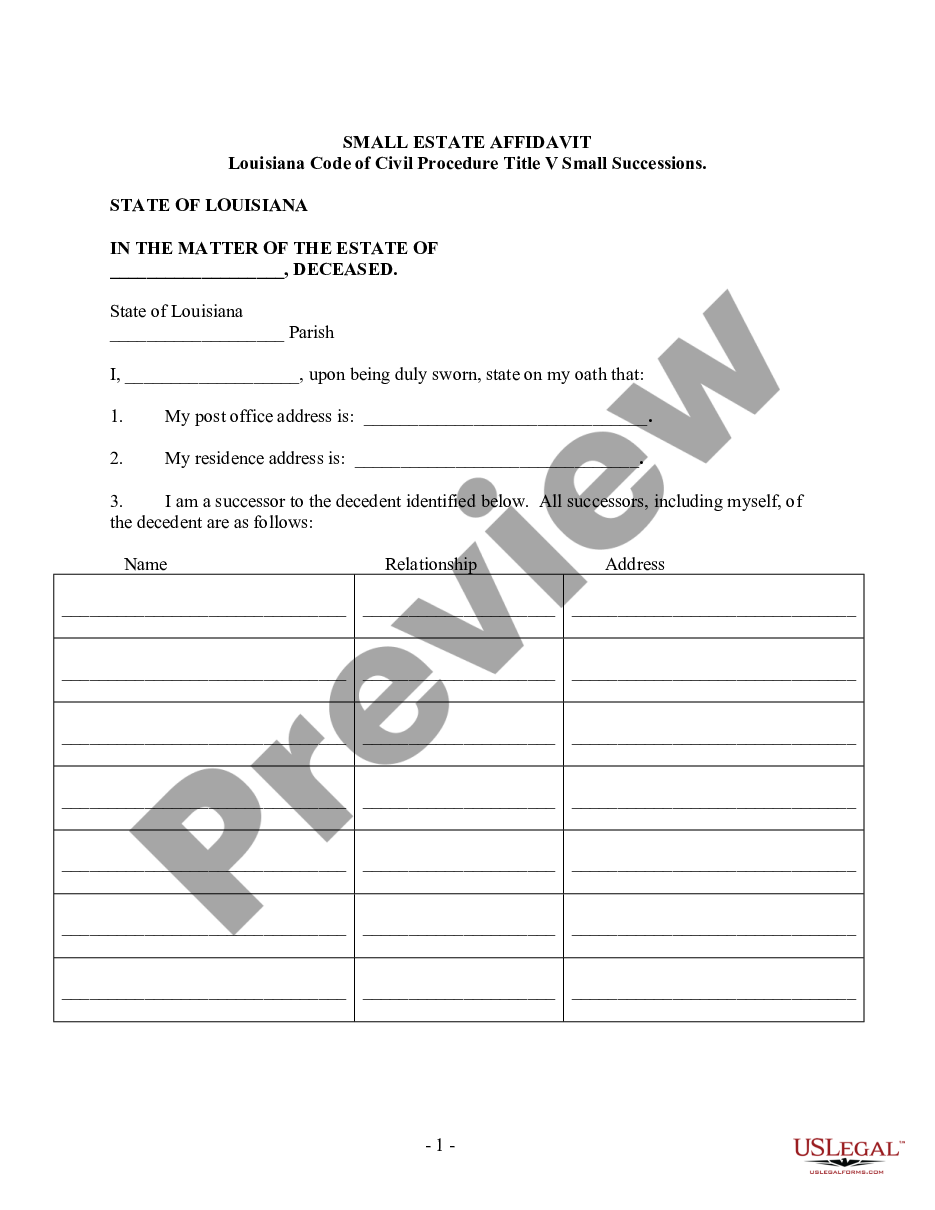

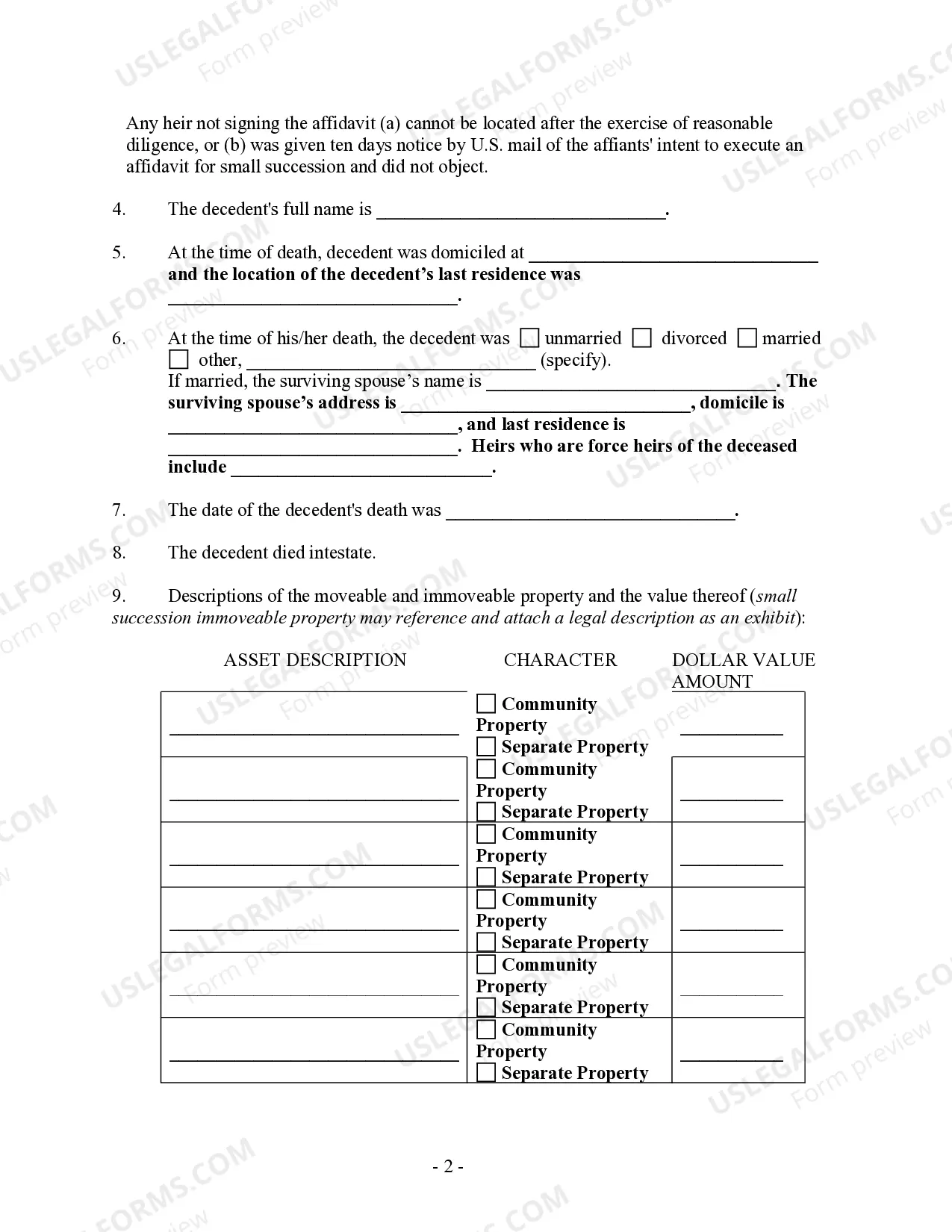

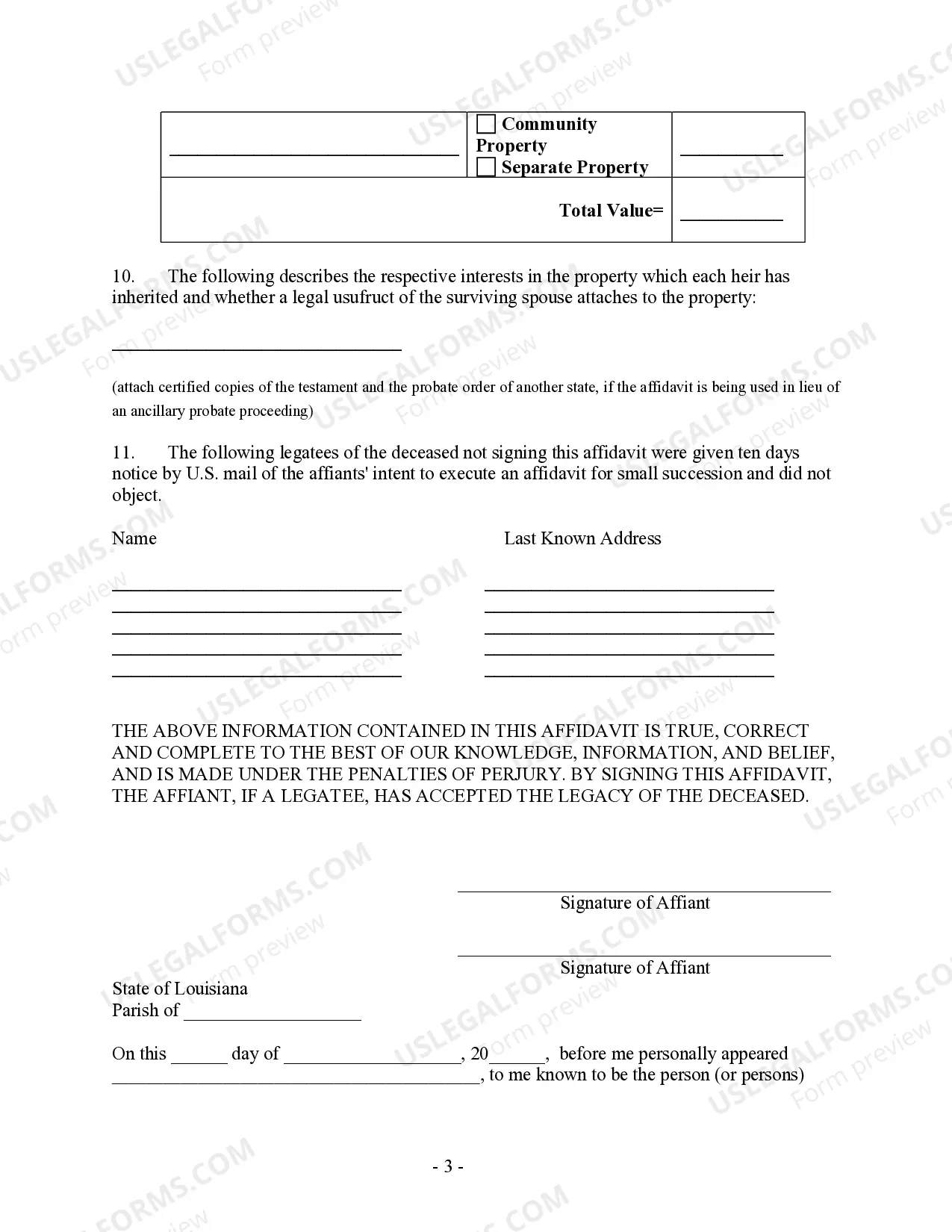

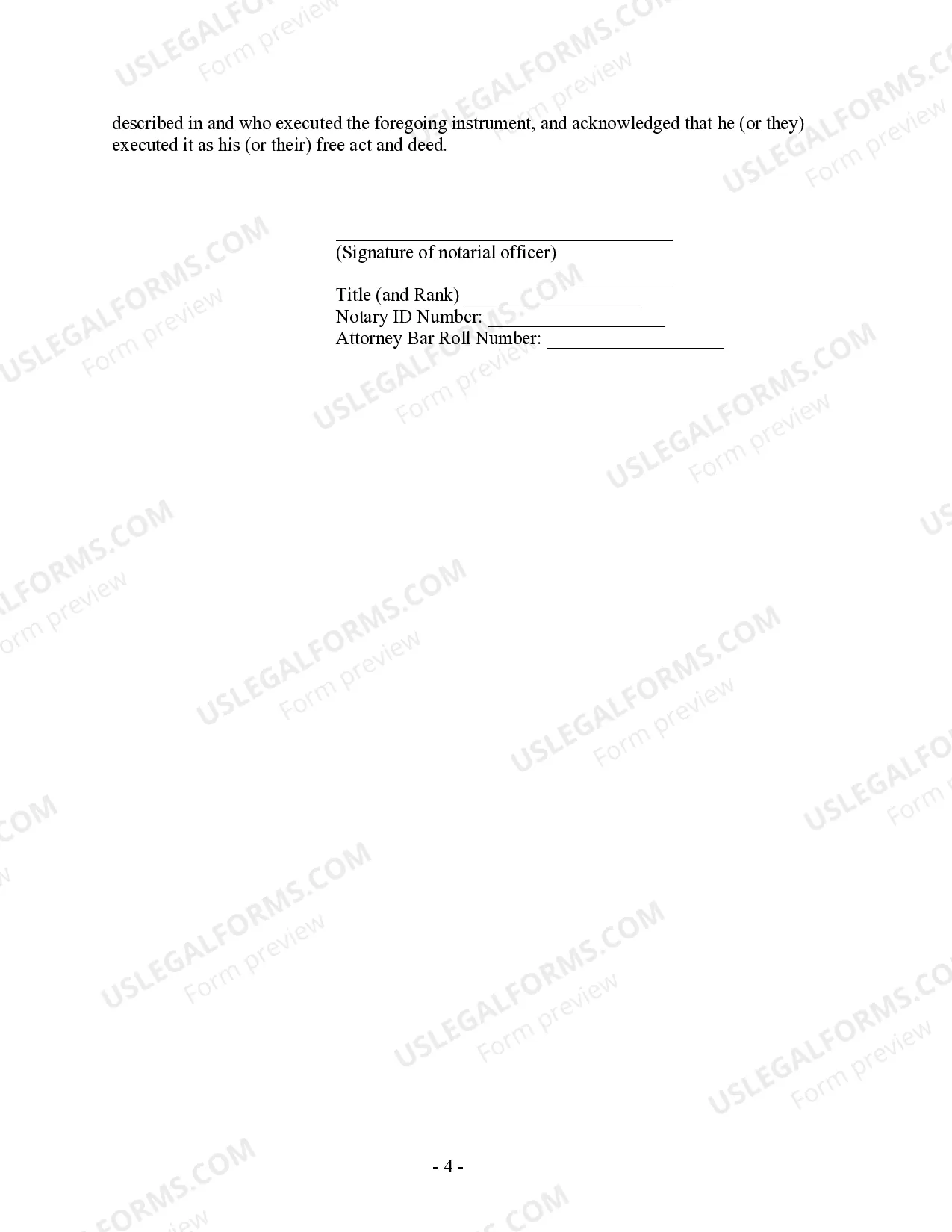

Shreveport Louisiana Small Estate Affidavit for Estates under $125,000: A Comprehensive Guide In Shreveport, Louisiana, individuals dealing with the distribution of an estate valued at under $125,000 may opt for the Small Estate Affidavit process. This streamlined procedure allows for a simplified transfer of property to heirs or beneficiaries without the need for prolonged probate proceedings. In this article, we will dive into the details of Shreveport's Small Estate Affidavit, exploring its purpose, requirements, and various types, if applicable. The Small Estate Affidavit serves as a legal document that enables surviving family members or beneficiaries to collect and distribute assets owned by a deceased individual. By utilizing this affidavit, individuals can avoid the often cumbersome and time-consuming probate process, making it a cost-effective and efficient alternative for small estates. Requirements for Shreveport Louisiana Small Estate Affidavit: 1. Monetary Limit: The total value of the estate, consisting of all personal property, real estate, and other assets, must not exceed $125,000. 2. Time Limit: The deceased individual (decedent) must have been deceased for at least 60 days before a Small Estate Affidavit can be filed. 3. Documentation: The petitioner, usually a surviving family member or beneficiary, must gather the necessary documents, including a certified copy of the death certificate, an itemized list of all assets, and any existing will or testament. Types of Shreveport Louisiana Small Estate Affidavit: While there may not be different types of Shreveport Louisiana Small Estate Affidavit specifically tailored for estates under $125,000, it is essential to note that each case can have unique circumstances that necessitate specific considerations. Therefore, it is advisable to consult with an attorney experienced in estate planning and administration to ensure that you choose the correct approach for your situation. However, it's worth mentioning that there might be different variations to the Small Estate Affidavit process based on the specific parishes or counties within Louisiana. Therefore, individuals residing in Shreveport and its surrounding areas should verify the requirements and procedures specific to their locale. Navigating a Shreveport Louisiana Small Estate Affidavit can be complex, especially when dealing with the emotional and legal aspects surrounding the passing of a loved one. Hence, seeking professional assistance from an attorney can help streamline the process and ensure compliance with all legal requirements. In conclusion, the Shreveport Louisiana Small Estate Affidavit for Estates under $125,000 offers an efficient alternative to probate administration for small estates. By adhering to certain guidelines and gathering the necessary documents, individuals can simplify the distribution of assets to heirs or beneficiaries. Remember, should you need guidance throughout the procedure, consult with an experienced attorney who can provide personalized assistance tailored to your specific needs and circumstances.

Shreveport Louisiana Small Estate Affidavit for Estates under $125,000

Description

How to fill out Shreveport Louisiana Small Estate Affidavit For Estates Under $125,000?

Regardless of social or professional status, filling out law-related forms is an unfortunate necessity in today’s professional environment. Too often, it’s almost impossible for someone with no law education to draft this sort of paperwork cfrom the ground up, mainly due to the convoluted jargon and legal subtleties they involve. This is where US Legal Forms can save the day. Our service provides a huge library with over 85,000 ready-to-use state-specific forms that work for almost any legal case. US Legal Forms also is a great asset for associates or legal counsels who want to to be more efficient time-wise utilizing our DYI forms.

Whether you need the Shreveport Louisiana Small Estate Affidavit for Estates under 125,000 or any other document that will be valid in your state or county, with US Legal Forms, everything is at your fingertips. Here’s how you can get the Shreveport Louisiana Small Estate Affidavit for Estates under 125,000 in minutes using our trustworthy service. In case you are already a subscriber, you can go on and log in to your account to download the appropriate form.

However, in case you are new to our library, make sure to follow these steps prior to downloading the Shreveport Louisiana Small Estate Affidavit for Estates under 125,000:

- Be sure the template you have found is specific to your area because the rules of one state or county do not work for another state or county.

- Review the document and go through a quick outline (if available) of scenarios the document can be used for.

- If the form you selected doesn’t meet your requirements, you can start over and search for the suitable document.

- Click Buy now and pick the subscription option that suits you the best.

- utilizing your credentials or register for one from scratch.

- Choose the payment gateway and proceed to download the Shreveport Louisiana Small Estate Affidavit for Estates under 125,000 once the payment is completed.

You’re good to go! Now you can go on and print out the document or fill it out online. Should you have any issues locating your purchased forms, you can quickly find them in the My Forms tab.

Whatever situation you’re trying to solve, US Legal Forms has got you covered. Give it a try today and see for yourself.